With U.S. Economic Indicators Slowing and Pressure from Trump, July Rate Cuts Gain Momentum

Input

Modified

S&P Global Services PMI Preliminary at 53.1 U.S. Economy Still in ‘Expansion Phase’ Michelle Bowman: “If Inflation is Contained, I Support a July Rate Cut”

The U.S. economy is now grappling with a precarious mix of slowing momentum and intensifying external pressures. As inflation fears resurface — driven in part by Donald Trump’s aggressive tariff policies — the Federal Reserve faces mounting pressure to act. Simultaneously, fresh geopolitical risks, including the U.S.'s direct military engagement in Iran, threaten to further destabilize energy markets, heighten uncertainty, and complicate the Fed’s already delicate balancing act. Amid this complex backdrop, the prospect of a July interest rate cut is rapidly gaining traction, even as inflation data sends conflicting signals.

Solid Growth on the Surface, Inflation Brewing Beneath

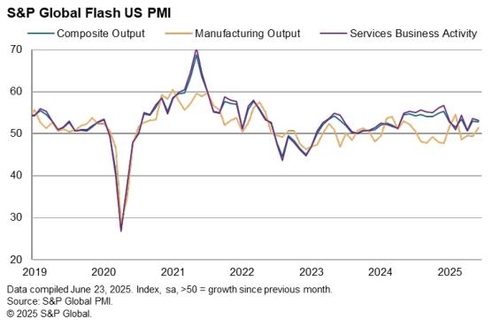

Despite loud warnings about the economic damage tariffs might cause, the latest data suggests that the U.S. economy remains fundamentally resilient — at least for now. According to S&P Global’s preliminary report released on June 23, the U.S. Services Purchasing Managers' Index (PMI) for June came in at 53.1, only slightly below May’s 53.7, signaling ongoing expansion despite a mild slowdown. The Manufacturing PMI remained unchanged at 52.0, holding steady at its highest level in 15 months, a reflection of stable industrial activity.

Particularly noteworthy was the rebound in the Manufacturing Output Index, which rose to 51.5 from 49.4 in May — its first return to expansion territory in four months. This uptick signals renewed manufacturing activity, supported primarily by robust domestic demand rather than exports.

However, the story isn't entirely reassuring. While domestic orders in manufacturing picked up, exports have continued to struggle, declining again in June after a brief rebound in May. In the services sector, new orders increased, but the rate of growth decelerated, and most concerningly, service exports fell for the third straight month, marking the largest quarterly drop since late 2022.

Beneath the solid headline numbers, inflationary pressures are quietly intensifying. Both manufacturing and services sectors reported noticeable price surges, with manufacturing experiencing the fastest jump in input and selling prices since July 2022. Alarmingly, around two-thirds of manufacturing firms reported rising input costs, while more than half attributed higher selling prices directly to tariffs.

The service sector is also grappling with compounding cost pressures stemming from tariffs, higher wages, rising fuel prices, and elevated financing costs. This convergence of cost-push factors threatens to feed inflation in ways that could be difficult to tame if left unchecked.

Chris Williamson, Chief Economist at S&P Global, contextualized the situation: “The U.S. economy continues to grow at the end of Q2, but inflation has accelerated again in the past two months.” He added that businesses appear to be stockpiling inventories and expanding hiring, likely in response to supply chain anxieties and efforts to preempt tariff-induced price increases. Yet, he warned, this type of growth could be transitory, lacking sustainable momentum if underlying price pressures persist.

The broader economic picture is reflected in the Composite PMI, which fell modestly to 52.8 from May’s 53.0, still above the key 50-point threshold that signifies expansion. However, the downward trend signals growing economic fragility beneath the surface stability.

The Fed’s Tightrope: Growth Resilient but Risks Mount

For the Federal Reserve, the latest data presents a formidable policy challenge. On one hand, resilient growth metrics suggest there’s no immediate need to rush into cutting interest rates. On the other hand, tariff-driven price pressures and global instability are muddying the outlook, making the path forward anything but clear.

