The Carbon Corrected Productivity Ledger: Understanding how the climate bill impacts “anemic growth” and its implications for education

Input

Modified

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

In April 2025, researchers estimated the long-term social bill of greenhouse gas emissions associated with U.S.-listed companies at $87 trillion. Dollars — an amount greater than their total market value. This is not a communication gimmick, but an assessment that applies the EPA's Social Carbon Cost (SCC) to price today's emissions over time. Let's do the growth now: the Global Carbon Budget estimates 37.4 billion euros—tonnes of CO₂ from fossil fuels in 2024. If we apply even the relatively "moderate" EPA price, about $190/ton, the annual damage bill approaches $7 trillion. Dollars. With the most recent macroeconomic estimates of around $1,300/tonne, the bill jumps to more than $48 trillion. Dollars. We are not "discovering" new spending; we are simply adding up what we are already paying through heatwaves, lost working hours, school interruptions, infrastructure damage, and risk premiums. This is an indirect tax on productivity. If we reframe production net of these losses, the "slowdown" of the last two decades looks less like stagnation and more like growth diluted by climate damage that we did not register.

Reformulation of the Question: From "produced per hour" to "produced per hour net from climate damage"

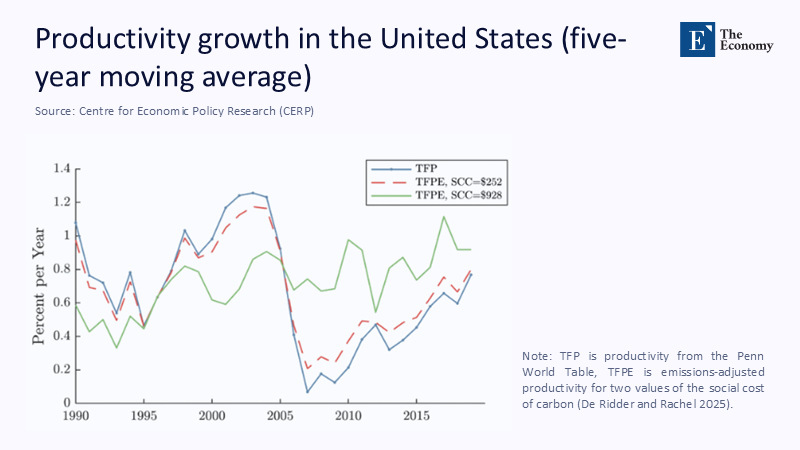

The classic productivity lens asks how efficiently labor and capital convert inputs into cash outflows. It does not ask how much climate damage the outflow incorporates, even though this is a production cost borne by society. The lens of carbon-corrected productivity corrects this omission. Conceptually, we subtract from the gross product the estimated climate damages corresponding to production: Y∗=Y−SCC×Emissions.

History is changing. If emissions fall faster than output, net productivity accelerates. If emissions remain high — because electricity comes from coal or because we migrate carbon into supply chains — net productivity lags even when output per hour increases. The recast is urgent for two reasons. First, the damage assessment has been upgraded: the EPA's updated SCC framework and new macroeconomic findings show much higher losses than older models. Second, the policy begins to price carbon at the border (CBAM), converting "off-books" costs into writeable in trade flows. This change presents a significant opportunity for positive change and a more sustainable future.

This is not a call to throw away the established measurements. It is a requirement for double accounting. Organizations, ministries, and school systems must maintain the classic figures, but publish carbon-corrected ones. Dual reporting turns a pervasive exterior into a functional controller: you decarbonise electricity and supplies, and "clean" productivity is visibly improved in the budget committees. You ignore the embedded emissions of imports, and the same committees will see the gap between "gross" and "net". The discipline of the new measure is its symmetry: it rewards absolute decoupling and exposes the false economies created when we "export" emissions to third parties.

