When Tariff Drama Turns into an Economy-Wide Latency Tax

Input

Modified

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

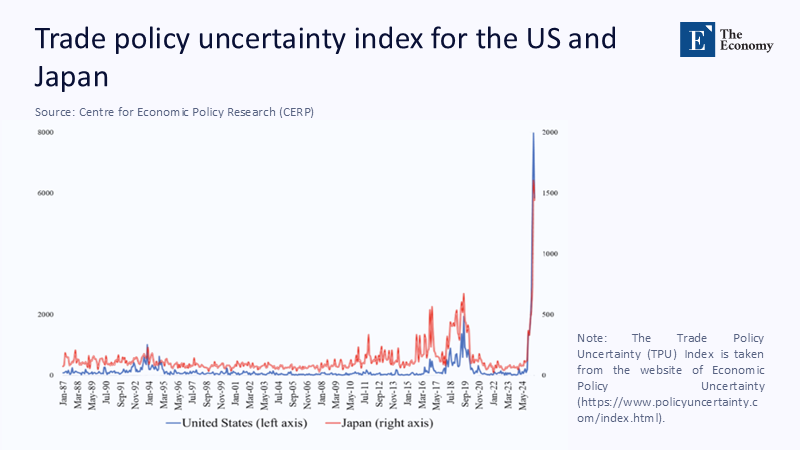

Let's delve into the numbers. In mid-April this year, the U.S. Trade-Policy-Uncertainty (TPU) index surged to more than sixteen standard deviations above its long-run mean. This was the single largest tail event recorded since the series was created a decade ago. The impact was profound. Firms didn't just adjust prices; they put the brakes on new capacity, treated every boardroom spreadsheet as provisional, and diverted free cash into safe assets instead of fresh plants. By reframing President Trump's revolving-door tariff announcements as a latency tax—a toll on the timing rather than the level of investment—we focus on the policy's hidden cost. This sets the stage for a more rules-based, less chaotic trade regime.

Tariffs as a Latency Tax: Where Conventional Analysis Stops Short

Standard tariff arithmetic tracks import prices, demand elasticities, and welfare triangles, then proclaims an x-percent duty will shave y-percent off GDP. But it overlooks a larger externality: the option value of waiting. After surveying 40 years of data, Federal Reserve economists found that a one-standard-deviation jump in broad uncertainty cuts business investment by roughly ¾-1% over the following year. The April TPU shock was sixteen such jumps, implying a drag measurable in full GDP points. That ignores a larger externality: the option value of waiting, which surges in response to policy-generated volatility. The Trade Policy Uncertainty (TPU) Index, shown in Figure 1, captures that volatility across countries—illustrating a synchronized and historic spike for both the U.S. and Japan.

The Fed's Financial Stability Report underscores the mechanism: announcement-driven volatility sent Treasury yields gyrating and wider credit spreads. This led to 'heightened uncertainty about the breadth and duration of possible changes to global trade patterns.' Treating tariffs as episodic taxes misses that each surprise extends decision latency across a production web—effectively charging rent on idle capital until the following tweet clarifies the game's rules.

Real Options and the Economics of Waiting Under Policy Fog

Real-options theory, developed by Dixit and Pindyck and summarised in Oxford Bibliographies, holds that volatility raises the hurdle rate for committing funds when investment is costly to reverse. In simpler terms, it means that when there's a lot of uncertainty, it becomes more expensive to make investment decisions. The maths look abstract until TPU spikes: the hurdle swells non-linearly with σ, so volatility on today's scale drives the net-present-value trigger far above any normal rate of return. CEPR's recent column on Trump-era tariffs translates that textbook logic into the current political economy, warning that policy-made uncertainty forces globally integrated firms to shelve expansion even in markets not directly covered by the duty schedules. In effect, the White House has written out-of-the-money American options that every exporter and importer is compelled to hold. Exercising the choice—to wait—is privately rational yet socially wasteful because thousands of similar decisions accumulate into a macro-scale pause.

