From "haven" to "haven of trust": teaching markets to price policy risk, not just fear

Input

Modified

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

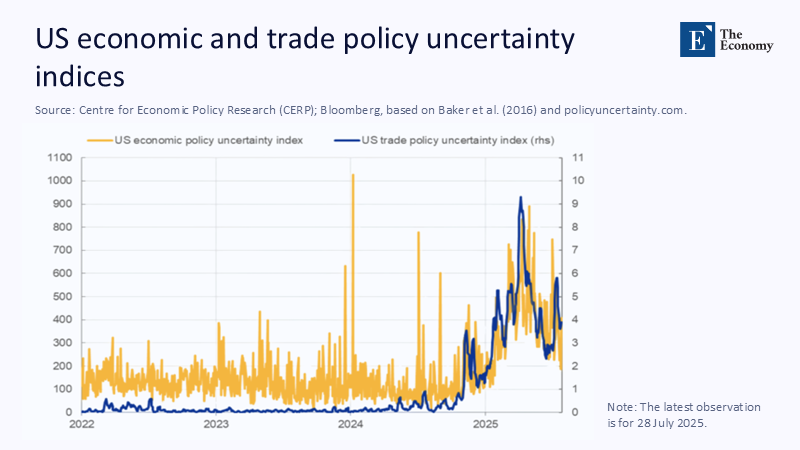

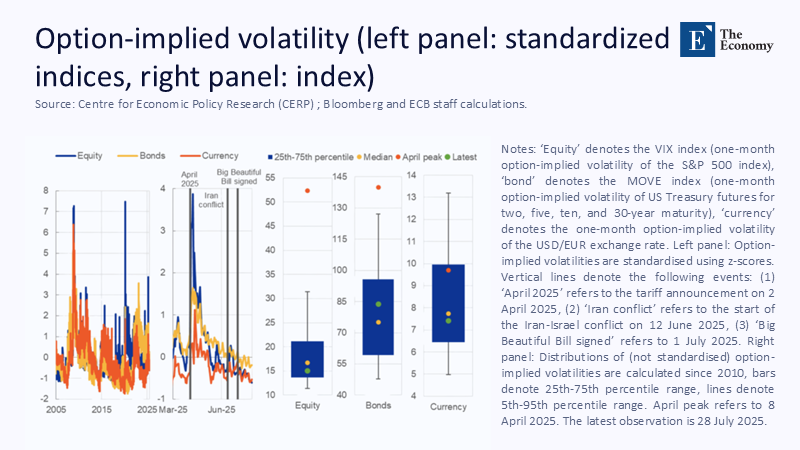

On April 8, 2025, the Cboe VIX closed at 52.33 points, the highest value since the pandemic disruptions. The "fear meter" of the government bond market, the ICE BofA MOVE index, was printed near 139.9, a peak that pushed traders and asset managers into defensive postures. By July 28, both indices had fallen – VIX 15.03, MOVE ~83.7 – even when the daily US economic policy uncertainty index hovered around 276, well above the sleepy baseline scenario before the announcement. In between came a sequence that should change the way we teach the role of the dollar: the dollar faltered, the Swiss franc and gold stabilized, and government bond yields first declined and then soared as investors shifted from a reflexive "dollar buy" to a more surgical search for assets that are less exposed to US policy decisions. This was not the playbook of 2008 nor the panic in early 2020. It was a shock of political origin – tariffs and related interventions – that forced investors to re-assume the guarantee of the rulebook, not the banking system. The lesson is hard: in an era of tariffs, the dollar is still a haven, but only when it's not the shock. The advantage that matters is trust – reliability of the process, clarity of the timetable, and confidence in the state's ability to enforce rules without moving goalposts in the middle of the game.

Redefining the rule: from "shelter" to "shelter of trust"

The old rule was neat: if you want odds, keep risk. If you want security, buy government bonds and, by extension, dollars. This rule was based on a century of US institutional stability and the enormous depth of dollar markets. It also identified the narrowest safe havens – CHF, JPY, and gold – whose attractiveness is real, but whose supply and market depth are limited. What changed this year was not so much the identity of the "safe" assets, but the state in which each one leads. When the shock is exogenous to the United States — high-risk insolvency, global pandemic — the world grabs US dollars and duration because the U.S. is the adult in the room. But when the shock comes from Washington — tariffs, threatened data revisions, or executive interventions that redistribute cross-border cash flows — the market briefly moves away from the dollar to wait for the new rules to be settled, and then selectively recurs. At the moment, gold is behaving like a lightning rod, CHF is trading rich to reflect the isolation of Swiss policy, and short-term US bills outperform major government bonds because the path of interest rates is less questionable than the regulatory perimeter. The "haven," in other words, becomes a haven of trust: the asset that best compensates for the source of risk, not just risk in general. A trust haven is an asset that maintains or increases its value in times of market volatility, providing a reliable hedge against specific sources of risk.

