Economy network

Trump Announces 50% Tariff Bomb on Steel, Hardline Stance Against China Becomes More Overt

Input

Changed

“Steel Tariff Hike Announced After Accusing China of Breaching Agreement” “25% Tariff System Had Loopholes; Hike Will Prevent Evasion” “Approval of Nippon Steel–U.S. Steel Merger Sends a Political Signal”

In a fiery return to protectionist trade policy, U.S. President Donald Trump has unveiled a dramatic escalation in tariffs on foreign steel and aluminum imports, doubling existing rates to 50%. The announcement, made during a speech at a U.S. Steel plant in Pittsburgh, is widely viewed not just as an economic maneuver, but a politically charged message aimed squarely at China. While cloaked in rhetoric about safeguarding American industry, the move comes at a time of legal, geopolitical, and corporate developments that reveal a deeper strategy at play. It signals Trump’s renewed commitment to his “America First” agenda and a more aggressive posture against foreign trade partners—especially Beijing.

Steel and Aluminum Tariffs Doubled in High-Stakes Announcement

On May 30, President Trump took to the stage at U.S. Steel’s facility in Pittsburgh and declared that tariffs on imported steel and aluminum would rise from 25% to 50%, effective June 4. The existing 25% duties had been in place since March 2024 under Section 232 of the Trade Expansion Act, which allows tariffs on imports deemed a threat to national security. However, Trump argued that these measures had loopholes that foreign producers—especially China—continued to exploit.

“Increasing the tariffs will shut down those loopholes,” Trump said. “This will protect American steel more safely than ever before, and no one will be able to get around it.”

Though his speech focused on steel, he later took to his Truth Social account to announce that aluminum tariffs would also be doubled. “It is a great honor to raise tariffs on steel and aluminum from 25% to 50%,” he wrote. “This takes effect on Wednesday, June 4.”

The escalation reflects Trump's frustration with ongoing foreign imports despite the 25% barrier and the stagnation of tariff negotiations with other countries. U.S. trade officials have cited continued inflows of foreign steel as evidence that the original policy lacked sufficient deterrent force. The new 50% rate is designed to close off indirect trade routes and send a strong signal to countries attempting to circumvent tariffs by rerouting exports through third countries.

Nippon Steel Deal Sets the Stage

Trump’s tariff announcement also coincides with the pending acquisition of U.S. Steel by Japan’s Nippon Steel Corporation—a deal that had initially faced resistance from Trump himself. Just a week prior, on May 23, Trump reversed his opposition to the acquisition, which he had once blocked over national security concerns. Analysts now believe the tariff hike was partly a political maneuver to position the acquisition as a victory for American workers rather than a foreign takeover.

Trump’s visit to the U.S. Steel plant was strategic. As he stood before workers in Pittsburgh, he tied the acquisition to his tariff policy, declaring: “I think the people who just made this investment [Nippon Steel] are going to be very happy—because now, no one can take your industry away from you.”

U.S. Steel had already disclosed in April filings to the U.S. Securities and Exchange Commission (SEC) that it would become a wholly owned subsidiary of Nippon Steel’s North American arm but would continue to operate as an independent company. Trump’s change of heart came just one day before the Committee on Foreign Investment in the United States (CFIUS) was scheduled to review national security implications of the deal. In a surprise move, the two companies announced a formal partnership, and the deal appears poised to move forward.

For Nippon Steel, the acquisition offers more than symbolic value—it delivers immediate production capacity within the U.S. market. This would allow the Japanese firm to sidestep tariff burdens, reduce shipping times, and gain a stronger foothold in American supply chains. For Trump, the optics are powerful: he can claim to have both approved foreign investment and strengthened protection for American steelworkers, all in one stroke.

Escalation Against China Amid Legal Setback and Political Theater

While the tariff announcement appeared to target all foreign steel producers, many observers see it as a thinly veiled strike against China. Just two days earlier, on May 28, the U.S. Court of International Trade (CIT) had dealt a blow to Trump's tariff strategy by issuing an injunction against the enforcement of “reciprocal tariffs”—a key pillar of the administration’s trade leverage. The ruling complicated Trump’s plan to use matching tariffs as bargaining chips in ongoing trade negotiations with global partners, especially China.

