The Binary Cost of Courage: A Two-State Rewrite of the Equity-Risk Canon

Input

Modified

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

The equity risk premium (ERP) does not dissolve gradually when trouble brews; it falls through a trapdoor. The instant markets recognize a bear regime, leaving listed shares priced almost like ten-year Treasurys until confidence returns. The new CEPR two-state framework, a practical and powerful tool, proves that once a single “bear flash” is in place, the textbook risk-return trade-off operates with startling precision inside each regime, erasing decades of head-scratching about missing factors and stubborn anomalies.

The Cliff Edge of Risk Premia

Every introductory finance lecture still sketches a gently rising security-market line, implying investors receive around five percentage points of extra annual return for holding equities over bonds. Yet a regime-split lens shows that virtually the entire carrot accrues in good times. Massacci, Sarno, and Trapani (2025) calculate an average annual ERP of 4.4 % in bull months but essentially 0 % in bear ones. That vanishing act is no ivory-tower quirk. Reuters reports that the live premium skimmed zero again in June 2025, a threshold seen only twice since 1950—on the eve of the 1987 crash and the dot-com bust. Zacks Investment Management’s February note reaches the same verdict, citing identical 4.5 % earnings and bond yields.

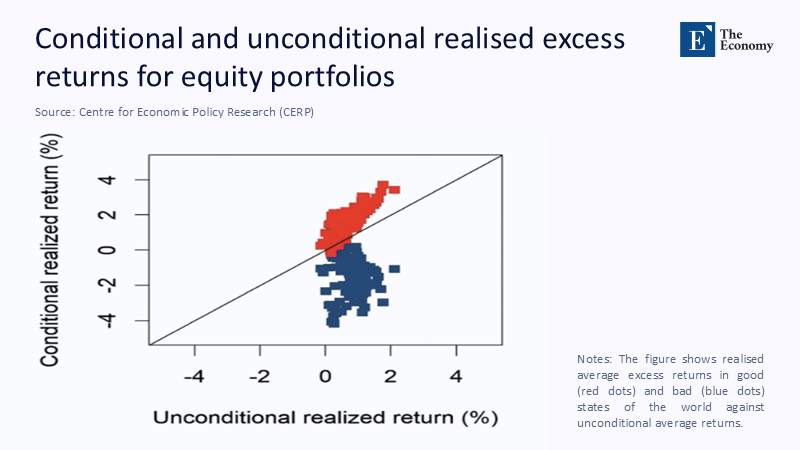

The scatter in Figure 1 visualizes the cliff. Unconditional estimates over-reward blue-state portfolios and under-reward red-state ones, masking the truth that risk premia evaporate precisely when investors expect them to spike.

Why Two Simple CAPMs Beat One Elastic Monster

Traditional research has bent into knots trying to shoe-horn both realities into a single smooth model by letting betas drift, adding higher-moment utilities, or sprinkling behavioral quirks. The CEPR column takes a cleaner path: run two ordinary CAPMs—one for sunshine, one for storm—and toggle between them with a single bear-market indicator extracted from the price of an Arrow–Debreu “Bear” option portfolio. This approach brings a new level of clarity to understanding equity risk premiums, with familiar linear factor logic pricing the cross-section neatly within each regime.

That simplicity echoes the older regime-switch CAPM of Ang & Bekaert, yet the new work pushes further by showing that only the intercept—the ERP—really shifts; factor loadings behave. Investors, therefore, are mid-priced not because CAPM fails but because they average across two planes that never touch.