Reading April's rise correctly: policy shock, not pressure on the system

The April 8 printouts — VIX 52.33 and MOVE ~ 139.9 — called narratives about the dollar's decline. A look at the half-life time of this episode tells a different story. Stock volatility dropped to 15.03 by July 28, and bond volatility fell back to the lows of the 1980s, later flirting with three-year lows. Systemic crises do not behave in this way. In 2008-2010, volatility remained elevated for months because the problem was the hydraulics of financing. At the beginning of 2020, the uncertainty was biomedical and global. In 2025, the shock was driven by the rules: tariffs and implementation chatter that required businesses to reprice supply chains, tax exposures, and exchange rate hedges. A rapid reversal of the VIX and MOVE alongside the persistently high text-based policy uncertainty is the signing of the recalibration, not the credit seizure. The dollar swing fits this pattern. Investors didn't sell wholesale US assets. They were turned. They preferred policy-insulated exposures — short-term bills, high-quality credit with limited trade sensitivity, selective foreign currency hedging — while waiting to see how tariff parking, exemptions, and diplomatic tit-for-tats would land. Once the road was simpler, money flowed back to the US peril, but not indiscriminately. It flowed where the exposure to politics was more subtle. April's rise, marked by a rapid increase in market volatility and subsequent normalisation, was the result of the rules-driven shock rather than a systemic crisis and provides valuable insights into market behaviour during policy shocks.

A simple, transparent meter for the classroom and boardroom

To keep this discussion practical, consider a risk translation score (RTS) that can calculate any seminar or investment committee in less than an hour. The RTS is a simple, transparent indicator that measures the transformation of political uncertainty into market volatility. It uses three liquid public meters – VIX for stocks, MOVE for interest rates, and a large-pair FX implied volatility substitute (for example, CVOL EUR/USD CVOL by CME). The process involves standardizing each from the 2010-2024 allocation to produce daily z-scores, defining the trigger as changing the z-score from the 60-day mean before the event to the event week (here, April 2-9, 2025), and measuring stickiness: trading days until the z-score returns within a standard deviation of its pre-event average. Finally, both impulse and stickiness are related to the change in political uncertainty (daily USEPUINDXD and trade policy category). When you run it for April-July 2025, three results are displayed. First, the shift from policy uncertainty to market volatility was substantial in the first week: the VIX and MOVE both exceeded two standard deviations from their baseline scenarios. Second, the stickiness diverged: stock volume normalized in about a calendar month, while interest rate volume took longer, but never looked like 2008-style discomfort. Third, the FX channel was the smallest and fastest to make a comeback, consistent with a swap between monetary havens rather than a generalized dollar debacle. The point of RTS is not theoretical elegance. It is playable. Students can perform it. Administrators can understand this. Policymakers can see how a more precise tariff timeline could have triggered less impetus and faster attenuation. RTS is a practical tool that provides a clear and transparent measure of market risk, allowing for quick and effective risk assessment in both educational and professional settings.

What does "safe" mean when Washington is the focus

When politics is the shock, markets chase both policy isolation and balance sheet strength. This is why CHF, JPY, and gold are outperforming their weight despite limited supply or thinner market depth. Switzerland's isolation stems from predictable rules, a conservative fiscal stance, and the credibility of the Swiss National Bank. Japan's role in the bailout — though more dependent now that domestic yields can move — is based on the Bank of Japan's policy toolbox and the scale of local savings. The attractiveness of the gold haven is agnostic about supply. It's a no-man's policy claim and has been backed up recently by stable central bank markets. The US dollar continues to dominate pricing, reserves, and cross-border financing, and government bonds remain the world's central collateral. But when policy leverage is the source of uncertainty, the market prefers temporary assets whose value driver does not sit behind the US policy curtain. This preference weakens when the rules are stabilized – as April showed – but conditionality remains. The teaching of this conditionality makes cases in the classroom more real in life. Incorporating it into Treasury Department policies makes institutions less likely to compensate for the wrong thing at the wrong time.