What the Numbers Show: A Rough, Transparent Adjustment

We start with the universal. For 2024, CO₂ emissions from fossil fuels are estimated at 37.4 Gt. Multiplying by $190/ton (EPA methodology), we get about 7.1 trillion. At $1,300/ton (a macro-consistent estimate based on climate shocks), the losses exceed $48 trillion. Even if we take the average value and cut it in half for conservatism, the size remains cataclysmic and explains much of the measured "anemia" of period productivity. The crucial thing is not the exact number but the direction and scale: considerable, persistent, and possibly under-recorded climate damage squeezes apparent productivity, creates the illusion of "cosmic stagnation" and blurs comparisons between countries that simple "output per hour" statistics are unable to explain.

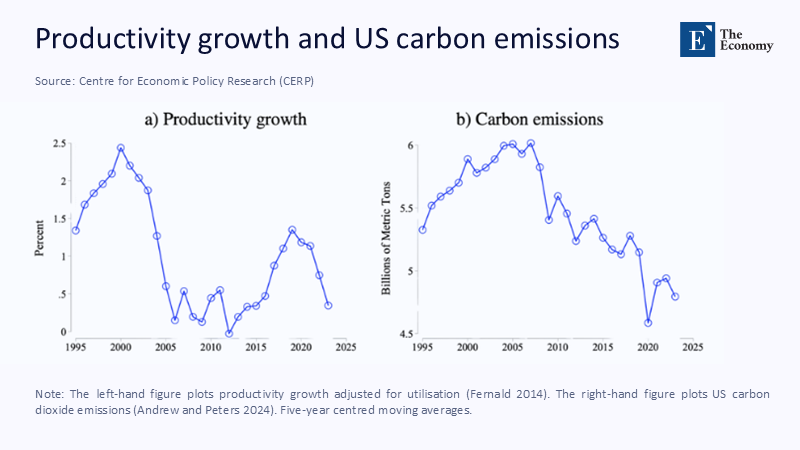

We turn our gaze to the US, where measured productivity has recently recovered: the BLS recorded +2.7% labor productivity in 2024 and +1.3% total factor productivity in 2023 and 2024. That is positive — but incomplete. With carbon correction, two opposing forces are at work. On the benefit side, the "emission factor" of the electricity grid is reduced (about 0.81 lb CO₂/kWh in 2023 in utilitarian energy), so the "climate friction" per dollar of electricity output is reduced. On the negative side, extreme weather events and heatwaves are increasing in frequency and cost, with 27 billion-dollar disasters in 2024 alone. The lens of corrected productivity captures both: it credits decarbonization and blames the acute and chronic damages of climate variability that classical statistics treat as exogenous.

Who Paid the Bill? The Supply Chain Outcome Focused on China

There is also the spatial distortion of the bill. Over the past two decades, many advanced economies have outsourced carbon-intensive processes — often in coal-fired grids, with China as a prime example — and introduced the final product. Based on production, the emissions are borne by the exporter; on the consumption basis, a significant part of the carbon is embedded in the buyer's basket. Recent estimates attribute China to a substantial share of embedded emissions in EU imports (around 8.5% of emissions attributed to EU consumption). In contrast, global emissions from fossil fuels remain at historic highs. When we judge productivity without carbon accounting based on consumption, "cheap" imports flatter the importer's figures, while the real social costs are paid elsewhere — or recorded nowhere.

Politics is adapting. The EU's Carbon Border Adjustment Mechanism (CBAM) entered the transition phase in October 2023 and will impose charges from 2026 on carbon-intensive imports (cement, electricity, fertilisers, iron-steel, aluminium, hydrogen). CBAM is not morality; it is accounting. It moves embedded carbon from the footnote to the tariff line, narrowing the gap between the "gross" and "net" measure of productivity, because it obliges import prices to reflect climate costs corresponding to those borne by producers within the EU ETS. The immediate outcome for schools and universities is indirect — through steel, paper, and equipment — but the strategic lesson is immediate: the carbon of logistics is not disappearing; it will show up in price or on the planet.

Why Education Should Matter: Learning, Buildings, Budgets

Education suffers climate costs in two places: in learning itself and in infrastructure. For learning, the findings are hard. Exposure to warmer school days undermines performance; in areas without adequate cooling, every +1°F in the average temperature of the school year is associated with about a 1% reduction in learning progress, while adequate air conditioning coverage almost zeros the effect. Modern studies confirm the temperature-performance link in different environments. When heat waves close schools or force early retirement, the loss of teaching time accumulates. In the pure ledger, these losses are not abstract externalities; they are a direct erosion of the "educational product" measured in skills, titles, and future incomes.

