Currency Hegemony War Unfolds on the Hong Kong Stage: The Yuan’s ‘Quiet Counterattack’

Input

Changed

China Expands International Settlements and Opens Capital Markets U.S.–China Conflict Expands into the Financial Front China’s Payment Network Expands via Hong Kong Base

In the arena of global finance, dominance is rarely declared with fanfare—it is often accumulated quietly, persistently, and strategically. As the established monetary order built around the U.S. dollar, euro, and Japanese yen begins to reveal its fractures, a new challenger is emerging not with confrontation, but with quiet confidence. The Chinese yuan, long seen as constrained by Beijing’s capital controls and limited convertibility, is now gaining momentum as a viable alternative in the global financial system. And at the epicenter of this subtle transformation is Hong Kong—a former British colony turned financial gateway—where China is staging what some describe as a “silent counteroffensive” in the unfolding war for currency hegemony.

Yuan Use Rises Amid Dollar Fatigue

The shift is not yet revolutionary, but it is unmistakably underway. According to the South China Morning Post, there is a growing international interest in the Chinese yuan, especially from companies in regions like the Middle East. Mary Huen, Chairwoman of the Hong Kong Association of Banks, noted a marked increase in inquiries from overseas firms—Qatar among them—about utilizing the yuan for transactions. She explained that Hong Kong is now well-positioned to offer a full suite of yuan-denominated services: payments, hedging mechanisms, and currency swaps, effectively functioning as a major offshore yuan liquidity pool.

Statistical evidence supports this sentiment. Data from the Society for Worldwide Interbank Financial Telecommunication (SWIFT) shows that the yuan accounted for over 7% of global payment volumes last year—a new record. Although the U.S. dollar continues to dominate with over 80% of transactions, and the euro and yen are seeing declining usage, the yuan stands out as the only major currency with a consistently upward trajectory.

This momentum is largely driven by a convergence of economic trends that have created openings for the yuan. The U.S. has pursued aggressive monetary tightening to combat inflation, weakening market confidence in dollar liquidity. Europe’s economic growth remains sluggish, and Japan persists with its ultra-low interest rate regime, further diminishing faith in traditional safe-haven currencies. In contrast, China has sustained relatively stable monetary policy and developed a robust financial infrastructure, making the yuan more attractive by comparison.

Beijing is capitalizing on this environment with a coordinated push for yuan internationalization. It is pursuing cross-border payment reforms, expanding capital market access, and promoting the use of yuan-denominated financial instruments. These efforts are not merely symbolic—they are functional strategies aimed at embedding the yuan deeper into the global financial fabric.

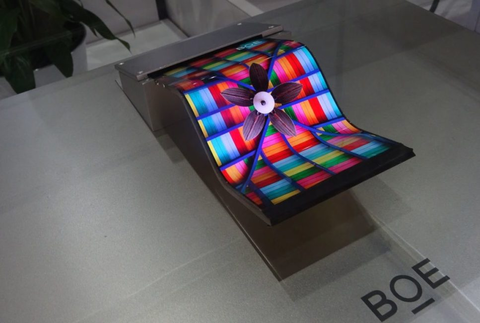

A particularly illustrative example is the Hong Kong listing of CATL, China’s largest battery manufacturer. This initial public offering (IPO) was not just a financial transaction; it was a geopolitical signal. It demonstrated that major Chinese corporations could tap into global capital markets using the yuan, all while operating outside the more tightly controlled financial system of the Chinese mainland. This model—raising funds through a semi-autonomous territory like Hong Kong—simultaneously enables foreign exchange flexibility and encourages wider yuan adoption.

U.S.–China Conflict Enters the Financial Arena

Amid this financial realignment, geopolitical undercurrents continue to intensify. The once-industrial trade war between the U.S. and China is increasingly expanding into the realm of monetary systems and capital markets. After years of tit-for-tat clashes in sectors like semiconductors, artificial intelligence, and telecommunications, both nations are now maneuvering to shape the future of global finance. The stakes are high. For the U.S., the challenge is to defend the primacy of the dollar; for China, it is to carve out space for the yuan as a legitimate rival.

To that end, China has been building strategic resilience. It has opened access to its previously insular bond market, removed longstanding quotas that restricted foreign investment, and reinforced its yuan-based transaction infrastructure. The goal is twofold: attract international capital while reducing dependency on dollar-based mechanisms. Simultaneously, Beijing is testing digital finance tools—most notably the Digital Yuan—as both a domestic modernization initiative and a potential disruptor to U.S.-led financial frameworks like SWIFT.

These moves are about more than economic pragmatism; they reflect a vision of long-term monetary autonomy. By establishing alternative financial pathways and clearing systems, China hopes to insulate itself from U.S. sanctions, such as those previously deployed against Iran and Russia. The yuan’s rise, then, is also a geopolitical insurance policy.

The U.S. has not remained idle. American investors are increasingly reducing their exposure to mainland Chinese assets and even those listed in Hong Kong. The Biden and Trump administrations alike have restricted investment in Chinese technology firms, citing national security concerns. Washington's intensified scrutiny signals an acknowledgement that the financial front is the next battleground—and a recognition that China's monetary ambitions are not to be underestimated.

According to market watchers, the era of financial decoupling is no longer hypothetical. It is happening. What began as a trade and industrial rift has metastasized into a financial disengagement with global implications. As capital flows become weaponized, currencies themselves are becoming instruments of influence and power projection.

“The Full-Scale Clash Will Be in Hong Kong”: China’s Buffer Strategy

Against this tense backdrop, China’s choice of Hong Kong as the beachhead for yuan internationalization appears all the more calculated. While Shanghai is the de facto financial capital of China, its association with stringent state controls has deterred many foreign institutions. Hong Kong, in contrast, offers a unique hybrid identity: Chinese sovereignty paired with British-era legal frameworks and a cosmopolitan business culture. For Beijing, this makes it the perfect “buffer zone”—a place where internationalization can proceed without the direct exposure of the mainland.

The strategy is already being implemented on multiple fronts. China has expanded the Cross-Border Interbank Payment System (CIPS) from Hong Kong, broadened the network of yuan clearing banks, and increased the issuance of yuan-denominated bonds. Major firms like Tencent Music have followed CATL’s lead in raising capital in Hong Kong, reinforcing its role as a conduit for offshore yuan liquidity and capital access.

This method allows China to hedge its ambitions. It facilitates the growth of a yuan-centered financial ecosystem while shielding the mainland from potential retaliation or capital shocks. The model also builds credibility for the yuan as a currency that can function internationally, backed by a semi-autonomous city with established rule-of-law principles and global market integration.

Still, experts caution that the yuan is far from dethroning the dollar. According to Nikkei, the yuan still constitutes only about 3% of global foreign exchange reserves. The international circulation of yuan-denominated bonds remains limited, and financial trust in the yuan continues to be shadowed by perceptions of political risk and convertibility concerns.

Yet, what sets China’s strategy apart is its patience. Analysts describe Beijing’s approach as one of “quiet infiltration,” a methodical campaign that could take decades. Just as the U.S. dollar gradually overtook the British pound in the 20th century, the yuan’s advance may also be generational—but no less real. For now, it may be a “niche currency.” But in the slow churn of history, niche today could mean dominant tomorrow.