China Aims for 'Global Leader' Role in U.S. Absence, Pledges Large Donation to WHO

Input

Changed

USD 500 Million Additional Donation to WHO Following U.S. Withdrawal Expanding Global Presence Amid U.S. 'America First' Policy Using Influence to Intentionally Exclude Taiwan from the International Community

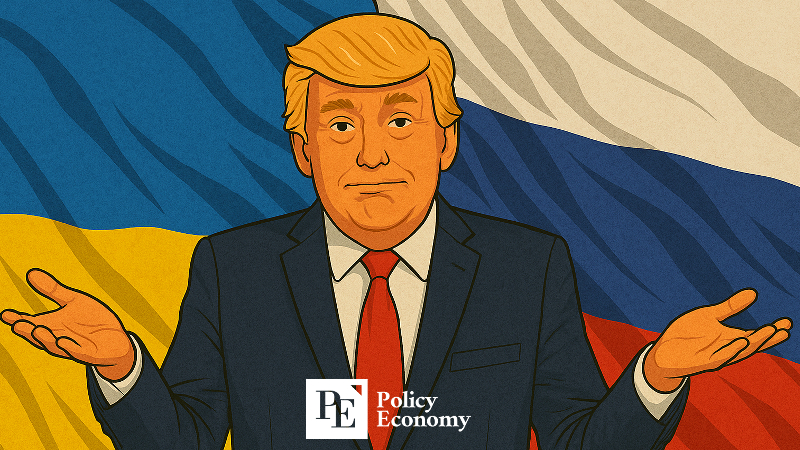

China is accelerating its efforts to expand its influence on the international stage. Since the launch of the Donald Trump administration, as the U.S. has stepped back from international organizations and agreements, China has moved to fill the void and shift the balance of power. While currently positioning itself as a guardian of multilateralism and acting with caution, experts predict that China will focus on expanding its influence without bearing significant burdens. This strategy appears to be aimed at shaping global opinion in its favor by investing heavily and becoming the largest contributor to international organizations.

U.S.: “WHO Unnecessary, Let’s Withdraw Together”

On the 21st May (local time), Reuters and Politico reported that U.S. Health Secretary Robert Kennedy Jr., in a video speech at the World Health Assembly (WHA)—the annual meeting of the WHO held at the UN's Geneva office—said, “I hope America’s withdrawal from the WHO serves as a warning to health ministers and the WHO itself.” He added, “We are already in contact with like-minded countries. We hope others will consider joining us.”

The U.S., once the WHO’s largest financial contributor, has begun the withdrawal process and halted its assessed contributions for 2024 and 2025 based on an executive order signed by President Trump on his first day in office. The U.S. urging WHO member states to withdraw is seen as part of a broader strategy to diminish the WHO—where China now has significant influence—and establish a new international health body in its place. Secretary Kennedy emphasized, “We want to liberate international health cooperation from the corrupt influence of pharmaceutical companies, hostile nations, and their (NGO) proxies.” Politico analyzed that this reflects U.S. efforts to build a global health cooperation network as an alternative to the WHO.

Kennedy also targeted China, stating, “International health cooperation remains a priority for President Trump and me, but as the COVID-19 pandemic revealed, the WHO does not function effectively.” He specifically cited the lab-leak theory and accused the WHO of helping to cover it up under China’s political pressure, suggesting the WHO is excessively influenced by the Chinese government.

China Pledges Extra USD 500 Million—Boosting Soft Power

Meanwhile, China has positioned itself as a financial savior of the WHO, which is facing a severe budget crisis following the U.S. withdrawal. On the same day, Chinese Vice Premier Liu Guozhong announced at the WHA, “China will provide an additional USD 500 million in funding to the WHO over the next five years.” He added, “In a time when unilateralism and power politics threaten global health security, the only solution is multilateralism. Through this donation, we aim to ensure the WHO operates independently and professionally, based on scientific principles.”

According to the WHO, in 2024–2025, the U.S. contributed over USD 700 million, more than 10% of the WHO’s entire budget. During the same period, China contributed about USD 200 million. If China’s new pledge is confirmed, it would surpass the U.S. and become the WHO’s largest donor. The WHO recently announced a 21% budget cut for 2026–2027 due to financial difficulties and is planning a 20% increase in member contributions over the next two years.