In infrastructure, US K-12 12 districts spend more than $8 billion annually for energy, and a respectable share is wasted due to aging HVAC, weak shells, and poor control. The conversion of energy to coal is straightforward: in 2023, the average emission of useful energy in the US was about 0.81 lb CO₂/kWh; regional factors vary, but arithmetic gives administrators a reliable approach. Even a medium-sized region with an annual consumption of 100 GWh. This entails around 36,700 tonnes of CO₂. At $190/ton, the shaded cost is approximately $ 7 million. Dol. per year; at $1,300/tonne, ~48 million. These are shadow costs, not checks that are being cut today. Still, really in social accounting — and they fit perfectly with the financial services' memory of heatwave shutdowns, maintenance overtime, and premature cooler replacements. The carbon fix says: interventions that reduce emissions increase your true productivity, even if in the current budget, you only see a reduction in your electricity bill.

Method without Mysticism: How Carbon-Corrected Productivity Is Applied in Practice

The technique for a Ministry of Education, a university, or a large school district is simple. First, estimate the annual Scope 1 and 2 emissions: on-site fuel and purchased electricity/thermal energy. Use local grid emission factors (e.g., eGRID for the US) and standard building consumption benchmarks for cross-reference. Second, choose social carbon costs. For regulatory alignment in the US, $190/tonne is defensive; to reflect the cutting edge of macroeconomic research, the published range is up to around $1,300/tonne. Third, calculate a climate damage charge by multiplying emissions by SCC and subtract it from gross product — tuition revenue, government funding, or a more refined indicator like "performance-adjusted learning hours." The result is a net carbon productivity indicator that you can track over time.

The same logic extends to Scope 3 — procurement and construction — where the real leverage lies. University hospitals, laboratories, and vocational schools buy steel, aluminum, paper, chemicals, electronics, and food. With the CBAM, many of them will carry increasing carbon price tags at the border. Education bodies can require suppliers to disclose embedded carbon at the product level, align reporting with ISO/EN standards, and evaluate bids on a cost+carbon basis. When two offerings are tied in price and quality, the one with the lowest built-in carbon intensity wins in terms of net productivity. Institutions can publish a simple 'Carbon-Adjusted ROI' table every quarter: energy savings, tonnes avoided, estimated losses avoided, and teaching time gained from improved indoor environment quality. The goal is not perfection, but direction — to stop confusing externalization of climate costs with actual efficiency.

Foreseen Objections — and a Reasoned Response

"The SCC is too uncertain to use." Every valuation incorporates uncertainty. The relevant question is whether the expected damage is significantly above zero. Modern published studies with global temperature vibrations suggest damages much greater than the outdated IAMs, pushing the SCC an order of magnitude higher. Publishing a range — from EPA to macro-consistent value — shows prudence and seriousness. The political mistake is not to choose the "wrong" number; it is to pretend that the number is zero.

"Targeting China is unfair." We agree — and that's not what corrected productivity does. It targets embedded carbon wherever it is in the chain. China's power mix remains coal-heavy, so many exports have higher embodied carbon than equivalent products produced in cleaner grids. At the same time, China is leading the way in new RES installations and, by mid-2025, showed a decline in emissions in a rolling 12-month period. The right message is not blame but alignment: border adjustments combined with commissions that reward net production everywhere. In this way, you respect the principle of common but differentiated responsibilities and accelerate net investment in exporting countries.

"Productivity is improving anyway." In the US, indeed, labor productivity and total factor productivity took a substantial leap in 2023–2024. That's good news — and that's precisely why the "carbon-clean" lens is relevant. If trends continue and emissions intensity falls, net productivity will accelerate faster than gross. If the trends stick while the damage from extreme events and heatwaves multiplies, the gap will open. The new lens helps you see which future you choose.