In response, Trump seems to have pivoted toward item-specific pressure tools. Only hours before announcing the steel tariff hike, he posted a blistering attack on China via Truth Social, accusing Beijing of violating a recent tariff agreement. “China has completely violated the deal it made with us,” he wrote. “I helped them avoid economic collapse—and now they’ve broken their word. No more Mr. NICE GUY.”

The outburst came just weeks after a temporary truce in the U.S.-China trade war. On May 12, following high-level negotiations in Geneva, the two nations agreed to lower their respective tariffs—China’s to 10% and the U.S.’s to 30%—for a 90-day period. Trump’s sudden reversal of tone suggested impatience with what he viewed as China’s unwillingness to fully honor the agreement or engage meaningfully in follow-up talks.

Though Trump did not cite specific violations, market analysts believe the accusation was a pretext to justify renewed tariff escalation. China, which accounted for 54% of global steel production in 2022 according to the World Steel Association, remains a dominant player in the industry. Its steel, priced well below global averages, continues to flow into U.S. markets through both direct and indirect export routes—often via intermediary countries to bypass tariffs.

Trump has long portrayed Chinese steel as the central villain in America’s industrial decline. Calling it a “core cause of the collapse of American industry,” he has repeatedly targeted it as a symbol of unfair trade practices and economic imbalance. In this latest move, Trump is not just protecting domestic factories—he’s reinforcing his tough-on-China image in the lead-up to the midterm elections.

Steel is more than just an economic issue; it’s a political battleground. For China, it is a strategic export and a pillar of its supply chain dominance. For Trump, it is a symbol of American resilience and a convenient pressure point in the broader geopolitical contest. By doubling down on tariffs, Trump is setting the stage for a new round of trade confrontation—one where economic policy, legal maneuvers, and political calculation all converge.

Similar Post

Dual Strategy of BYD, the World's No. 1 Electric Vehicle Maker: The Hidden Crisis Behind the Price Cuts

Input

Changed

BYD’s ‘Bombshell Sale’ Intensifies Price Competition Potential Reshaping of Competitive Landscape with Tesla Accounting Transparency and Hidden Debt Issues Come to Light

As the world accelerates toward a future dominated by electric vehicles, China's BYD—now the global EV leader—is not just participating in the race but rewriting the rules. Known for its rapid ascent and formidable domestic presence, BYD is intensifying a two-pronged strategy aimed at reshaping both the Chinese and global electric vehicle markets. By launching a wave of aggressive price cuts across its lineup, the company seeks to eliminate smaller rivals at home and corner major players like Tesla on the world stage. But while the surface narrative showcases dominance and innovation, a closer look reveals mounting financial risks, opaque accounting practices, and a low-margin business model that could jeopardize its long-term ambitions.

The EV “Chicken Game” Heats Up in China

In a bold move announced at the end of May, BYD revealed plans to slash prices by up to 34% on 22 of its vehicle models through the end of June. Among the most dramatic cuts was the compact Seagull (SEAGULL), whose price dropped nearly 20%, from approximately USD 9,600 to USD 7,600. Meanwhile, the mid-to-large Seal (SEAL) sedan was reduced by a full 34%, now retailing for USD 14,300. The scale and scope of these reductions were seen as unprecedented, signaling a new phase in China’s EV war.

The motivation behind these aggressive discounts, according to industry analysts, lies in a ballooning inventory problem. Since the beginning of the year, BYD’s unsold vehicle stock has increased by roughly 150,000 units—nearly half of its average monthly sales volume of 350,000 vehicles. After selling 4.27 million vehicles in 2023, BYD raised its 2024 target to a staggering 5.5 million. With such lofty goals, the company is under enormous pressure to clear inventory to maintain sales momentum.

But BYD’s pricing bombshell didn’t go unnoticed. It ignited a ripple effect across the industry, pushing competitors into a corner. Leapmotor responded by slashing prices by around 30%, and Geely cut up to 18% on seven of its models. Even Changan Automobile—a player known for focusing on high-end models—was forced to offer a 10.5% discount on its flagship Deepal S07, bringing its price down to about USD 23,700.

Industry observers believe BYD’s tactics signal more than a push to boost short-term sales—they point to a larger strategy of forced consolidation. By triggering an industry-wide price war, BYD appears intent on weeding out weaker firms, restructuring the market around a few major players. As of March 2024, BYD’s domestic market share stood at 29.7%, down from 37.5% a year prior. While still in the lead, the 7.8 percentage point drop suggests the company is under pressure to defend its dominant position. Its price war, then, is not just tactical—it’s existential.

