Moral Capital at the Front: How Ukraine’s “Market of Indebtedness” Rewrote Modern Fundraising—and What Education Can Learn

Input

Modified

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

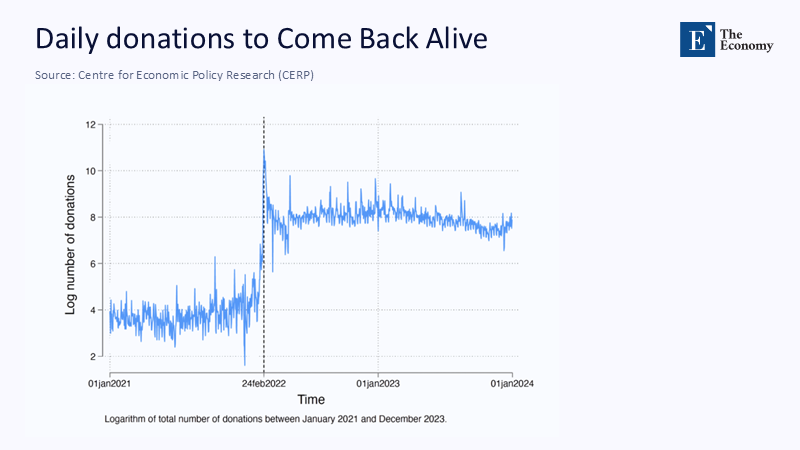

In wartime Ukraine, the efficiency of the fundraising mechanisms is striking. A one percent rise in same-day civilian fatalities triggers a roughly 0.1% surge in donations to a leading military nonprofit within hours. This translates to thousands of dollars per death and more than $8,000 in cumulative giving as the shock reverberates through public attention. The media coverage acts as a pricing signal, lifting same-day donations by about 0.03% for every one percent uptick in frontline news mentions. In three years, more than 17 billion hryvnia—nearly half a billion dollars—has flowed through a single Ukrainian organization, tracked transparently and allocated with the speed of a purchase order. These are not the soft contours of sentiment; they are elasticities, magnitudes, and lags—evidence that moral awareness behaves like a traded asset whose “dividends” are measured in night-vision goggles, tourniquets, and drones. This is Western Europe’s conscience repriced in real time, with Ukraine at the frontier converting indebtedness—the felt duty of defense—into cash flow at scale.

Reframing the Argument: From Media Effects to a Market for Moral Capital

The more compelling account is that Europe’s publics, aware that Kyiv is shielding the eastern flank of liberal norms, behave like participants in a market for moral capital, where events revalue a shared asset—indebtedness—and donations are the corresponding cash yield. In this market, transparency and immediacy play the role of liquidity and settlement. Ukraine’s success has been to make the asset legible—auditable line items, daily dashboards, and rapid procurement—and therefore investable. The result is not charity as an occasional surge but charity as a predictable, event-linked stream responding to signals, just as equities respond to earnings surprises.

Crucially, this market has credible backstops. On the public side, the European Union’s €50 billion Ukraine Facility, in force since March 2024 with successive disbursements—including a fourth payment exceeding €3.2 billion in August 2025—provides the sovereign floor beneath private flows. On the private side, organizations like Come Back Alive publish high-frequency donation and expenditure data, making each euro traceable and each procurement legible. Together, they create a hybrid architecture where state finance stabilizes the macro path while civic finance fills the micro-gaps frontline units face. This duality—backstop plus liquidity—explains resilience even as global donor appetite tightens, and it illuminates a policy lesson well beyond war: durable giving is built when moral value is priced clearly and cleared quickly.

Pricing the Asset: Elasticities, Totals, and Drift

The VoxEU analysis of 2.9 million donations to Ukraine’s largest non-governmental provider of lethal aid identifies a consistent elasticity: a 1% increase in same-day civilian fatalities maps to a 0.097–0.134% increase in daily donations, or about $547–$756 in May 2025 values, with each additional civilian death linked to roughly $5,184 the same day and more than $8,000 cumulatively as attention decays. Media mentions of frontline activity show a parallel pattern—smaller per-unit responses but meaningful compounding as coverage sustains salience. These are quantifiable sensitivities, which we can refer to as 'moral beta,' that translate shock into cash flow with a short half-life. The donation curve peaks within three days and fades by day ten, an impulse response akin to disaster-relief dynamics, except that daily conflict shocks retrigger the function.

Totals underscore the scale. Come Back Alive reports more than 16 billion UAH raised since 2014, with roughly 326 million UAH in the last 30 days alone as of August 12, 2025. Wider Ukrainian philanthropy continues to mobilize: the UK’s Disasters Emergency Committee Ukraine appeal has raised about £445 million since 2022, a long-tail testament to persistent public support. At the same time, macro drift is visible in global data: Gallup finds that charitable activities—donating, volunteering, helping strangers—declined in 2024 after pandemic-era peaks, signaling a turning cycle in baseline generosity. The term' macro drift' refers to this decline in charitable activities, which indicates that Ukraine’s moral capital trades in a tightening market; price discovery still works, but liquidity is thinner. Sourcing becomes strategy: transparent, event-linked appeals amid a global contraction in attention and funds.