Implications for teachers, administrators, and policymakers

For teachers, immediate information is conceptual clarity. Teach safe havens as conditional claims to trust, not axioms. Use the RTS assignment to compare three episodes – 2008, 2020, and 2025 – and ask students to explain why identical leaps in policy uncertainty can be transmitted differently in stocks, interest rates, and foreign exchange. For managers who manage legacy, operating cash, and capital projects, the April course supports the diversification of hedging. Short-term options were expensive during the spike. The combination of maturities and the addition of options with forward contracts makes the risk of a policy timeline more tolerable. For policymakers, the recommendation is behavioral, not ideological: sequence and signal. The same tariff schedule, announced with explicit staging, well-advertised review points, and publication-level data support, would likely produce a smaller RTS and less dramatic rotation in countries outside the US. Havens. In a world that compares reliability in real-time, the cheapest risk reduction tool is a predictable process. The market will continue to disagree with policy; It will punish the surprise more than it punishes the direction.

Anticipating reviews – and absorbing the best of them

One review says that the dollar's central position is untouched: it remains on one side of the vast majority of foreign exchange transactions, dominates transaction pricing, and anchors official reserves. All valid and necessary. But sovereignty is not immunity. April showed that when Washington creates uncertainty, the first instinct is to wait outside the dollar until the terms are settled and then come back with its eyes open. Another critic calls the April reaction a flashback: volatility faded, stocks rebounded, and the government bond market found its pace. Also true. Transience, however, does not mean insignificance. A short-lived but predictable pattern has real policy and portfolio consequences. It tells us that the relative risk is the origin of the policy, not just the "risk-on versus risk-off". A final critique argues that safe havens "failed" because correlations broke at the top: gold was disconnected from real prices. The CHF rallied as US yields fell. This is precisely what political shocks should do. When the rules, rather than growth, are in motion, tradeoffs that ignore exposure to politics will be disappointing. The remedy is not to abandon paradises, but to match them to the source of danger.

Back to the spike, forward to a playbook

Back to the morning screens on April 8. Volatility screamed, the dollar stumbled, and the debate about haven hardened in the minds of one or the other. Four months later, the picture was calmer, but the best story is not fading; it's the map that gave us the episode. When the United States is the source of uncertainty, the shelter's premium is emigrating. It migrates to assets isolated from US policy — gold, CHF, in some cases JPY — and to US exposures whose yield is less affected by the new rules, especially very short-term accounts. As the course of policy stabilizes, capital returns, but wiser: the tradeoffs are greater. The exposures are more surgical. And "buy dollars" regains power once trust is restored. This is not dethronement; It is a conditional truth. Our task now is to teach it clearly, to measure it transparently, and to govern with that in mind. Teachers should train students to calculate and interpret risk translation and stickiness. Managers should pre-approve strategy manuals for policy origin-related disruptions; Policymakers should stage and signal so that uncertainty does not escalate into mistrust. If you do this, the subsequent rise will hurt fewer balance sheets – and justify a safer version of dollar leadership.

The original article was authored by Magdalena Grothe, a Senior Lead Economist at the European Central Bank, along with three co-authors. The English version of the article, titled "Recent patterns in global risk behaviour in financial markets," was published by CEPR on VoxEU.

References

Baker, S. R., Bloom, N., &; Davis, S. J. (2016). Measurement of economic policy uncertainty and related US EPU datasets (including daily series USEPUINDXD and trade policy category). PolicyUncertainty.com.

Cboe Global Markets. (2025). Historical Cboe Volatility Index (VIX) data (VIXCLS series, via FRED).

CME Group. (2025). CVOL: EUR/USD 30-day imputed volatility (documentation and index data).

Goldhub / World Gold Council. (2025). Gold Demand Trends 2025 (Q1–Q2) — central bank purchases and market commentary.

ICE / Bank of America. (2025). MOVE: ICE BofA U.S. Bond Market Option Volatility Estimate (level and methodology, daily data accessible through public market data services, such as Yahoo Finance and Investing.com).

International Monetary Fund. (2024–2025). Currency composition of official foreign exchange reserves (COFER) — latest quarterly update.

Reuters. (2025, April–August). Real-time market reports on invoice announcements, volatility spikes, and subsequent smoothing out in VIX, MOVE, FX, and gold.

T. Rowe Price. (2025). Safe shelters in 2025? It is a complex relationship, as illustrated by the analysis of shelter behavior and VIX cooling profile.

VoxEU / CEPR. (2025). Recent Patterns in Global Risk Behavior in Financial Markets

Comment