Samsung Electronics Nears Mass Production of HBM4, While SK Hynix Holds a Precarious Lead

Input

Modified

Customer Undecided, Presumed for AMD Strategy in Motion: Securing Both Supply Chain and Technological Capabilities Possibility of Restructuring SK Hynix’s Market Dominance

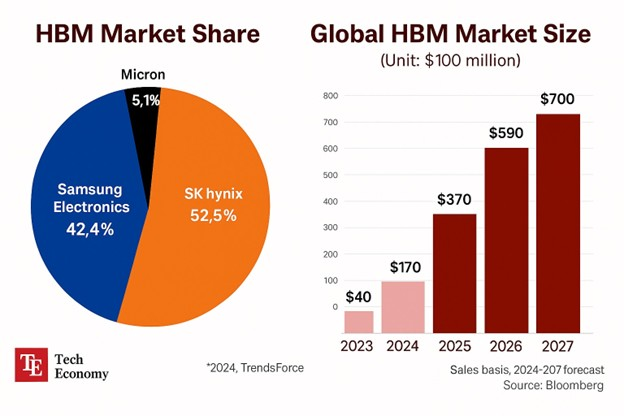

The global race for high-bandwidth memory (HBM) supremacy is entering a critical phase, with Samsung Electronics preparing to launch mass production of its next-generation HBM4 in the latter half of 2025. Once a market dominated decisively by SK Hynix, the competitive terrain is shifting rapidly as technological innovation, customer diversification, and strategic independence become central to long-term success. Micron Technology has also thrown its hat into the ring, accelerating the tempo of competition. As demand for AI and cloud computing memory surges, HBM suppliers are not just fighting for market share—they're battling over who will supply the core memory powering the next wave of data-driven infrastructure.

Samsung’s Offensive: Advanced Process, U.S. Expansion, and Strategic Ties

Samsung’s HBM4 rollout marks a significant leap in its semiconductor roadmap. The sixth-generation memory will feature 2,048 data transfer channels—twice that of HBM3E—offering up to 2 terabytes per second of bandwidth. It is also the first Samsung HBM product to fully adopt the 1c DRAM process node, enhancing performance while improving energy efficiency and thermal output. This technological edge is pivotal as AI models become larger and more compute-intensive, demanding faster memory with lower power consumption.

The tech giant is backing this technological push with substantial manufacturing investment. Samsung is currently constructing a $16.5 billion (KRW 23 trillion) semiconductor plant in Taylor, Texas, a facility set to become a strategic hub for advanced semiconductors, including HBM and AI-centric chips. This site not only strengthens Samsung’s North American supply chain resilience but also serves as a counterweight to competitors’ packaging dependencies in Asia.

Despite this momentum, the company has yet to confirm a flagship customer for its HBM4 chips. However, industry observers believe AMD is a likely candidate. AMD is one of the few players besides NVIDIA with advanced GPU capabilities for AI accelerators and has already selected Samsung’s 12-layer HBM3E chips for its latest MI350X and MI355X models. Given AMD's urgency in launching its next-generation MI400 and MI500 accelerators, a deepened partnership with Samsung appears increasingly likely, and could serve as a breakthrough moment for Samsung's HBM market re-entry.

Meanwhile, Micron, another challenger, has begun sample shipments of its own 12-layer HBM4 chips, just three months behind SK Hynix. These samples, which deliver up to 1TB/s of bandwidth, are already undergoing performance validation with major hyperscalers such as Google and Amazon Web Services (AWS). Micron’s entrance signals not only broader supply diversity but also intensifying price and performance competition as HBM becomes the memory standard for AI workloads.

