Culture Pays: How Inclusion Became Thailand’s Quiet Export—and What Korea’s Classrooms Should Learn

Input

Modified

This article was independently developed by The Economy editorial team and draws on original analysis published by East Asia Forum. The content has been substantially rewritten, expanded, and reframed for broader context and relevance. All views expressed are solely those of the author and do not represent the official position of East Asia Forum or its contributors.

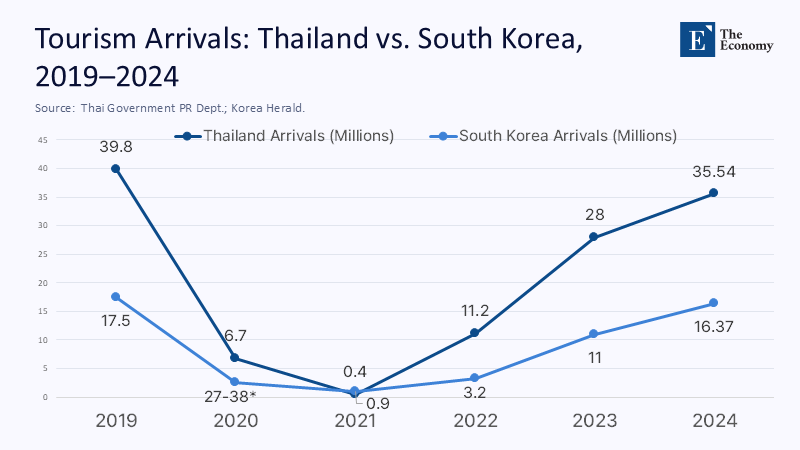

In 2024, Thailand welcomed about 35.5 million international visitors as tourism surged back, with the government attributing the rebound to visa policies, new air routes, and a nationwide embrace of festivals that signal welcome. In June alone, Pride Month events were projected to inject 4–4.5 billion baht into local economies. Put these numbers against the estimated $4.7 trillion in global LGBTQ+ purchasing power, and a pattern emerges: inclusion is not a press release. It’s an export built from culture, codified in law, and monetized through visitor experiences. Thailand’s full legalization of same-sex marriage in early 2025 gave legal scaffolding to what the market already knew: destinations that align policy, culture, and service design convert values into value. This is not about corporate sloganeering or morality plays; it is about a service economy that learns fast, signals clearly, and sells confidently. In this light, Pride parades aren’t performative—they’re product launch events for an inclusive destination brand.

From Morality Play to Market Design

The usual argument frames LGBTQ+ tourism as a tension between political correctness and commercial reality: celebrate Pride to counter prejudice, and hope the brand lift covers the costs. That story misses what Thailand has built. The country did not bolt rainbow flags onto a hostile infrastructure; it aligned a long-standing culture of gender diversity and hospitality with legal reforms and a visitor economy hungry for clarity. When Pride Month generates billions of baht in economic activity and couples marry legally, the message to travelers is simple: your family is real here, and your money is welcome. In policy terms, that’s destination competitiveness, not virtue signalling. Educators should recognize this as a design problem: how do we train graduates to build inclusive services that reduce friction, raise satisfaction, and increase return visits? In Thailand’s case, the “product” is a predictable, cohesive experience, from airport signage to hotel check-in to clinic intake forms—each step tuned to a broader market.

A second misconception equates inclusive tourism with niche demand. But the revenue math is closer to a portfolio effect. Global tourism has recovered above pre-pandemic levels, yet growth is uneven and price-sensitive. Inclusive destinations diversify their customer base, lowering volatility when one source market softens. Thailand’s 2025 mid-year slowdown in arrivals, led by weaker Chinese traffic, is precisely when high-propensity segments—such as LGBTQ+ travelers who travel more frequently and spend more per trip—can stabilize occupancy and receipts. Inclusion is not a special-interest subsidy; it’s risk management through market breadth. That framing belongs in business schools and vocational colleges as much as in government plans.

