When laws speak with riddles, markets are silent

Input

Modified

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

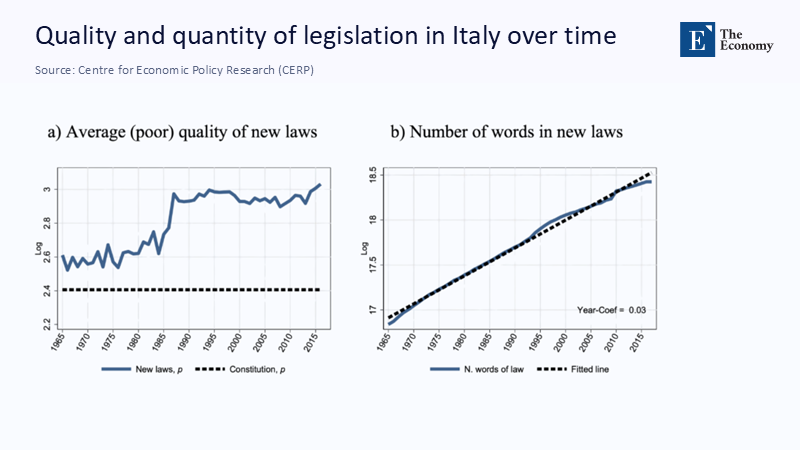

Italy's economy loses about 110 billion euros every year because too many laws are incomprehensible to those who have to obey them. This is not a metaphor; It's a number calculated by economists who model the spill-over effects of legal opacity on compliance costs, delays, and misallocation of capital. In a country whose GDP in current prices was around €2.19 trillion in 2024, the annual cost of muddy laws is about 5% of economic output – more than three times Italy's yearly total R&D spending by the public and private sectors combined. The consequence is predictable: investments are postponed, projects are resized, and innovation is delayed, while businesses wait for clarity that often arrives late or not at all. When the government creates uncertainty, fences are scarce and insurance is useless. Investors face a simple, grim calculation: act now and risk being blindsided by a later interpretation or "wait and see" until the rules stop changing. In 2025, this calculation will become Europe's quiet growth killer.

Redefining the Problem: From "Uncertainty" to State-Created Option Price

Most discussions about investment shortages cite market uncertainty as a key factor. However, a more precise perspective shows that certain uncertainties are negative externalities created by the state. Ambiguous statutes, delayed guidance, and irregular executive actions lead to a 'delay choice value,' making waiting economically rational. This phenomenon has been emphasized by the theory of real choices, but the current scale of politics-driven ambiguity in advanced democracies is concerning. The European Investment Bank found that companies citing uncertainty cut their investment rates by 2.5 percentage points. In 2022, EU corporate investment could have been 0.42 percentage points higher if uncertainty perceptions hadn’t worsened.

Legal opacity compounds these issues, causing delays in enforcement and costly litigation, which translate to risk premiums and affect capital allocation. This opacity is most significant in tax, labor, and competition laws, which influence most investment decisions. The state has the potential to solve common knowledge problems, but vague laws create a scenario where businesses wait for others to act. This trend extends beyond borders, as the World Bank's governance indicators link perceptions of rule of law quality to investment flows. Europe’s 2025 policy reviews highlight that cumulative regulations, particularly in digital and sustainability reporting, raise compliance costs without clear guidance. The issue lies not in the regulations themselves but in their ambiguous implementation.

The rational thinking of "we wait and see"

The answer 'we wait and see' is often ridiculed as cowardice. However, it is a rigorous strategy that values information irreversibly. When the distribution of results is widened due to policy ambiguity, the option of delay gains value. Leaders who lag are not indecisive; They prize the benefit of learning. MIT Sloan's recent composition puts it clearly: waiting is optimal when uncertainty is likely to decrease, and the cost of delay is lower than the expected loss from action under the wrong set of rules. In modern regulatory environments, both conditions often apply. Rules are usually clarified ex post through guidance and court rulings, while capital goods, procurement contracts, and recruitment remain difficult and costly to relax. The fundamental choice framework is not about risk avoidance; This is the sequence of commitments, so that irreversible choices arise after the strengthening of the policy signal. This 'we wait and see' strategy is not about inaction, but about strategic timing and risk management in the face of policy ambiguity.

