Educating for the Interregnum: How ‘Liberation Day’ Turned a Trade Tactic into the End of U.S. Economic Supremacy

Input

Modified

This article was independently developed by The Economy editorial team and draws on original analysis published by East Asia Forum. The content has been substantially rewritten, expanded, and reframed for broader context and relevance. All views expressed are solely those of the author and do not represent the official position of East Asia Forum or its contributors.

When Washington announced a blanket 10% tariff on every good entering the United States, the proclamation did more than shock markets—it marked the first time a great power willingly taxed the credibility that had underwritten its ascendancy. That single act recast American leadership from the guarantor of openness to the architect of fragmentation, signaling that a nation can surrender hegemony not in defeat but by policy choice. This shift, termed “Liberation Day”, did not merely dent global demand; it accelerated an already-visible transfer of productive capacity, soft-power gravity, and curricular relevance away from the United States and toward a multipolar ecosystem dominated, though not monopolized, by China. The challenge for educators preparing the next cohort of economists, trade lawyers, and policy analysts is clear-the focus of education needs to shift to adapt to the new normal of turbulence in global trade dynamics.

The Arithmetic of Voluntary Dethronement

The East Asia Forum’s judgment that the American century “expired by executive decree” is more than a journalistic flourish; tariff arithmetic makes the verdict empirical. In 2024, the United States imported goods worth roughly US$3 trillion. A universal levy of 10%, therefore, imposes a first-round tax of US$300 billion. As indicated by Congressional Budget Office modeling, this significant financial burden is not without consequences. Every percentage-point increase in the average tariff rate trims 0.2 percentage points from real GDP in the subsequent year; the White House has thus hard-wired a one-percentage-point growth penalty into 2025 before rival retaliation is even counted. By contrast, China, Europe, and a widening club of “swing exporters” have responded by rerouting but not retreating. UN Trade data show world commerce hit a record US$33 trillion in 2024—proof that globalization can thicken even as its erstwhile sponsor erects barriers. The United States, once the system’s anchor, has become the pivot around which trade now revolves.

Soft-Power Erosion as Leading Indicator

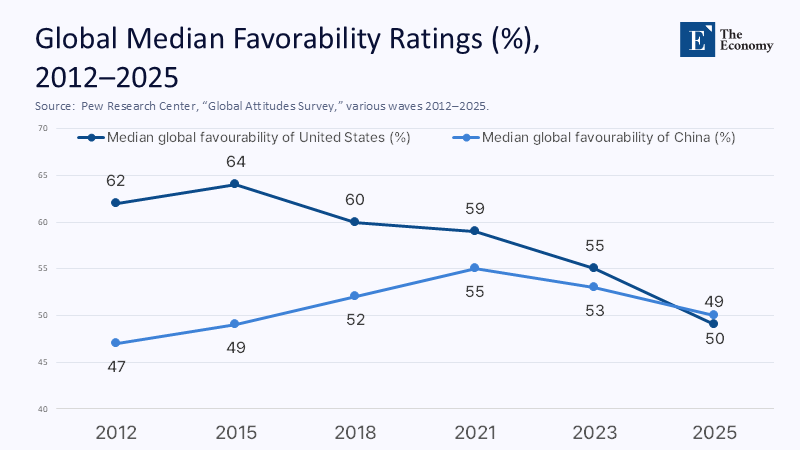

Hard-power superiority traditionally masks softer vulnerabilities, yet attitude surveys reveal attrition long before weapon systems lose edge. Pew’s June 2025 poll across twenty-four countries registers a dead-even split: 49% view the United States favorably, and 49% do not—the worst median reading in two decades and a full twenty-point slide since 2021.

Confidence in the United States’ democratic model sits below half in nineteen states. Such perception shifts are not cosmetic; they influence where high-skill migrants enroll, where investors litigate, and which data regimes multinationals trust. Student visas offer a quantifiable proxy: new F-1 issuances to Chinese nationals in the last twelve-month cycle were 28% below the 2019 benchmark, while Canadian and European universities recorded double-digit growth in the same market. Global talent is no longer predisposed to view US campuses as an automatic first choice; like container ships, brains follow reliability.