Amid this backdrop, Vice Chair Michelle Bowman, widely regarded as one of the Fed’s most hawkish members, made remarks that are attracting significant attention. Despite her reputation for favoring tight monetary policy, Bowman signaled her openness to a rate cut, perhaps as soon as the July Federal Open Market Committee (FOMC) meeting, provided that inflation does not spike further.

“We have not observed any meaningful negative economic impact from recent trade developments or other external factors,” Bowman stated. “The U.S. economy continues to demonstrate resilience despite a modest slowdown.”

On the inflation front, Bowman struck a surprisingly reassuring tone, explaining that the upward pressure on goods prices due to tariffs is being offset by other factors. More critically, she suggested that the underlying trend in core PCE (Personal Consumption Expenditures) inflation — the Fed’s preferred gauge — is trending much closer to the 2% target than headline numbers might imply.

Bowman also voiced confidence that current tariff levels could ultimately come down, stating, “We expect that trade negotiations will result in lower tariff rates over time, consistent with the optimism currently reflected in financial markets.” Even if inflation does materialize in the coming months, she emphasized that the U.S. economy's increased capacity — particularly stronger labor markets and industrial output — will help absorb much of the shock, reducing the need for aggressive policy intervention.

However, despite this cautious optimism within the Fed, the reality remains that the risk calculus is shifting. While inflationary pressures are currently seen as manageable, their persistence — especially when fueled by supply-side shocks like tariffs and energy prices — could force the Fed into a narrow decision corridor where delaying cuts could risk a deeper economic slowdown, while cutting too soon could inflame inflation.

Middle East Tensions Fuel Oil Shock Fears — and Trump’s Anxiety

Compounding the Fed’s dilemma are fast-escalating geopolitical tensions in the Middle East. In a stunning escalation, the U.S. recently launched a direct airstrike on Iranian territory, marking a rare and bold move that immediately roiled global energy markets. The Middle East — often referred to as the “world’s powder keg” — is once again the epicenter of global economic risk.

The economic fallout could be severe. A sharp surge in oil prices would directly fuel inflation, exacerbating the very cost pressures already inflamed by tariffs. For the U.S. economy, which is already contending with slowing growth, a simultaneous oil shock could ignite stagflation — the dreaded combination of stagnation and inflation.

Recognizing this, President Trump moved swiftly into damage control. Deeply concerned about the political ramifications of soaring gas prices — particularly heading into an election season already burdened by tariff backlash — Trump reportedly leaned heavily on the energy industry and his Cabinet to hold fuel prices in check.

According to The New York Times, Trump posted a blunt message on social media on June 23: “Do not raise oil prices. Otherwise, you’re playing into the hands of our enemies. I’m watching you!” Alongside this public warning, he issued a direct order to the Department of Energy to immediately ramp up domestic crude oil production. Energy Secretary Chris Wright responded with a simple but telling reply: “Understood.”

But the math is unforgiving. With inflation already squeezing households thanks to tariffs and supply chain disruptions, any additional jump in fuel costs could become a severe political liability for Trump. The risk is not only economic; it’s also electoral. A fragile economy, surging gas prices, and growing consumer dissatisfaction could converge into a perfect storm — one that neither the White House nor the Fed can easily defuse.

The American economy is walking a razor’s edge. Resilient growth metrics offer comfort, but rising inflation driven by tariffs and the risk of an oil shock from Middle East tensions darken the outlook. The Federal Reserve faces a pivotal choice at its July policy meeting — to act preemptively with a rate cut or risk waiting too long as inflation and geopolitical shocks mount.

At the same time, President Trump’s aggressive foreign and trade policies, once touted as levers to strengthen America’s hand globally, are now ricocheting back into the domestic economy — threatening to tip the fragile balance between growth and inflation. Whether the combined weight of tariffs, military conflicts, and energy crises will push the U.S. economy off its current path remains the defining question of this summer.