Shadow of China’s Regional Economic Downturn: Wage Arrears Rise, Sparking Protests Across the Country

Input

Changed

Wage Arrear Protests Spread Across China Over 60 Incidents in 21 Regions, Including Factory Arson Expanding Across All Fronts—from Construction Sites to Schools and Hospitals

In recent months, China has been gripped by a wave of labor unrest, revealing a simmering economic crisis far deeper than numbers alone suggest. As the country’s once-booming real estate sector collapses and domestic consumption stalls, unpaid wages have emerged as a flashpoint for widespread frustration. Factories, construction sites, hospitals, and schools—once bastions of stable employment—have become grounds for protest, desperation, and in some cases, destruction. Workers from all walks of life, from blue-collar migrants to white-collar professionals, increasingly find themselves left behind in an economy under stress. And as protests spread from inland provinces to major cities, the underlying cause points to a more troubling reality: the structural weaknesses in China’s regional economies, long hidden beneath layers of local government debt and unsustainable growth models.

Desperation on Display: From Factory Fires to Sit-Ins

The unrest gained widespread attention when a 27-year-old textile worker named Yuan in Pingshan County, Sichuan Province, resorted to arson after not receiving his roughly USD 110 monthly salary. On May 20, Yuan allegedly confronted his employer in a heated dispute over unpaid wages before setting fire to the factory. The blaze lasted 37 hours, causing damage to tens of millions of yuan. He was arrested at the scene.

While Yuan’s act was extreme, public sentiment was not unsympathetic. On Chinese social media platforms, many netizens expressed sorrow rather than condemnation, calling him “800 형 (Comrade 800)” and framing his act as a tragic expression of voiceless desperation. According to online commenters, Yuan urgently needed the money to care for his ailing mother. His story struck a national nerve, leading to widespread calls for reforms to ensure that similar "800-yuan tragedies" never happen again.

Yuan’s case is not isolated. On May 19, workers at a Yangxin Expressway construction site in Hubei Province—operated by China Railway Seventh Group—posted a video demanding overdue wages. Just days earlier in Nanning, Guangxi Province, 32 construction workers began staging a sit-in outside the Guangxi Power Transmission and Transformation Construction Company, protesting wage delays that left them without pay for months.

Data compiled by Radio Free Asia (RFA) reveals a broader pattern: from April 1 to May 21, over 60 wage-related protests and strikes erupted across 21 Chinese provinces and even at Chinese-run sites in Indonesia. Tens of thousands of workers from key sectors—automotive, apparel, electronics, construction, education, and healthcare—joined the growing movement. Most reported receiving only partial payments, delayed basic wages, or the total loss of bonuses and benefits. As stories spread, so did anger and resolve.

A Crisis That Crosses Class and Industry

Traditionally, wage arrears were a plight endured by China’s rural migrant workers, who traveled to urban centers seeking better pay. But today’s wage crisis is far-reaching and includes a broader swath of the workforce—teachers, nurses, and service employees are now among the hardest hit.

In Shenzhen, a bustling tech hub in Guangdong Province, employees of a home appliance service company occupied their workplace for nine hours, demanding overdue salaries. In Zaozhuang, a city in Shandong Province, contract teachers revealed they had not received wages for six months, despite continuing to work. In Gansu Province, a nurse at a state-run hospital lamented that her monthly salary was around USD 180, and she had not received her performance bonus for four months.

These cases highlight a profound shift in the composition of China’s economic victims. Not only are construction laborers and factory workers affected, but also professionals in public service roles—those once presumed to have job security. Their discontent reveals the extent to which fiscal strain has bled into essential sectors like healthcare and education.

Moreover, many public institutions and private employers claim they are unable to meet payroll due to cash flow problems rooted in local economic downturns. Delayed payments are not merely accounting issues—they are signs of systemic failure. Workers dependent on these wages for daily survival are now pushed to the edge, triggering unrest and, in extreme cases, acts of desperation and destruction.