BYD’s Bold Push for Global Dominance

Beyond its domestic turf, BYD’s ambitions stretch across continents. Its dramatic price reductions are not merely a reaction to local competition but part of a larger strategy to alter the global EV hierarchy. Nowhere is this more evident than in the shifting status of Tesla, BYD’s chief international rival. As Tesla grapples with dual pressure from BYD and local disruptor Xiaomi in China, its once-prized position in the world's largest EV market is weakening. Tesla’s continued emphasis on high-end models appears increasingly out of sync with consumer demand, especially in a market where affordability and technological novelty drive sales.

BYD, in contrast, has a structural advantage. With a vertically integrated business model that includes in-house battery manufacturing, the company enjoys a level of price flexibility that Tesla cannot easily match. This nimbleness allows BYD to deploy aggressive pricing strategies without immediately jeopardizing its supply chain or production efficiency. In effect, it can weaponize price while maintaining scale.

Meanwhile, Xiaomi is carving out space in the premium EV segment, effectively flanking Tesla from the opposite side. The release of Xiaomi’s debut electric car, the SU7, generated a media frenzy when it racked up 50,000 pre-orders in just eight minutes. With Xiaomi appealing to consumers seeking style and novelty, and BYD dominating the value market, Tesla finds itself squeezed between two aggressive and fast-moving Chinese competitors. This dynamic marks a clear shift in consumer preference toward vehicles that are either significantly cheaper or notably more innovative than Tesla's offerings.

This domestic battle has clear international echoes. BYD is accelerating its expansion into Europe and Southeast Asia, markets where Tesla had previously enjoyed considerable dominance. In several emerging markets, BYD’s affordability and solid performance are winning over consumers and governments alike. Its growing presence in economies experiencing financial instability only strengthens its value proposition—where price and durability matter more than brand prestige.

Industry consensus is coalescing around a sobering conclusion: Tesla must revise its strategy if it hopes to retain relevance in this rapidly shifting landscape. BYD, by launching an assault on both domestic and foreign fronts, is no longer just a competitor—it’s the primary architect of a new EV world order.

Aggressive Pricing Strategy Could Amplify BYD’s Debt Risk

But behind BYD’s relentless drive lies a less glamorous reality. The company’s financial foundation is riddled with uncertainties that could ultimately undermine its rapid ascent. In early 2024, Bloomberg cited data from Hong Kong accounting firm GMT Research estimating BYD’s net debt at an eye-popping USD 44 billion. More troubling, the report suggested BYD may be obscuring its real debt load by underreporting or delaying the recording of accounts payable—particularly commercial notes issued to suppliers.

The average maturity period for BYD’s supplier-issued notes was found to be around nine months—more than four times the industry standard of two months. This longer delay in settling payments raises red flags about the company’s cash flow management and long-term liquidity. In an environment of rising costs, intense competition, and global expansion, even a minor disruption in funding could snowball into a full-blown liquidity crisis.

These financial maneuvers paint a troubling picture: a company pursuing breakneck growth while straining its financial resilience. And it’s not just about cash flow. A significant portion of BYD’s business model relies on government subsidies and foreign investment. As one analyst warned, "Any change in policy could directly impact performance." In other words, BYD’s strategy is as exposed to political winds as it is to market forces.

This precarious balance has sparked deep division among investors and analysts. On the one hand, BYD’s pricing strategy could yield a surge in market share and global brand recognition. On the other, it risks becoming a “race to the bottom,” where rising fixed costs and plummeting margins crush long-term profitability. In such a capital-intensive industry, the combination of shrinking gross profit and mounting debt could create a financial trap from which even the most innovative firms might not escape.

Thus, what appears on the surface to be a triumph of strategy may also be a cautionary tale in the making. BYD’s aggressive push for dominance, both at home and abroad, is clearly reshaping the global EV sector. But whether it emerges as a lasting powerhouse or stumbles under the weight of its own ambition will depend on how well it can manage its expanding risk profile while maintaining its technological and pricing edge.

