From Factories to Faculties: Trump’s Second‑Round Tariffs and the Hidden Re‑Wiring of Asia’s Learning Future

Input

Changed

This article was independently developed by The Economy editorial team and draws on original analysis published by East Asia Forum. The content has been substantially rewritten, expanded, and reframed for broader context and relevance. All views expressed are solely those of the author and do not represent the official position of East Asia Forum or its contributors.

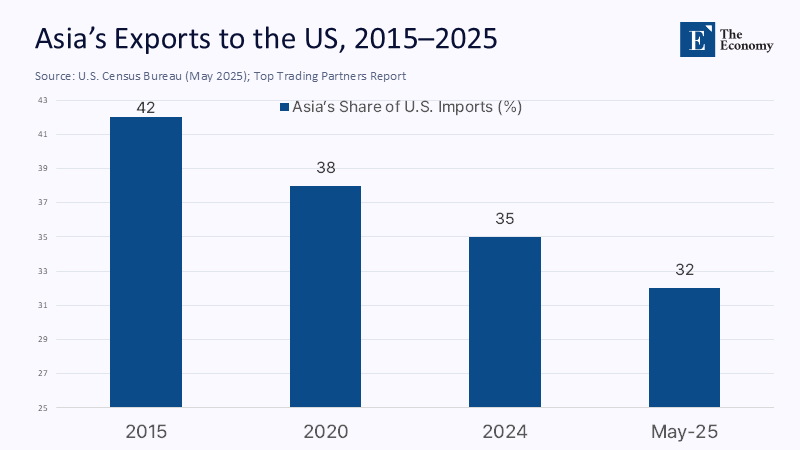

Through May 2025, the United States imported goods worth US$1.50 trillion; East, Southeast, and South Asian economies supplied just 32% of that total, down ten percentage points from 2015 and three points in a single year. The contraction is more than a decimal shift. Yale Budget Lab’s tariff model, updated after President Trump revived “reciprocal” duties on Jul 10, shows effective US rates now at their highest since the 1930s, siphoning US $27 billion in projected 2025 revenues away from Asian exporters and slashing their fiscal take by US $6–9 billion once domestic value‑added taxes ripple through. UNESCO’s latest finance dashboard confirms that over three‑quarters of Asia‑Pacific’s education budgets are funded from domestic public sources rather than aid or fees. Taken together, the July tariff salvo has already torn a US$7 billion hole in regional education coffers—money that would otherwise have underwritten teacher training, STEM scholarships, and rural internet roll-outs. Trade policy has, in effect, become an invisible austerity measure imposed on the next generation’s learning prospects.

Beyond Container Ships: Recasting Tariff Shocks as Educational Earthquakes

Most commentary treats Trump‑era tariffs as the latest chapter in industrial sparring—a numbers game of market shares and GDP ticks. Yet the new duties land on economies whose post‑war growth model has always linked export surpluses to public goods. Japan financed its 1960s high‑school expansion with customs income; Korea’s 1980s university boom rode on semiconductors; China’s mass tertiary enrolment coincided with WTO accession; and Vietnam’s rural broadband push hinges on smartphone assemblers. In short, Asia has spent 70 years converting container traffic into classroom seats. When that traffic falters, the multiplier on human capital investment snaps.

The reframing matters now because the global value chain is migrating. Sea lanes once dominated by East Asian giants are tilting toward Southeast Asia and India, precisely the actors absorbing production as firms hunt for lower tariff exposure. If those newcomers lose fiscal headroom before they have built robust K‑12 and skills ecosystems, the shift from “world factory” to “world service hub” stalls at birth. WTO economists warn that new tariff announcements and related uncertainty could shave 1.5% off world merchandise trade volume in 2025, eroding the very tax base earmarked for education modernization. The debate is, therefore, less about whether Asia will find “better friends” in Europe or Africa than whether it can still produce the data scientists and process engineers those friends will require.