Debt-Driven Development Reaches a Breaking Point

Beneath the growing unrest lies a more structural and deeply rooted problem: China’s local governments, once champions of aggressive economic expansion, are now drowning in debt. The dual pressures of a prolonged real estate slump and rising geopolitical tensions have left these local entities cash-strapped, unable to sustain payrolls, fund investments, or deliver social services.

For years, local governments acted as engines of national growth, channeling vast sums into infrastructure and urban development. But this model relied heavily on borrowing through entities known as Local Government Financing Vehicles (LGFVs)—special-purpose platforms that allowed regional governments to fund projects without showing debt on official books. These "shadow debts" grew quietly and quickly, especially as many investments, such as expressways and bridges in remote provinces like Guizhou, proved to be low-return ventures.

Now, the chickens are coming home to roost. The prolonged property market crash that began in late 2021 has choked off a critical source of local revenue—land sales—while also deepening the debt burden of LGFVs. Many localities are caught in a fiscal death spiral, where mounting interest payments consume shrinking revenues, leaving little for operational costs like wages.

A retired staff member from Guizhou University in Guiyang remarked, “High local government debt combined with central government austerity measures has severely impacted regional fiscal operations. The most direct victims are frontline and contract workers.” His statement reflects a growing consensus among economists: that China's growth model, built on debt-fueled regional expansion, is unraveling.

According to the Chinese Ministry of Finance, as of September 2024, official local government debt stood at USD 6.2 trillion. However, this figure excludes the enormous off-the-books liabilities incurred through LGFVs. The International Monetary Fund (IMF) estimates that LGFV debt alone reached about USD 8.3 trillion by the end of 2023, nearly half of China’s GDP.

In response, Beijing announced a massive, approximately USD 1.4 trillion bailout plan to be disbursed over five years in hopes of stabilizing local finances. But analysts remain skeptical. Without structural reform, such bailouts may merely delay the reckoning rather than resolve it.

Similar Post

Currency Hegemony War Unfolds on the Hong Kong Stage: The Yuan’s ‘Quiet Counterattack’

Input

Changed

China Expands International Settlements and Opens Capital Markets U.S.–China Conflict Expands into the Financial Front China’s Payment Network Expands via Hong Kong Base

In the arena of global finance, dominance is rarely declared with fanfare—it is often accumulated quietly, persistently, and strategically. As the established monetary order built around the U.S. dollar, euro, and Japanese yen begins to reveal its fractures, a new challenger is emerging not with confrontation, but with quiet confidence. The Chinese yuan, long seen as constrained by Beijing’s capital controls and limited convertibility, is now gaining momentum as a viable alternative in the global financial system. And at the epicenter of this subtle transformation is Hong Kong—a former British colony turned financial gateway—where China is staging what some describe as a “silent counteroffensive” in the unfolding war for currency hegemony.

Yuan Use Rises Amid Dollar Fatigue

The shift is not yet revolutionary, but it is unmistakably underway. According to the South China Morning Post, there is a growing international interest in the Chinese yuan, especially from companies in regions like the Middle East. Mary Huen, Chairwoman of the Hong Kong Association of Banks, noted a marked increase in inquiries from overseas firms—Qatar among them—about utilizing the yuan for transactions. She explained that Hong Kong is now well-positioned to offer a full suite of yuan-denominated services: payments, hedging mechanisms, and currency swaps, effectively functioning as a major offshore yuan liquidity pool.

Statistical evidence supports this sentiment. Data from the Society for Worldwide Interbank Financial Telecommunication (SWIFT) shows that the yuan accounted for over 7% of global payment volumes last year—a new record. Although the U.S. dollar continues to dominate with over 80% of transactions, and the euro and yen are seeing declining usage, the yuan stands out as the only major currency with a consistently upward trajectory.

This momentum is largely driven by a convergence of economic trends that have created openings for the yuan. The U.S. has pursued aggressive monetary tightening to combat inflation, weakening market confidence in dollar liquidity. Europe’s economic growth remains sluggish, and Japan persists with its ultra-low interest rate regime, further diminishing faith in traditional safe-haven currencies. In contrast, China has sustained relatively stable monetary policy and developed a robust financial infrastructure, making the yuan more attractive by comparison.

