Trump Tax Plan Clears House After Senate: “Weak-Dollar Concerns Rise”

Input

Modified

Trump-led ‘One Big Beautiful Bill’ Passed Trump’s First-Term Tax Cuts Made Permanent, Medicaid Trimmed EVs and Solar Hit Hard, Fiscal Deficit Concerns Mount

The so-called “One Big Beautiful Bill Act” (OBBBA), encapsulating President Donald Trump’s second-term policy agenda, has cleared the final hurdle in the U.S. Congress. Having passed both chambers, the bill enshrines nearly all of Trump’s core pledges and is expected to be officially enacted following the president’s signature.

Tax Cuts and Spending Reductions Package Narrowly Passes House

On the 3rd (local time), the House of Representatives approved the Senate-revised version of OBBBA by a narrow vote of 218 in favor to 214 against. Two Republican representatives—Thomas Massie of Kentucky and Brian Fitzpatrick of Pennsylvania—joined all 212 Democrats in opposition. President Trump is scheduled to hold a signing ceremony at the White House at 5 p.m. on the 4th.

Passage through the House was far from smooth. Members of the House Freedom Caucus, representing fiscal conservatives within the GOP, voiced concerns over the bill’s significant increase to the national debt and the relatively modest cuts to Medicaid. Moderates, meanwhile, worried about the potential impact of Medicaid reductions on constituents. It took over 12 hours—from the night of the 1st into the early hours of the 2nd—for the House Rules Committee to craft the procedural “rule” needed to bring the bill to the floor, ultimately passing it narrowly by a 7–6 vote.

The floor vote on the rule was even more contentious. Known as the “rule vote,” it began late on the 2nd and saw all Democrats opposed, while five Republicans voted no and eight abstained. It wasn’t until 3:30 a.m. that the rule passed 219 to 213, following six hours of voting during which President Trump and House Speaker Mike Johnson lobbied dissenters. Debate ensued, further delayed by House Democratic Leader Hakeem Jeffries’ opposition speech. Speaking for 8 hours and 45 minutes, Jeffries broke the previous record of 8 hours and 32 minutes set in 2022 by former Republican Leader Kevin McCarthy.

Musk: Trump Tax Cuts Are Political Suicide

OBBBA centers on large-scale tax cuts, offset by reductions in welfare spending and increases in defense and immigration enforcement budgets. A key provision permanently extends the tax cuts implemented by Trump in 2017. The bill also introduces new tax deductions for tips and overtime pay, offering significant tax benefits to corporations and high-income earners. Meanwhile, programs for low-income Americans—including Medicaid and food assistance—face cuts totaling USD 930 billion. Numerous green energy incentives introduced under former President Joe Biden will also be repealed.

Support for renewable energy is set to be scaled back. While some of the most hardline provisions were omitted from the final version, the Trump administration has signaled its intention to further withdraw from renewable energy subsidies. The EV tax credit will expire on September 30. Additionally, the bill includes a USD 5 trillion increase to the national debt ceiling, raising projections that total U.S. debt could exceed USD 40 trillion. Market analysts warn this could lead to USD 4 trillion in additional debt over the next decade.

Tesla CEO Elon Musk publicly condemned the legislation as a “massive cost bomb,” clashing openly with President Trump. On his X (formerly Twitter) account, Musk wrote, “It will destroy millions of jobs in the U.S. and inflict enormous strategic damage on our nation. It’s utterly insane and destructive—a political suicide mission.”

Musk not only lashed out at those who supported the bill but also raised the prospect of launching a new political party. “Any member of Congress who campaigns on cutting government spending and then votes for the largest deficit increase in history should hang their head in shame,” he said, taking direct aim at the ruling GOP. He added, “If this deranged tax bill passes, the ‘America Party’ will be launched the very next day.”

Dollar in Worst Shape in 50 Years

Economists have voiced escalating concerns about a weakening dollar. The U.S. dollar saw its largest first-half decline in five decades. According to Bloomberg, the dollar index—which measures the greenback against six major currencies—closed at 96.89 on June 30, down more than 10.7% from the final trading day of the previous year (108.49). This marks the steepest first-half drop since 1973, when the U.S. ended the Bretton Woods system linking the dollar to gold, and the index fell 14.8%. The Wall Street Journal stated, “The dollar has had its worst start to a year since 1973.”

Before Trump’s inauguration, expectations were high that a trade war would drive investment into the U.S., strengthening the dollar. However, after assuming office, Trump’s inconsistent tariffs and massive tax cuts began eroding confidence in the U.S. dollar as the world’s most trusted safe-haven asset.

With the passage of a large-scale tax plan expected to generate substantial deficits over the next decade, the dollar’s weakness is only accelerating. As the U.S. debt burden grows, trust in the dollar declines. On the 3rd, Taiwan’s foreign exchange market saw a surge in demand for the Taiwan dollar, with its value rising 2.5% intraday as investors offloaded U.S. dollars. Francesco Pesole, FX strategist at ING, told the Financial Times, “The dollar has become a casualty of Trump’s erratic second-term policies.”

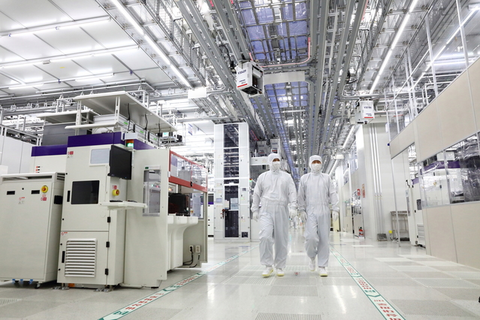

- Previous Tibet, which has emerged as a power supply site for China's AI computing center, installs the world's largest hydroelectric turbine

- Next "Despite Plunge in Exports to the U.S., Shipments to ASEAN on the Rise" — Surge in Chinese Rerouted Exports via Southeast Asia to Evade Trump’s High Tariffs