Traditional Powerhouses Lose Steam While Chinese Semiconductors Surge — Is the Automotive Chip Market Being Upended?

Input

Changed

Sluggish Downstream Demand Triggers Earnings Shock for Automotive Chip Giants As Traditional Leaders Falter, Chinese Automotive Semiconductors Surge Ahead Chinese Cars Embrace Domestic Chips, Accelerating Toward Semiconductor Self-Sufficiency

The automotive semiconductor market, once defined by a few dominant Western and Japanese players, is entering a dramatic phase of transformation. As global leaders struggle with declining profits and market share, Chinese semiconductor companies are racing ahead—backed by strong government support, strategic investments, and a booming domestic electric vehicle (EV) industry. What was once a gap in technological capability is now narrowing at unprecedented speed.

This surge comes at a pivotal time. Downstream demand has weakened across the globe, triggering stagnation among legacy chipmakers. But for China, this downturn has become an opening. Aided by targeted industrial policies and aggressive localization efforts, Chinese firms are not only climbing the global rankings but also challenging the long-standing hierarchy in one of the most critical sectors powering the future of mobility. The question now is no longer if Chinese chipmakers will reshape the global market—but when.

China Gains Ground in Power Semiconductor Market

The cracks in the dominance of legacy players are becoming more visible. In its Q2 FY2025 earnings call covering the January–March period, Infineon Technologies, the world’s top automotive semiconductor supplier, revealed that its grip on the power semiconductor market is weakening. These chips—critical for energy efficiency in electric vehicles and home electronics—have long been a linchpin of Infineon’s success. But in 2024, the company’s global market share slipped to 17.7%, a steep 2.9 percentage point drop from the previous year.

The story is similar for Onsemi and STMicroelectronics, the second- and third-ranked players, whose shares fell to 8.7% and 7%, respectively. Declining operating profits tell a deeper story of contraction: Infineon's Q1 operating profit plunged 36% year-over-year to €318 million, forcing the company to revise its 2025 outlook downward and reduce investments. Onsemi posted a staggering $573 million operating loss, while STMicro’s earnings plummeted to just $3 million, down nearly 100% from the year before.

While these global giants grapple with slowing growth, Chinese firms are charging ahead. Hangzhou Silan Microelectronics, a relatively lesser-known IDM, now holds a 3.3% share of the global power semiconductor market, securing sixth place worldwide. Even more symbolic is the rise of BYD, a Chinese EV giant that captured a 3.1% share—its first time breaking into the top 10 globally. Once reliant on imported chips, BYD is now a formidable force in chip manufacturing.

This reshuffling of rankings signals more than temporary shifts—it hints at a systemic reordering of global semiconductor leadership, with China rapidly ascending the value chain.

Beijing’s Push for Semiconductor Self-Sufficiency

China’s rise in the automotive chip market is no accident—it’s the product of a coordinated national strategy. Despite a domestic market valued at $16.47 billion USD in 2024 and expected to exceed $42.3 billion by 2030, China’s self-sufficiency rate in automotive semiconductors remains below 15%. Even more concerning is that for complex, high-performance chips such as System-on-Chips (SoCs) and Microcontroller Units (MCUs), the localization rate is still under 5%.

To close this gap, the Chinese government has set a clear target: achieve 25% localization in automotive semiconductor sourcing by the end of 2025. In pursuit of this goal, Beijing has become the world’s largest purchaser of semiconductor manufacturing equipment, while actively pressuring domestic firms to transition to homegrown chips.

The policy measures are bold and direct. Companies are required to report their quarterly procurement data, particularly the extent of their reliance on locally produced chips. This ensures accountability and alignment with national priorities. In tandem, generous government subsidies are accelerating R&D and production capabilities across the board.

Evidence of progress is already visible. According to a study by UBS, all the power semiconductors used in BYD’s high-end Seal EV model are now entirely sourced from Chinese suppliers. In the autonomous driving sector, Horizon Robotics—a key player in smart vehicle chips—increased its clientele from 14 to 25 companies within just three years.

These advances are a testament to China’s ability to execute large-scale industrial transformation, turning policy vision into production reality at remarkable speed.

Chinese Carmakers Take Chipmaking into Their Own Hands

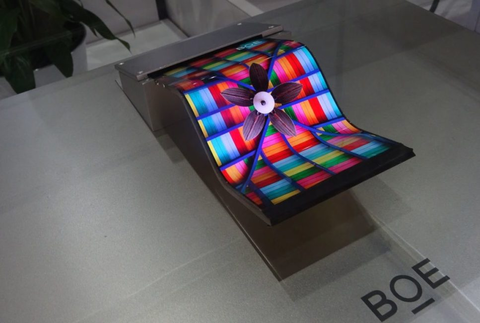

Perhaps the most transformative development is the strategic shift by Chinese carmakers toward in-house semiconductor development. These firms are no longer content to depend on third-party suppliers—foreign or domestic—for critical components. They are becoming chipmakers themselves.

Take BYD: just two years ago, it sourced its power semiconductors from international firms. Today, it operates its own chip fabrication plants dedicated to electric vehicles. Similarly, Geely, one of China’s largest automakers, began developing its own semiconductors as early as 2018. EV upstarts like NIO, Xpeng, and Li Auto have also joined the self-reliance push, committing resources to internal chip R&D.

While reducing costs and gaining tighter control over supply chains were initial motivators, the evolution of automotive technology has added urgency. With AI-driven smart cars on the rise, general-purpose chips no longer suffice. Vehicles now require chips that can handle real-time data processing, image recognition, and complex decision-making—functions that demand highly specialized, application-specific chips.

The performance gap is becoming more apparent. Generic chips may compromise speed, energy efficiency, and safety, whereas custom-designed automotive chips offer superior responsiveness and optimization. This matters not just for performance, but for survival in the race toward fully autonomous vehicles.

In China, a new maxim is gaining ground: “Whoever controls semiconductors will control the future of the automobile.” This belief is driving a strategic transformation, not only in production but in ideology. For Chinese automakers, semiconductors are no longer just a component—they are a competitive frontier, and conquering it is key to future leadership in the global mobility market.