Beijing is capitalizing on this environment with a coordinated push for yuan internationalization. It is pursuing cross-border payment reforms, expanding capital market access, and promoting the use of yuan-denominated financial instruments. These efforts are not merely symbolic—they are functional strategies aimed at embedding the yuan deeper into the global financial fabric.

A particularly illustrative example is the Hong Kong listing of CATL, China’s largest battery manufacturer. This initial public offering (IPO) was not just a financial transaction; it was a geopolitical signal. It demonstrated that major Chinese corporations could tap into global capital markets using the yuan, all while operating outside the more tightly controlled financial system of the Chinese mainland. This model—raising funds through a semi-autonomous territory like Hong Kong—simultaneously enables foreign exchange flexibility and encourages wider yuan adoption.

U.S.–China Conflict Enters the Financial Arena

Amid this financial realignment, geopolitical undercurrents continue to intensify. The once-industrial trade war between the U.S. and China is increasingly expanding into the realm of monetary systems and capital markets. After years of tit-for-tat clashes in sectors like semiconductors, artificial intelligence, and telecommunications, both nations are now maneuvering to shape the future of global finance. The stakes are high. For the U.S., the challenge is to defend the primacy of the dollar; for China, it is to carve out space for the yuan as a legitimate rival.

To that end, China has been building strategic resilience. It has opened access to its previously insular bond market, removed longstanding quotas that restricted foreign investment, and reinforced its yuan-based transaction infrastructure. The goal is twofold: attract international capital while reducing dependency on dollar-based mechanisms. Simultaneously, Beijing is testing digital finance tools—most notably the Digital Yuan—as both a domestic modernization initiative and a potential disruptor to U.S.-led financial frameworks like SWIFT.

These moves are about more than economic pragmatism; they reflect a vision of long-term monetary autonomy. By establishing alternative financial pathways and clearing systems, China hopes to insulate itself from U.S. sanctions, such as those previously deployed against Iran and Russia. The yuan’s rise, then, is also a geopolitical insurance policy.

The U.S. has not remained idle. American investors are increasingly reducing their exposure to mainland Chinese assets and even those listed in Hong Kong. The Biden and Trump administrations alike have restricted investment in Chinese technology firms, citing national security concerns. Washington's intensified scrutiny signals an acknowledgement that the financial front is the next battleground—and a recognition that China's monetary ambitions are not to be underestimated.

According to market watchers, the era of financial decoupling is no longer hypothetical. It is happening. What began as a trade and industrial rift has metastasized into a financial disengagement with global implications. As capital flows become weaponized, currencies themselves are becoming instruments of influence and power projection.

“The Full-Scale Clash Will Be in Hong Kong”: China’s Buffer Strategy

Against this tense backdrop, China’s choice of Hong Kong as the beachhead for yuan internationalization appears all the more calculated. While Shanghai is the de facto financial capital of China, its association with stringent state controls has deterred many foreign institutions. Hong Kong, in contrast, offers a unique hybrid identity: Chinese sovereignty paired with British-era legal frameworks and a cosmopolitan business culture. For Beijing, this makes it the perfect “buffer zone”—a place where internationalization can proceed without the direct exposure of the mainland.

The strategy is already being implemented on multiple fronts. China has expanded the Cross-Border Interbank Payment System (CIPS) from Hong Kong, broadened the network of yuan clearing banks, and increased the issuance of yuan-denominated bonds. Major firms like Tencent Music have followed CATL’s lead in raising capital in Hong Kong, reinforcing its role as a conduit for offshore yuan liquidity and capital access.

This method allows China to hedge its ambitions. It facilitates the growth of a yuan-centered financial ecosystem while shielding the mainland from potential retaliation or capital shocks. The model also builds credibility for the yuan as a currency that can function internationally, backed by a semi-autonomous city with established rule-of-law principles and global market integration.

Still, experts caution that the yuan is far from dethroning the dollar. According to Nikkei, the yuan still constitutes only about 3% of global foreign exchange reserves. The international circulation of yuan-denominated bonds remains limited, and financial trust in the yuan continues to be shadowed by perceptions of political risk and convertibility concerns.