What the Numbers Say

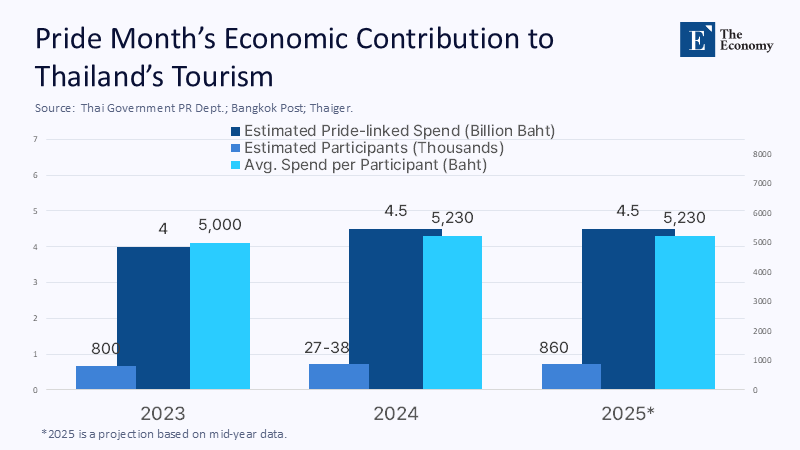

Start with the topline: the WTTC estimates travel and tourism contributed 10.4% of Thailand’s GDP in 2023 (THB 1.86 trillion, including indirect and induced effects), with further growth projected through the next decade. Within that base, June Pride activities are becoming a measurable seasonal driver. Government and media estimates for 2024–2025 cluster around 4–4.5 billion baht in Pride-linked spend and roughly 860,000 participants—a sizeable micro-season when considered against monthly tourism cash flows. The passing of marriage equality in 2024, implemented in 2025, removes a decision-friction for couples considering weddings, honeymoons, or family travel. A clear legal regime is an on-switch for demand; it converts intent into booking.

Now look at market depth. LGBT Capital’s 2022 model places global LGBTQ+ purchasing power at $4.7 trillion and estimates Thailand’s “pink” spending power at around $26 billion. These are modelled figures, but they square with industry observation: LGBTQ+ travelers are more likely to be dual-income and to travel off-peak, smoothing demand. To stay honest with the uncertainties, here’s a simple back-of-the-envelope: assume the TAT’s 860,000 Pride participants spend a conservative 5,200 baht per person over event periods (lodging, food, intra-city travel). That yields ≈4.5 billion baht—consistent with government projections and plausible given Bangkok’s hotel ADRs in June. The point is less the exact number than the policy lever: the combination of permissive law, safe streets, visible Pride programming, and targeted airlift turns inclusion into receipts.

Inclusion as a Supply-Side Upgrade

Destinations don’t capture this dividend by marketing alone; they need supply-side capability. Thailand’s medical tourism sector illustrates how inclusion becomes an operational edge. Private hospitals compete on transparent pricing, English-language intake, and staff trained to serve trans and queer patients without friction. Market analysts size Thailand’s medical-tourism revenue in the mid-teens of billions of U.S. dollars in 2024, driven not only by cosmetic procedures but also fertility care and gender-affirming services. Even if you cut those estimates to account for methodology, the direction is clear: a large service ecosystem is already optimized for international clients who require courteous, competent, and confidential care. For hospitality schools and nursing programs, the lesson is concrete: create modules on inclusive protocols, privacy law, and cross-cultural communication; partner with clinics to place students; and assess learning with mystery-guest audits rather than essays.

Crucially, the international evidence suggests this is not a Thailand-only phenomenon. Studies from the OECD, World Bank, adjacent scholars, and business coalitions such as Open For Business link legal inclusion with higher GDP per capita, productivity, and foreign investment. A 2019 OECD analysis associated stronger legal LGBTI inclusion with roughly $3,200 higher real GDP per capita, after controls. Macro-level correlations are never destiny, but they do sharpen policy trade-offs: rights frameworks don’t just protect; they recruit capital and talent. In tourism, where word of mouth and repeat visitation matter, the spillover shows up as higher RevPAR, longer length of stay, and smoother staff recruitment. Those are the micro-metrics that TVET and business programs should teach, because that is where culture turns into cash flow.

Policy for Schools: Turning Culture into Curriculum

If inclusion is a competitive factor, then education systems should treat it as a teachable competency. Start with curriculum design. In secondary and tertiary hospitality programs, build a “Destination Literacy” strand that integrates service law (e.g., non-discrimination statutes), revenue management, festival logistics, and customer journey mapping for diverse travelers. Assessment should move beyond rote compliance to scenario-based performance: resolve intake for a trans traveler whose passport marker doesn’t match their presentation; rebook a same-sex honeymooner when a vendor balks; design public-space wayfinding that avoids dead-ends and unsafe bottlenecks during Pride events. These are not culture wars; they are service engineering and safety.

