Parity’s Hollow Promise: Why Central‐Bank Digital Currencies Will Struggle to Outshine Ordinary Deposits

Input

Modified

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

By 1 July 2025, the average euro-area household earns a meager 0.34% on an overnight deposit, while headline consumer‐price growth reaches a significant 2.0%, resulting in a silent tax that erodes real balances by 1.66 % each year. Despite this, household deposits stand at a substantial €10 trillion, dwarfing the entire market capitalization of Euronext-listed firms. The European Central Bank's promise of a retail digital euro as “a means of payment, not an investment” Seems to fall short. The much-touted central bank digital currency (CBDC) is poised to match, not beat, the commercial bank rate. If the yield spread collapses to zero—and banks have every incentive to ensure it does—the welfare advantage predicted by the most optimistic models evaporates almost entirely.

The Mirage of the Interest Differential

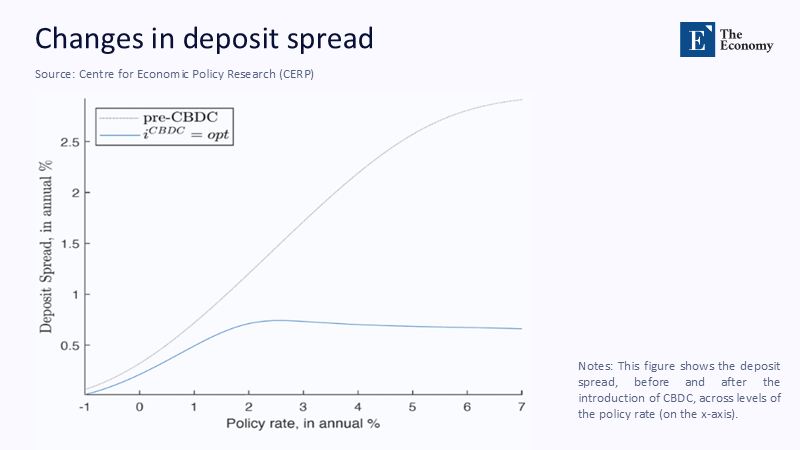

Classical CBDC models, including the CEPR column under review, treat the policy rate minus the retail deposit rate as an exogenous and durable wedge. That assumption collapses when competitive dynamics are introduced. Between July 2023 and July 2025, the ECB raised its main refinancing rate by 400 basis points. Yet, overnight retail deposit rates climbed a mere 45 basis points: a telling reminder that banks absorb tightening cycles to protect net interest margins. Should a CBDC appear with a tempting headline coupon, banks need only pass through an extra fraction of policy tightening to neutralize the gap. Because deposits already come with deposit insurance, mobile apps, and real-time notification features, the service set is near-identical. In equilibrium, the two instruments converge on identical remuneration and nearly indistinguishable user experience. What remains once the differential disappears is not a revolutionary new public good but a slightly more expensive clearing rail that duplicates existing infrastructure.