SK Hynix’s Stronghold and Structural Strains

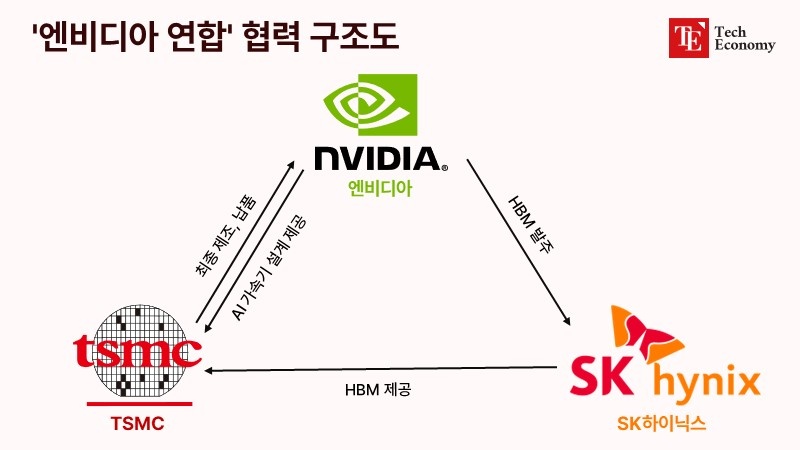

SK Hynix has long been the leader in the HBM segment, holding over 52.5% of the global market share as of 2024 and supplying approximately 80% of NVIDIA’s HBM requirements. It has already secured the world’s first formal supply agreement for 12-layer HBM4 and began distributing product samples as early as March. With NVIDIA expected to release new-generation GPUs later this year, SK Hynix is prioritizing yield stabilization and supply chain consistency to maintain its market leadership.

However, this lead is increasingly encumbered by structural weaknesses—foremost among them, SK Hynix’s deep reliance on Taiwan’s TSMC for high-performance packaging. While this partnership has boosted product completeness, it has also exposed SK Hynix to pricing vulnerabilities. Key processes such as logic die production and chip integration are outsourced to TSMC, which significantly limits SK Hynix’s negotiation power. If TSMC raises prices, SK Hynix is effectively forced to comply, eroding its margins.

Further complicating matters is the inherently high cost and yield instability of HBM production compared to traditional DRAM. Delivering consistent quality to large-scale clients like NVIDIA and AMD requires tight control over packaging processes—control that SK Hynix currently lacks due to its dependence on external suppliers. Additionally, this structure increases the risk of technical leaks, a growing concern in a fiercely competitive, IP-sensitive landscape.

Samsung and Micron, in contrast, are investing in vertically integrated packaging capabilities. Their goal: reduce reliance on external partners, optimize cost structures, and secure proprietary know-how. Samsung’s adoption of 1c DRAM in HBM4, coupled with its Texas fab, and Micron’s progress with in-house integration and validation with top-tier cloud providers, all signify long-term structural advantages that could erode SK Hynix’s lead over time.

To navigate these headwinds, SK Hynix is reportedly exploring expanded investments in packaging infrastructure and is considering strategic adjustments to its relationship with TSMC. As it proceeds toward HBM4E and HBM5 development, the company may pursue partial internalization of packaging to protect both profitability and technological independence. However, such efforts require significant time, capital, and skilled personnel—factors that could prolong the company’s exposure to market risks.

Customer Realignment and the Shifting Landscape

Amid these developments, customer sentiment is also evolving. Clients that once relied almost exclusively on SK Hynix are rethinking their supplier strategies. While SK Hynix’s integration with TSMC has delivered performance benefits, its single-vendor packaging model is increasingly seen as a liability in terms of risk exposure. As a result, Samsung and Micron are gaining attention for offering alternative packaging solutions that are not dependent on TSMC’s ecosystem.

Both companies are currently engaged in rigorous technical verification processes with major high-performance AI GPU manufacturers. The success of these partnerships will be a key determinant of whether Samsung and Micron can meaningfully challenge SK Hynix’s dominance. In an environment where performance demands, cost pressures, and supply chain resiliency all carry equal weight, client diversification has become a strategic imperative.

In this emerging multi-supplier landscape, market leadership can no longer rest on technical superiority alone. Price competitiveness, operational self-sufficiency, and long-term trust with clients will define the next chapter in the HBM saga. With Samsung poised for a major reentry, Micron pushing from below, and SK Hynix reevaluating its strategic footing, the global HBM race is no longer a one-horse sprint—it’s a full-fledged battle for memory supremacy in the AI age.