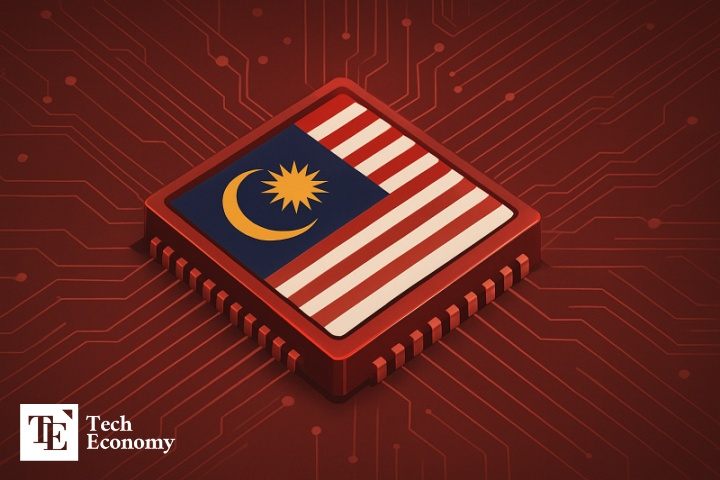

Experts believe this additional support will significantly enhance China’s soft power. The UK-based academic nonprofit The Conversation noted, “China has become one of the most influential countries in global health through funding health infrastructure and training medical professionals.” It added, “China is likely to continue engaging in bilateral and regional development via the WHO and expand its global health soft power agenda, especially across sub-Saharan Africa.”

In global politics, both hard power (military and economic strength) and soft power (the ability to shape preferences without force) are at play. After the collapse of the Soviet Union, China emerged as a counterbalance to the U.S. and began emphasizing soft power to compensate for its hard power limitations.

China Expands Contributions to the UN and Paris Agreement

China’s soft power expansion goes beyond the WHO. Among the five permanent members of the UN Security Council, China sends the most troops to UN peacekeeping operations. Last week, Chinese Defense Minister Dong Jun visited Europe and expressed China’s intention to play a greater role in peacekeeping.

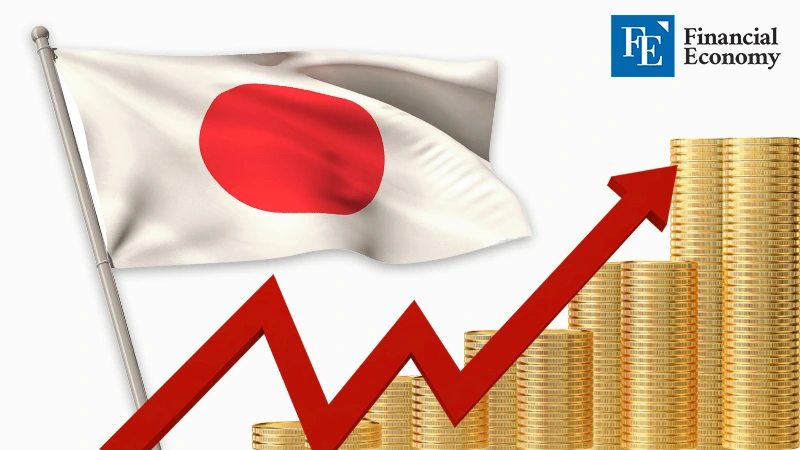

In 2019, China surpassed Japan to become the second-largest financial contributor to the UN and has continued to increase its contribution share. This figure now approaches that of the U.S., which has maintained a 22% contribution since 2001. Compared to the final year of Trump’s first term in 2021, China's share has increased by 8 percentage points. Even within the UN, there is growing recognition of China’s leadership. UN climate chief Simon Stiell stated at COP29 in Baku, Azerbaijan, “We need China’s continued leadership,” acknowledging China’s capabilities in the climate sector.

While the U.S. decided to withdraw from the Paris Climate Agreement, China has stressed its importance and supported renewable energy transitions in countries like the Philippines. Chinese President Xi Jinping previously said, “No matter how the international situation changes, China will not slow down its efforts to tackle climate change or its push for international cooperation,” vowing to pursue “a shared future for humanity.”

Xi also emphasized four priorities: defending multilateralism, deepening international cooperation, promoting a fair green transition, and implementing concrete actions, reinforcing China’s active role in combating climate change.

China’s push to expand soft power influence within international organizations is also seen as a move to reshape global norms in its own favor. China has been using its influence to assert sovereignty over Taiwan, leading to Taiwan’s exclusion from the WHO General Assembly for the past nine years.

On May 19, China’s Ministry of Foreign Affairs reiterated in a statement, “Taiwan has no basis, reason, or right to participate in the WHA without central government approval.” China’s effort to establish an “International Mediation Institute” is viewed in a similar light. According to the Chinese government, a signing ceremony led by Foreign Minister Wang Yi regarding the founding of the institute will take place on May 30 in Hong Kong. The event is expected to host representatives from more than 60 countries and over 20 international organizations across Asia, Africa, South America, and Europe.

Chinese Foreign Ministry spokesperson Mao Ning stated, “This will be the world’s first intergovernmental organization dedicated to resolving international disputes through mediation,” and claimed the institute will be a key mechanism for upholding the principles of the UN Charter.