Liquidity and the Market Makers: Institutions that Keep Flows Moving

Markets need market makers—actors willing to stand in the spread, transform sporadic interest into steady volume, and publish information that restores confidence. In Ukraine’s case, three intertwined players fill that role. First are frontline nonprofits, which play a crucial role in the market for moral capital. They demonstrate radical transparency, posting real-time dashboards of receipts and deliveries, which helps to restore confidence and ensure a steady volume of donations. Second are firms that have internalized civic purpose; during the invasion, Ukrainian companies redefined corporate social responsibility as an existential function, rerouting logistics, capital, and talent to keep supply chains—and social services—alive. Third are public institutions orchestrating predictable, rules-based disbursements on a multi-year horizon. Together they bind volatility, ensuring that spikes in moral demand become equipment, repairs, and salaries rather than stranded intent.

This architecture is visible in the data. The EU’s Ukraine Facility is a classic backstop, entering into force on March 1, 2024, and disbursing exceptional bridge financing of €6 billion within weeks to maintain macro-stability; subsequent tranches, including the August 2025 payment, signal policy continuity. Private dashboards, by contrast, solve the micro-allocation problem: donors can see that UAH 230 million bought sniper equipment or that a specific medical training center was built from a defined project pot. The informational symmetry shortens the distance between moral shock and practical output. It also sets a high bar for integrity: when 0.8% of UN-tracked humanitarian funding to Ukraine reached local NGOs directly between February 2022 and October 2024, the system left efficiency on the table—a reminder that liquidity without localization risks fragility.

From War to the Classroom: Translating Moral Capital into Education Finance

Education systems face their emergencies—teacher shortages, student mental-health crises, digital divides, and infrastructure deficits that erode learning. The wartime lesson is not to sensationalize but to operationalize. If moral capital is an asset whose yield rises with salience and falls with opacity, schools and universities can build ethical versions of Ukraine’s market design. Start with transparent, high-frequency reporting: rather than a once-a-year glossy, publish weekly ledgers showing how last month’s donations translated into devices for low-income students, tutoring hours, or repaired boilers. Treat stories as signals, not spectacle; align them with measurable outcomes on a public dashboard. When shocks occur—a local school closure, a flood, a breakthrough in attendance—use time-bounded campaigns that match the short donation half-life, then close the loop with documented delivery.

There is reason for guarded optimism. In 2024, charitable giving in the United States rose to $592.5 billion, with education among the sectors showing notable gains year-over-year; Giving USA reports increases across several subsectors, buoyed by equity markets and GDP growth. In the UK and Ireland, CASE’s latest survey frames 2023–24 as a milestone period for higher-education philanthropy despite macro turmoil. The wartime template suggests how to sustain momentum: peg appeals to verified events in student lives, price moral capital by linking each narrative to a fundable unit, and clear the “trade” with public receipts within days—not months. This is not militarizing education fundraising; it is adopting the mechanics of liquidity, transparency, and event-linked accountability to direct moral attention toward learning outcomes.

Managing Donor Fatigue: Hedging the Volatility of Conscience

Moral markets are volatile because attention is scarce. Donor fatigue is not a moral failure; it is a structural feature of a crowded information environment and tightening household budgets. In 2024, global humanitarian appeals underperformed sharply; by mid-year, only 18% of required funding had been met across crises, and the UN later trimmed its 2025 ask amid contracting appetite. European support for Ukraine remained high but became more sensitive to trust and personal economic strain, with some softening among groups facing rising deprivation. The hedging task for education leaders is to diversify the sources of moral yield: mix recurring micro-gifts with episodic, event-driven campaigns; alternate between local, particular asks and systemic, policy-matched investments; and anchor each to evidence of effect so that donors see their contribution as a durable claim on a better future, not a fleeting salve.

There is also a portfolio lesson in Europe’s wartime support mix. When U.S. aid paused, European governments and institutions expanded commitments, with Europe surpassing the U.S. in military support in early 2025. Private appeals thus operated alongside macro-finance and defense procurement, creating redundancy. Education systems can copy this redundancy by aligning donor campaigns with public funds and employer co-investment so that no single stream is decisive. The UK’s DEC Ukraine appeal shows the power of a long-tail, branded channel that donors trust; its cumulative £445 million illustrates how steady, low-friction giving can endure beyond the initial shock. A school district should aspire to the same: a recognizable vehicle, audited data, and a drumbeat of fulfillment that converts sporadic attention into stable budgets.

Governance and Ethics: Guardrails for an Emotional Market

Treating indebtedness as an asset risks cynicism unless guardrails are explicit. The wartime evidence points to three. First, transparency is non-negotiable. Come Back Alive’s granular reporting is not a brand flourish; it is the moral warrant that allows a market in conscience to operate without exploitation. Education analogs should publish open ledgers—not summaries—linking each donation to a unit of delivery and an outcome metric. Second, speed matters. The ten-day decay in donations after a shock implies that lags erode efficacy; procurement and contracting must be pre-approved so that funds can be allocated quickly. Third, localization is both efficient and ethical. When less than 1% of tracked humanitarian funds to Ukraine went directly to local NGOs through late 2024, the system left frontline knowledge underfunded; education funders should invert that ratio by routing a significant share to school-level budgets with accountability.