Similar Post

7 Out of 10 Global Investment Banks Forecast Korea's Growth Rate in the 0% Range — Is 'Zero Growth' Becoming a Reality?

Input

Changed

Korea’s Growth Forecasts Lowered by Up to 0.8 Percentage Points by Institutions Outlook Favors Two Interest Rate Cuts Within the Year, With Focus on Supporting Growth Concerns Grow Over Structural Stagnation Amid Declining Birthrate, Aging Population, and Slowing Productivity

South Korea, once lauded as a model of economic dynamism, now finds itself at a critical juncture. The country that once vaulted from war-torn poverty to high-tech prosperity is now facing the stark possibility of stagnation. A growing number of global institutions are sounding the alarm: South Korea may be entering an era of near-zero economic growth. In just one month, the number of international investment banks projecting South Korea’s 2025 growth in the 0% range has nearly doubled. The convergence of deep-seated structural issues—an aging population, a shrinking workforce, and weakening productivity—has accelerated this grim outlook. As policymakers and analysts weigh their options, a deeper question emerges: is zero growth no longer a possibility, but an impending reality?

Pessimism Deepens: Global Forecasts Fall Below 1%

According to a comprehensive survey compiled by Bloomberg on May 30, 30 out of 41 major global institutions, including top-tier investment banks, now expect South Korea’s economic growth rate in 2025 to fall below 1%. That number marks a dramatic rise from the 16 institutions forecasting sub-1% growth just a month earlier—nearly doubling in four weeks. The average projection among these institutions now stands at 0.985%, down sharply from 1.307% the previous month, reflecting a widespread downward revision of expectations.

The forecasted figures vary from as low as 0.3% to as high as 2.2%, but the lower end of the range has garnered the most attention. France’s Société Générale (SG) stands out with a particularly bleak estimate of just 0.3%, a full 0.5 percentage points below the Bank of Korea’s own projection of 0.8%. Over half of all surveyed institutions—21 in total—expect South Korea’s growth to remain within the 0% range. This group includes financial heavyweights like Bank of America Merrill Lynch (0.8%), Capital Economics (0.5%), Citigroup (0.6%), and HSBC (0.7%). Meanwhile, another nine institutions, such as Barclays, Fitch, and Nomura Securities, predict growth at precisely 1%.

The downward trend in outlooks is consistent across the board. Crédit Agricole slashed its forecast from 1.6% to 0.8%. HSBC cut its estimate from 1.4% to 0.7%. Singapore’s DBS Group lowered its projection from 1.7% to 1.0%. SG dropped its outlook from 1.0% to 0.3%, the lowest among all major banks. Only four institutions made minor upward revisions—Goldman Sachs, Barclays, Bloomberg Economics, and Morgan Stanley—and even those adjustments were a modest 0.1 percentage point, keeping their revised forecasts in the low 1% range.

This swift and coordinated shift toward pessimism reflects growing unease over domestic and international factors undermining Korea’s economic resilience. Soft domestic demand, sluggish exports, and the ongoing global economic slowdown have all combined to squeeze growth potential. But the most worrisome causes lie deeper—in the fabric of Korea’s demographic and productivity trends.

The Long-Term Outlook: A Nation Drifting Toward Negative Growth

Beyond short-term projections, the long-range economic picture looks even more disheartening. In its recent report titled “Potential Growth Rate Outlook and Policy Implications,” the Korea Development Institute (KDI) painted a sobering scenario for the country's future. If South Korea’s total factor productivity (TFP)—the part of economic growth attributed to innovation, efficiency, and intangible improvements beyond labor and capital—remains at its 10-year average of 0.6% (2015–2024), the nation’s potential growth rate is projected to fall to zero by 2047.

That’s not even the worst-case scenario. If structural reforms stall and productivity growth slows further to just 0.3%, the KDI warns that South Korea could slip into negative growth as early as 2041. In contrast, under an optimistic scenario where AI technology accelerates productivity and reforms gain traction, TFP growth could rebound to 0.9%, potentially sustaining modest economic growth of 0.3% by 2050.

The urgency of these projections is underscored by how quickly the outlook has darkened. In a similar report published by KDI in November 2022, the institute suggested that under a pessimistic scenario, Korea would hit zero potential growth by 2050. Just two years later, that projection has been revised forward by nearly a decade. According to KDI researchers, this dramatic shift is due to updated demographic projections and revised assumptions about productivity growth.

At the core of the problem is Korea’s worsening demographic structure. The country is experiencing one of the fastest-aging populations in the world, coupled with one of the lowest birth rates. These twin forces are shrinking the working-age population, reducing potential output, and dragging down overall productivity. Without a significant reversal in population trends or a breakthrough in technological and institutional productivity, South Korea’s economy may be on a glide path toward prolonged stagnation—or worse.

