"Bank of Japan Begins Tightening Amid a ‘Once-in-30-Years Opportunity’ — Signals Given, but Certainty Still Lacking"

Input

Changed

Governor Ueda expressed his intention to raise interest rates. A 1.0% rate is expected around year-end to early next year. Declining trust in the government bond market is a variable.

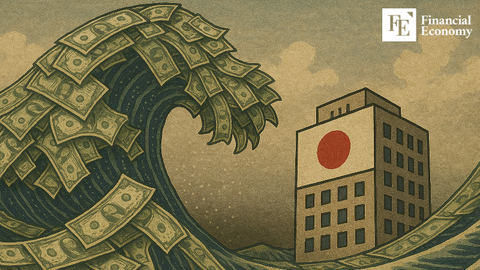

As the Governor of the Bank of Japan signals a potential interest rate hike, expectations of the first tightening cycle in 30 years are sweeping through the Japanese financial markets. Japan, which has long been trapped in deflation and low growth, is now attempting to normalize interest rates on the back of rising prices and currency changes. However, multiple variables—such as declining demand for long-term government bonds and tariff shocks originating from the U.S.—remain a burden. This cycle, where trust with the market will be crucial, is expected to test the policy competence of Japan’s financial authorities.

Rising Expectations for ‘Policy Normalization Conditions’

According to local media including the Nihon Keizai Shimbun (Nikkei) on May 28, Bank of Japan Governor Kazuo Ueda attended an event hosted in Tokyo where domestic and international economists and central bank officials gathered. There, he stated, “Consumer prices in Japan are once again rising due to increases in food prices such as rice,” adding, “We are closely watching how the underlying inflation rate will affect the overall economy.” He continued, “Assuming our economic growth and inflation forecasts are realized, we will adjust by raising the policy interest rate.”

Domestically, Governor Ueda’s remarks are being seen as a symbolic turning point. Japan’s prolonged stagnation and deflation since the 1990s have shackled the economy, and negative interest rates and quantitative easing have functioned as near-defeatist measures. However, with inflation recently reaching its highest level in 30 years, hopes are growing that Japan finally has the conditions necessary to begin policy normalization. In particular, interest rate normalization is considered a significant turning point not only for the capital and foreign exchange markets but also for encouraging the repatriation of Japanese capital that had previously flowed overseas.

Still, Governor Ueda remained cautious about the specific timing and magnitude of the rate hikes. He said, “We expect the underlying inflation rate to gradually converge to 2% toward the end of the forecast period,” but also noted, “Given the heightened uncertainty from U.S. tariff policies and other factors, we plan to proceed cautiously in judging policy and adjusting the level of monetary easing.”

Signals for Rate Hikes Continue Despite Recession Fears

The Bank of Japan ended its negative interest rate policy with a rate hike in March of last year, the first in 17 years, and raised rates again in July, marking a departure from its long-standing ultra-loose monetary policy. In January this year, it raised the rate to 0.5% and has maintained that level since. This gradual hike approach is based on a clear scenario. Financial markets and government officials in Japan are already sharing the expectation that “rates will rise to 1.0% by the end of this year or early next year,” and they are beginning to implement a scenario of small rate hikes every six months.

However, there are still uncertainties. Recent U.S. tariff policies are shaking the export outlook across Asia, and Japan, being highly export-dependent, is unlikely to avoid direct impacts. Sectors like automobiles, semiconductors, and machinery are showing signs of being affected by U.S.-led tariffs, which could lead to a slowdown in Japan’s growth. For the Bank of Japan to continue utilizing interest rate hikes as a policy tool, strong support from real economic indicators is essential.

In this context, the Bank of Japan’s recent decision to hold the benchmark rate steady while expressing confidence in achieving its inflation target is particularly noteworthy. The message it wants to send to the market is clear: “Unless growth slows significantly, we will maintain our tightening stance.” In Japan, this has been described as a policy that “seems realistic, but is actually quite ambitious,” with some expressing concern that the “policy clock is fixed firmly on normalization.” For this normalization-focused stance to continue, Japan will also need a favorable global trade environment.

Long-Term Bond Market Sends Warning Signs

Another variable is the poor performance of the long-term government bond market. A recent auction for 20-year government bonds recorded the lowest bid-to-cover ratio ever, essentially resulting in a “failed auction.” This highlights the growing distrust in long-term interest rates and suggests a widening gap between the central bank’s rate policies and what the market perceives. Normally, long-term rates would rise alongside policy rate hikes, but if demand falls and rates spike too sharply, this could undermine fiscal stability and market confidence.

Analysts say the decline in demand is largely due to major Japanese institutions—such as insurance companies and pension funds—adjusting their portfolios, thereby reducing demand for long-term bonds. This goes beyond supply and demand issues and signals a shift in risk appetite in Japan’s financial markets. If long-term bond demand does not support the Bank of Japan’s gradual hikes, long-term rates could rise faster than intended or become more volatile. This could, in turn, lead to a chain reaction: higher funding costs, greater public debt burdens, and reduced private investment.

This situation highlights the importance of effective communication with the market when adjusting interest rates. Governor Ueda’s insistence on avoiding premature conclusions reflects a deliberate approach—one that aims to implement policy at a pace the market can absorb, not merely respond to surface-level indicators. Japanese economists define the central bank’s cautious approach as “managing a psychological turning point.”