Quantitatively, the result is visible in Europe's investment pulse. A 2025 ECB survey of large euro area firms reports that political uncertainty and energy price uncertainty remain the dominant reasons for postponing capital expenditure despite lower interest rates. Complementary micro-elements are undeniable: in many sectors and business sizes, increased perceived uncertainty mechanically reduces the probability of an increase in investment by up to 4.5 percentage points, while increasing the likelihood of a reduction in investment by three points. These are not small numbers when multiplied by national capital reserves. They imply a structural brake on productivity growth when Europe needs to invest in digitalisation, the energy transition, and defence supply chains. Optimal delay by any business adds suboptimal results for the economy.

The new policy risk engines of 2025

Uncertainty is not just a domestic product. It is imported through trade policy and exported through the unpredictable situation in the major economies. In 2025, U.S. micropolitics and efforts to politicize official statistics have caused new noise in planning cycles. Announcements to lay off statistical leaders and consider restructuring data organizations have alarmed market participants relying on reliable, timely macroeconomic data for capital allocation. Meanwhile, the threats of serial tariffs – delayed, revised, and then revived – have hit the order books of European exporters. Italy's second-quarter 2025 GDP fell 0.1% quarter-on-quarter as trade flows worsened amid growing uncertainty over tariffs, a reminder that today's policy debate may move tomorrow's national accounts. Businesses know what to do when the source of risk is the market – hedging, diversifying, and insuring. They cannot compensate for the ministerial whims.

The direct macroeconomic indicator of these shocks is the Economic Policy Uncertainty Index (EPU). This index measures the level of uncertainty in the economy based on news coverage, tax code provisions, and other factors. Italy's EPU soared to 246 points in April 2025 – the highest of the year – before falling to 164 in July, levels that are still significantly higher than periods of calm. These moves coincide with the headlines of tariffs and domestic legal debates, again appearing as a tax on the embargo. The European Commission's forecasts now highlight 'modest growth amid global economic uncertainty,' and the OECD's 2025 survey points out that cumulative regulatory burden — successors to the GDPR, sustainability reporting, and due diligence mandates based on old rules — has become a drag on business dynamism. The message is consistent across all sources: political turbulences, not just price levels, are stifling investment.

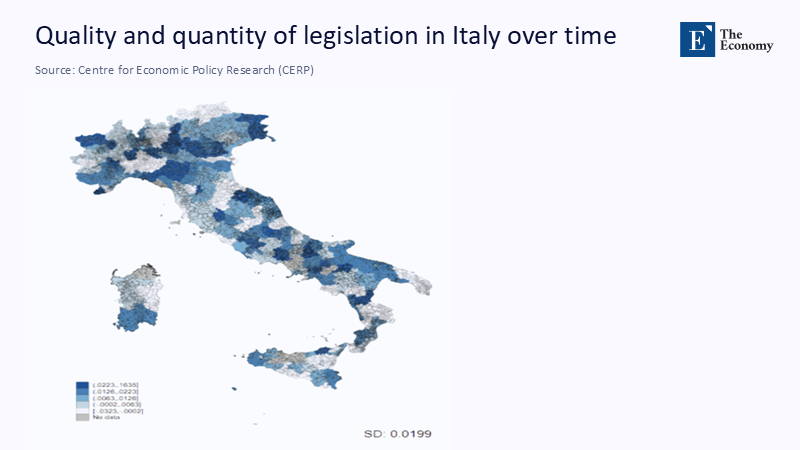

The case of Italy: when legal ambiguity becomes industrial policy – by accident

Italy offers a stark illustration of how vague rules choose winners and losers inadvertently. The estimated annual dead weight loss of €110 billion from incomprehensible laws is on a macroeconomic scale and distorts incentives. Large established bodies with legal departments can arbitrate ambiguity. Smaller businesses and newcomers cannot. Rule of law concepts, as monitored by the World Bank, matter more to those on the margin, and in Italy, the marginal investor is often an SME facing severe funding constraints. This explains why the overall R&D effort remains well below the EU average and why the country's private R&D intensity has declined further since 2019. When the rules are unclear, scale is an advantage unrelated to productivity. The result is the misallocation that appears as lower overall growth.