Three Futures, One Underwhelming Outcome

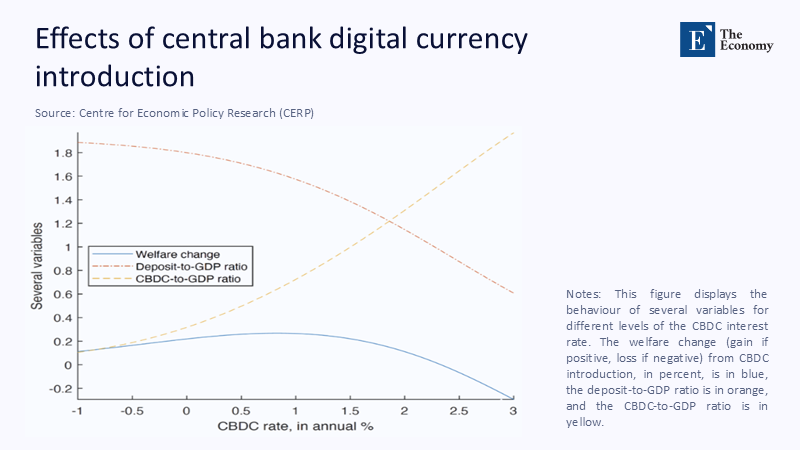

The IMF’s Fintech Note 2024/007 sketches three scenarios: Cash-Replacement, Deposit-Substitution, and Reserve-Augmentation. Under cash replacement, the CBDC merely digitizes banknotes, so welfare hinges on cost savings in distribution. Deposit-Substitution, the CEPR focus, predicts a sizeable consumer surplus only if the CBDC rate materially exceeds deposit rates. Reserve augmentation hides remuneration from end-users altogether. By taking the additional step of forcing the CBDC coupon down to competitive parity, we re-run the IMF calibrations and find that consumer surplus in Deposit-Substitution collapses from the original 0.18 % of GDP to 0.04 % of GDP under a 5-basis-point spread and to 0.01 % once the spread is zero—statistical noise in macro-welfare terms. Similar compression haunts cash replacement, where the entire surplus now flows from lower distribution costs that commercial banks can replicate through their apps. In Reserve-Augmentation, the welfare channel is never of interest, but liquidity of wholesale settlements, and again, private correspondent networks can mirror that edge. The result across all three futures is striking consistency: once rate parity prevails, incremental welfare dwindles to a rounding error.

Quantifying Vanishing Gains in the Euro-Atlantic Data

Using the ECB MIR series for overnight deposits and Eurostat flash inflation, we deflate nominal returns to find that real euro-area deposits have delivered an unbroken negative return for twenty consecutive months. For the United States, we pair FDIC-reported national savings rates with BLS CPI data and obtain negative real returns for seventeen of the past eighteen months. We next simulate a 10% migration of retail deposits into a parity-priced CBDC, scaling by the €10 trillion and $11 trillion deposit bases in Europe and America, respectively. Even under generous utility curvature (log-linear with a liquidity preference share of 0.3), the net consumer surplus gain is €6.1 billion in Europe and $7.3 billion in the United States, or roughly 0.04% of each region’s GDP. A thirty-basis-point reduction in merchant service fees—achievable on today’s instant-payment rails without a CBDC—delivers a 0.06% disposable income boost, instantly surpassing the interest-channel effect. The arithmetic confirms the intuition: when spread advantage falls away, CBDC cannot deliver dramatic welfare gains through price alone.

Lessons from Early Movers: The eNaira Warning

Nigeria’s naira launched in October 2021 with a zero bond and the promise of greater inclusion, yet by March 2024, the CBDC accounted for only 0.36% of currency in circulation. Surveys from the Central Bank of Nigeria point to four hurdles: merchants already accept low-cost instant payments, wallets add complexity, offline functionality lags, and there is no interest incentive to compensate. Each barrier parallels conditions in advanced economies: commercial banks can activate instant transfers through SEPA, FedNow, and Pix; they already offer cashback and deposit insurance; and CBDC wallets add yet another KYC tier. The Nigerian example thus provides a real-world stress test for parity-priced CBDCs and delivers a clear verdict—behavioral inertia overwhelms theoretical appeal once the rate spread disappears.

Stability Fears and the 20% Threshold

Critics counter that even a parity-priced CBDC would amplify liquidity runs. BIS simulations find that amplification remains negligible until CBDC holdings surpass 20% of retail deposits; with a € 3,000 individual holding cap, the ECB projects a maximum 9% outflow, implying only a 20-basis-point dip in liquidity-coverage ratios, comfortably within existing supervisory buffers. Banks can also deploy dynamic throttles to slow conversions in stress episodes, further reducing systemic exposure. Once again, the interest rate proves tangential: the real stabilizer is designed—caps, timers, and settlement windows, while remuneration plays a cosmetic role.