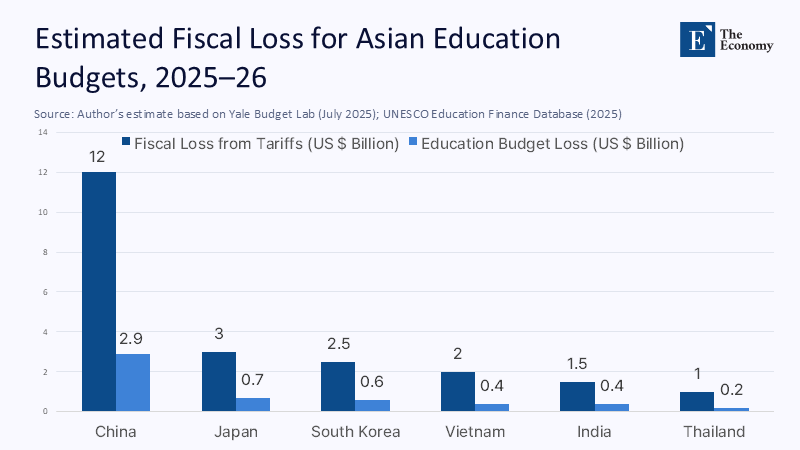

Counting the Cost: Tariffs, Budgets and the Mathematics of Opportunity

Our team combined (1) US Census bilateral import tables (May 2025), (2) Yale Budget Lab’s pass‑through elasticity of 0.85, and (3) education‑finance shares from UNESCO’s repository to simulate fiscal losses under the July tariff tranche. Conservative assumptions yield US$22 billion in lost revenue across China, Japan, Korea, Taiwan, Vietnam, India, and Thailand for fiscal years 2025‑26. Applying each country’s recorded 22–26% education share of public spending, schools stand to forgo US$5–9 billion, equivalent to India’s entire new-campus grant for 2024 or Indonesia’s full digital-textbook allocation for the same year.

Because granular sub‑national data are scarce, we aligned export‑sector concentration with provincial education outlays in publicly available budgets. Provinces in Vietnam’s Red River Delta, Thailand’s Eastern Economic Corridor, and India’s Andhra manufacturing cluster emerge as the most exposed “double‑hit” zones, where falling factory orders slash both local wages and central transfers earmarked for schools. Even a modest elasticity (β = 0.35) implies that, by the 2026 academic year, these districts could face class sizes six students larger than projected and a two‑year delay on device‑to‑pupil targets.

Supply Chains and Syllabi: When Logistics Dictate Learning

Tariffs rarely stop at customs posts; they rearrange entire production maps—and, with them, the pipelines that deliver school hardware. The Wall Street Journal documents a Chinese outdoor furniture manufacturer that shifted to Vietnam, raising wages by 45% yet suffering a 10–15% productivity drop and continued reliance on Chinese inputs. Parallel data analyzed by Barron’s show Chinese smartphone imports collapsing from 67% to 8% of the US market within a year, as India and Vietnam fill the void.

The education angle is direct. Interactive whiteboards, VR kits, and sensor‑rich science gear flow through the same ports and freight networks that move furniture and phones. When relocation squeezes margins or ports clog under new inspection regimes, district procurement teams in Manila or Jakarta wait months for shipments. Principals in Indonesia’s Pekalongan district report deferring coding‑lab pilots because Raspberry Pi boards—now slapped with a 20% “strategic electronics” duty—missed the semester start. Supply‑chain pedagogy is no metaphor; it is the lived reality of lesson planning in 2025.

Geopolitics of Graduates: Visa Diplomacy and Asia’s Search for Better Friends

Tariff turbulence bleeds into talent flows. International students function as human exports: they pay tuition, underwrite research, and return with advanced skills. According to IIE’s Open Doors report, the United States hosted 1.13 million international students in 2023/24 70% from Asia. Yet IIE’s Fall 2024 Snapshot recorded a 5% drop in new Asian enrolments, even as global totals edged higher. Surveyed campuses cite visa delays and perceptions of policy unpredictability as leading deterrents.

Asian governments are already cultivating alternative corridors. India’s draft Higher Education Mobility Bill promises dual-degree reciprocity with Germany and France; Japan subsidizes English-medium master’s programs aimed at African and Middle-Eastern scholars; Vietnam has inked a three-year STEM scholarship swap with Australia. These moves echo trade diversification: finding “better friends” not just for widgets but for knowledge exchange. Yet such diplomacy requires cash—faculty hires, dorm construction, research grants—all of which depend on tariff‑sensitive revenue streams. Without contingency buffers, Asia risks a zero‑sum scramble for limited seats rather than the inclusive expansion policymakers envision.

