When Tariffs Chase China, Its Factories Cross Borders

Input

Modified

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

Contrary to their intended purpose of blocking China from the US market, tariffs had an unexpected effect. They inadvertently educated Chinese factory owners about geography. In a single business cycle, these manufacturers learned that a change in location, from Guangdong to Nuevo León or from Zhejiang to the Suez littoral, could restore duty-free access almost as effectively as a trade lawyer.

The Geography of Tariff Arbitrage: From Shenzhen to Saltillo

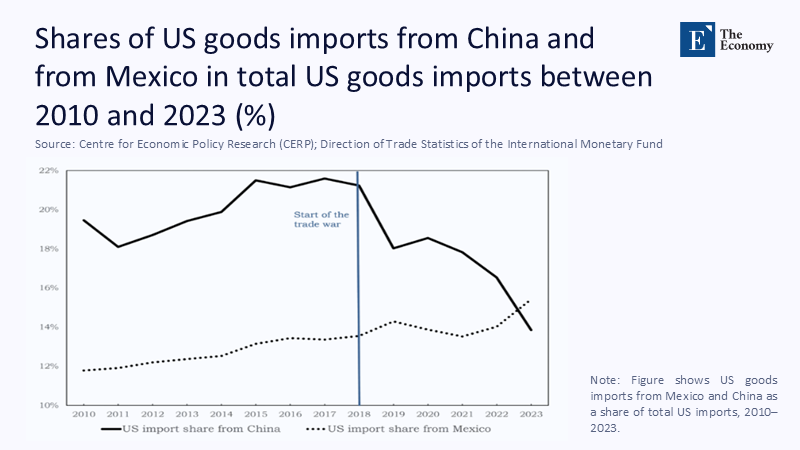

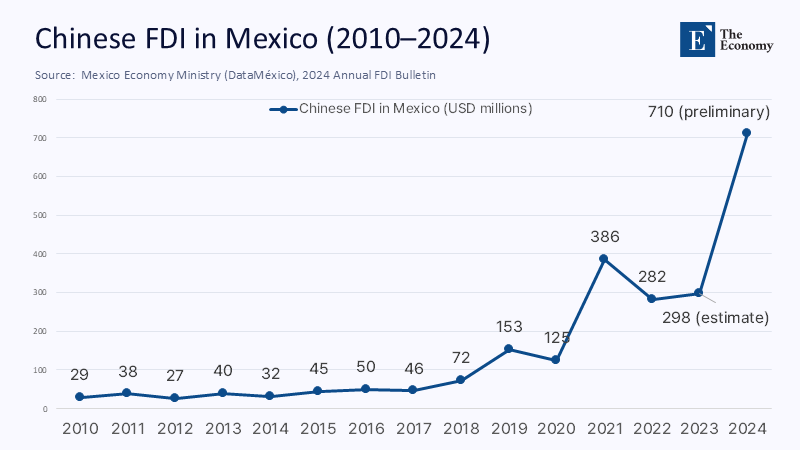

The 25-percentage-point Section 301 duties introduced in 2018-19 did not eliminate Chinese involvement in America's consumer-goods pipeline; they redirected it. By the first quarter of 2025, the combined value of Mexico's trade had reached US$2.61 trillion, with imports from Mexico alone accounting for US$ 510 billion, or 15.2% of the US total, surpassing China's 13.8% share for the second consecutive year. A superficial analysis might suggest that Mexico emerged victorious and China suffered a loss. However, customs micro-data reveal a more complex picture. Chinese-owned green-field plants now produce a growing portion of these 'Mexican' exports. The Dallas Federal Reserve notes that Chinese FDI flows into Mexico quadrupled between 2018 and 2022, with the 2024 inflow at US $710 million, bringing the cumulative stock since 1999 to nearly US $3 billion. In essence, the tariff shock not only shifted orders but also ownership.

A cost simulation illustrates the logic. A 20-cubic-foot refrigerator that left a Shenzhen factory gate at US $370 in 2017 now lands in Los Angeles for roughly US $524 once the 25% duty, inland haulage, and post-pandemic freight premiums are tallied. Shift final assembly to Monterrey, satisfy USMCA's 75% regional-value threshold by sourcing sheet metal locally and compressors from the United States, and the landed cost falls to about US $394—saving US $130 per unit while trimming door-to-store transit time from twenty-three days to two. That swing is larger than many appliance makers' entire operating margin in North America, so the migration calculus writes itself.

