China Ramps Up “Battery Supremacy,” Accelerating Past Japan’s All-Solid-State Gamble

Input

Modified

Expanding New Energy Ecosystem and Storage Systems

All-Solid-State Batteries Pitched as a “Game Changer”

Japan’s Edge in Patents and Technology Under Threat

China is doubling down on its battery industry as a strategic sector to cement its position as the world’s top producer. Backed by $35 billion in funding, Beijing is pushing to expand new energy storage systems while simultaneously developing alternative technologies, with the goal of doubling the nation’s storage capacity by 2027. While Japan is betting on its patents and technical expertise in all-solid-state batteries to hold ground, China’s capital-driven speed race is rapidly closing the gap. South Korea, constrained by limited investment capacity, risks falling behind as the competitive landscape among the three powers is reshaped.

Long-Term Strategy for Global Dominance

According to the South China Morning Post on the 16th, China’s National Development and Reform Commission (NDRC) and National Energy Administration (NEA) recently unveiled a joint plan to strengthen leadership in energy storage technologies. The initiative designates energy storage as a cornerstone of the modern power system and sets a target of nearly doubling capacity by 2027. To that end, Beijing will invest $35 billion, expanding its new energy storage systems—built primarily on lithium-ion batteries—from 95 GW as of June to more than 180 GW.

The expansion dovetails with China’s carbon-neutrality roadmap. Storage capacity is seen as essential to buffer renewables’ intermittency and manage peak-hour imbalances. The NEA described storage as “a critical tool to ensure flexibility and security of the power system,” emphasizing its role in sustaining wind and solar growth. The plan also promotes mega-projects in deserts and decommissioned coal sites, alongside R&D into hydrogen storage, compressed air, and sodium-ion batteries.

China’s confidence stems from its surging battery industry. InfoLink reported that global shipments of energy-storage battery cells reached 240.21 GWh in the first half of this year, up 106.1 percent year-on-year, with Chinese firms accounting for all of the top 10 suppliers and 91.2 percent of the total. Shares of industry leaders CATL and Sungrow recently hit record highs, underscoring recognition not just of their scale but also their strategic market value.

Ultimately, China is elevating energy storage to a structural pillar of its industrial ecosystem. Huatai Securities lauded the plan, noting that “government provides a clear roadmap while companies develop independent revenue models, together ensuring sustainable long-term growth.” With the world’s largest energy-storage systems already in place, analysts expect China to solidify global leadership as renewable energy and EV adoption accelerate.

Breaking the Limits of Lithium-Ion

China is also casting all-solid-state batteries as the next frontier. Replacing liquid electrolytes with solid materials, the technology reduces explosion risks while more than doubling charging capacity and driving range, earning the moniker “dream battery.” Last year Beijing allocated $840 million in R&D funds to six firms—including CATL and BYD—to accelerate commercialization.

This state-led push has galvanized the industry. SAIC announced plans to begin production of all-solid-state batteries this year, with mass production slated for 2025, initially with hybrid cells containing 10 percent liquid content before advancing to fully solid systems. By 2027, the automaker aims to install them in its “Zhiji” series. CATL has mapped out small-scale production within the same timeframe. The race reflects Beijing’s intent to be first to prove large-scale commercialization.

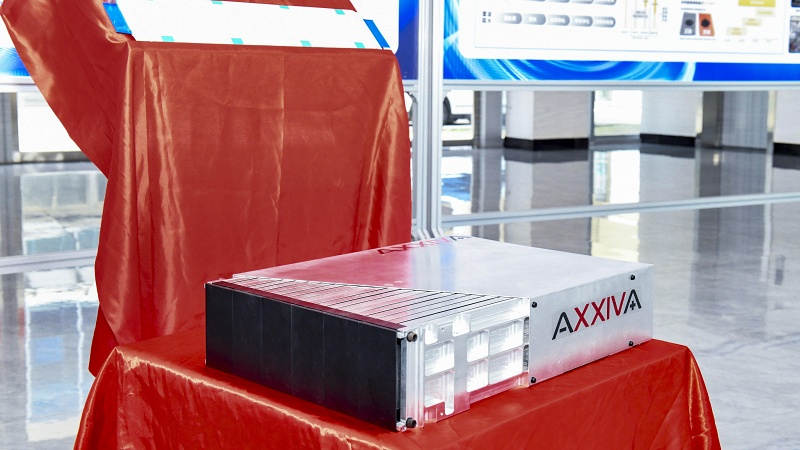

Technological progress is gathering pace. In July, Anhui Wanxin New Energy Technology unveiled a prototype solid-state cell with an energy density of 227 Wh per pound, cutting costs by 30 percent through dry-process manufacturing. The battery is already slated for Chery’s Exeed Exlantix ET, signaling imminent commercial rollout.

The momentum underlines widespread confidence in China that solid-state adoption is a matter of “when, not if.” While Japan and South Korea focus on patent filings and prototypes, China’s vast domestic market and policy resources are enabling the fastest path to scale—potentially turning all-solid-state batteries into the decisive blow that entrenches its dominance over the global battery industry.

Japan Bets on Patents to Defend Its Edge

In response, Japan is treating all-solid-state batteries as a national strategic industry. Once dominant, it has seen market share collapse to below 5 percent, ceding leadership to China and South Korea. Tokyo has pledged more than $41 billion in public-private investment by 2030 to reclaim 20 percent of the global market, with Toyota and Panasonic racing to establish pilot and mass-production lines.

Japan’s strategy leans heavily on patents and R&D. According to the World Intellectual Property Organization, Japanese firms filed 7,046 solid-state battery patents between 2000 and 2023, accounting for more than 40 percent of the global total—far ahead of China’s 4,625 and South Korea’s 3,225. In academic output, however, China leads with 899 papers, followed by the U.S. (587), Japan (295), and South Korea (176), revealing a deepening divergence between patent strength and research breadth.

Japan’s financial commitments are also significant. In 2020, the government launched a $13.6 billion Green Innovation Fund, earmarking $1 billion over 10 years for solid-state R&D and pilot production. Last year, Tokyo committed another $38.7 billion in combined public and private investment, supplemented by $2.2 billion in subsidies.

South Korea, by contrast, faces tighter constraints. While Seoul has rolled out R&D programs spanning polymer, oxide, and sulfide chemistries, bottlenecks in permitting, demonstration infrastructure, and long-term funding remain unresolved. As a result, the competitive map is shifting: Japan leaning on patents to defend its pride, China accelerating with capital and scale, and South Korea struggling to keep pace.

Comment