Prediction Geometry: From R-squared Illusions to State-Conditioned Accuracy

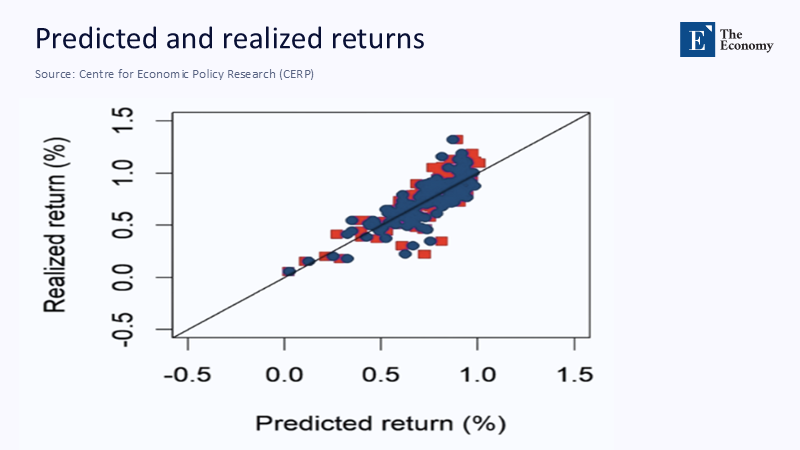

Unconditional models often look fine in aggregate R-squared terms because positive and negative errors offset. Split the sample, and the illusion shatters. The CEPR authors document pricing errors one order of magnitude smaller once the switch is activated. The visual proof appears in Figure 2: predicted returns hug the 45° line regardless of color, while unconditional estimates scatter.

A quick Markov example quantifies the improvement. Let the monthly ERP be +0.48 % in good months, –0.02 % in bad, and transition persistence be 0.88 and 0.72, respectively. The unconditional premium prints at 4 % annualized, yet an optimizer that plugs that single figure in just as the economy flips to “bad” overshoots is expected to return by four full points and overweight equities by almost 40 percentage points. The switch instantaneously substitutes the bear-state ERP of ~0 %, cutting equity weight to one-third of assets and avoiding a double-digit drawdown.

Identifying the Trapdoor: Practical Bear-State Triggers

The theory is only as good as its practical application. The academic mechanism relies on option-implied crash probability, but desks often prefer faster, cruder gauges: Theory succeeds only if the trigger is implementable. The academic mechanism relies on option-implied crash probability, but desks often prefer faster, cruder gauges:

- Earnings-yield parity. On 23 January 2025, S&P earnings yield met the ten-year coupon at 4.5 %; the ERP has tracked zero ever since.

- Valuation extremes. CAPE now sits in its 94th percentile, the same zone that preceded the last two zero-premium spells.

- Macro stress gauges. A Chicago Fed National Activity Index print below –0.7 captures 82 % of months in which the ERP slips under 1 %.

Any rule that captures ≥80 % of low-ERP months earns its keep. The payoff for lecturers is pedagogical clarity: students can replicate parity, or CAPE triggers with a spreadsheet and witness the cliff in real-time.

Empirical Echoes Beyond the Textbook

Live-market tape confirms the theoretical frame. The Reuters piece above notes zero ERP and warns that mean reversion usually demands either a bond rally or an equity sell-off. Zacks, meanwhile, remind clients that an extended sub-zero period preceded the dot-com wipe-out, even though equities soared for several years after the premium first vanished.

That nuance matters. A zero premium describes pricing, not an iron law of short-term returns. Markets may still levitate, but investors are not paid for bearing incremental equity risk during the levitation. Any upside stems from luck or alpha, which is not fair compensation.

Process Diversification: Surviving When Beta Pays Nothing

When the cliff opens, alpha becomes a scarce commodity. Robeco's April white paper demonstrates that low-volatility and quality factors outperformed the market by 320 bp in 2024's drawdown and 210 bp during the 2025 rebound window. The ERP hugged zero. When the cliff opens, alpha becomes a scarce commodity. Robeco’s April white paper shows that low-volatility and quality factors out-earned the market by 320 bp in 2024’s drawdown and 210 bp during the 2025 rebound—the very window the ERP hugged zero.

