Samsung Confirms a Bottom, Eyes Second-Half Rebound via Yield Improvements and DRAM Supply

Input

Modified

A Lone Earnings Shock Amid the AI Rally Second-Quarter Losses Reflect Future Write-Downs Room for Earnings Recovery in the Second Half Expands

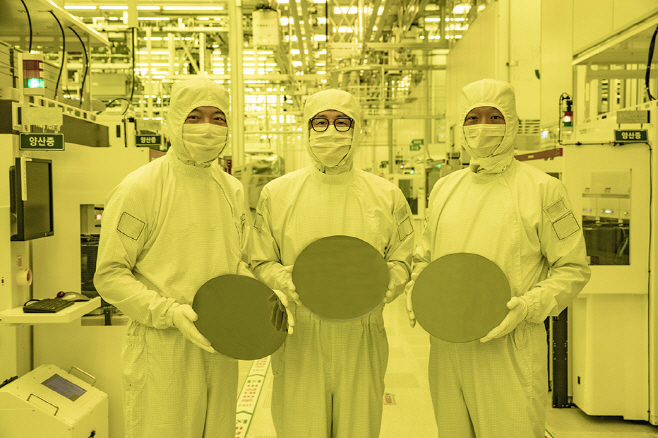

Samsung Electronics reported a significant “earnings shock” in the second quarter (April–June), falling far short of market expectations despite the ongoing AI rally. Its high-bandwidth memory (HBM) business, a core component in AI semiconductors, underperformed more than expected, and the foundry (semiconductor contract manufacturing) unit, which was expected to reduce losses, still recorded an operating loss exceeding $1.44 billion. However, the company sees Q2 as the bottom, having accounted for substantial inventory loss provisions, and anticipates a strong rebound starting in Q3.

Over $720 Million Below Market Expectations, Due to DS Inventory Provisions and China-Targeted Sanctions

On July 8, Samsung Electronics announced its preliminary Q2 consolidated earnings: sales of $53.28 billion and operating profit of $3.31 billion. Compared to the same quarter last year, sales and operating profit declined by 0.1% and 55.9%, respectively. Compared to Q1, sales fell by 6.49% and operating profit by 31.24%. Operating profit came in well below the already-lowered market forecast of $4.54 billion. Although securities analysts had sharply lowered their Q2 forecasts for Samsung’s operating profit by around $1.44 billion over the past month, the actual figures were even weaker.

The disappointing Q2 results stemmed primarily from the poor performance of Samsung’s semiconductor division, its cash cow. Although Samsung did not disclose detailed segment results in the preliminary announcement, analysts estimate the Device Solutions (DS) division's operating profit at around $288 million—a 94% plunge compared to the $4.64 billion profit recorded in Q2 last year when the market was recovering. This drop was largely attributed to inventory provisions and U.S. sanctions on cutting-edge AI chips targeting China.

In particular, the HBM business, which had attracted significant market attention, became a drag. Kim Sun-woo, an analyst at Meritz Securities, said, “Revenue from HBM, which should have driven growth, likely declined compared to the previous quarter,” adding, “Both quality certification and orders from North American clients are still far off.” Samsung failed to deliver 12-layer HBM3E (5th generation HBM) chips to Nvidia—the dominant player holding 80% of the AI chip market—on time, leading to excess inventory and deteriorating profitability.

Other semiconductor segments also struggled. Analysts estimate that the foundry and System LSI businesses posted operating losses exceeding $1.44 billion. The foundry business has posted losses of over $720 million for each quarter since Q4 last year due to difficulties securing clients for advanced process nodes. The NAND flash memory business also reportedly continued to suffer losses due to declining prices. Additionally, as semiconductors are settled in U.S. dollars, the steep decline in the USD/KRW exchange rate since June further impacted earnings negatively.

DRAM Prices Soaring, Strengthening Bargaining Power

Experts expect Samsung to benefit from improving DRAM prices in the second half of the year, despite lingering external uncertainties such as tariffs and weak USD. According to DRAMeXchange, the average fixed transaction price of DDR4 8Gb 1Gx8 DRAM for PCs jumped by 23.81% to $2.60 in June, continuing the trend of over 20% monthly increases observed in April (22.22%) and May (27.27%).

The DRAM market has recently exhibited an unusual phenomenon in which the price of older, soon-to-be-discontinued products has risen faster than newer DDR5 versions. This is due to heightened inventory stocking by customers in anticipation of the phase-out of DDR4 and uncertainty around U.S. tariff policies (including a 90-day grace period for reciprocal tariffs). DRAM inventories held by PC assemblers increased from 9–13 weeks at the end of Q1 to 12–15 weeks in early Q2. In contrast, DRAM suppliers’ inventories dropped from 10–16 weeks to 6–13 weeks during the same period, thereby strengthening suppliers' pricing power.

Samsung has made some technical progress in HBM, where it has lagged behind SK hynix. It recently developed DRAM based on the 1c process node, a prerequisite for manufacturing the 6th generation HBM (HBM4), and has completed internal validation for mass production. The 1c node represents the most advanced current DRAM process technology—part of the 10nm-class process scale, it follows six generations: 1x, 1y, 1z, 1a, 1b, and 1c. Samsung plans to apply the 1c node in its production lines to start manufacturing the latest DRAM and eventually use it as the foundation for HBM4 development. Last month, it reportedly agreed to supply HBM3E, the preceding generation to HBM4, to AMD and Broadcom. A Samsung spokesperson said, “Improved HBM products are currently undergoing evaluation and shipments by individual customers.”

Foundry Business Holds the Key

Samsung’s latest mobile application processor (AP), the Exynos 2500, also drew attention when it was listed as “mass production” on the company’s website last month—signaling improved yield levels. Samsung plans to install the Exynos 2500 in its next-generation Galaxy smartphones, beginning with the foldable Galaxy Z Flip 7, to be unveiled on July 9. The Flip 7 is expected to serve as a test bed to gauge the Exynos 2500’s performance.

The company is also betting big on the next-generation 2nm process node, set to drive next year’s advanced chip market. Samsung is aggressively investing in customer collaboration and networking in the U.S. to win 2nm process orders, focusing on rebuilding trust lost over unmet performance and yield promises for 5nm and 3nm nodes. At the recent “SAFE (Samsung Advanced Foundry Ecosystem) 2025” event, the company presented a roadmap prioritizing the 2nm process over the uncertain 1.4nm node.

The key challenge lies in stabilizing 2nm yield and securing local clients before its multibillion-dollar fab in Taylor, Texas, becomes fully operational. Samsung must win orders not only from its existing client Qualcomm but also from major customers such as Nvidia, AMD, and Broadcom—especially in the high-performance “big chip” server foundry segment where it has shown weakness. Industry insiders believe the fate of Samsung’s foundry business hinges on whether it can raise 2nm process yield to 60–70% within six months and deliver performance and pricing that meet client expectations.