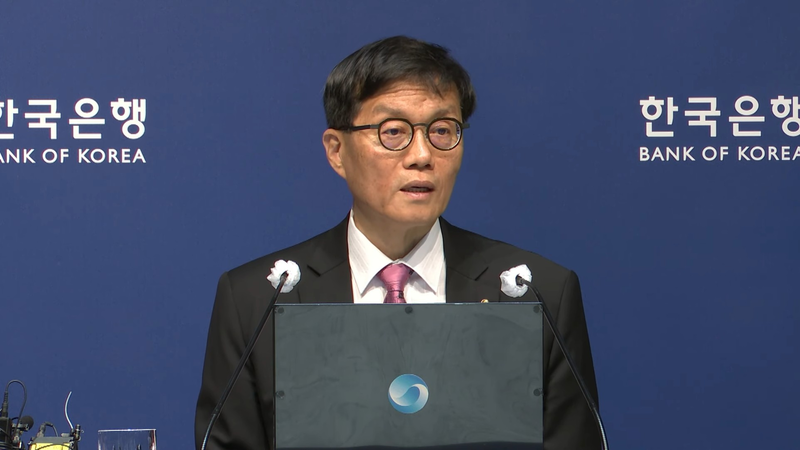

Central Bank Under Pressure: Eyes on August and November Rate Cuts

In response to the deteriorating economic outlook, attention has turned sharply toward the Bank of Korea (BOK) and its next monetary policy moves. On May 29, the BOK’s Monetary Policy Board voted to lower the benchmark interest rate by 25 basis points to 2.5%. It was a cautious but symbolic shift, acknowledging the mounting downside risks facing the economy.

Following the decision, 13 out of 15 major domestic and international securities firms predicted that the BOK would implement another rate cut as soon as August. Their reasoning is grounded in the growing likelihood of further economic deceleration and the dovish posture of the Monetary Policy Board—four out of its six members have indicated openness to another cut within the next three months. One firm projected a July cut, while another placed the likely timeline in August or October.

Kyobo Securities judged August to be the more probable timing for the next rate reduction, noting that monetary policy would likely center on managing downside growth risks in the months ahead. Kiwoom Securities cautioned that while rate cuts may stimulate demand, they could also inject excess liquidity into already frothy asset markets, particularly as household debt remains elevated. “Rather than cutting rates consecutively in July, the central bank may opt for an August cut and then pause to observe how the new government implements its policies,” Kiwoom noted.

That said, not everyone is confident that further rate cuts will come swiftly. Analysts from Shinyoung Securities and IBK Investment & Securities warned that mounting household debt and potential volatility in the foreign exchange market could delay the timing of future rate adjustments.

Despite these concerns, the majority of surveyed institutions—eight out of fifteen—expect the BOK to cut interest rates twice more this year. Most foresee the current 2.5% rate falling to 2.0% by year-end. SK Securities, for instance, predicted cuts in August and November, suggesting that the BOK will likely avoid back-to-back reductions and instead pursue a more measured pace. Meritz Securities offered a slightly different scenario: while forecasting two cuts in August and November, it projected the rate might stabilize at 2.25%, depending on shifts in U.S. monetary policy and the effectiveness of Korea’s upcoming supplementary budget.

Regardless of the precise timing, the consensus is clear—the Bank of Korea is preparing to act, and soon. Whether these interventions will be enough to counteract the growing structural and demographic challenges, however, remains to be seen.

Similar Post

Ukraine's "Spiderweb Operation" Drone Strikes Show Signs of Cracking 'Putin's Pride and Trump's Calculations'

Input

Changed

Drone attacks on four Russian Air Force bases Ukraine may be abandoning its strategy to undermine negotiations Trump's diplomatic card at risk of disappearing

The second round of peace talks between Russia and Ukraine, scheduled to take place in Istanbul, Turkey, is now at serious risk of falling apart. Ukraine's large-scale drone strikes, dubbed the "Spiderweb Operation," precisely targeted Russian strategic bases, wounding the pride of the Putin regime and intensifying the conflict between the two nations. With U.S. President Donald Trump—who has long presented himself as a peace mediator—now likely to pull out from the issue, the entire negotiation process risks collapsing and returning to square one.