Yet, what sets China’s strategy apart is its patience. Analysts describe Beijing’s approach as one of “quiet infiltration,” a methodical campaign that could take decades. Just as the U.S. dollar gradually overtook the British pound in the 20th century, the yuan’s advance may also be generational—but no less real. For now, it may be a “niche currency.” But in the slow churn of history, niche today could mean dominant tomorrow.

Similar Post

Is the Unwinding of the Yen Carry Trade Coming? Soaring Japanese Government Bond Yields Stir Global Market Fears

Input

Changed

Japanese Long-Term Bond Yields Hit Record Highs Across the Board Bank of Japan and Others Reluctant to Buy Bonds Yen Carry Trade Losing Its Appeal

The Japanese financial markets are trembling under the weight of soaring government bond yields, a faltering currency, and eroding investor confidence. At the heart of the unfolding crisis is a decades-old strategy that has quietly underpinned global capital flows—the yen carry trade. Long a cornerstone of international investment, this tactic has relied on Japan’s ultra-low interest rates, allowing investors to borrow cheaply in yen and chase higher returns abroad. But the tide may now be turning.

A growing storm of inflationary pressures, rising debt concerns, and shifts in central bank policy are converging to challenge the fundamentals that once made Japan's bonds and currency symbols of stability. If Japanese government bond (JGB) yields continue their relentless ascent, a full-scale unwinding of yen carry trades could be triggered—one with potentially devastating ripple effects across both the bond and foreign exchange markets.

Japanese Bonds on Shaky Ground

The Japanese bond market is facing a historic test. Yields on long-dated government bonds have spiked dramatically in recent days. As of May 20, the 30-year JGB yield surged to 3.14%, marking its highest level since the instrument was first introduced in 1999. On the same day, the 40-year bond yield climbed to a record-breaking 3.61%, while 20-year bonds jumped by 15 basis points to hit their highest level in 25 years.

The catalyst for this surge was the remarkably poor demand at a 20-year bond auction. The bid-to-cover ratio—a measure of investor appetite—plummeted to 2.5x, the lowest in 13 years. Even more telling was the spread between the average and lowest accepted bid price, which widened to 1.14 yen—an unprecedented gap since 1987. These indicators suggest that once-coveted JGBs are now being coldly avoided, even by domestic institutional players.

The roots of this aversion are complex. For decades, Japan struggled with deflation, but since 2021, consumer prices have climbed steadily. In April 2025, Japan recorded a 3.6% year-on-year increase in its consumer price index—the highest among major economies. This signals not just the end of deflation, but the emergence of a persistent inflationary phase. As inflation expectations climb, bond prices fall and yields rise.

Other concerns compound the pressure. Japan’s staggering national debt—already among the highest in the developed world—is becoming more burdensome. In a politically charged atmosphere, pre-election pledges of tax cuts are raising eyebrows over fiscal responsibility. Meanwhile, the rise in U.S. Treasury yields is drawing capital away from Japanese markets, worsening the outflow.

The Bank of Japan (BOJ), once the market’s most dependable buyer, has scaled back its purchases through a policy of tapering. Since August 2024, the central bank has reduced its quarterly JGB purchases by about USD 2.6 billion. This pullback leaves a vacuum in the bond market—one that private-sector institutions are unwilling to fill. Major domestic investors like life insurance firms are scaling back their bond exposure amid growing volatility driven by the Trump administration’s unpredictable economic policies and a resurgent global tariff war.

As Bloomberg bluntly summarized, Japan’s super-long-term bonds are now facing a de facto “buyer boycott”—an alarming turn of events for a market that has long served as a global financial anchor.

The Fragile Foundations of the Yen Carry Trade

Nowhere is the potential fallout more worrying than in the world of currency speculation. The yen carry trade—valued by Deutsche Bank at USD 20 trillion globally as of 2024—represents an enormous and delicate balancing act. Investors borrow in yen, benefiting from low interest rates, and invest the proceeds in higher-yielding assets abroad. But as Japanese yields rise, this delicate mechanism becomes unprofitable—and dangerous.

