Carlyle Group Pursues Acquisition of KFC Korea, Envisions ‘Bolt-on’ Synergy with KFC Japan

Input

Modified

Orchestra PE pushes sale barely two years post-acquisition Aggressive expansion and franchise turnaround lift performance Carlyle eyes rare buyout, synergy with Japanese portfolio

Fast-food franchise KFC Korea, which has staged a turnaround and achieved robust growth, is accelerating its divestment process, with global investment firm Carlyle Group Inc. emerging as the prospective acquirer. Following its takeover of KFC Japan last year, Carlyle is moving to expand its portfolio into the Korean market, signaling a more concerted strategy to build a pan-Asian food-service franchise network.

Carlyle Group Conducting Due Diligence on KFC Korea

According to investment banking (IB) sources on the 16th, Carlyle Group is conducting due diligence for the acquisition of KFC Korea. The firm is expected to conclude the process within the month and move into negotiations for a share purchase agreement (SPA). The controlling shareholder, private equity firm Orchestra Private Equity (PE), appointed Samil PwC as lead manager earlier this year to pursue the sale. Orchestra PE acquired KFC Korea from KG Group in 2023, injecting more than $50 million through a mix of existing and new shares.

Orchestra PE is said to be seeking over $220 million for the sale. The success of the transaction hinges on how much Carlyle is willing to meet the seller’s valuation. One IB industry source noted, “KFC Korea’s performance has rebounded, lifting its valuation. With both seller and buyer highly motivated, the likelihood of a deal being struck is considerable.”

Business Model Overhaul through Franchise Expansion

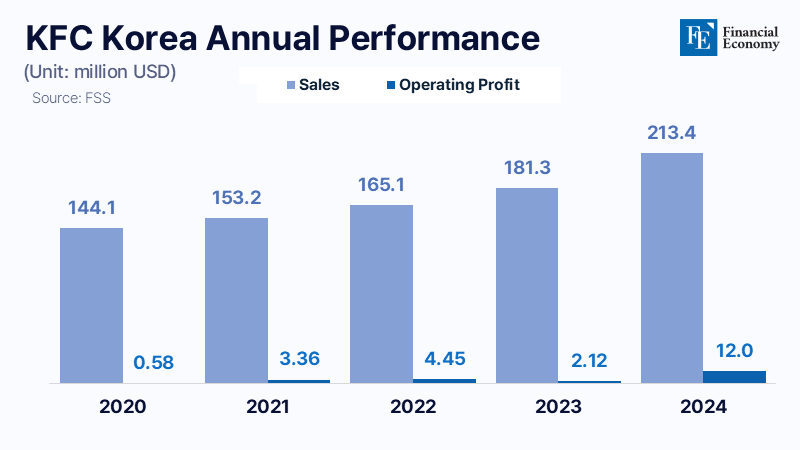

KFC Korea’s performance has rebounded rapidly under Orchestra PE’s ownership. In 2023, the year of acquisition, the company’s revenue grew 9.8% year-on-year, yet operating profit plunged 53%, slipping back into net losses. Its financials remained precarious: despite two capital injections totaling nearly $9 million, KFC Korea’s debt ratio at the end of 2023 still stood at an alarming 4,531.6%.

The prolonged slump stemmed largely from its decades-old company-owned store model, under which the headquarters directly bears labor and rent costs, suppressing profitability compared with franchise-based peers. It also restricted aggressive expansion. Whereas Lotteria and Mom’s Touch each operate over 1,000 outlets nationwide, KFC’s footprint fell short of 200 stores by end-2023.

This trajectory shifted in 2023 when Orchestra PE, in consultation with Yum! Brands, greenlit a pivot into franchising. The Munjeong Station branch in Seoul, opened in April last year, was the first franchise outlet. As of now, the network has expanded to 28 franchise stores, while company-owned outlets have undergone restructuring and renewal. By May, KFC Korea operated 206 locations—12 more than the prior year. The emergence of the brand’s first multi-unit franchisee this year underscores momentum, with expectations for further growth.

Leveraging these structural advantages, Orchestra PE expanded revenues significantly. In 2024, KFC Korea recorded its highest-ever results with revenue of $210 million and operating profit of $11.8 million. The first half of 2025 has already set fresh semiannual records, with revenue of $120 million and operating profit of $6.7 million. Absent major disruptions, full-year earnings are projected to surpass last year’s benchmarks.

Asian Market Expansion and Bolt-on Strategy

Carlyle had long been considered the frontrunner to acquire KFC Korea, given the potential synergies with KFC Holdings Japan Ltd., which it acquired in May 2024. The firm has aggressively targeted Japanese franchises in recent years, deploying a $3 billion fund to pursue its “Buy Japan” strategy. The move to acquire KFC Korea is seen as an extension, with scope for integrated procurement, logistics, and marketing platforms to boost cost efficiency. Market observers suggest Carlyle could pursue a “bolt-on” strategy—building scale before selling the integrated asset to a global food-service player or strategic investor.

According to IB industry sources, Carlyle’s Tokyo office initially led the deal, though control has now shifted to its Seoul operations. The group has pursued major Korean acquisitions in recent years—including intraoral scanner maker Medit and environmental services firm Ecobit—but without closing deals. A successful takeover of KFC Korea would mark Carlyle’s first significant buyout in Korea since its 2021 acquisition of coffee franchise Twosome Place.

Still, doubts linger over the $220 million price tag. KFC Korea’s EBITDA for the first half of 2025 stood at $10 million, which annualizes to roughly $20 million. Applying the typical 5–6x multiple for F&B franchises would imply a valuation closer to $110–130 million. Unlike Japan, Korea faces severe saturation in the fried-chicken segment, while soaring global grain and oil prices cast uncertainty over the broader dining sector. Meanwhile, the domestic burger market is intensifying with the arrival of foreign premium brands such as Gordon Ramsay Burger and Obama Burger. Against this backdrop, some analysts view the KFC Korea divestment as part of a broader restructuring to streamline operations amid economic headwinds and market volatility.

Comment