From Diagnosis to Application: Education Policy Programme

Ministries and universities need to make a carbon-adjusted productivity standard in two budget cycles. Start with the buildings. Link capital investments to energy and carbon efficiency contracts that guarantee kWh/sqm reductions and publish avoided emissions next to bill savings. The literature for schools and campuses shows tangible results: improved design and heat/geothermal pumps reduce operating costs and stabilize thermal comfort, protecting teaching time in the warmer months. These are productivity as well as climate policies, because they limit the silent "climate tax" on teaching.

Then, rebuild the supplies. Request emission statements for paper, laboratory equipment, IT hardware, and construction materials, and apply a cost+carbon assessment to the assessment. Where CBAM applies, align supplier reports with EU thresholds to avoid double charges and send a follow-up signal. Where not, pilot "border adjustment" at the organization level within the procurement system itself: estimate embedded carbon with reliable databases and adjust bids accordingly. Post both the "shelf price" and the adjusted carbon price to make the exchanges visible.

Finally, incorporate climate learning costs into the assessment. Performance losses from heat are predictable and, with adequate cooling and shells, manageable. If every +1°F without air conditioning subtracts one percentage point from learning progress, then cooling and ventilation are not luxuries; they are teaching infrastructure. Set targets for learning minutes per tonne of CO₂e and link infrastructure funding to improving this ratio. The moment you make learning a numerator and carbon denominator, you're aligning incentives: suppliers compete for lower embodied carbon, contractors for lower energy intensity, and technical services turn into productivity teams.

Turning the Climate Account into Productivity

A decade from now, the argument that "productivity has mysteriously slowed down" will seem outdated. We will see that the outflow has not stopped increasing; we have refused to cushion the planetary wear and tear that has been embodied in our products, classrooms, and budgets. Once we transfer the climate bill to the ledger, the supposed riddle is dispelled: "slow growth" was mostly loss-diluted growth. The good news is that this is a correctable accounting error with immediate practical derivatives. Education systems can be pioneers because their budgets touch buildings, equipment, paper, and, above all, teaching time. The steps are specific: publish carbon-adjusted productivity indicators following the classic figures; upgrade infrastructure to reduce the climate strain on teaching and budgeting; align commissions with carbon border pricing; and announce avoidable losses as part of the return on investment. The reward isn't just fewer shows. It's a clearer picture of productivity, fairer prices, cooler classrooms — and a generation of students learning in buildings that don't mortgage their future to balance the books of the present.

The original article was authored by Maarten De Ridder and Łukasz Rachel. The English version of the article, titled "Adjusting productivity for carbon emissions: A new perspective on the growth slowdown," was published by CEPR on VoxEU.

References

Carbon Brief. (2024, 13 Νοε.). Analysis: Global CO₂ emissions will reach a new high in 2024 despite slower growth.

Carbon Brief. (2025, 15 Μαΐου). Analysis: Clean energy just put China's CO₂ emissions into reverse for the first time.

Chicago Booth Review. (2025, 14 Απρ.). The price of corporate America's carbon emissions: $87 trillion.

European Commission — DG TAXUD. (2023, 17 Αυγ..). CBAM transitional phase reporting rules adopted.

European Commission — DG TAXUD. (n.d.). Carbon Border Adjustment Mechanism (CBAM).

Global Carbon Budget Team. (2024). Global Carbon Budget 2024. Earth System Science Data (preprint & data supplement).

Goodman, J., Hurwitz, M., Park, R. J., & Smith, J. (2018). Heat and learning. NBER Working Paper No. 24639.

IEA. (2025, July 15). Electricity Mid-Year Update 2025.

Our World in Data / Global Carbon Project. (2024). Consumption-based CO₂ emissions (data explorer).

SEI (Stockholm Environment Institute). (2024). EU consumption-based greenhouse-gas emissions: China's share and trends.

US BLS. (2025, March 21). Total factor productivity, 2024.

U.S. EIA. (2024–2025). CO₂ per kWh from US electricity generation (FAQ).

U.S. EIA. (2024, 30 Απρ.). How much energy is consumed in US buildings?

U.S. EPA. (2023–2024). Report on the Social Cost of Greenhouse Gases (SC-GHG) & supporting materials.

US EPA ENERGY STAR. (2024). K-12 schools: Energy facts and resources.

Comment