LG Chem Pursues PRS Issuance Using LG Energy Solution Stake as Collateral Amid Cash Crunch

Input

Modified

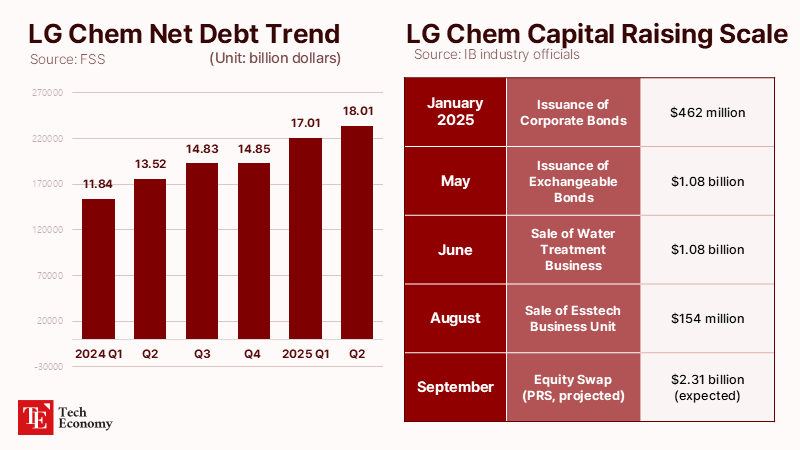

Parent in deficit, subsidiaries weakening, fundamentals eroding Up to $2.2 billion in cash to be raised through stake monetization Target stake amounts to 2.2–3.7% of LG Energy Solution shares

LG Chem is moving to issue up to $2.2 billion in profit return swaps (PRS) backed by shares in its battery subsidiary LG Energy Solution (LGES). The plan reflects its bid to reinforce financial stability amid a prolonged slump in the core petrochemical business, while also maneuvering to adjust its ownership stake to avoid the looming global minimum tax. Market watchers note that LG Chem is likely to proceed with an outright disposal of LGES shares following the PRS issuance. While PRS transactions are typically booked as equity rather than debt, the classification remains open to debate; however, should the underlying LGES shares be sold, recognition as equity becomes more probable.

Record-scale profit return swap under way

According to investment banking (IB) sources on the 16th, LG Chem is advancing a PRS deal using LGES shares as the underlying asset. Until recently, the company had prioritized exchangeable bond (EB) issuance or block trades as liquidity options. In May, LG Chem raised $1 billion by issuing EBs backed by 4.12 million LGES shares (1.76% of the company) and used the proceeds to repay debt. However, concerns over the direct impact of such deals on LGES’s share price prompted LG Chem to delay further action.

The company now targets raising around $1.5–2.2 billion, a scale comparable to the amount SK On secured through a similar PRS structure. Based on LGES’s closing price of $263 on the 15th, the contract would cover 2.2–3.7% of the company’s total shares. Korea Investment & Securities, KB Securities, NH Investment & Securities, and Shinhan Investment & Securities are weighing participation, with some considering commitments of up to $440 million each, while others are exploring investments between $220–$370 million.

A PRS resembles a stock-backed loan but incorporates derivatives, with final settlement depending on fluctuations in the underlying stock’s value. LG Chem would pledge part of its LGES stake to securities firms to raise at least $1.5 billion. At maturity, should LGES’s share price fall, LG Chem would compensate securities firms for the difference, while a price increase would see securities firms remit the gains to LG Chem.

LG Chem, which owns 191.5 million LGES shares (82%), has been in negotiations with multiple securities houses for months and has completed most procedural reviews. With a 90-day lockup period on further LGES share sales expiring at the end of this month following its EB issuance in June, LG Chem is expected to sign PRS contracts shortly thereafter. Each securities firm is expected to underwrite about $370 million in LGES shares. The PRS annual interest rate will likely be set between 4–4.5%, around 1–1.5 percentage points higher than LG Chem’s three-year bond yield of 3%. Given the $2.2 billion scale, securities firms are anticipated to form a syndicate to absorb the exposure.

LG Chem turns to stake monetization amid petrochemical downturn

The company’s decision stems from urgent liquidity needs as its core petrochemical segment continues to languish. Sources note that LG Chem has raised $440 million through a corporate bond issue in January, while also divesting its water treatment and aesthetics divisions. More recently, the company has pursued a sale of its bisphenol A (BPA) unit. These moves reflect efforts to shore up financial soundness amid years of deteriorating petrochemical market conditions.

Once a group profit engine generating multi-billion-dollar annual earnings, LG Chem has seen margins collapse under the weight of Chinese overcapacity, weakening global demand, and rising input costs. Regulatory filings show that in 2023, consolidated revenue fell 11.5% year-on-year while operating profit plunged 63.8%. Ongoing investment in new businesses has further pressured its balance sheet, pushing the company’s net debt-to-capital ratio from 35.6% in Q1 2023 to 52.5% in Q2 2024.

Its portfolio, centered on commodity products such as ethylene, polyethylene (PE), and polyvinyl chloride (PVC), lags in price competitiveness, leaving prospects bleak. High-value segments such as advanced materials and life sciences remain nascent. While the company is investing heavily in battery materials and innovative pharmaceuticals, these ventures are far from contributing meaningfully to earnings. The group remains heavily dependent on the battery business as its singular profit axis.

Compounding risks, expectations are rising that the U.S. Advanced Manufacturing Production Credit (AMPC) will be reduced starting next year. Such a shift would undermine the subsidy framework underpinning long-term growth and constrain LG Chem’s financing strategy. In Q1 2024, LG Chem posted $330 million in operating profit, driven largely by expanded U.S. tax credits for LGES. LGES reported $4.6 billion in revenue and $280 million in operating profit that quarter, but AMPC reimbursements amounted to $340 million—without which the subsidiary would have posted a $62 million loss.

Stake disposal seen inevitable to avoid minimum tax

Industry observers expect LG Chem to sell down its LGES holdings once the PRS contracts expire, rather than repay securities firms in cash. Under the OECD’s global minimum tax rules, a parent holding more than 80% of a subsidiary becomes liable for top-up taxes where the subsidiary’s effective tax rate falls below 15%.

With LGES benefiting from AMPC credits, its U.S. units may face effective tax rates below this threshold, exposing LG Chem—as 82% shareholder—to additional liabilities. By cutting its stake below 80%, LG Chem would shift much of the tax obligation to LGES, reducing the burden at the parent level. Should LG Chem pursue a long-term divestment strategy, the PRS would likely be classified as equity rather than debt. While PRS instruments are commonly treated as equity, dissenting views remain.

Recognition as equity would also mitigate capital strain for participating securities firms. Regulatory capital requirements, based on risk-weighted assets (RWA), mandate higher capital buffers for riskier holdings such as loans. By contrast, derivative exposures are assessed with more favorable risk weights. As such, treating PRS as a derivative rather than a loan would enable securities firms to process larger volumes of business with the same capital base.

Comment