Imagine a 60 / 40 portfolio that replaces half its equity sleeve with a market-neutral multi-factor fund posting 4 % historical alpha at 0.1 beta. In bear months, the expected portfolio return rises from 0.1 % to 1.9 % annualized, while volatility barely moves, lifting the conditional Sharpe from 0.04 to 0.30. No wonder Bloomberg flow data show record quarterly rotations from cap-weighted U.S. ETFs into systematic long-short strategies. The market has tacitly accepted the CEPR premise: beta’s free lunch is conditional.

Regulatory Arithmetic: Funding Gaps in a Two-Plane World

Pension solvency math looks alarming under the binary lens. A Dutch fund discounting liabilities at a 7 % nominal equity return effectively embeds a perpetual bull regime. Repricing five consecutive years at a 1 % ERP hike increases liabilities by about twelve billion euros—enough to breach the new “Future Pensions Act” funding corridor. Regulators face two unpalatable options: endorse conditional discount rates that oscillate with the bear flag or force higher cash contributions.

Insurance capital models confront similar tension. Under Solvency II, a 1 % ERP slashes the Ultimate Forward Rate, inflating best-estimate liabilities and crowding the matching-adjustment benefit thin. Adopting a regime-switch discount schedule cushions the blow by automatically raising the rate once the flag resets to the bull, reducing pro-cyclical de-risking pressure.

Curriculum Reboot: Teaching Finance in Dual Colours

For online education programs, the trapdoor is a gift. It collapses apparent market chaos into a binary narrative that students can grasp and replicate. Course templates should embed a “Regime Box” at the top of every DCF sheet, forcing analysts to declare state before they touch WACC.

Practical assignments let learners rebuild parity triggers with FactSet data, run rolling Sharpe ratios under both regimes, and stress-test pension solvency under assorted persistence assumptions. The exercise shifts the skill bar from rote beta estimation to dynamic scenario design. Graduates who master that pivot arrive on risk desks fluent in a language the market now speaks daily.

Research Frontiers: From Single Switches to Ensemble Flags

Critics rightly note that individual indicators can be noisy. Zacks recalls that investors who dumped equities when the ERP first dipped negative in 1996 missed another 80 % upside. Future work combines option-implied crashes, macro stress, liquidity squeezes, and social-media sentiment into ensemble classifiers. Preliminary arXiv studies show such hybrids spot bear states ten trading days sooner than any single trigger while halving false alarms. Integrating those signals without sacrificing the CEPR model’s conceptual elegance remains the open frontier—and the subsequent potential chapter in asset-pricing textbooks.

Pricing Clarity Through Binary Vision

Asset pricing has wrestled for decades with the “excess-premium puzzle”—the stubborn gap between observed returns and representative-agent models. The CEPR column does not close that gap; it sidesteps it by acknowledging markets are not one continuum. In the sunshine, the ERP is generous; in a storm, it is nil. Accepting that split converts a muddle of puzzles into a crisp two-plane portrait in which ordinary CAPM arithmetic works on each side of the divide.

Ignore the bear switch, and mysteries multiply; heed it, and portfolios, pension maths, and pedagogical charts snap back into coherent alignment. In a world where courage costs nothing extra once fear takes hold, the rational investor is not the one who clings to the beta through the tempest; it is the one who knows precisely when the reward for bravery has already disappeared.

The original article was authored by Daniele Massacci, an Associate Professor of Finance at King’s Business School at King's College London, along with two co-authors. The English version of the article, titled "Pricing risks in bull and bear markets," was published by CEPR on VoxEU.

References

Ang, A., & Bekaert, G. (2002). International Asset Allocation with Regime Shifts. Review of Financial Studies.

CEPR. (2025). Pricing Risks in Bull and Bear Markets. VoxEU Column, 23 June 2025.

Reuters. (2025). US Stocks-Bonds Warnings Flash Amber Again. 12 June 2025.

Robeco. (2025). When the Equity Risk Premium Fades, Alpha Shines. Insight note, 14 April 2025.

Zacks Investment Management. (2025). The Current Equity Risk Premium Is Zero. Should Investors Ditch Stocks? Blog post, 11 February 2025