GIAI's Suspended Expansion: A Micro-Case of Macro Contagion

Nowhere is the latency tax clearer than at GIAI, a mid-cap industrial automation champion based in the Midwest. By February, the firm had lined up a €400 million assembly-robotics project stitched together with long-dated supply contracts. In March, after a volley of reciprocal tariff threats with the EU, GIAI's Japanese servo-motor supplier asked for a ninety-day standstill clause; a German precision-gearbox maker followed suit; a U.S. steel-plate mill demanded an escalator in case President Trump switched quotas for tariffs. These clauses did not just postpone construction—they cascaded across sub-suppliers and service providers, leading to a significant delay in the project. A conservative discounted-cash-flow exercise shows the lost quarter alone erodes €5.9 million of present value at GIAI's 6% WACC, but the tally balloons when you add the project financing fees that keep ticking and the supplier penalties loaded onto the lead contractor. None of the parties pays the delay explicitly; the policy-induced uncertainty spreads the cost invisibly like humidity, raising the project's implicit hurdle rate past any rational 'go' decision. The tariff may never be collected, yet the latency tax is already paid.

Supply-Chain Propagation: From One Deferred Contract to a Grid of Idle Assets

Trade networks transmit postponement faster than price shocks. Oxford Economics calculates that every U.S. dollar of capital-goods spending pulls $2.70 of intermediate orders within three quarters. Reverse the flow, and the multiplier operates in a mirror image: the Federal Reserve's April Beige Book notes "flat or softer orders because of ongoing trade policy uncertainty," with some manufacturers offshoring international orders "to avoid retaliatory tariffs." Dallas Fed surveys show Texas service-sector outlook indices plunging into negative territory as "clients asked for delays pending tariff clarity," a sentiment never before recorded outside recessions. The ripple reaches real estate when warehouse developers freeze projects intended to service now-on-hold exporters; it sloshes into community colleges that postpone specialized training programs; it even dents tourism as visa-on-arrival negotiations become bargaining chips in the broader trade contest. The latency tax thus mutates into an economy-wide toll booth where every firm's queues and meters are running.

Putting a Price Tag on Deferred Time: A Back-of-the-Envelope Macroeconomic Bill

Aggregate the micro delays, and the macro cost is startling. Non-residential fixed investment averages 13 % of the U.S. GDP. Suppose half that pool—roughly $1.8 trillion annualized- is subject to high import content or exposed export demand. Suppose the median firm, echoing GIAI, imposes a 90-day wait, and academic estimates suggest 8% of planned spending evaporates with each quarter of deferral. In that case, the lost flow equals 0.13 × 0.5 × 0.08 × 0.25 ≈ 0.13% of GDP per quarter. Scaling up and compounding with fiscal multipliers of 1.5 drawn from Fed VAR simulations transforms the pause into a drag exceeding $100 billion—enough to wipe out an entire month of expected 2025 growth. This calculation is conservative: it omits inventory hoarding ahead of tariff deadlines, the lobbying outlays to secure exemptions, and the R&D attrition when engineers are reassigned from innovation to compliance. The IMF's World Economic Outlook echoes the warning, emphasizing that "heightened trade-policy uncertainty may further hinder both short-term and long-term growth prospects."

Financial Ripples: Cash Hoards, Spread Widening, and Shifts in Capital Flows

Money markets react instantly to latency. The Financial Stability Report records a "wave of price declines and volatility" across multiple asset classes following tariff leaks, while Treasury term premia gyrated to the top of their post-2010 range. Corporations, uncertain whether replacement parts will cost 10 or 30% more next quarter, hoard liquidity: aggregate runnable money-like liabilities hover near historical medians even as cash on-balance-sheet climbs. Equity markets price the pause, too; April saw a six-percent drawdown in the S&P before bargain hunters stabilized valuations. Yet the U.S. remains a magnet for global capital: Reuters notes the country captured 41% of worldwide gross capital inflows in 2022-23, a share that looks unsustainable if tariff roulette accelerates. Investors are not fleeing, but they are repricing. According to market data collated by the Fed, credit-default-swap spreads on highly globalized manufacturers widened fifteen basis points relative to domestically oriented peers in April. The latency tax thus transmits from Main Street to Wall Street with remarkable speed.