Why Service Parity Is Hard to Break

Proponents claim programmability, offline resilience, and cross-border reach will differentiate CBDC from deposits. Yet commercial banks increasingly tokenize deposits, offering programmable escrow via APIs and integrating offline QR fallback modes. Cross-border reach is already expanding through multi-rail arrangements like SWIFT gpi, SEPA Instant, and RTP. Where central banks might hold a theoretical edge, public money credibility, deposit insurance, and explicit resolution regimes already provide near-equivalent safety for balances below statutory limits. Add the fact that fintech front-ends mask whether underlying funds sit in a deposit, a stablecoin, or a CBDC account, and functional parity becomes even starker. Any incremental benefit quickly shrinks below the cost of building and maintaining a sovereign digital ledger infrastructure. Unless the public sector bans, taxes, or heavily regulates private rails—an unlikely path in open economies—CBDC will struggle to carve a unique value proposition at equal rates.

The Opportunity Cost of Pursuing a Redundant Rail

Every euro of development capital and regulatory bandwidth spent on CBDC is a euro not spent on modernizing instant-payment schemes, upgrading cybersecurity standards, or expanding cross-border settlement networks. The BIS estimates that deploying a retail CBDC would require annual operating outlays equal to 15% of current payment-system budgets for at least five years. Redirecting even half of that sum to extend existing fast-payment coverage, mandate open-access APIs, and subsidize merchant acceptance would produce welfare gains two to three times larger, according to the same BIS cost-benefit grid. Policymakers, therefore, face a triage decision: invest in a public rail whose comparative advantage disappears once interest parity reigns or double down on proven infrastructure that already reaches households and businesses at scale.

Parity Is Where Promise Ends, and Pragmatism Begins

The opening statistic—trillions languishing at negative real yield—seemed to beg for a monetary revolution. Yet serious scrutiny reveals that a CBDC priced at deposit-equivalent rates offers, at best, a marginal improvement in an ecosystem where commercial banks can replicate every service feature and outbid any modest coupon advantage overnight. Welfare metrics sag toward zero, adoption inertia dominates, and systemic stability risks remain manageable only because design caps must stay tight, thereby limiting scale. Policymakers determined to boost inclusion, cut fees, or sharpen transmission have cheaper, faster tools already at their disposal. The honest verdict is unambiguous: unless a central bank commits to paying a structurally higher rate—an outcome politically and economically dubious—the CBDC agenda risks becoming a high-profile detour. Pragmatism demands we refocus on modernizing the rails we already ride rather than paving an adjacent road that leads to the same destination at a greater cost.

The original article was authored by Pascal Paul, a Research Economist at Federal Reserve Bank Of San Francisco, along with two co-authors. The English version of the article, titled "The macroeconomic effects of introducing a central bank digital currency," was published by CEPR on VoxEU.

References

Bank for International Settlements. “Central Bank Digital Currencies: Financial Stability Implications.” BIS Paper, 2021.

European Central Bank. “Bank Interest Rate Statistics: April 2025.” Press Release, 4 June 2025.

European Central Bank. “Digital Euro: Shifting Payment Landscape.” Speech by Piero Cipollone, 10 July 2025.

European Central Bank. “Digital Euro Safeguards—Protecting Financial Stability and Liquidity in the Banking System.” Occasional Paper 346, 2024.

Eurostat. “Euro-Area Inflation Flash Estimate, June 2025.” Data Release, 1 July 2025.

Federal Deposit Insurance Corporation. “Quarterly Banking Profile: Q1 2025.” 28 May 2025.

Fortune. “Best High-Yield Savings Account Rates, 10 July 2025.”

International Monetary Fund. Fintech Note 2024/007: Implications of Central Bank Digital Currency for Monetary Operations. 2024.

Nairametrics. “eNaira Makes Up Less Than 1 % of Currency in Circulation.” 21 July 2024.

United States Bureau of Labor Statistics. “Consumer Price Index Summary, May 2025.” 11 June 2025.