USD 7 Billion in Damages Hits Russian Prestige

On June 1 (local time), the Kyiv Independent reported that Ukraine’s Security Service (SBU) launched a major drone strike on four Russian Air Force bases within Russian territory. The targeted bases included Belaya in Irkutsk, Olenya in Murmansk, Dyagilevo in Ryazan, and Ivanovo in Ivanovo. Reports indicate that 41 Russian strategic bombers were damaged. The estimated cost of the damage stands at around USD 7 billion, according to the SBU.

Citing internal sources, the media reported that the SBU transported first-person view (FPV) drones into Russia, concealing them inside mobile wooden boxes loaded on civilian trucks. At the right moment, the drones were remotely activated and deployed to strike strategic bombers. Ukrainian President Volodymyr Zelensky reportedly directed the attack himself, which took around 18 months to prepare. The operation was named “Spiderweb.”

Russia presented a conflicting account. The Russian Ministry of Defense acknowledged attacks on five air bases, claiming it repelled all but two, including Irkutsk. It admitted minor aircraft damage and reported arrests of several individuals involved in the attacks. Still, international media note that Russia's admission of a precision strike on key military bases severely damages President Vladimir Putin’s image as a strong leader.

Russia’s Anger, Ukraine’s Silence

With tensions rising, the scheduled second round of peace negotiations in Istanbul now appears likely to be canceled. Russia had unilaterally informed Ukraine of its intention to hold the talks at Istanbul’s Çırağan Palace on June 2 at 1 p.m., shortly after rejecting Ukraine’s call for a trilateral summit that included the United States. The move was seen as an effort by Russia to dictate the terms and timing of the talks to its own advantage.

Ukraine had formally confirmed its participation and sent over a document outlining its peace terms. These included a full and unconditional 30-day ceasefire, the exchange of all prisoners of war, and the repatriation of Ukrainian children taken to Russian-occupied territories. It also proposed using the current frontlines as the starting point for territorial negotiations, with a summit between Zelensky and Putin to follow.

These proposals differ significantly from Russia’s long-stated demands, which include Ukraine's renunciation of NATO membership and international recognition of Russia’s control over occupied Ukrainian territories. Russia has yet to provide an official response and planned to reveal its position on the day of the negotiations.

In this context, Ukraine’s drone strikes are widely interpreted as a de facto withdrawal from diplomatic efforts. The timing, method, and targets of the operation are all seen as undermining the likelihood of negotiations. The fact that Ukraine launched the attacks without offering any diplomatic clarification or messaging suggests a deliberate distancing from not only Russia but also from international mediators.

As the possibility of talks collapses, Europe is reacting sensitively. France and Germany reportedly reached out via unofficial channels to revive the dialogue, but Russia dismissed any talk not on its terms. Ukraine, meanwhile, reiterated its stance that no talks can proceed without addressing accountability for war crimes first.

Trump Gains an Excuse to Exit Mediation Role

The potential collapse of talks in Istanbul sends a negative signal to international actors who had hoped to mediate the conflict. Chief among them is U.S. President Donald Trump, who has repeatedly claimed that the war would never have started if he had been in office. He has shown a consistent interest in acting as a peace broker.

However, Ukraine's high-intensity drone strikes just before the talks, and Russia's interpretation of them as a clear provocation, have shattered any remaining justification for Trump’s mediation efforts.

For Trump, calling for an end to the war has been more than diplomacy—it has been a key strategy to reinforce his image as a “strong leader.” But the current climate offers little room to maneuver. Getting involved now risks failure without payoff. Analysts suggest that from Trump's perspective, it’s smarter not to get involved at all than to risk a fruitless intervention.

The geopolitical landscape no longer favors him. President Putin sees the war as a matter of pride, not diplomacy. President Zelensky has shown resistance to one-sided U.S. approaches. Other issues—like Israel or North Korea—where Trump might have intervened through personal diplomacy are also at a standstill. Strategically, Trump has fewer openings than ever.

In this context, Trump's likely decision to walk away from his mediator role appears to be a calculated withdrawal from a politically disadvantageous situation. With the Russia-Ukraine negotiations on the verge of collapse, any forced attempt at diplomacy risks being seen as empty interference. Many experts believe the "Trump factor" in the war will now quickly fade.

Similar Post

Selective Openness 2.0: Why Liberal Societies Should Have Screened Smartly Before the Populist Wave

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

The High-Speed Trade-Off: How Instant Connectivity Erodes Social Resilience

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

After the Miracle: Why Only Radical Openness Can Stop Japan's Demographic Implosion

This article was independently developed by The Economy editorial team and draws on original analysis published by East Asia Forum. The content has been substantially rewritten, expanded, and reframed for broader context and relevance. All views expressed are solely those of the author and do not represent the official position of East Asia Forum or its contributors.