Teacher preparation matters just as much. Ministries can issue micro-credential frameworks for “inclusive service design,” stackable into diplomas, and tie them to internship funding with vetted partners—hotels, airlines, clinics, event producers. Regional universities can host Inclusion ROI labs to run field experiments during festivals: randomized trials of signage vs. staff roaming, bilingual vs. trilingual concierge scripts, cashless vs. mixed payment at pop-up venues. Publish results openly; treat each Pride month as a living lab where students gather data, iterate, and present to city councils. This is how the education sector moves from values talk to value creation: by training graduates who can measure the impact of their work.

A Korean Case: Hallyu as an Inclusive Tourism Engine

South Korea’s visitor economy is bouncing back—16.37 million foreign arrivals in 2024, roughly 94% of 2019’s peak—powered by K-pop, K-drama, fashion, and food. Cultural exports continue to ripple through merchandise, cosmetics, and location tourism. Yet legal recognition for LGBTQ+ families remains incomplete despite a 2024 Supreme Court ruling extending health-insurance spousal coverage to a same-sex couple. In competitive terms, this is a margin reducer: unclear rules inject friction into trip planning and wedding tourism. Rather than treating inclusion as a hot-button social issue, tourism educators can model it as a conversion rate problem. Think of Hallyu: a clear legal environment paired with curated “filming-location to festival” itineraries and inclusive vendor accreditation would lift both bookings and satisfaction. The playbook is Thailand’s—translated through Seoul’s assets.

Here, the classroom levers are straightforward. Design Hallyu Pride Trails linking filming sites with nightlife corridors and cultural institutions that commit to inclusive service standards; create pop-up visitor centers during Seoul’s Queer Culture Festival, staffed by hospitality and event-management students; and partner with city halls to collect visitor-journey data. The festival itself is a live case: despite venue constraints, Seoul Pride has drawn six-figure crowds, yet its public-space logistics, vendor training, and booking funnels are ripe for optimization. In short, Korea can keep the cultural draw while upgrading the service layer to widen the addressable market. That is less about ideology than about engineering a visitor journey that is seamless for everyone.

Anticipating the Objections

One critique says monetizing Pride cheapens the cause. The evidence from Thailand suggests the opposite: economic visibility helps lock in civil rights. Legalization arrived after decades of activism, but mass weddings and Pride-linked spend now create constituencies—hotels, airlines, clinics, small vendors—whose livelihoods depend on keeping the welcome mat out. Rights shouldn’t need a business case, but when one exists, it reduces policy whiplash. This is consistent with research linking inclusive laws to stronger growth and investment climates; when more stakeholders win, policy endurance rises. That’s not to replace ethics with economics; it is to admit that stable coalitions keep the doors open.

Another critique points to box-office debates—“inclusive content doesn’t sell”—as proof that inclusion and profitability don’t mix. That’s a category error. Hollywood metrics track the return on storytelling choices in saturated media markets, not the return on service design in destination economies. Thailand’s results hinge on logistics, safety, and legal clarity, not on cinematic subplots. More broadly, international tourism surpassed pre-pandemic levels in 2024, but winners are those that make planning easy for diverse families: visa waivers, clear legal status, and predictable vendor behavior. Educators should train students to see the difference between tastes and transactions. The former is contested; the latter rewards friction reduction every time.

Methodology and Measurement: Making the Intangibles Count

Data on LGBTQ+ tourism are improving, but still patchy. Government tallies typically don’t code travelers by identity, and private estimates vary by method. The prudent approach is to triangulate: combine official tourism receipts and visitor counts with festival attendance estimates, card-spend samples, and hotel ADR/RevPAR disclosures. From there, build transparent ranges rather than single numbers. In the Pride example, we took the Tourism Authority’s participant estimate and multiplied it by conservative per-capita spend assumptions consistent with Bangkok ADRs in June. Future iterations should add mobile-device footfall, transit ridership, and anonymized card spend to refine the confidence interval. In classrooms, this looks like student teams publishing methods alongside results, not just totals.

Policy schools can also model counterfactuals to test inclusion’s ROI. Use OECD-style frameworks that relate legal inclusion indices to GDP per capita changes, then translate elasticities into tourism-specific metrics: what does a move from ambiguous partnership recognition to full marriage equality do to wedding tourism bookings? What is the expected uplift in average length of stay for destinations that certify inclusive vendor networks? These are not abstract exercises; they guide where to invest curriculum hours (e.g., training registrars and hotel planners in international documentation rules) and where to aim marketing (e.g., source markets with higher marriage equality rates and pent-up travel demand).

