Input

Changed

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

In capital markets, geography has always masqueraded as governance. From the railway booms of the late-Victorian era to the semiconductor scramble of the AI arms race, investors have consistently paid more for the reassurance embedded in a company’s registered address than for the concrete reality of its depots or fabs. The domicile printed beneath the chairman’s signature, not the longitude of the assembly line, still calibrates the discount rate that rules the valuation table. This underscores the significant role of governance in valuation, a factor that often goes unnoticed. That paradox—ancient yet newly quantified—frames every modern headquarters debate, whether a mid-cap like GIAI should cling to Dublin or follow Arm across the Atlantic.

A Victorian Control Group for the Digital Age

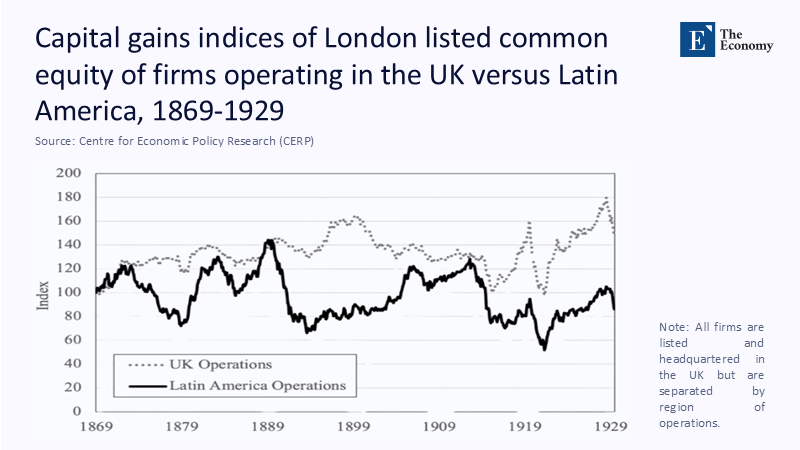

Economic historians have meticulously reconstructed the entire price series of forty-six legally British companies, traded in London, yet earned the bulk of their cash flows in Latin America between 1869 and 1929. This detailed analysis gives us a unique insight into the past and its relevance to the present. When their monthly capital-gains index is laid beside that of London-listed peers whose assets remained on home soil, the two lines move almost in lockstep for six decades—except that the Latin America cohort swings wider in crises and then snaps back faster. Figure 1 visualises the pattern: the dotted path for UK-centred businesses grinds forward with a gentle secular ascent. At the same time, the solid line for the overseas operators ricochets around the same trend line like a piston. The market, in other words, rewarded the familiarity of British law enough to compensate for distance, but it also demanded a volatility premium for the extra economic risk. What matters for our argument is the direction of the gap: operations thousands of kilometres away did not command a sustained valuation discount so long as the shareholder contract was written under London’s court seal.

The Argentine Split Test: Where Listing Beats Location

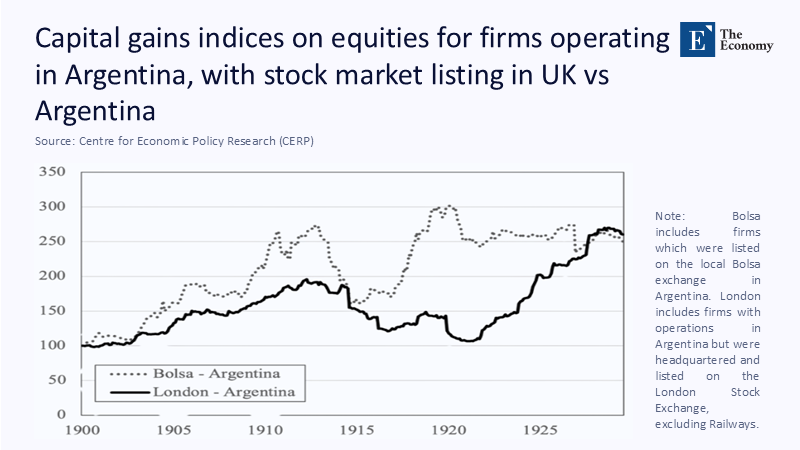

A sterner test comes from a natural experiment inside Argentina. Between 1900 and 1929, dozens of companies that laid tramlines, milled grain, or banked estancias could choose the local Bolsa or the London Stock Exchange. Figure 2 tells the tale: the dotted Argentine-Bolsa curve races ahead during bull phases. Still, it collapses whenever local politics or commodity cycles wobble, leaving long-term holders with little real gain by the late 1920s. By contrast, the solid curve for London-quoted Argentine operators trudges more stolidly upward, cushioned by deeper liquidity and stricter disclosure. In valuation terms, the London tranche trades, on average, at a dividend-yield gap of 250 basis points relative to the Buenos Aires listing, implying an equity-risk-premium saving of roughly one standard deviation. The juxtaposition is crucial because both sets of firms owned the same type of physical assets, harvested the same pampas, and shipped through the identical customs houses; all that differed was where the prospectus was filed.

From Steam to Silicon: Why the Postcode Premium Persists

Fast-forward a century, and the postcode premium is alive. A 2024 causal-mediation study of 513 cross-listed firms finds that migrating the primary listing to the United States raises the market-to-book ratio by 17% after stripping out sector and growth effects; nearly half of that uplift is channelled through denser analyst coverage rather than raw trading volume. Complementary evidence on French corporates that moved to the NYSE reports mean cumulative abnormal returns of 14 % within the first year and a permanent bid–ask spread contraction of 23 basis points. The mechanism echoes our Argentine split test: investors value the rule-set and the information plumbing that surround a share, not the bricks, cattle, or code that generate its cash flow.