Reading the Customs Ledger: Quantifying the Mexican Surge

The VoxEU analysis by Chen, Novy, and Solórzano finds that every 25-point tariff tranche diverted roughly 4.2% of U S demand from Chinese to Mexican suppliers and lifted payrolls in tariff-exposed Mexican industries by two percentage points relative to unaffected sectors. But the headline masks a deeper ownership flip. Rhodium Group tracks the US $3.8 billion in announced Chinese green-field projects in Mexico during 2023—triple the 2020 figure—and counted forty-two separate deals in the first half of 2024 alone, nearly half clustered in Nuevo León. Hofusan Industrial Park, a converted 2,100-acre cattle ranch north of Monterrey, houses ten Chinese plants today, with executives projecting thirty-five tenants and 15,000 workers by 2026 after a further US $1 billion expansion.

Such statistics translate into complex employment effects. Nuevo León's maquiladora payroll grew 8.1% year-on-year in 2024, twice the national average. Average industrial wages in the state rose 7.4%, yet productivity increased only 4.1%, underscoring Mexico's continued specialization in labor-intensive, low-value segments of the chain. Therefore, the federal government's new near-shoring decree ties tax credits to a phased local-content ladder: 35% Mexican value added in year one and 45% by year five. The decree echoes state-level experiments that converted a modest US $26 million in subsidies into US $83 million in import-substitution output and 700 skilled jobs.

Knock-On Effects on Mexico's Labour Market and the Policy Response

While the migration of assembly plants brings real payroll gains, it heavily relies on first-time entrants and workers without tertiary credentials. Surveys by the Mexican National Institute of Statistics (INEGI) show that 63% of new hires in tariff-induced factories hold only a secondary school certificate. Local suppliers voice concerns about the difficulty of tooling amortization due to high-mix, low-volume component orders, limiting proper technology diffusion. President Claudia Sheinbaum's administration has allocated 6 billion pesos (about US $340 million) for a tri-national' skills corridor' program. This initiative aims to harmonize CNC-machinist and electronics-technician certifications across Mexico, Texas, and Ontario. The program's first cohort of 1,200 apprentices is set to begin cross-border rotations in September 2025.

The Southward and Westward Detours: From ASEAN to the Suez

Not all Chinese manufacturers fancy Mexico's higher wage bill or USMCA's sourcing rules. Many initially routed output through Vietnam or Cambodia until April 2025, when the Trump administration's second-term trade team extended "reciprocal" tariffs of up to 49% to six ASEAN exporters. Vietnam's stock index fell 6.7% on announcement day; ING now estimates that 5.5% of Vietnamese GDP faces tariff exposure. Egypt's Suez Canal Economic Zone (SCZone) has emerged as the safety valve for firms forced into a second relocation.

According to Chairman Walid Gamal El-Din, SCZone secured US $894 million in fresh commitments between January and April 2024—40% of them Chinese. Haier's Egypt Eco-Park, inaugurated in May 2024, spans 200,000 square meters and already rolls out 900,000 appliances annually; phase two will add refrigerators and freezers, pushing capacity past 1.5 million units. The average wage is US $280 per month, well below Mexico's industrial mean, and container transit to New York via the Mediterranean is eighteen days, half the Pacific route from Shanghai. Crucially, exports incorporating 10% Israeli or U S content qualify for zero duty under the Qualifying Industrial Zone (QIZ) protocol, effectively neutralizing tariff risk for selected product lines.

Logistics vs. Wages: The New Cost Hierarchy

Traditional site-selection spreadsheets ranked locales by unit labor cost; today, they optimize three variables: delivered-duty-paid (DDP) cost, transit time, and policy risk. A refrigerator assembled in Mexico costs about US $394 DDP to Laredo and requires two days in transit; the same unit built in Egypt costs roughly US $408 DDP and eighteen days; in untariffed China, the number would be US $370 but faces a 25-point duty and a 23-day voyage. When we add a policy-risk premium—derived from IMF estimates that a one-standard-deviation uptick in trade-policy uncertainty depresses bilateral trade by 4.5%—Mexico's apparent cost advantage widens because its USMCA shield mutes uncertainty. The implication is that geopolitical insurance now carries a shadow price that can outweigh pure wage arbitrage.