Macroeconomic data tells the same story in motion. Italy's economy grew by 0.7% in 2024, supported by EU recovery spending, but investment in equipment fell even as construction increased – an unpleasant composition for long-term productivity. By mid-2025, growth momentum had subsided as trade tensions filtered into orders. Meanwhile, readings of Italy's political uncertainty rose this spring, as legal debates and external shocks were watched. None of this is destiny. Economies can grow by complex rules; They struggle with ambiguity. The solution is not deregulation in all sectors, but predictable, decipherable regulation, provided with interpretative guidance before – not after – the companies that need to commit capital. Predictability is a public good; in Italy, as in much of Europe, it is not adequately provided.

The Stakes of Education: How Policy Ambiguity Freezes Human Capital Investment

An online educational magazine might ask: What does legal opacity in tax or trade policy have to do with classrooms? Quite a bit. Universities and vocational institutes are also investors, relying on people, workshops, and industry collaborations. When procurement rules or research funding calls change unexpectedly, managers shift to maintenance mode, leading to fewer apprenticeships and slower curriculum updates in emerging fields like AI and green technologies. This uncertainty also affects graduate outcomes as hiring freezes prompt students to reconsider their career paths.

Moreover, fluctuating R&D tax credits and unclear reporting burdens increase the costs of university-industry cooperation, stifling innovation. The OECD's Regulatory Policy Outlook highlights that compounding new rules without thorough cost-benefit reviews hinders progress, contrary to the needs of green and digital transitions. Italy's R&D investment gap within the EU has widened since 2019, impacting partnerships essential for projects and technology transfer. Thus, legal clarity is vital for fostering human capital and maintaining a strong connection from classrooms to research labs and industries.

From "Wait and See" to "Plan and Commit": A Theoretical Push for Policymakers

To create a game-changing policy with reasonable delay options, the goal is to reduce uncertainty shaped by policy, rather than eliminate it. Three key strategies can help. First, agencies should provide binding interpretative guidance alongside complex statutes, including examples and safe harbors, to clarify potential enforcement outcomes. Secondly, introduce 'windows without surprises,' where rules can't be interpreted retroactively for compliant businesses. Lastly, ensure budgetary clarity by withdrawing an old reporting requirement for each new one and offering a concise summary controlled by stakeholders.

These measures, highlighted in OECD assessments for 2025, aim to create a focal point in decision-making, encouraging businesses to act when they believe others will follow, transforming "wait and see" into "plan and commit." Europe's GDPR experience shows that strict regulations can coexist with investment when guidance is clear. The challenge arises when updates proliferate or national applications vary. The European Commission predicts that economic growth is now more constrained by expectations than by funding; reducing political noise could enhance capital flow, fostering a fairer investment distribution among SMEs and less advantaged regions.

Anticipating criticisms – and refuting them

Critics say that uncertainty is inherent in innovation, and that protecting businesses from it mitigates their competitive advantage. It applies to market uncertainty; it is false for arbitrary legal ambiguity. Markets must be rough; The statutes must be legible. It is not a question of guaranteeing success, but of allocating policy risk so that businesses can price it. Evidence shows that when uncertainty is driven by policy, investments' sensitivity to ordinary economic stimuli – such as interest rates or prices – weakens. This attenuates the effect of macroeconomic stabilisation and wastes budgetary capacity. A system that communicates the rules does not caress the incumbents; It gives newcomers a fair chance by reducing fixed compliance costs that are not related to productivity.