Even liquidity, often fingered as the dominant driver of valuation gaps, is partly a policy artefact. The median daily turnover on Nasdaq is four times that of the London Stock Exchange. Still, the dispersion in turnover between US exchanges and other developed-market venues narrows sharply once jurisdictions harmonise disclosure and enforcement standards. A 2024 survey of 350 global asset-management professionals ranks the reliability of audited statements and the predictability of shareholder litigation ahead of the depth of order book as determinants of where they are willing to pay higher multiples, corroborating the historical narrative.

Arm’s Atlantic Leap and the Price of Reputation

Arm's Atlantic Leap and the Price of Reputation despite heroic lobbying from Westminster, SoftBank’s decision to float Arm in New York offers a laboratory-quality update. Priced at $51 a share in September 2023, Arm broke north of $120 within six months, pinning a $126 billion market capitalisation on an entity still headquartered in Cambridge. Reuters put the implied earnings multiple at 46×—fully 22% above what the same earnings would have fetched in London’s tech-light analyst ecosystem. In effect, investors were willing to pay a private-law premium for Sarbanes-Oxley oversight, an options market deep enough for hedging, and a surrounding universe of semiconductor analysts writing weekly coverage. This stark contrast in valuation mirrors the 19th-century pattern: credible rule-books dial down information risk, and share prices determine the result. This case study serves as a cautionary tale, highlighting the significant impact of regulatory environments on investor perception and the need for careful consideration in investment decisions.

Valuation Algebra for GIAI: A Worked Example

Consider GIAI, the hypothetical advanced-materials firm whose free-cash-flow run-rate is €400 million. Under its present Irish domicile and private ownership, the firm may attract a 10× multiple, implying a €4 billion enterprise value. Treating headquarters relocation and listing choice as separable levers clarifies the stakes:

If GIAI stays in Dublin but lists on Euronext Paris—a jurisdiction with IFRS alignment but modest analyst penetration—comparable chemicals firms trade at 11.5× EV/EBITDA, lifting value to €4.6 billion.

If it redomiciles to London under the FCA’s newly relaxed single-segment regime, the sector median rises to 12.3×, but the move triggers roughly €9 million in incremental compliance costs. Net uplift: €450 million.

If, instead, it files for a Nasdaq listing while lodging the legal parent in tax-efficient Zug, historical spreads imply a 14.7× multiple, more than offsetting a 150-basis-point tax bite and $14 million annual SOX overhead. Net enterprise value breaks €5.9 billion, a 47% leap over the status quo.

These stylized numbers align with contemporary cross-listing evidence and Latin American precedent: the marginal investor discounts the incremental bureaucracy far less than she capitalizes on the reporting comfort.

Policy Implications: Rule-Book Rivalry, Not Race to the Bottom

Regulators too often mistake the postcode premium for a tax arbitrage game. The UK’s 2024 overhaul of its Listing Rules slashed related-party voting hurdles and relaxed dual-class share restrictions. Still, early reaction from capital-raising advisers is blunt. Unless the reforms precipitate a step-change in analyst coverage and global capital-pool integration, they will not close the valuation gap with New York. Continental Europe faces a similar cul-de-sac; the long-promised consolidated tape will make price discovery smoother. However, without binding EU-wide enforcement of securities litigation, hedge fund risk budgets will not change. Emerging-market exchanges occupy still shakier ground. Forcing a national champion like MercadoLibre to float locally would thicken domestic order books, but the likely valuation haircut would dilute the pensions that domestic capital regulators aim to protect. The more durable blueprint is regulatory stack-sharing: mutual recognition of stringent home-country standards plus optional Level-II or Level-III ADR programmes that let firms tap global liquidity without uprooting governance.

Beyond Latitude and Longitude: Building an Information Spine

What ultimately commands a valuation premium is an ecosystem that minimises information friction: deep pools of specialised analysts, data vendors that strip and standardise filings in minutes, legal circuits that police insider behaviour, and retirement-fund mandates that channel savings into equities. The headquarters location signals whether that spine exists. Where it does not, investors price a surcharge for ambiguity, precisely the penalty visible in our Buenos Aires curve. Crucially, digital transparency tools have not made the postcode premium obsolete; they have merely turned it from a proxy for distance into a proxy for institutional density. The Victorian market paid extra for the telegraph-enabled comfort of London; the 2020s market pays extra for the API-enabled comfort of US-style disclosure, complete with machine-readable XBRL tags and a Securities and Exchange Commission that sues when numbers go stale.

Headquarters as Algorithm, Not Architecture

Brick-and-mortar headquarters are a relic, but the legal architecture they signify has never mattered more. Economic history, reinforced by modern event studies and live-fire examples such as Arm, shows a surprisingly stable coefficient on the value of who keeps score, irrespective of where the score is made. Corporate boards plotting their next move—and policy-makers eager to court those boards—should treat governance credibility as the core programmable variable. Everything else, from tax rates to marketing spin about national pride, is a derivative instrument. The headquarters decision is neither sentimental nor symbolic; it is a valuation algorithm written in the grammar of disclosure, enforcement, and analyst mind-share. Get that grammar right and the postcode premium accrues naturally, even if the factory floor sits half a world away.

The original article was authored by Gareth Campbell, a Professor of Finance at Queen's University Belfast. The English version of the article, titled "Living la vida loca? Remote investing in Latin America, 1869-1929," was published by CEPR on VoxEU.