Trump's Reciprocal Tariff Policy, Once on the Brink of Being Scrapped, Revived in Just One Day

Input

Changed

U.S. Court of International Trade: "Trump Tariffs an Abuse of Authority" Appeals Court Upholds Tariffs at Government's Request Global Markets Fear Prolonged Uncertainty

Just one day after a U.S. federal court ruled Donald Trump's retaliatory tariffs invalid, the decision lost its immediate effect. On May 29, the U.S. Court of Appeals for the Federal Circuit quickly accepted the Trump administration’s emergency request to pause the enforcement of the lower court’s decision. The sudden reversal signals a looming legal battle over the tariffs, but market sentiment suggests Trump’s tariff policy will continue regardless of legal outcomes.

A Blow to Trump’s Tariff Powers—Then a Reversal

On May 28 (local time), the U.S. Court of International Trade blocked the implementation of the reciprocal tariffs announced by Trump on April 2. According to Reuters, the court ruled that the U.S. Constitution grants taxing authority to Congress—not the President. The judges noted that even under emergency powers meant to protect the U.S. economy, this authority cannot be overridden. As a result, they permanently barred the enforcement of the executive order in question.

The ruling centered on the interpretation of the International Emergency Economic Powers Act (IEEPA). The court concluded that IEEPA does not grant the president unrestricted authority to impose tariffs on foreign goods. Passed in 1977, the IEEPA allows the president to declare a national emergency in response to unusual or extraordinary threats to U.S. national security, foreign policy, or the economy. Trump had argued that America’s chronic trade deficits qualified as such a threat, justifying the aggressive tariffs.

However, the court rejected this view, stating that trade deficits do not constitute a national security emergency. It deemed Trump’s invocation of IEEPA as a temporary trade regulation tool—not a weapon for trade wars. Consequently, the 10% baseline tariff imposed globally and additional reciprocal tariffs targeting countries like China were rendered legally vulnerable.

Appeal Halts the Ruling and In Effect until June 9

In response, the Trump administration filed an immediate appeal and requested a stay of the ruling. The very next day, the appeals court granted the request, effectively reinstating the contested tariffs—at least temporarily.

The court ordered plaintiffs to respond to the government’s stay request by June 5, with the administration’s reply due by June 9. After reviewing the submissions, the court will decide whether to maintain the stay while the appeal proceeds. If the stay remains in effect, Trump’s tariffs could remain valid for months, or even longer, as appeals often take up to a year. The legal process around the stay is distinct from the broader appeal.

Despite the legal volatility, experts downplay the likelihood of significant international fallout. With many major trade negotiations expected to conclude before a final court ruling, the decision may ultimately have limited practical impact. A market analyst noted that "the Trump administration can resort to alternative legal justifications or diplomatic pressure to maintain tariffs, regardless of court outcomes." The European Union, for example, stated that it would proceed with upcoming trade talks with the U.S. as planned, unaffected by the legal dispute.

"No One Knows What Will Happen" — A Market in Turmoil

U.S. markets remained largely unmoved by the court battles. The belief that Trump’s tariffs will persist in some form seems to have reassured investors. On May 29, the Dow Jones Industrial Average rose 117.03 points (+0.28%) to close at 42,215.73. The S&P 500 gained 23.62 points (+0.40%) to finish at 5,912.17, and the tech-heavy Nasdaq added 74.93 points (+0.39%) to end at 19,175.87.

Still, concerns are mounting over long-term policy and economic uncertainty. Wall Street analysts are unsure whether the tariffs will ultimately be overturned or what kind of new measures the Trump administration might implement in response. Ulrike Hoffmann-Burchardi of UBS Global Wealth Management commented, “Policy-driven headlines will likely heighten market volatility going forward,” adding that while U.S. equities could trend higher over the next 12 months, short-term gains may remain limited.

Foreign exchange markets also reflected growing anxiety. On May 29, the USD/KRW exchange rate closed at 1,371.10 won—down 5.40 won from the previous session in Seoul. Compared to the weekly close of 1,375.90 won, the Korean won strengthened by 4.80 won. Analysts attribute the dip to market fears of Trump’s unpredictability, which weakened the dollar.