What Thailand Clarifies—and What Korea Can Build

Thailand clarifies that the economic upside of inclusion comes from consistency. Pride isn’t a one-month exception to daily life; it’s an annual showcase of norms that apply year-round. The business case strengthens when rights are stable, services are trained, and the welcome is legible from visa-on-arrival to vendor checkout. Korea, armed with a wildly successful cultural export engine, is well-placed to make inclusion a predictable part of that experience. A lawful, friction-free framework for LGBTQ+ couples would align messaging with reality, lowering planning anxiety and unlocking premium segments like destination weddings, family travel, and medical tourism. Pair that with TVET programs geared to inclusive service design, and Hallyu’s draw converts to measurable receipts.

The final piece is resilience. Tourism is cyclical; source markets ebb and flow. Inclusive destinations hedge that risk by broadening appeal. Thailand’s mid-2025 dip in arrivals is a reminder: competitiveness is not just price; it’s policy and pedagogy. Countries that build inclusion into the skill-based curricula, credentials, and internships can attract travelers who book despite currency swings or airfare spikes because they trust the experience. That trust is taught before it is sold.

Teach the Dividend, Not the Debate

The most powerful statistic in this story is not a single baht figure or a trillion-dollar headline. It is the recurrence of the pattern: when a destination aligns culture, law, and service design, inclusion becomes an export with compounding returns. Thailand’s Pride economy works because it is not a seasonal exception but a visible expression of everyday norms, now anchored by marriage equality and operationalized by trained workers. The right takeaway for educators and policymakers is not to mimic the parade but to teach the system: standards that reduce friction for diverse travelers, curricula that turn inclusion into operational skill, and measurement that honors uncertainty while improving performance. Korea can apply the same logic to Hallyu—upgrade the service layer, clarify the rules, and invite the world to participate. If we teach the dividend, the market will take care of the scale. The choice is not between values and value; it is whether we are willing to train for both.

The original article was authored by Alexandre Veilleux, an Advisor at the Asia Pacific Foundation of Canada. The English version, titled "Thailand sells pride to counter prejudice," was published by East Asia Forum.

References

Al Jazeera. (2024, September 25). Thailand to allow same-sex couples to marry in January.

Bangkok Post. (2024, May 25). Pride Month activities to generate B4bn: govt.

Bangkok Post. (2024, June 15). Govt to chase pink baht after Pride nets B4.5bn.

Economist Intelligence / WTTC. (2024). Travel & Tourism Economic Impact 2024: Thailand (factsheet/PDF).

JURIST. (2024, June 2). Over 150,000 attend South Korea LGBTQ+ Pride festival despite Seoul Plaza ban.

Korea Herald. (2025, February 7). South Korea tourism surges in 2024 with record spending and arrivals.

Korea.net (KOFICE). (2024, June 10). Higher image raised Hallyu exports last year to KRW 19.54T.

LGBT Capital. (2023). Estimated LGBT purchasing power (global and by country) – Executive summary (data as of 2022) (PDF).

Open For Business. (n.d.). The Economic Case: Evidence linking LGBTQ+ inclusion to better economic performance.

OECD. (2019). Over the Rainbow? The Road to LGBTI Inclusion.

Reuters. (2025, January 20). Historic Thai law recognises same-sex marriages – but not all families are equal.

Reuters. (2025, January 23). Thailand holds its first same-sex weddings, targets record registrations.

Reuters. (2025, July 29). Thailand’s foreign visitors down more than 6% y/y so far in 2025.

Thai Government Public Relations Department. (2025). Incoming tourists amounted to 35.54 million at year end.

Thaiger. (2024, June 1). Pride Month to boost Thai economy by 4.5 billion baht.

Time (via Bloomberg). (2024, July 18). South Korea’s Supreme Court upholds landmark LGBTQ ruling.

UN Tourism (UNWTO). (2025, January). International tourism recovers pre-pandemic levels in 2024.

WTTC. (2024). Travel & Tourism economic impact research hub.

Future Market Insights. (2024, March 22). Thailand Medical Tourism Market: Size & Forecast 2024–2034.

Grand View Research. (n.d.). Thailand Medical Tourism Market Size & Report to 2030.

Comment