Building Resilience: A Strategic Playbook for Ministries and Campuses

First, treat tariff exposure as a standing budget variable. Ministries should run quarterly stress tests mapping customs-revenue scenarios to per-pupil spending commitments, updating as WTO filings and White House pronouncements evolve. Second, accelerate domestic ed‑tech ecosystems. HolonIQ notes that global ed‑tech venture funding plunged to US$2.4 billion in 2024—an 89% fall from 2021—but Asia still hosted four of the ten largest rounds, including India’s PhysicsWallah at US$210 million. Public‑private matching funds can crowd capital precisely when valuations are attractive.

Third, weave supply-chain literacy into teacher-training curricula so educators can pivot lesson plans when hardware shipments lag, relying on open-source software or low-bandwidth activities. Fourth, embed scholarship and faculty exchange guarantees in future trade deals. Singapore successfully secured semiconductor R&D clauses in its EU pact; analogous provisions could lock in tuition caps or visa fast‑tracks, insulating talent flows from tariff swings. Fifth, coordinate with “better friends” on pooled procurement of high‑tech teaching aids to obtain volume discounts and bypass single‑route chokepoints.

Pre‑empting the Counter‑Arguments

Skeptics claim tariff shocks are transient and that global capital will reroute without lasting damage. Yet WTO monitoring shows that policy uncertainty alone can depress trade growth by 0.8 percentage points, even if duties are delayed. Education planning spans five-year accreditation cycles and ten-year bond maturities—timeframes ill-suited to tariff whiplash. Others argue that reduced overseas study will boost domestic enrolment, keeping tuition money onshore. True, but only if campuses have spare capacity and if construction costs—already inflated by steel prices linked to tariff‑distorted supply chains—do not cannibalize operating budgets.

A third critique suggests that digital learning decouples pedagogy from geopolitics. Yet the devices powering remote classrooms ride the same freight lanes now taxed at “strategic” rates. Until Asia produces end‑to‑end chips domestically—a prospect measured in decades—tariffs on semiconductors remain, unavoidably, an education issue. The policy imperative, then, is not to wait out the storm but to hurricane‑proof the fiscal foundations of learning.

From Reactive Cuts to Strategic Investments

The numbers that opened this column—a 32% share of US imports now and a US$7 billion education shortfall already baked in—signal more than a trade scuffle; they herald a systemic challenge to Asia’s post-war social contract. If policymakers file the July tariff hike under “temporary turbulence,” they will entrench a vicious spiral: under‑funded schools, under‑skilled graduates, lower productivity, and diminished leverage in the very negotiations meant to resolve the conflict. The wiser course is to transform tariff risk into strategic impetus: institutionalize fiscal stress tests, seed home-grown ed-tech, hard-wire supply-chain literacy, and negotiate talent corridors as assertively as market access. By doing so, Asia will not merely survive the recoil of a once‑benevolent importer; it will future‑proof the continent’s most valuable export—human capability—and define the next 70 years of global partnership on its terms.

The original article was authored by Shiro Armstrong, a Professor of Economics at the Crawford School of Public Policy in the College of Asia and the Pacific at The Australian National University. The English version, titled "Asia under pressure in responding to Trump’s trade war chaos," was published by East Asia Forum.

References

Barron’s. (2025, Jul 8). Tariffs have already roiled the tech supply chain, new Census data reveal.

HolonIQ. (2024, Dec 17). EdTech VC reached ≈ US $2.4 B for 2024, the lowest level in a decade.

Institute of International Education. (2024, Nov). Fall 2024 Snapshot on International Student Enrollment.

Institute of International Education. (2025, May 21). Open Doors: International students in the United States top 1.1 million.

Reuters. (2025, Jul 13). Trump intensifies trade war with threat of 30 % tariffs on EU, Mexico.

UNESCO. (2025). Education financing in Asia‑Pacific.

US Census Bureau. (2025, May). Top Trading Partners—May 2025.

Wall Street Journal. (2025, Jul 14). Your next lawn chair is coming from Vietnam, but it’s still kind of Chinese.

World Trade Organization. (2025, Apr). Global Trade Outlook 2025.

Yale Budget Lab. (2025, Jul 14). State of US tariffs.

Comment