The size of this trade is staggering. It amounts to 505% of Japan’s GDP, meaning any mass liquidation would reverberate far beyond Tokyo’s trading desks. Rising JGB yields erode the very foundation of the carry trade. As the interest rate gap between Japan and the U.S. narrows, and the cost of hedging currency exposure climbs, the return on such trades shrinks. If profits vanish, investors will rush to unwind positions, potentially triggering a massive selloff of foreign assets and a spike in global market volatility.

Adding urgency to the situation are shifting BOJ policies. In March 2024, the central bank ended its long-held negative interest rate policy, and by January 2025, raised its benchmark rate to 0.5%—the highest in 17 years. With inflation still running hot, markets anticipate another hike in June or July. Every increase in domestic rates raises the cost of borrowing yen, putting further strain on carry trade margins.

Then there’s the global currency dynamic. The U.S. dollar has weakened significantly, with the Dollar Index falling to 99.05 as of May 23. This decline has been fueled by a toxic mix of policy uncertainty from the Trump administration, spiraling U.S. fiscal deficits, and a downgrade of America’s credit rating by Moody’s. A weaker dollar naturally strengthens the yen, further reducing the profitability of yen-funded investments in dollar assets.

In this environment, the yen is no longer the rock-solid funding currency it once was. JP Morgan recently issued guidance advising clients to exit “long yen, short Swiss franc” positions, citing increasing risk. The Nihon Keizai Shimbun also reported that speculative capital is shifting toward the Swiss franc, a signal that confidence in the yen is wavering. A mass pivot from yen to Swiss franc by global investors would be a powerful sign of deteriorating trust in Japan’s financial stability.

A Looming Market Reckoning

The question now is not whether the yen carry trade is under threat—but how far the damage will go if it collapses. As Japanese yields rise and the yen strengthens, the conditions that once made the carry trade viable are quickly evaporating. A cascade of liquidations could unleash financial volatility far beyond Japan’s shores, destabilizing equity markets, currencies, and debt instruments globally.

Japan's JGB market, once seen as a model of predictability, is revealing its fragility. The fear now gripping global markets is not unfounded. With USD 20 trillion in speculative capital hanging in the balance, even modest shifts in monetary policy, currency valuation, or inflation outlook could set off a chain reaction. The carry trade, long taken for granted as a reliable arbitrage engine, now stands at the edge of a global reckoning—one that could reshape the future of international finance.

Similar Post

As Arctic Route Opens, Power Struggle Intensifies — U.S.-Russia Tensions Rise, Urgent Need for Korea to Formulate Strategy

Input

Changed

The Arctic rapidly emerges as the shortest route between Europe and Northeast Asia Greenland’s importance rises as a strategic key point Urgent need for Northeast Asia to restructure global logistics strategy

As Arctic sea ice melts faster due to climate change, the Northern Sea Route bypassing the Suez Canal is emerging as a major global maritime logistics route. Accordingly, the U.S. and NATO are increasing military and diplomatic attention to counter Russia’s monopoly over the Arctic shipping lanes and strategic points like Greenland. East Asian countries, including South Korea and Japan, also urgently need to restructure their logistics strategies based on the potential use of the Arctic route.

Russia reacts sensitively to Western Arctic forward base developments

According to foreign media such as CNBC on the 25th (local time), Russia is responding sensitively as the U.S. and NATO emphasize the Arctic's importance for geopolitical and security reasons. Russia consistently asserts sovereignty over the Arctic, noting that it controls about 53% of the Arctic coastline and that approximately 2.5 million Russians reside in the region.

The growing tension around the Arctic stems from climate change. As Arctic ice rapidly melts, the once-imagined ‘Arctic route’ is becoming a reality. Experts expect that by 2030, parts of the Arctic will be navigable for more than eight months a year without icebreaker support. This route, running along Russia’s northern coast connecting Europe and East Asia in a straight line, will allow Asian countries like Korea and Japan to reach major European nations such as the Netherlands and the Baltic states directly—bypassing the Suez Canal.

This change signals a shift in global dominance beyond just opening new sea lanes. The strategic significance of traditional maritime hubs like the Suez Canal and the Strait of Malacca diminishes as Arctic countries rise in influence. Russia is particularly intent on leveraging the Arctic route along its northern coast as a second energy export channel and a maritime power base. Controlling this route means layered benefits across energy, minerals, and cargo transportation.

