Hyundai’s Push to Localize Its U.S. Supply Chain Triggers Survival Crisis Among Korean Parts Suppliers

Input

Modified

U.S.-Centric Procurement Strategy Accelerates

Tariff Pressure Threatens Supplier Bankruptcies

Vertical Integration Strategy Undercuts Partner Firms

As Hyundai Motor Group ramps up local sourcing of auto parts in the United States, the ripple effects are spreading through Korea’s auto parts industry. With declining order volumes now visible on top of persistent pricing pressure, the stable supply relationships of the past are quickly eroding. Hyundai’s growing vertical integration strategy is further shrinking the role of suppliers, transforming the competitive landscape into one where survival depends on technological strength and adaptability.

Avoiding Tariffs Without Raising Prices

In a second-quarter earnings call held on July 24, Hyundai stated, “In the short term, we plan to shift parts sourcing strategies, and in the longer term, we aim to promote strategic localization through comprehensive cross-organizational collaboration.” The company said it has formed a dedicated task force and is reviewing optimal procurement options for approximately 200 components. Kia, Hyundai’s sister automaker within the group, is also participating in this initiative.

This move is a response to the U.S. government’s proposed 25% tariff hike. With Washington demanding a staggering $400 billion in investment as a condition for tariff reductions, the South Korean government has limited room to maneuver. As a result, automakers are being forced to restructure their supply chains. To protect profit margins without raising vehicle prices, Hyundai is looking to increase local sourcing as a way to offset future tariff burdens.

The problem is that this shift comes at a cost to Korea’s domestic parts industry. Hyundai has long maintained a tightly integrated supply chain with Korean vendors, a structure that supports local economies and employment across both urban and rural regions. But as production and procurement pivot toward the U.S., the role of Korean suppliers—and their share of business—will inevitably shrink. This raises the likelihood of output cuts, restructuring, and ultimately large-scale layoffs.

Warning Signs of Restructuring, Impact Across Industry Ecosystem

Hyundai’s domestic suppliers are also under mounting pressure to cut prices. With automakers pledging not to pass increased costs on to American consumers, the burden has been pushed downstream to parts vendors. Hyundai’s move to expand local procurement has reduced its dependency on Korean suppliers, giving it stronger leverage in pricing negotiations. As a result, many suppliers now face a double blow: fewer orders and lower prices.

Industry insiders warn that a wave of bankruptcies may be looming, particularly among small and mid-sized firms. Unlike automakers, which generally have the financial strength to absorb tariff shocks, smaller suppliers remain highly vulnerable. Those further down the multilayered supply chain are especially exposed. A credit analyst noted, “Tariffs are a negative for automakers, but not a threat to their financial stability in the short term,” adding, “But second- and third-tier suppliers could face credit downgrades or even bankruptcy.”

Concerns are rising that the industry may be heading toward a repeat of the 2021 collapse triggered by the electric vehicle transition. That year, HM Metal—an auto parts supplier that provided brake calipers for models like the Hyundai Ioniq 5 and Genesis G80—went bankrupt, halting production lines across Korea. Because most auto parts are tailor-made, finding alternative suppliers takes considerable time, meaning supply disruptions often cascade through the entire ecosystem. At least three parts firms filed for court receivership during that period, and many in the industry now fear similar structural shocks could return.

U.S.-Based Full Production Systems on the Horizon

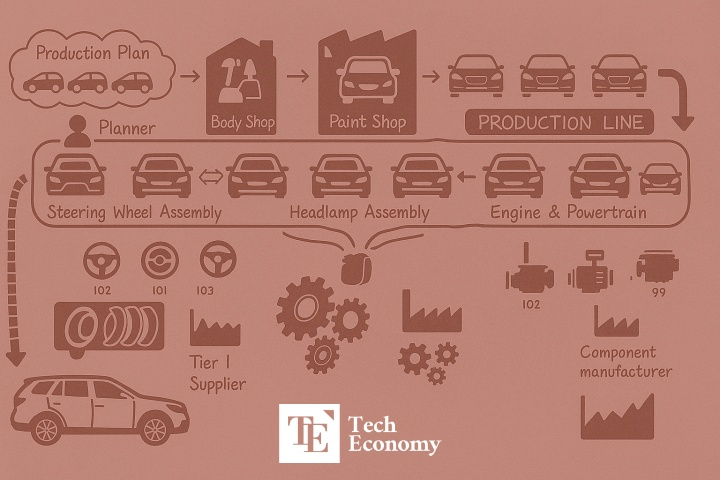

Hyundai’s supply chain transformation involves more than geographic relocation. The company is also moving to internalize core technologies and parts production—including batteries and semiconductors. From in-house hybrid battery development to investments in automotive chip startups and the creation of specialized task forces, Hyundai is taking steps not only to accumulate technical expertise but also to exert greater control over its supply chain. The group aims to build a stable production system even amid growing global uncertainty, by vertically integrating sourcing and development within its affiliates.

This strategy is a continuation of Hyundai’s long-standing vertical integration model. The company has historically prided itself on its “from molten iron to finished vehicle” approach, controlling everything from raw materials to final assembly. That structure helped Hyundai maintain relatively stable output during crises like the COVID-19 pandemic and global chip shortages. Under Chairman Euisun Chung, this approach has evolved further, with an increased focus on internalizing parts for electric and autonomous vehicles.

Hyundai’s strategy also mirrors global trends in the restructuring of the auto parts ecosystem. In the past, it was common for automakers to maintain captive supplier networks through majority ownership or long-term contracts. Today, however, competitive suppliers are increasingly asserting independence. Toyota and Denso, for instance, have unwound mutual shareholdings, while Hyundai Mobis has expanded its client base to reduce reliance on its parent company. Other major parts firms are reorganizing along technical lines, spinning off or separating internal combustion, battery, and autonomous driving divisions.

These shifts demand structural responses across the supplier landscape. The era when survival could be assured by a stable relationship with a single automaker is now over. As vertical integration intensifies, the role of independent suppliers is diminishing, and their bargaining power over price and order volume is weakening. The consensus across the industry is clear: relying on one buyer is no longer viable. Only firms with strong technical capabilities and the agility to adapt will survive in the new competitive order.