Samsung Biologics Surpasses USD 2.19 billion Won in Contract Manufacturing Orders, Marking Korea’s Leap as a Global Bioproduction Hub

Input

Changed

Contract Manufacturing Division Restructured as Independent Operation CDMO Market Growing at Double-Digit Rates Annually Industry Focus Shifting from ‘R&D → Production and Supply’

Samsung Biologics has surpassed approximately USD 2.3 billion in contract manufacturing (CMO) orders this year through deals with European and Asian pharmaceutical companies. This milestone marks the beginning of a full-scale expansion for Korea’s bio contract development and manufacturing (CDMO) industry. Many Korean companies are rapidly narrowing the technology gap with global competitors, and the government is accelerating infrastructure support and legislative efforts. Amid concerns that regulatory frameworks lag behind industrial growth, attention is turning to Korea’s long-term strategy for establishing itself as a “global bioproduction hub.”

Establishing a Profit Base for Future Investment

According to a disclosure on May 26, Samsung Biologics signed two new CMO contracts on May 23 with pharmaceutical companies in Europe and Asia, totaling USD 319.57 million. The European deal is worth USD 175.55 million and runs through 2030, while the Asian contract is worth USD 144.03 million and extends to the end of 2033. Due to confidentiality agreements, the names of the clients and products were not disclosed.

As a result, Samsung Biologics’ cumulative order volume since its founding has now surpassed USD 18.2 billion. Since its first contract of the year in January, the company has secured new orders from the U.S., Asia, and Europe, reaching 3.2525 trillion won in just five months—already over 60% of its total annual orders from last year (5.4035 trillion won).

This success reflects Samsung’s restructuring of its bio business into two main arms: pharmaceutical CDMO and the development of new drugs and biosimilars. On May 22, Samsung Biologics announced it would spin off a division responsible for subsidiary management and new investments into a new holding company, Samsung Epis Holdings. This will leave Samsung Biologics as a pure-play CDMO, while the new entity focuses on drug development.

This restructuring is aimed at resolving potential conflicts of interest raised by global pharmaceutical clients and enabling a more focused investment in the high-growth field of new drug development through Samsung Bioepis. Samsung Biologics CEO John Rim explained, “We decided on this split to proactively respond to rapid global changes and to ensure both companies can build overwhelming competitive advantages through focus and specialization.”

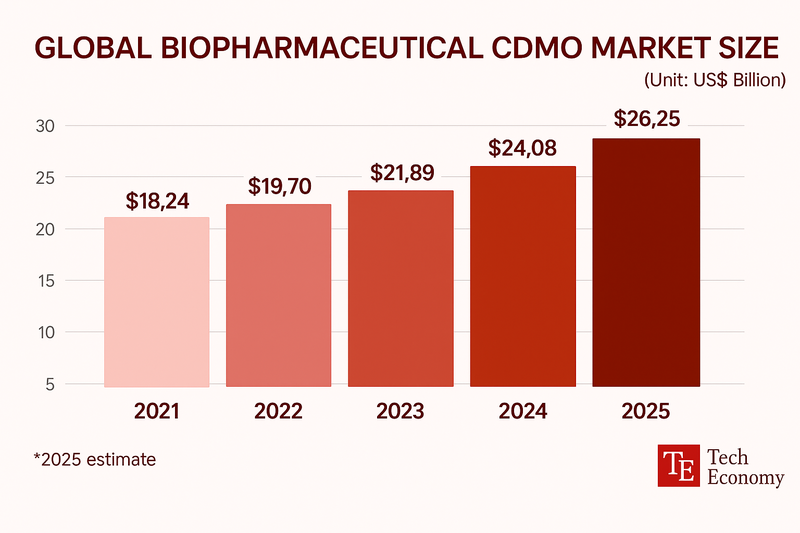

Surge in Demand for Off-Patent Drug Production

According to Samjong KPMG, the global CDMO market for biopharmaceuticals is projected to grow about 13% this year to USD 24.8 billion. Key growth drivers include rising demand to reproduce off-patent biologics and a shift by global pharmaceutical firms away from in-house manufacturing. Given the complex production processes and stringent quality requirements for biologics, demand for CDMOs with advanced facilities and proven capabilities is expected to continue rising.

The global CDMO market has long been dominated by a few major players like Samsung Biologics, Lonza (Switzerland), and WuXi Biologics (China). These companies not only operate large-scale facilities with flexible production capabilities but have also secured certifications from various national regulators. However, Korean CDMOs are now rapidly closing the technology gap, expanding not just facilities but also into high-value segments. In particular, capabilities in next-generation products like ADCs (antibody-drug conjugates) are poised to reshape the competitive landscape.

Beyond technology, Korea is also gaining ground in terms of talent, regulation, and infrastructure. A bio cluster centered in Songdo, Incheon is attracting multinational pharmaceutical companies with its manufacturing capacity and skilled workforce. The government is also pushing regulatory reforms. As global pharma moves away from in-house production toward specialized outsourcing, Korean CDMOs are expected to become key nodes in the new biomanufacturing supply chain.

Regulatory and Infrastructure Gaps Must Be Addressed

Korean companies are rapidly accelerating their efforts in this space. SK Group is expanding its CDMO operations through SK Pharmteco and SK Bioscience, having acquired U.S. cell and gene therapy firm CBM and German CDMO IDT Biologika. IDT, with over 100 years of history, serves multinational pharmaceutical firms and government agencies across North America, Europe, and Asia.

Lotte is also entering the CDMO market through its affiliate Lotte Biologics, currently investing about 4.6 trillion won to build three production plants and a bio campus in Songdo. At the JP Morgan Healthcare Conference in San Francisco this January, Lotte presented its proprietary ADC platform “Soluflex Link” in the APAC track.

Traditional pharmaceutical firms such as Hanmi Pharmaceutical and Daewoong Pharmaceutical are also showing interest in CDMO operations. Hanmi plans to utilize its Pyeongtaek Plant 2—previously underutilized after Sanofi returned its technology in 2020—for CDMO purposes. Daewoong has launched its CDMO business via its subsidiary Daewoong Bio. This marks a broader industry shift in Korea from R&D-centric activity to production and supply, signaling a new phase of industrialization.

The Korean government has presented a vision to foster biopharmaceutical CDMOs as a next-generation export growth engine. The Ministry of Trade, Industry and Energy, in collaboration with the Ministry of Health and Welfare, is developing a "Bio Production Strategy Roadmap," considering measures such as tax incentives, regulatory easing, and workforce training programs. This is part of a long-term strategy to establish Korea as a national-level biomanufacturing hub.

However, some observers point out that regulatory infrastructure still lags behind the pace of industrial growth. Biomanufacturing requires a multilayered governance framework encompassing quality, safety, and data protection, but Korea has yet to implement regulatory systems or global certification standards comparable to advanced countries. Particularly in high-value areas like ADCs and mRNA platforms, Korea lacks sufficient experience and know-how, making regulatory reform essential to building trust with global clients.

To address this, the Ministry of Food and Drug Safety plans to propose special legislation supporting biopharmaceutical CDMOs. The envisioned law would waive the need for full marketing approval under the current Pharmaceutical Affairs Act, provided the products meet export country requirements—thereby encouraging business activity. A ministry official said, “If this system is legally certified, counterpart countries will perceive Korean CDMO companies as being endorsed by the government, improving confidence in product quality and boosting global market expansion.”