The second criticism argues that "wait and see" wastes the advantage of the first move. Yes, when the market primarily drives uncertainty. But when the uncertainty concerns whether a project will later be considered compliant, going first is not strategic. It is reckless. In 2025, as tariff rhetoric and discussions about data reliability subside, the rational company is holding funds for windows of political calm. This behaviour is visible at the peaks of Italy's policy uncertainty and quarterly fluctuations in growth. It fits both the ECB's business survey narrative and the OECD's warnings about cumulative regulatory burden. The answer is not to reprimand skeptical CFOs; It is to reduce the share of uncertainty that only policymakers can eliminate. A clear law is a development policy.

From Ambiguity to Action

The number that opened this essay - 110 billion euros a year lost due to legal opacity - should not be read as a curiosity of the Italian government. It is a mirror in any jurisdiction where legislation accumulates faster than guidance and where executive discretion replaces rules-based administration. In such places, "wait and see" is not cowardice. It is prudent. But prudence escalates to stagnation when everyone waits together. The manual is now clear. Treat clarity as infrastructure. Publish binding interpretative notes by law—retrospective reinterpretation of the ceiling. Review and retire duplicate reports. Make communication in plain language the rule, not the exception. These steps will not eliminate uncertainty, but they will shrink the state department that is now quietly taxing Europe's growth ambitions. If policymakers act, businesses will respond, classrooms will be filled with new apprenticeships, workshops will partner with more start-ups, and "wait and see" will give way to "building and competing." Clarity is not a concession to businesses. It is a commitment to the common good.

The original article was authored by Tommaso Giommoni, an Assistant Professor at the University of Amsterdam, along with three co-authors. The English version of the article, titled "Italy and the cost of unintelligible laws: 110 billion euros a year," was published by CEPR on VoxEU.

References

Baker, S. R., Bloom, N., &; Davis, S. J. (2015). Measuring economic policy uncertainty (working document; index website with updates). Retrieved August 13, 2025, from the Economic Policy Uncertainty website.

European Central Bank. (2025). The outlook for business investment in the euro area – findings of the ECB's survey of large companies (Financial Bulletin, Issue 4/2025).

European Commission. (2025, May 19). Spring Economic Forecast 2025: Moderate growth amid global economic uncertainty.

European Commission. (2025). Economic forecast for Italy. (Country page, updated May 19, 2025).

EF. (2025). Attractiveness Research in Europe 2025 (FDI trends).

Financial Times. (2025). Investors are frogs in a Trumpian pot (analysis, August 2025).

Giommoni, T., Guiso, L., Michelacci, C., &; Morelli, M. (2025, August 13). Italy and the cost of incomprehensible laws: €110 billion per year. VoxEU/CEPR.

INTERNATIONAL MONETARY FUND. (2025, July 22). Italy: Consultation under Article IV of 2025 – Press Release; Evaluation report. International Monetary Fund.

ISTAT. (2025, March 3). GDP and net general government borrowing – Years 2022–2024. Italian National Institute of Statistics.

Kolev, A., & Randall, T. (2024, April). The effect of uncertainty on investment: Evidence from EU survey data (EIB Economics Working Paper 2024/02). European Investment Bank.

MIT Sloan Management Review. (2025, June 23). When you wait and see, it's a smart strategy.

OECD. (2025, April 9). OECD Regulatory Policy Outlook 2025: Regulatory for the Planet (selected findings on cumulative burden and innovation).

OECD. (2025, July 3 / 2025 PDF). OECD economic surveys: The European Union and the euro area in 2025 (regulatory burden and documentation requirements).

Civil. (2025, August 12). Trump wants to influence government statistics. Data enthusiasts worry about what this means.

Reuters. (2025, July 30). Italy's economy unexpectedly contracted in Q2 due to trade uncertainty.

St. Louis Fed/FRED. (2025). Economic Policy Uncertainty Index for Italy (ITEPUINDXM). (Monthly Observations, updated July 30, 2025).

World Bank. (2025). Worldwide Governance Indicators (Rule of Law measure; project updates 2025).

Comment