Meanwhile, the U.S. and NATO are increasingly strengthening maritime and aerial surveillance to check Russia’s Arctic route monopoly. This has military implications: the Arctic overlaps with sensitive missile defense systems and nuclear submarine transit paths, making it a strategic forward area. In March, NATO conducted extreme-environment combat readiness exercises in Norwegian waters involving 10,000 troops from nine countries.

Russia promptly showed vigilance. President Vladimir Putin described NATO’s exercises as “moves to enhance extreme environment operational capabilities and cooperation” and accused NATO countries of treating the Arctic as a potential conflict zone. Russia responded with its own Arctic exercises involving 20 Northern Fleet ships and around 1,500 personnel, reflecting the redefinition of the Arctic as a “strategic asset” beyond an icy sea.

U.S. shows ownership ambitions toward Greenland

Among regions gaining importance with the opening of the Arctic route, Greenland stands out. As an autonomous Danish territory near the North Pole and a gateway between the Atlantic Ocean and the Arctic Ocean, Greenland is expected to serve as a critical hub for vessels and military assets using the Arctic route.

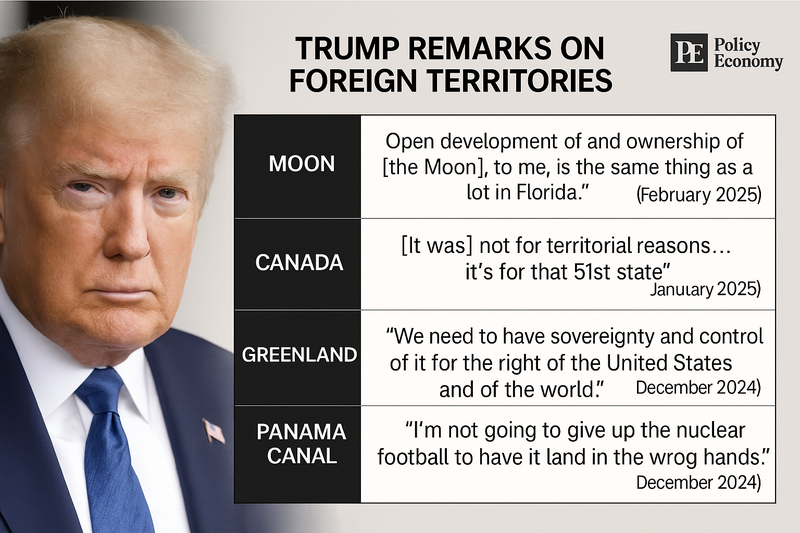

The U.S. government, especially under former President Donald Trump, has focused on Greenland in its Arctic strategy. Since Arctic airspace is the shortest path for missiles targeting North America, Greenland is considered optimal for monitoring and countering Russia and China. Trump stated after winning the 2020 election that “the U.S. should own and control Greenland for security and global freedom” and later emphasized willingness to consider “military options” regarding Greenland. This suggests potential expansion of the existing Thule Air Base on Greenland.

This U.S. stance is perceived as a serious security threat by Russia. Since the Ukraine invasion, Russia has been sensitive to Western territorial expansions and strongly opposes Western military activity growth in the Arctic, including Greenland. The tense Arctic standoff could influence broader European and North American diplomatic landscapes, raising Greenland’s importance as a frontline security zone.

“Northeast Asia without an Arctic strategy risks falling behind in global logistics,” experts warn

With the Arctic route’s opening becoming a reality, East Asian countries face a critical moment to rethink logistics and industrial strategies. South Korea currently relies heavily on the transshipment logistics system centered around Busan Port within the global shipping network. If the Arctic route becomes fully operational, the main axis between Asia and Europe may shift from the Suez Canal to Russia’s northern sea, relatively weakening Busan’s strategic position.