The U.S. Dollar Index, which measures the greenback against six major currencies, fell 0.565 points to 99.348 on the same day. As the legal and political drama continues, markets remain alert, but not yet alarmed—anticipating that, one way or another, Trump’s trade tactics will remain in play.

Similar Post

Bang Si-hyuk and Associates Hit Multi-Billion Won Jackpot After IPO? Prosecutors and Police Ramp Up All-Out Pressure on HYBE

Input

Changed

HYBE Deceived Public by Claiming No IPO Plans, Then Went Public Early Investors Induced to Sell Off Large Stakes Secured Over USD 290 Million — Prosecution Investigation Imminent

Prosecutors have launched a full-scale investigation into alleged insider stock trading at HYBE, following a recent raid of the company's headquarters. Simultaneously, police are pursuing a separate probe targeting HYBE Chairman Bang Si-hyuk on suspicions of "fraudulent unfair trading," with the Financial Supervisory Service (FSS) also conducting an inquiry—indicating mounting legal pressure on the company from all fronts.

Bang Si-hyuk Under Investigation for Fraudulent Trading

According to sources in the entertainment and legal industries on the 30th, the Financial Securities Crime Joint Investigation Division of the Seoul Southern District Prosecutors’ Office raided HYBE’s headquarters on May 27. The investigation involves a former HYBE employee (referred to as "A"), who allegedly used insider information in January 2021—before HYBE (then Big Hit Entertainment) publicly announced its investment in YG PLUS—to buy shares and earn an illicit profit of about USD 173,858. Big Hit later confirmed a partnership with YG PLUS involving equity and music distribution.

Separately, the Seoul Metropolitan Police’s Financial Crimes Unit applied for a search warrant on May 28 targeting Bang Si-hyuk in relation to fraudulent trading allegations. The FSS’s Investigation Division 2 is conducting a parallel probe. An FSS official stated, “Once final charges are confirmed, we plan to fast-track the case and refer it to the prosecution.”

Misleading Investors Pre-IPO and Dumping Stock

According to materials obtained by the FSS, in 2019—prior to HYBE's IPO—early investors who held shares in Big Hit Entertainment urged Bang Si-hyuk to begin preparing for a listing. However, Bang’s team reportedly told them that listing was not feasible at the current company valuation. Believing this, many venture capital (VC) investors sold their shares.

Contrary to those assurances, Bang was actively preparing for an IPO. The sold shares were purchased by private equity firms (PEFs) such as Eastone Equity Partners, New Main Equity, and STIC Investments—firms established or linked to Bang’s associates. Bang reportedly entered into secret agreements with these PEFs, promising to receive 30% of any IPO-related investment profits. The contracts included a clause obligating Bang to repurchase shares if the IPO failed within a set timeframe.

After the IPO, these PEFs reaped massive profits, and Bang personally received an estimated USD 300 million as part of the deal. The FSS reportedly secured evidence showing that, despite publicly denying IPO plans, Bang's side had applied for a designated audit—an essential IPO preparation step—suggesting he was already moving toward listing. Had early investors retained their shares, they could have profited significantly; instead, they lost that opportunity by trusting Bang’s claims.

Undisclosed Shareholder Agreements and Lock-Up Evasion

These shareholder agreements were not disclosed in HYBE’s IPO filings, as required. Neither the Korea Exchange during its IPO review process nor the FSS during securities registration received reports of the agreements.

Investment bankers now question how HYBE’s IPO underwriters failed to report the agreements despite standard due diligence procedures. One Korea Exchange official stated, “Bang’s agreement to share profits with major investors should absolutely have been disclosed as a material issue,” noting that such omissions are virtually unheard of during IPO processes.

Experts believe this arrangement allowed the PEFs linked to Bang to avoid lock-up restrictions normally placed on major shareholders. As a result, these funds dumped large volumes of stock immediately after HYBE went public. The IPO was priced at USD 97.8 per share—roughly five times higher than the pre-IPO valuation. After listing, the stock surged to over USD 304.25 before crashing by around 70% within a week, partly due to the massive sell-off.

This scheme—where a major shareholder collects post-IPO profits from behind-the-scenes investors—is now being flagged as a potential method for evading mandatory lock-up periods. The FSS is focusing on this point and is reportedly considering charging Bang with fraudulent unfair trading under Korea’s Capital Markets Act. If the illegal profits exceed USD 3.6 million, the law mandates a minimum five-year prison sentence or even life imprisonment.