Paused U.S.-China Trade War Could Deal a 'Fatal Blow' to Chinese Industry if Resumed

Input

Changed

Natixis: "If the U.S.-China trade war reignites, 9 million jobs could disappear in China." Companies that have built supply chains in China are also expected to exit. There is also a risk of the U.S. strengthening sanctions on China in advanced technology sectors.

If the U.S.-China trade war resumes, analysts warn that China could bear significant losses. The longer the trade conflict between the two countries lasts, the greater the blow it will deal to China’s industries in areas like employment, investment, and technological advancement.

U.S.-China Trade Tensions Threaten Chinese Jobs

On May 27 (local time), The New York Times cited analysis from French investment bank Natixis, reporting that if U.S. tariffs remain at around 30%, China’s exports to the U.S. could fall by half, potentially resulting in the loss of up to 6 million manufacturing jobs in China. If tariff negotiations fully collapse and a full-scale trade war resumes, job losses could rise to as many as 9 million. Earlier this month, the U.S. and China held high-level talks in Geneva and agreed to temporarily reduce tariffs by 1.15 percentage points for 90 days.

These warnings come amid growing concerns about China’s already fragile job market under a second Trump administration. Alicia Garcia-Herrero, Chief Economist for Asia-Pacific at Natixis, said, “The situation has definitely worsened compared to Trump’s first term,” adding that job preservation in manufacturing has become more crucial as employment in other sectors declines. According to China’s National Bureau of Statistics, the urban youth unemployment rate for non-students aged 16–24 reached 15.8% as of last month. After youth unemployment reached a record 21.3% in June 2023, China ceased publishing this data and now reports a modified figure that excludes middle school, high school, and college students. Even currently employed workers face instability. Since the trade war began and tariffs increased, many firms have been laying off workers to reduce costs. A 33-year-old office worker named Hu in Shanghai told the NYT that she was laid off after China imposed a 125% tariff on U.S. construction equipment, blocking imports and causing her company’s revenue to drop by 40%.

Global Firms Accelerate ‘China Exit’

Prolonged trade tensions are expected to impact not only employment but the entire Chinese industrial landscape. Billionaire investor Bill Ackman, often dubbed the “Baby Buffett” on Wall Street, posted on X (formerly Twitter) last month that some believe China could outlast the U.S. in a trade war due to its long-term outlook. However, he warned that if tariffs persist, companies with supply chains in China are likely to relocate to India, Vietnam, Mexico, the U.S., or elsewhere.

Ackman emphasized that China must understand these dynamics and reach a trade agreement swiftly. Without assurances of steady, cost-effective supplies, he said, companies will leave China. He argued that the only reason both countries haven’t cut tariffs yet is fear of appearing weak, insisting that reducing tariffs is not a sign of weakness, and urging both sides to lower them to more reasonable levels, around 10–20%. Ackman concluded that if China continues to resist negotiations out of pride or emotional reasons, it could face far more serious and lasting economic damage. “Time is on America’s side, and an enemy to China,” he wrote.

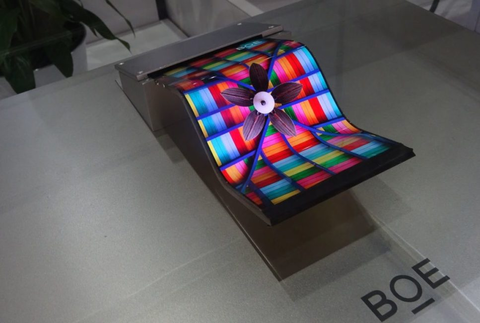

U.S. Blocks China’s Push for Tech Independence

Another concern is the U.S. potentially strengthening sanctions on China’s high-tech sector if the trade war continues. Since the trade dispute began, Washington has gradually increased its restrictions on Chinese tech firms. In March, the U.S. Commerce Department’s Bureau of Industry and Security (BIS) added over 50 Chinese entities related to quantum computing to its “Entity List.”

Being added to this list restricts companies from accessing U.S. technology and products, including advanced semiconductors. Among those newly listed were six subsidiaries of Inspur, China’s largest server manufacturer. Inspur was already sanctioned in August 2023, but this round added five subsidiaries in mainland China and one with an office in Taiwan. Also listed were two affiliates of Suma Electronics, which is associated with the Beijing Academy of Artificial Intelligence, backed by China’s Ministry of Science and Technology.

The Commerce Department stated these entities were listed because they engaged in activities contrary to U.S. national security and foreign policy interests. They were allegedly involved in the development of advanced AI, supercomputing, and high-performance semiconductors with military applications. The move also aims to further limit China’s access to exascale computing and quantum technologies, which are vital for processing massive volumes of data.