A complicating factor is the unavoidable political and diplomatic burden on South Korea, Japan, and other U.S. security allies when using a route that requires cooperation with Russia. Experts agree on the urgent need for a “Korean-style Arctic maritime strategy.” Although the Arctic route offers unavoidable advantages in route diversification and logistics efficiency, there is criticism that Korea lacks the institutional, technological, and diplomatic foundations to systematically adopt it.

Joo Eun-jung, a research fellow at the National Security Strategy Institute, said in a report last month titled “The Arctic as a Pivot of Hegemonic Competition: The Arctic Strategy of the Second Trump Administration,” that “Domestic shipping companies face challenges such as designing ships optimized for the Arctic route, ensuring operational safety, and securing insurance and weather data systems.” She urged, “The current rise in Arctic geopolitical importance should be seized as an opportunity to promptly develop a comprehensive national ‘Arctic strategy’ plan.”

Similar Post

Samsung Biologics Surpasses USD 2.19 billion Won in Contract Manufacturing Orders, Marking Korea’s Leap as a Global Bioproduction Hub

Input

Changed

Contract Manufacturing Division Restructured as Independent Operation CDMO Market Growing at Double-Digit Rates Annually Industry Focus Shifting from ‘R&D → Production and Supply’

Samsung Biologics has surpassed approximately USD 2.3 billion in contract manufacturing (CMO) orders this year through deals with European and Asian pharmaceutical companies. This milestone marks the beginning of a full-scale expansion for Korea’s bio contract development and manufacturing (CDMO) industry. Many Korean companies are rapidly narrowing the technology gap with global competitors, and the government is accelerating infrastructure support and legislative efforts. Amid concerns that regulatory frameworks lag behind industrial growth, attention is turning to Korea’s long-term strategy for establishing itself as a “global bioproduction hub.”

Establishing a Profit Base for Future Investment

According to a disclosure on May 26, Samsung Biologics signed two new CMO contracts on May 23 with pharmaceutical companies in Europe and Asia, totaling USD 319.57 million. The European deal is worth USD 175.55 million and runs through 2030, while the Asian contract is worth USD 144.03 million and extends to the end of 2033. Due to confidentiality agreements, the names of the clients and products were not disclosed.

As a result, Samsung Biologics’ cumulative order volume since its founding has now surpassed USD 18.2 billion. Since its first contract of the year in January, the company has secured new orders from the U.S., Asia, and Europe, reaching 3.2525 trillion won in just five months—already over 60% of its total annual orders from last year (5.4035 trillion won).

This success reflects Samsung’s restructuring of its bio business into two main arms: pharmaceutical CDMO and the development of new drugs and biosimilars. On May 22, Samsung Biologics announced it would spin off a division responsible for subsidiary management and new investments into a new holding company, Samsung Epis Holdings. This will leave Samsung Biologics as a pure-play CDMO, while the new entity focuses on drug development.

This restructuring is aimed at resolving potential conflicts of interest raised by global pharmaceutical clients and enabling a more focused investment in the high-growth field of new drug development through Samsung Bioepis. Samsung Biologics CEO John Rim explained, “We decided on this split to proactively respond to rapid global changes and to ensure both companies can build overwhelming competitive advantages through focus and specialization.”