Netflix’s subscriber geography supplies unexpected corroboration. In 2024, Asia-Pacific overtook Latin America as the platform’s third-largest base, closing the year above fifty million paid memberships even as North American growth plateaued. Cultural dominance is drifting in the same direction as trade routes: eastwards.

The Manufacturing Ledger: From Margin to Minority

In 2000, the United States accounted for one-quarter of global manufacturing value-added. By 2024, its share had slipped to 15.9%—less than half of China’s 31.6%. UNIDO baseline projections, replicated by the Information Technology and Innovation Foundation, show the US slice falling to 11% by 2030 while China approaches 45%. The numbers matter because manufacturing retains the economy’s highest research spillover multiplier and anchors 55% of merchandise exports.

Boston Consulting Group’s experience-curve studies quantify why scale is destiny: each percentage-point gain in global market share lowers unit cost by about 0.4% through learning effects. A ten-point advantage, therefore, embeds a four-per-cent cost edge—beyond the reach of most subsidy packages. If China already holds a fifteen-point lead in aggregate share, Washington would need double-digit productivity miracles merely to catch up, all while its tariff policy raises input costs. Once advertised as revival tools, tariffs have become levies on the very capital expenditure the sector requires to escape decline.

Innovation Scoreboards and the Slow Fade of Exceptionalism

The Global Innovation Index was long an American showcase; in 2024, Switzerland and Sweden displaced the United States to third, while Singapore topped more individual indicators than any other economy. Now eleventh overall, China leads the world in eight metrics outright and ranks first in filings for artificial intelligence patents. Even more telling is cluster density: WIPO data place Tokyo–Yokohama, Shenzhen–Hong Kong–Guangzhou, and Beijing ahead of Silicon Valley on triadic patent families. Innovation is migrating to mega-regions situated inside, or orbiting, the Chinese production ecosystem.

Capital flows follow. Of the US$412 billion in global venture capital deployed in 2024, the Asia-Pacific region attracted 48%, North America 38%, and Europe 13%, reversing the allocation ratios in 2019. A virtuous circle ensues: start-ups gravitate to where fabrication, talent, and downstream markets concentrate; that clustering then accelerates the departure of incremental know-how from the old core. Soft power falters, manufacturing margins widen elsewhere, and innovation prestige migrates—three feedback loops running in the same direction.

Supply Chains without a Centre

UN Trade’s March 2025 update reports that services trade—particularly computing, logistics, and professional support—grew 9% in 2024 and supplied nearly 60% of the year’s expansion. The conventional sequence of goods preceding services has flipped; digital networks now allow services to pioneer new corridors, after which physical production follows. Vietnam, Indonesia, and India have become manufacturing satellites for China and the European Union, falling behind tariff-diverted orders. Once a footnote, South-South trade constituted 41% of total world merchandise flows last year—almost triple its 2005 weight.

The message is blunt for supply-chain educators: case studies anchored solely in NAFTA or EU–US auto integration are no longer universal templates. Students must master customs regimes in Ho Chi Minh City and Chennai, rules-of-origin subtleties under CPTPP, and digital-services taxes in Nairobi, not because the “rules-based order” is dead but because it now wears multiple constitutions simultaneously.

Policy Curriculum in an Age of Multiplexity

International political-economy courses that still lead with Bretton Woods nostalgia risk graduating students fluent in institutions with dwindling leverage. The WTO’s April 2025 briefing warns that the present tariff volley could shave 1% off global merchandise volumes next year—a hit equivalent to a mild global recession in goods-trade terms. Yet dispute panels remain paralyzed, and litigants increasingly bypass Geneva for ad-hoc regional tribunals. Teaching the WTO as the apex guardian of predictability now misrepresents the enforcement grid.

Curricular reform, therefore, has three imperatives. First, econometrics instruction must include tariff-volatility scenarios as a baseline, not tail risks; second, diplomacy modules need to replace US hegemonic-stability theory with Acharya’s multiplex order, where power, narrative, and rule-setting disperse; third, capstone simulations should pair climate-transition negotiations with supply-chain resilience drills, reflecting that industrial policy and decarbonization are joined at the hip in Asia’s next-wave economies.

