Is the Unwinding of the Yen Carry Trade Coming? Soaring Japanese Government Bond Yields Stir Global Market Fears

Input

Changed

Japanese Long-Term Bond Yields Hit Record Highs Across the Board Bank of Japan and Others Reluctant to Buy Bonds Yen Carry Trade Losing Its Appeal

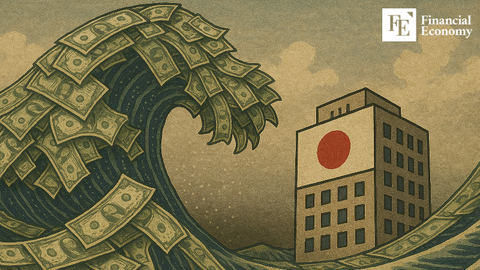

The Japanese financial markets are trembling under the weight of soaring government bond yields, a faltering currency, and eroding investor confidence. At the heart of the unfolding crisis is a decades-old strategy that has quietly underpinned global capital flows—the yen carry trade. Long a cornerstone of international investment, this tactic has relied on Japan’s ultra-low interest rates, allowing investors to borrow cheaply in yen and chase higher returns abroad. But the tide may now be turning.

A growing storm of inflationary pressures, rising debt concerns, and shifts in central bank policy are converging to challenge the fundamentals that once made Japan's bonds and currency symbols of stability. If Japanese government bond (JGB) yields continue their relentless ascent, a full-scale unwinding of yen carry trades could be triggered—one with potentially devastating ripple effects across both the bond and foreign exchange markets.

Japanese Bonds on Shaky Ground

The Japanese bond market is facing a historic test. Yields on long-dated government bonds have spiked dramatically in recent days. As of May 20, the 30-year JGB yield surged to 3.14%, marking its highest level since the instrument was first introduced in 1999. On the same day, the 40-year bond yield climbed to a record-breaking 3.61%, while 20-year bonds jumped by 15 basis points to hit their highest level in 25 years.

The catalyst for this surge was the remarkably poor demand at a 20-year bond auction. The bid-to-cover ratio—a measure of investor appetite—plummeted to 2.5x, the lowest in 13 years. Even more telling was the spread between the average and lowest accepted bid price, which widened to 1.14 yen—an unprecedented gap since 1987. These indicators suggest that once-coveted JGBs are now being coldly avoided, even by domestic institutional players.

The roots of this aversion are complex. For decades, Japan struggled with deflation, but since 2021, consumer prices have climbed steadily. In April 2025, Japan recorded a 3.6% year-on-year increase in its consumer price index—the highest among major economies. This signals not just the end of deflation, but the emergence of a persistent inflationary phase. As inflation expectations climb, bond prices fall and yields rise.

Other concerns compound the pressure. Japan’s staggering national debt—already among the highest in the developed world—is becoming more burdensome. In a politically charged atmosphere, pre-election pledges of tax cuts are raising eyebrows over fiscal responsibility. Meanwhile, the rise in U.S. Treasury yields is drawing capital away from Japanese markets, worsening the outflow.

The Bank of Japan (BOJ), once the market’s most dependable buyer, has scaled back its purchases through a policy of tapering. Since August 2024, the central bank has reduced its quarterly JGB purchases by about USD 2.6 billion. This pullback leaves a vacuum in the bond market—one that private-sector institutions are unwilling to fill. Major domestic investors like life insurance firms are scaling back their bond exposure amid growing volatility driven by the Trump administration’s unpredictable economic policies and a resurgent global tariff war.

As Bloomberg bluntly summarized, Japan’s super-long-term bonds are now facing a de facto “buyer boycott”—an alarming turn of events for a market that has long served as a global financial anchor.

The Fragile Foundations of the Yen Carry Trade

Nowhere is the potential fallout more worrying than in the world of currency speculation. The yen carry trade—valued by Deutsche Bank at USD 20 trillion globally as of 2024—represents an enormous and delicate balancing act. Investors borrow in yen, benefiting from low interest rates, and invest the proceeds in higher-yielding assets abroad. But as Japanese yields rise, this delicate mechanism becomes unprofitable—and dangerous.

The size of this trade is staggering. It amounts to 505% of Japan’s GDP, meaning any mass liquidation would reverberate far beyond Tokyo’s trading desks. Rising JGB yields erode the very foundation of the carry trade. As the interest rate gap between Japan and the U.S. narrows, and the cost of hedging currency exposure climbs, the return on such trades shrinks. If profits vanish, investors will rush to unwind positions, potentially triggering a massive selloff of foreign assets and a spike in global market volatility.

Adding urgency to the situation are shifting BOJ policies. In March 2024, the central bank ended its long-held negative interest rate policy, and by January 2025, raised its benchmark rate to 0.5%—the highest in 17 years. With inflation still running hot, markets anticipate another hike in June or July. Every increase in domestic rates raises the cost of borrowing yen, putting further strain on carry trade margins.

Then there’s the global currency dynamic. The U.S. dollar has weakened significantly, with the Dollar Index falling to 99.05 as of May 23. This decline has been fueled by a toxic mix of policy uncertainty from the Trump administration, spiraling U.S. fiscal deficits, and a downgrade of America’s credit rating by Moody’s. A weaker dollar naturally strengthens the yen, further reducing the profitability of yen-funded investments in dollar assets.

In this environment, the yen is no longer the rock-solid funding currency it once was. JP Morgan recently issued guidance advising clients to exit “long yen, short Swiss franc” positions, citing increasing risk. The Nihon Keizai Shimbun also reported that speculative capital is shifting toward the Swiss franc, a signal that confidence in the yen is wavering. A mass pivot from yen to Swiss franc by global investors would be a powerful sign of deteriorating trust in Japan’s financial stability.

A Looming Market Reckoning

The question now is not whether the yen carry trade is under threat—but how far the damage will go if it collapses. As Japanese yields rise and the yen strengthens, the conditions that once made the carry trade viable are quickly evaporating. A cascade of liquidations could unleash financial volatility far beyond Japan’s shores, destabilizing equity markets, currencies, and debt instruments globally.

Japan's JGB market, once seen as a model of predictability, is revealing its fragility. The fear now gripping global markets is not unfounded. With USD 20 trillion in speculative capital hanging in the balance, even modest shifts in monetary policy, currency valuation, or inflation outlook could set off a chain reaction. The carry trade, long taken for granted as a reliable arbitrage engine, now stands at the edge of a global reckoning—one that could reshape the future of international finance.