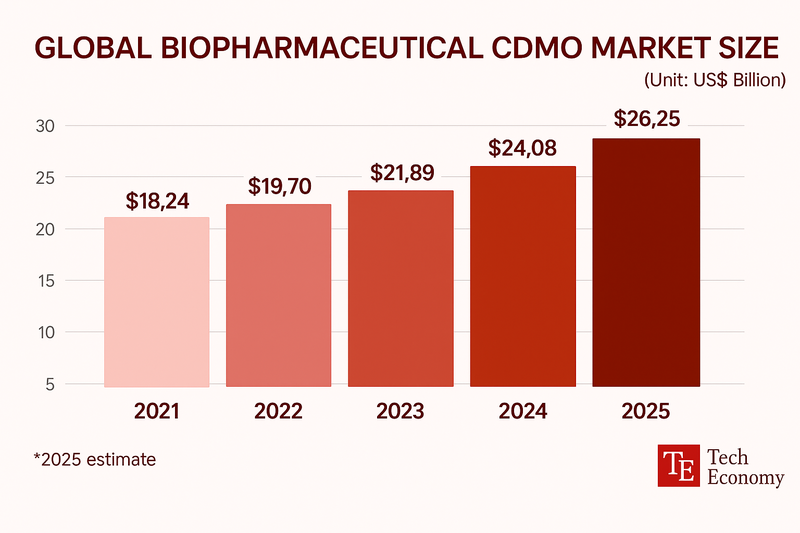

Surge in Demand for Off-Patent Drug Production

According to Samjong KPMG, the global CDMO market for biopharmaceuticals is projected to grow about 13% this year to USD 24.8 billion. Key growth drivers include rising demand to reproduce off-patent biologics and a shift by global pharmaceutical firms away from in-house manufacturing. Given the complex production processes and stringent quality requirements for biologics, demand for CDMOs with advanced facilities and proven capabilities is expected to continue rising.

The global CDMO market has long been dominated by a few major players like Samsung Biologics, Lonza (Switzerland), and WuXi Biologics (China). These companies not only operate large-scale facilities with flexible production capabilities but have also secured certifications from various national regulators. However, Korean CDMOs are now rapidly closing the technology gap, expanding not just facilities but also into high-value segments. In particular, capabilities in next-generation products like ADCs (antibody-drug conjugates) are poised to reshape the competitive landscape.

Beyond technology, Korea is also gaining ground in terms of talent, regulation, and infrastructure. A bio cluster centered in Songdo, Incheon is attracting multinational pharmaceutical companies with its manufacturing capacity and skilled workforce. The government is also pushing regulatory reforms. As global pharma moves away from in-house production toward specialized outsourcing, Korean CDMOs are expected to become key nodes in the new biomanufacturing supply chain.

Regulatory and Infrastructure Gaps Must Be Addressed

Korean companies are rapidly accelerating their efforts in this space. SK Group is expanding its CDMO operations through SK Pharmteco and SK Bioscience, having acquired U.S. cell and gene therapy firm CBM and German CDMO IDT Biologika. IDT, with over 100 years of history, serves multinational pharmaceutical firms and government agencies across North America, Europe, and Asia.

Lotte is also entering the CDMO market through its affiliate Lotte Biologics, currently investing about 4.6 trillion won to build three production plants and a bio campus in Songdo. At the JP Morgan Healthcare Conference in San Francisco this January, Lotte presented its proprietary ADC platform “Soluflex Link” in the APAC track.

Traditional pharmaceutical firms such as Hanmi Pharmaceutical and Daewoong Pharmaceutical are also showing interest in CDMO operations. Hanmi plans to utilize its Pyeongtaek Plant 2—previously underutilized after Sanofi returned its technology in 2020—for CDMO purposes. Daewoong has launched its CDMO business via its subsidiary Daewoong Bio. This marks a broader industry shift in Korea from R&D-centric activity to production and supply, signaling a new phase of industrialization.

The Korean government has presented a vision to foster biopharmaceutical CDMOs as a next-generation export growth engine. The Ministry of Trade, Industry and Energy, in collaboration with the Ministry of Health and Welfare, is developing a "Bio Production Strategy Roadmap," considering measures such as tax incentives, regulatory easing, and workforce training programs. This is part of a long-term strategy to establish Korea as a national-level biomanufacturing hub.

However, some observers point out that regulatory infrastructure still lags behind the pace of industrial growth. Biomanufacturing requires a multilayered governance framework encompassing quality, safety, and data protection, but Korea has yet to implement regulatory systems or global certification standards comparable to advanced countries. Particularly in high-value areas like ADCs and mRNA platforms, Korea lacks sufficient experience and know-how, making regulatory reform essential to building trust with global clients.

To address this, the Ministry of Food and Drug Safety plans to propose special legislation supporting biopharmaceutical CDMOs. The envisioned law would waive the need for full marketing approval under the current Pharmaceutical Affairs Act, provided the products meet export country requirements—thereby encouraging business activity. A ministry official said, “If this system is legally certified, counterpart countries will perceive Korean CDMO companies as being endorsed by the government, improving confidence in product quality and boosting global market expansion.”