Talent Flows, Visa Anxiety and the Academy

For universities that once relied on Chinese and, increasingly, Indian enrolments to cross-subsidize domestic tuition, the policy chill is immediate. The Trump administration’s decision in May 2025 to “aggressively revoke” Chinese student visas—an extension of Proclamation 10043—has already suppressed new postgraduate STEM intake by a quarter relative to 2020. The Chronicle of Higher Education finds that visa approvals for Chinese students this summer were 28% below the 2019 reference period. Oxford, Melbourne, and Toronto are the beneficiaries, converting uncertainty into application spikes. As soft-power assets go, nothing rivals in-person academic experience; in effect, Washington is taxing its knowledge surplus.

Educational administrators must, therefore, hedge by formalizing dual-degree routes with Asian and European partners, embedding semester-long residencies in supply-chain hubs, and expanding remote collaboration modules that draw on global research teams. These are not mere program add-ons but survival strategies in a world where student flows track perceptions of openness faster than rankings do.

What Turbulence Teaches: A Pedagogical Agenda

If the next two decades resemble earlier hegemonic transitions, episodic crises will punctuate longer arcs of institutional recalibration. The silver lining for educators is that turbulence enhances relevance: forecasting models, scenario planning, behavioral risk analysis, and cross-cultural negotiation are suddenly core, not electives. Business schools should introduce real-options valuation tied to tax-regime uncertainty; law faculties must teach overlapping jurisdictional authorities; public policy programs should pair quantitative trade modeling with qualitative soft-power diagnostics.

That agenda aligns with the angle articulated by SETA’s recent commentary: American soft power is eroding because its promise of predictable rules is no longer backed by competitive manufacturing or unassailable technological leadership. China is closing the perception gap faster than Washington’s policy circles anticipated. The educational mission is to prepare graduates for that in-between world—a phase of systemic turbulence that could last decades.

Teaching in the Vacuum

“Liberation Day” dramatized a lesson theorists of hegemony long suspected but had seldom witnessed: a dominant power can abdicate by abandoning the practices that made it dominant. Tariffs have not rebuilt Midwestern factories; they have re-priced trust. Manufacturing cost curves, innovation rankings, talent flows, and opinion surveys now converge on one insight: more than coercion, credibility sustains leadership. In sacrificing credibility for tariff revenue, Washington exported market share and moral authority, allowing rivals to pitch an alternative script.

Educators occupy the front line of adaptation. If universities continue to teach a unipolar syllabus, they will consign students to analytic obsolescence. If, instead, they integrate the volatility of a multiplex order into economics, law, and diplomacy pedagogy, they will equip graduates to navigate longer and bumpier transitions than any textbook written in the high noon of US hegemony ever contemplated. The American century ended not with a bang abroad but a budget line at home; the syllabus for what follows cannot wait for the dust to settle.

The original article was authored by the EAF editors at the Australian National University. The English version, titled "The end of the American century," was published by East Asia Forum.

References

Ampere Analysis (2024) Asia Pacific surpasses Latin America to become Netflix’s third-largest subscriber base.

Boston Consulting Group (1968; accessed 2025) The Experience Curve: Business Unit Strategy and Growth.

Chronicle of Higher Education (2024) ‘Sharp decrease in visas to Indian students alarms U.S. colleges’.

Congressional Budget Office (2024) Effects of Illustrative Policies That Would Increase Tariffs.

East Asia Forum (2025) ‘The end of the American century’, 23 June.

Information Technology and Innovation Foundation (2025) ‘Fact of the Week: U.S. share of global manufacturing will fall to 11 per cent by 2030’, 18 February.

Pew Research Center (2025) ‘Views of the United States in 24 nations’, 11 June.

Reuters (2025) ‘U.S. Congress budget office sees economic output falling from Trump tariffs’, 4 June.

UN Trade (UNCTAD) (2025a) Global Trade Hits Record US$33 Trillion in 2024, 14 March.

UN Trade (UNCTAD) (2025b) Global Trade Update, March.

UN Trade (UNCTAD) (2025c) Key Statistics and Trends in International Trade 2024.

United Nations Industrial Development Organization (2024) The Future of Industrialization: Building Future-Ready Industries to Turn Challenges into Sustainable Solutions.

Vanguard News (2024) ‘Top ten manufacturing countries in the world’.

WIPO (2024) Global Innovation Index 2024.

World Trade Organization (2025) ‘Tariffs could bring contraction of 1 percent in global merchandise trade volumes’, 3 April.