Ethics also extends to narrative restraint. The strongest donation responses follow coverage of civilian harm; in education, the temptation will be to foreground worst-case tragedies. Resist that shortcut. Salience can be earned by success as well as suffering: a program that lifts attendance by five percentage points, a mental-health pilot that halves wait times, a teacher residency that cuts vacancies by a third. Publish those “earnings” as if they were quarterly results, with time-series charts and open datasets. The rigorous act of measurement replaces manipulative imagery with public accountability. It is how moral capital becomes a patient asset, not a spasm.

Reconstruction, Legitimacy, and the Long Game for Education

The war will end; the balance sheet will not. Ukraine’s reconstruction needs are estimated at $524 billion over the next decade—about 2.8 times the country’s 2024 nominal GDP—an order of magnitude that will pull public and private capital into schools, universities, and research as much as bricks and bridges. The political economy is already visible: Europe’s multi-year facility offers predictable cash; firms are practicing a hardened version of civic duty; and civil society has learned how to turn shock into supply. Meanwhile, Russia faces a separate, slower contest: restoring the legitimacy of its claims over occupied land, a battle where coercion cannot substitute for consent and where narratives of rights and freedom will continue to define Europe’s moral calculus. Education sits at the hinge of these dynamics, both as a beneficiary of reconstruction and as the producer of the beliefs that make legitimacy possible.

For Western Europe, indebtedness to Ukraine is not only retrospective—thanking a protector—but prospective—funding a neighbor’s return to self-rule, prosperity, and integration. That prospect will mobilize investments in human capital: teacher training to meet demographic loss, apprenticeships to rewire supply chains, and universities to absorb displaced researchers and rebuild scientific capacity. It will also refine how Europe funds its classrooms. If moral capital can be priced, it can be reinvested: in exchange programs that knit a continent, in civics curricula that clarify why borders cannot be redrawn by force, and in transparency systems that teach young citizens how to follow the money they help raise. The long game is not charity; it is the compounding of norms.

From Crisis Yield to Civic Dividend

The data point that opened this argument—a measurable, event-linked surge in giving after each new civilian death—was never just about wartime mechanics. It revealed how publics behave when they perceive their values on the line: they reprice conscience and convert it into cash with startling speed, provided that institutions supply transparency and immediacy. That same logic can serve schools and universities without drifting into manipulation. Build visible pipelines between story and outcome. Publish ledgers that settle every moral “trade.” Design campaigns with the humility to accept decay in attention and the skill to refresh salience with proof, not spectacle. Western Europe’s sense of indebtedness to a frontline ally has been transformed into the equipment and resilience that kept a democracy alive. The next transformation should be at home: channel that learned capacity for mobilization into classrooms, labs, and student wellbeing so that the dividend of today’s moral capital is a generation equipped to defend freedom without having to pay for it again in blood.

The original article was authored by Margaryta Klymak, a Lecturer (Assistant Professor) at King’s College London, along with four co-authors. The English version of the article, titled "Charitable giving in wartime: Evidence from Ukraine’s war fundraising," was published by CEPR on VoxEU.

References

Business Insider. (2025, June). A handful of European nations mostly filled the gap the U.S. left for Ukraine’s aid—at least in dollar terms.

Charities Aid Foundation. (2023). World Giving Index 2024.

Council of the European Union. (2025, August 8). Ukraine Facility: Kyiv to receive over €3.2 billion in EU support following Council decision approving fourth payment.

Disasters Emergency Committee. (2025). Ukraine Humanitarian Appeal.

European Commission. (2024). Ukraine Facility.

Eurofound. (2025). Support for Ukraine still high among EU citizens, but some fall-off apparent among specific groups.

Gallup. (2025, February 26). Global Generosity: World felt less charitable in 2024.

Giving USA. (2025, June 24). U.S. charitable giving grew to $592.5 billion in 2024.

MIT Sloan Management Review. (2024, November 25). How Ukrainian companies are transforming wartime challenges into lifelines.

New Humanitarian. (2025, April 17). What new funding data tells us about donor decisions in 2025.

OCHA (UN Office for the Coordination of Humanitarian Affairs). (2025). Ukraine: Response and funding—Year-end 2024 analysis.

OpenDataBot. (2025, February 23). 28% more donations were collected by the three largest funds in 2024.

Savelife/“Come Back Alive.” (2025). Donations statistics (updated August 12, 2025).

VoxEU/CEPR. (2025, August 10). Klymak, M., Kosenko, A., Korenok, O., Mykhailyshyna, D., & Vasilaky, K. Charitable giving in wartime: Evidence from Ukraine’s war fundraising.

World Bank Group. (2025, February 25). Updated Ukraine recovery and reconstruction needs assessment: $524 billion over the next decade.

World Bank Group. (2025, March). Support to Ukraine (factsheet).