Comparative Evidence: How Other Economies Price Policy Fog

International data confirm that waiting is contagious. The TPU index for Japan surged in parallel with its U.S. counterpart, mirroring the CEPR column's Figure 1. Handley and Limão's survey of empirical work catalogs dozens of episodes—from Brexit to Brazil's fiscal crises—showing that uncertainty shocks slash export entry, foreign affiliate investment, and job creation. The IMF warns that escalating trade tensions could tighten global financial conditions and catalyze capital outflows from emerging markets, amplifying dollar-funding stress. In Europe, Commission briefing papers estimate that a sustained 12-14% average tariff environment—considered the "most likely scenario"—could trim Euro-area potential growth by 0.4 percentage points, mainly via the real-options channel. The pattern is universal: when the rules dance, money sits.

Policy Prescription: Certainty Is the Cheapest Growth Stimulus

If volatility is the disease, credibility is the vaccine. The Council of Economic Advisers underscores that the U.S.'s dominance of capital inflows rests on perceived institutional reliability; squander that, and the 41% share melts. Three design tweaks would slash the latency tax without touching tariff rates. First, hardwire automatic sunsets: absent Congressional renewal, duties revert to WTO-bound levels, anchoring expectations. Second, codify maximum notice periods—180 days—between proposed and effective tariff changes, mirroring the SEC's rulemaking calendar. Third, embed downward-only adjustment clauses in trade agreements, ensuring that retaliatory escalation ratchets down after adjudication rather than resetting to zero on political whim. Together, these steps push σ lower, shrinking the option value of waiting and nudging hurdle rates back within reach of normal corporate returns. The Fed's analysis shows that moving uncertainty from the 95th to the 50th percentile would add ¾-1% to investment over a year; today's capital stock is a stimulus worth more than the entire R&D tax credit. Unlike fiscal giveaways, certainty costs nothing.

Time Is Money—and Policy Controls the Clock

Tariffs grab headlines as a tug-of-war over relative prices, yet their bigger mischief is temporal. Each unpredictable revision functions like a derivative contract that the government writes against the real economy, compelling firms to purchase an unwanted option to idle. The bill appears not as a line on the Customs form but as empty loading docks, paused payrolls, and a creeping malaise in forward-order indices. Real-options logic exposes that hidden toll; the data confirm it; GIAI's stalled robots personalize it. If Washington wants growth without inflation, the budget-neutral lever is obvious: stop taxing time. In capital deployment—as in life—delay is the deadliest form of denial. Therefore, a trade policy that kills suspense is not business charity; it is the lowest-cost macro stimulus on the menu.

The original article was authored by Masayuki Morikawa, a Distinguished Senior Fellow at Research Institute of Economy, Trade and Industry (RIETI). The English version of the article, titled "Trump tariff policy, uncertainty, and the role of economics," was published by CEPR on VoxEU.

References

Baker, S., Bloom, N., & Davis, S. (2025). "Costs of Rising Uncertainty." FEDS Notes (April 24).

Board of Governors of the Federal Reserve System (2025). Financial Stability Report, April 25.

Dallas Fed (2025). Texas Service Sector Outlook Survey, April 1.

Dixit, A., & Pindyck, R. (1994). Investment under Uncertainty. Princeton University Press.

Economic Policy Uncertainty (2025). "Trade Policy Uncertainty Index, Monthly Series for the United States and Japan." Available at policyuncertainty.com.

International Monetary Fund (2025). World Economic Outlook, April edition.

Morikawa, M. (2025). "Trump Tariff Policy, Uncertainty, and the Role of Economics." VoxEU/CEPR, June 14.

Oxford Bibliographies (2023). "Real Options Theory."

Reuters (2025). "Strong Economy, Safe-Asset Demand Boosted U.S. Dominance in Capital Flows." January 10.

U.S. Federal Reserve (2025). Beige Book, April 23.