When Ideas Stay Home, but Factories Wander: The Limits of Tariffs

Tariff efficacy diverges starkly between tangibles and intangibles. U S import share from China in toys and low-margin apparel fell 18 percentage points between 2017 and 2024, yet China's share in IP-rich categories such as embedded software devices slipped only three points. Design, architecture, and firmware writing are rooted in talent clusters, not duty schedules. Royalty payments from U S companies to Chinese licensors declined a mere 3% over the same period. Tariffs can shuffle where screwdrivers turn screws, but they scarcely touch where code is written or patents are filed.

Policy Roadmap: Building Bridges Over Walls

For Washington, doubling down on punitive tariffs risks an infinite game of whack-a-mole: each new wall spurs another jurisdictional hop. A more brilliant industrial strategy would convert Mexico's magnetism into a true North American production ecosystem. A carbon-indexed border adjustment—taxing embodied emissions rather than national flags—could refine competitiveness goals while aligning with climate policy. For Mexico, the priority is to climb beyond screwdriver assembly. Tying incentives to indigenous tooling, local R&D, and higher local content tiers, as Nuevo León now does, is a step toward embeddedness rather than mere transience.

For its part, China faces the strategic reality that it cannot outrun every tariff perimeter indefinitely. Diversifying FDI can cushion shocks, but long-run competitiveness rests on pivoting the domestic industry up the value ladder. Beijing's latest Five-Year Plan, which directs 8% of industrial stimulus toward advanced materials and digital design tools, acknowledges that geography games will not secure the next generation of margins.

Educational Implications: Teaching the New Trade Algebra

Now pivoting from Shenzhen to Saltillo and Dongguan to Ain Sokhna, the itinerant assembly line poses a curricular challenge for business schools and public administration. Future managers must master a geometry that factors time-zone differentials, treaty networks, and political risk coefficients as naturally as they once compared hourly wages. Policymakers, meanwhile, need to recognize that supply-chain maps are dynamic heat charts, not static globe engravings. Introducing interdisciplinary modules that blend logistics analytics with political-risk modeling will prepare graduates for a world where a factory's passport may change faster than its tooling dies.

The Factory With a Suitcase

Tariffs have not subdued Chinese manufacturing; they have put wheels under it. Capital proved geographically promiscuous, hitching rides on duty-free corridors whenever the tariff frontier moved. Mexico's export boom and Egypt's fast-rising industrial parks illustrate that the global assembly line is no longer tethered to a single nation's comparative advantage. For educators, executives, and policymakers, the lesson is stark: understand the choreography of cost, risk, and regulation—or be outpaced by those who do.

The original article was authored by Natalie Chen, a Professor of Economics at the University Of Warwick, along with two co-authors. The English version of the article, titled "How the 2018/19 US tariffs against China boosted exports and employment in Mexico," was published by CEPR on VoxEU.

References

Business Today Egypt. (2024, April 17). SCZone Attracts $849 Million in Investments with 40 % Chinese Contribution Since January 2024.

Chen, N., Novy, D., & Solórzano, D. (2025). "How the 2018/19 US Tariffs Against China Boosted Exports and Employment in Mexico." VoxEU Column, CEPR.

Financial Times. (2024, December 15). "How China Is Setting Up Shop in America's Backyard."

Haier Smart Home. (2024, May 3). Egypt Ecological Park Opening Press Release.

International Monetary Fund. (2024). The Heterogeneous Effects of Uncertainty on Trade (WP/24/139).

Mexico Economy Ministry (DataMéxico). (2025). Foreign Direct Investment from China, 1999–2024.

Mexico News Daily. (2024, September 30). "Hofusan Industrial Park Announces US $1 Billion Expansion Plans."

Prosperous America (Rapoza, K.). (2024, March 19). "Mexico Is Growing as New China Hub; 2024 Exports Already Breaking Records."

Reuters (Guarascio, F., & Sriring, O.). (2025, April 3). "Southeast Asian Nations, Among Hardest-Hit by Trump Tariffs, Seek Talks."

South China Morning Post (Nulimaimaiti, M.). (2025, June 15). "Cairo Calling: Why Chinese Factories Are Moving to Egypt Amid the Trade War."

Tradeimex/USImportData. (2025, May 1). Top U S Trade Partners in 2025: A Deep Dive into Trade Statistics.