Stablecoins Enter Regulatory Framework, U.S. Financial Market Power Struggle Intensifies

Input

Modified

Battle for Sovereignty in Treasury Yields and Currency Circulation Dollar-Backed Banking Ambitions Emerge "Trust vs. Innovation"—Profitability Under Scrutiny

With the Trump administration enacting legislation that provides a regulatory path for stablecoins, dollar-backed coin issuance has now entered the legal mainstream. Crypto firms such as Ripple and Circle are moving aggressively toward banking operations. In response, traditional financial institutions are pushing back against these firms’ treasury-based revenue structures while exploring stablecoin issuance of their own to defend market leadership. Although concerns over the profitability and trustworthiness of crypto-based models persist, the growing confrontation is beginning to signal a potential overhaul of the U.S. financial system.

Rising Influence as “Alternative Dollar” Triggers Bank Alarm

According to crypto-focused media outlet CoinGape on July 20 (local time), the American Bankers Association (ABA) and Independent Community Bankers of America (ICBA) recently sent a joint letter to the Office of the Comptroller of the Currency (OCC), requesting that bank license approvals for crypto companies like Ripple and Circle be postponed. The associations argue that these firms lack transparency and fail to provide consumers with sufficient information to assess their business models and associated risks.

The Trump administration’s official endorsement of stablecoin integration has been seen as a major turning point in the financial sector. The newly passed legislation allows the issuance of coins backed by dollar-denominated assets and enables these coins to generate returns through the purchase of U.S. Treasury securities. This effectively authorizes crypto firms to engage in "dollar-based asset management," a role traditionally reserved for banks, particularly with regard to bond investments and income generation.

Following the bill's passage, expectations have grown that crypto companies will rapidly advance into banking services. If crypto-backed assets are converted into U.S. Treasuries and begin yielding stable returns, the issuers will effectively function as quasi-financial institutions deriving revenue from sovereign debt. This marks a shift in the role of stablecoins from simple payment tools to fully fledged asset management instruments.

Use cases for stablecoins are also expanding at a rapid pace. In regions such as Latin America and other emerging markets—where confidence in local currencies is weak—stablecoins are increasingly functioning as "digital dollars." Due to limited access to USD and underdeveloped financial infrastructure, stablecoins, with their low fees and real-time transfer capabilities, are gaining traction as tools for everyday commerce and remittances. This development positions crypto issuers as emerging players in global liquidity management, thereby intensifying competitive pressure on traditional banks.

Ultimately, the banking sector’s resistance can be interpreted not merely as a fight over market share but as a broader contest for systemic control. The model of replacing dollar circulation through stablecoins and earning interest on U.S. Treasuries directly undermines the revenue foundation of the existing banking system. As the Trump administration signals a long-term pivot toward a stablecoin-centric financial architecture, observers see a full-scale showdown between banks and crypto firms as inevitable.

Major Banks Signal Their Own Coin Issuance

In what appears to be a move to accelerate this confrontation, Ripple has applied to the OCC for a national banking charter—aiming to operate under the same regulatory regime as traditional banks. Ripple Labs CEO Brad Garlinghouse announced via social media on July 3, “Ripple has submitted an application for a national bank charter with the OCC,” adding that this step would serve as a “unique benchmark” for the broader market.

Should Ripple secure the national banking license, it would be subject to federal regulatory oversight—a significant elevation from state-based licensing structures previously used for stablecoin operations. Ripple had already launched its RippleUSD (RLUSD) stablecoin in December of last year, signaling its commitment to a regulation-centered strategy. Circle is also pursuing a banking license, laying the groundwork to offer services akin to those of traditional banks, including anti-money laundering protocols and deposit insurance.

Meanwhile, several major U.S. banks are beginning to develop their own stablecoin initiatives. Jamie Dimon, CEO of JPMorgan Chase—one of the largest banks in the country—recently stated in an interview, “We are involved in both JPMorgan deposit coins and stablecoins.” The bank is reportedly piloting an internal deposit-token dubbed “JPMD,” with plans for external deployment in the future. Additionally, JPMorgan is said to be considering a collaborative stablecoin project alongside Bank of America, Citigroup, and Wells Fargo.

Some banks are also exploring connections with central bank digital currencies (CBDCs), using internally issued coins as testbeds. Leveraging their established infrastructure and regulatory expertise, these institutions aim to quickly build trust within the stablecoin market. This shift indicates that banks are moving beyond viewing stablecoins solely as risk factors and are now positioning them as potential revenue generators and payment solutions.

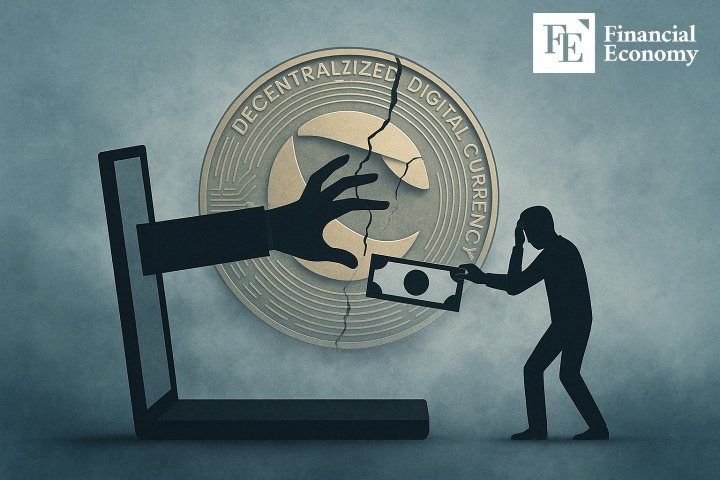

Sustainability in Question—Echoes of Luna’s Collapse

However, questions remain regarding the long-term viability and profitability of stablecoins. By design, stablecoins must maintain a fixed value, limiting volatility and making it difficult to generate revenue organically. While Treasury yields offer a potential income source, returns remain constrained by issuance volume and prevailing interest rates. As such, it remains uncertain whether coin issuers can create stable, long-term profit streams comparable to those of traditional banks.

Trust issues also persist. For stablecoins to function as currencies, both technical stability and public confidence are essential. Yet, major collapses like the Luna incident continue to cast a long shadow over the market. Luna’s algorithmic stablecoin TerraUSD (UST) was designed to maintain a $1 peg by automatically minting and burning its native coin, Luna, without any underlying collateral.

In May 2022, Terra’s peg failed, triggering an exponential minting of Luna tokens. The result was a catastrophic price collapse, erasing nearly $50 billion in combined market value in just a few days. Countless investors suffered massive losses, and the event led to a widespread erosion of trust in the stablecoin system as a whole. The incident underscores the argument that technical innovation alone cannot replace the social role of banks.