U.S. and China Head to the Negotiating Table — ‘Swiss Summit’ Could Shift Global Economy

Input

Modified

U.S. Treasury Secretary and Chinese Vice Premier Hold Talks From Tariffs to Supply Chains, a Signal of Comprehensive Dialogue China Chooses Practical Gains Behind Its Assertive Diplomacy

The United States and China are set to sit down again at the trade negotiation table. While both sides maintain the façade of only responding to the other’s request—reflecting a battle of pride—they are, in reality, engaged in a strategic struggle for economic advantage. Learning from its experience during the first Trump administration, China approaches the talks with a pragmatic, benefit-driven strategy rather than a confrontational stance. The U.S., for its part, also appears to recognize the need for negotiations amid rising inflationary pressure. This round of talks is expected to focus less on immediate results and more on long-term structural changes, such as global supply chain realignment and technological dominance, potentially serving as a compass that redirects the flow of the global economy.

Rebuilding Dialogue Amid Harsh Rhetoric

On the 6th (local time), the U.S. Department of the Treasury announced that Treasury Secretary Scott Bessent and U.S. Trade Representative (USTR) head Jamison Greer plan to visit Switzerland on the 8th to meet with Chinese representatives for trade negotiations. Secretary Bessent stated, “We aim to realign the international economic order to better serve U.S. interests, and we hope for productive dialogue.”

That same day, former U.S. President Donald Trump also commented on China-related negotiations. Posting on social media, he claimed, “We’re not trading with them at all right now, which is causing significant economic pain on their side. We're not incurring any trade deficits because of this.” He added, however, “They’ve asked for talks and meetings, and we will meet with them at an appropriate time.”

China’s Ministry of Commerce confirmed in a separate announcement that Vice Premier He Lifeng will visit Switzerland for talks with the U.S. When asked by local media about contact with the U.S., the ministry said, “High-level U.S. officials have recently indicated a willingness to adjust tariffs and have reached out through various channels. After considering global expectations, China’s national interest, and the needs of U.S. industries and consumers, we decided to engage.”

Shared Recognition of Negotiation Need, Ongoing Behind-the-Scenes Coordination

This meeting was a foreseeable step. Earlier this month, a spokesperson for China’s Ministry of Commerce remarked, “The U.S. has conveyed its desire for talks multiple times. We are currently evaluating this.” This contradicts claims from the Trump administration that China initiated the talks, suggesting instead that the U.S. is under more pressure to act.

China has set the mutual removal of tariffs as a precondition for discussions, implying that sincere gestures must precede meaningful dialogue. A ministry spokesperson stated, “Failing to correct unjust tariff measures only shows the U.S. lacks sincerity, and mutual trust will further deteriorate.” The spokesperson also warned, “Empty words and coercion disguised as negotiations won’t work.”

As inflation continues to weigh heavily on the U.S., trade issues—directly tied to consumer prices—can no longer be ignored. Nevertheless, the U.S. maintains that China is the party eager to resume dialogue. On May 1, U.S. Secretary of State Marco Rubio said in a local interview, “China is reaching out. They want to negotiate with us,” and added, “A meeting between the two countries will take place soon.”

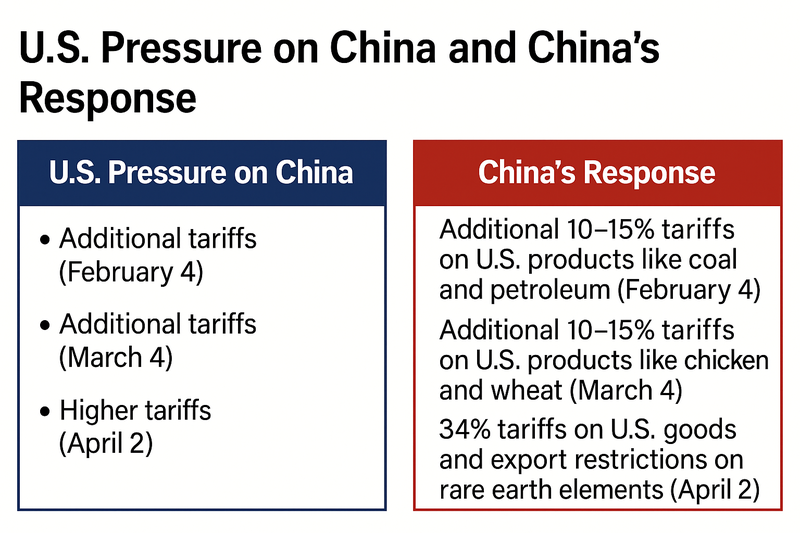

Previously, on April 9, the Trump administration announced a 145% tariff on Chinese imports. In response, China imposed a 125% tariff on U.S. goods and appeared disinterested in talks, maintaining a “hold-the-line” strategy. However, as the impact of the trade war becomes more evident, both sides now seem to recognize the necessity of dialogue. In the first quarter, U.S. GDP shrank by 0.3% year-on-year, while China’s Purchasing Managers’ Index (PMI) for April fell to 49.0—well below market expectations. A PMI below 50 is typically interpreted as a sign of economic contraction.

China Strengthens Readiness, Responds Quickly and Proactively

The U.S. and China had previously clashed over trade during the first Trump administration in 2018. At that time, the U.S. ignited tensions by imposing a 25% tariff on $34 billion worth of Chinese goods. China immediately retaliated with tariffs of equivalent scale on U.S. agricultural products, automobiles, and other goods. The conflict escalated further when the U.S. added another 10% tariff on $200 billion worth of Chinese imports.

In December of the same year, hopes of easing tensions emerged when Chinese President Xi Jinping and President Trump met during the G20 summit. However, negotiations broke down by May of the following year. The U.S. ramped up pressure by designating China a "currency manipulator," and China struck back by increasing tariffs on American products. Both nations suffered as a result, experiencing declines in consumption, exports, and investment confidence.

This backdrop explains why China is taking a different approach in the current negotiations. While outwardly warning that “coercion and extortion will not work,” it is simultaneously making it clear that it is open to dialogue if it serves its interests. Unlike in the past, when China would wait to react until after the U.S. took action, this time it has moved swiftly—reviewing U.S. statements and organizing its position almost immediately to push talks forward. The BBC commented that “China no longer remains passive in its response to the U.S., but is seeking to maintain strategic initiative.”

This shift in China’s stance stems in part from its reduced dependence on the U.S. According to the U.S. Trade Representative (USTR), last year’s total U.S.-China trade (imports and exports combined) amounted to $582.4 billion, a 12% decrease from $659.8 billion in 2018, when the trade conflict began. Notably, China’s export share to the U.S. fell from 20% in 2018 to 15% in 2023, and further down to 12% last year. This decline reflects China’s efforts to diversify its export markets, lending weight to the view that broad-based U.S. pressure on China may no longer be as effective as it once was.