NATO Allies Insist Ukraine and Europe Must Be in Peace Talks as Trump Touts Putin Meeting

Input

Changed

As the ongoing conflict between Russia and Ukraine enters yet another tense phase, the diplomatic efforts to bring about peace have become increasingly contentious. NATO allies are insisting that Europe, as well as Ukraine, must be involved in peace talks with Russia to ensure a lasting resolution. However, former President Donald Trump, now making headlines for his upcoming meeting with Russian President Vladimir Putin, seems to have a different vision. He advocates for direct, bilateral negotiations between the U.S. and Russia, sidelining Europe in the process. This has created a significant rift between the U.S. and its European allies, each with distinct interests at play.

The Growing Divide Between the U.S. and Europe

NATO allies have long argued that any peace talks regarding the Ukraine conflict must include European nations. They believe that Europe’s geographical proximity to Russia and its historical ties to the region make it indispensable in negotiations. But Trump’s approach threatens to marginalize Europe’s role, focusing instead on direct discussions between the U.S. and Russia. His approach risks bypassing NATO allies and European leaders, potentially sidelining key concerns related to Ukraine’s sovereignty and the long-term security of Europe.

Trump’s stance aligns with his general "America First" policy, which often emphasized U.S. interests over multilateral cooperation. He sees direct engagement with Russia as a way to secure a quicker resolution without the delays and complexities that could arise from involving European allies in the talks. Trump wants to negotiate a deal with Putin directly, focusing on outcomes that could appeal to American strategic goals.

The U.S.-Russia Bilateral Approach: A Dangerous Shortcut?

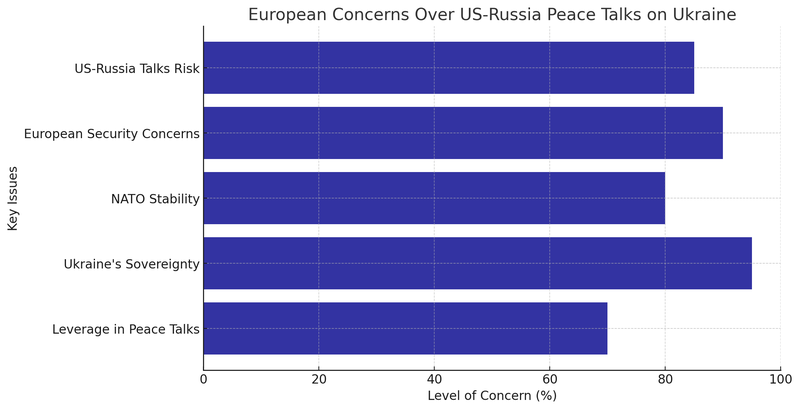

The prospect of the United States engaging in direct peace talks with Russia over the war in Ukraine—without the involvement of European allies—has sparked alarm across the continent. European leaders have expressed growing concerns that such an approach could sideline their influence and weaken the long-term stability of the region.

Former U.S. President Donald Trump, who has suggested that he could broker an end to the war quickly through direct negotiations with Russian President Vladimir Putin, is drawing skepticism from European policymakers. They fear that a settlement reached without European involvement could lead to territorial concessions that compromise Ukraine’s sovereignty and further destabilize Europe’s security landscape.

European nations view the ongoing war not just as a regional issue but as a direct threat to the stability of the continent. If the U.S. were to strike a deal with Russia that allows significant territorial compromises, it could create lasting instability and embolden Moscow to exert greater influence over its neighboring states.

Analysts argue that Trump’s approach reflects a broader pattern in his foreign policy—one that prioritizes rapid deals that serve immediate U.S. interests while downplaying the strategic concerns of allies. The United States has historically been the dominant force in NATO, but in recent decades, Europe has asserted itself more forcefully in matters of security and diplomacy.

By pursuing direct U.S.-Russia talks, Trump risks undermining NATO’s cohesion and weakening the collective influence of Western allies. European officials emphasize that their nations have been at the forefront of supporting Ukraine—both militarily and financially—making their exclusion from peace negotiations particularly troubling.

Many European leaders also worry that Trump’s personal relationship with Putin could lead to concessions that favor Moscow at the expense of Ukraine and Europe. Past interactions between the two leaders have raised concerns about Trump’s willingness to challenge Russian aggression, leading to fears that a rushed deal could leave Ukraine in a vulnerable position.

The exclusion of Europe from peace talks would have profound consequences for the continent’s security architecture. NATO members such as Poland and the Baltic states—who see Russian aggression as an existential threat—are particularly wary of any settlement that does not account for their security concerns.

One of the major risks is that a U.S.-Russia deal could prioritize ending hostilities without ensuring long-term stability. If European leaders are not at the table, any agreement could overlook critical aspects of security policy, such as ensuring NATO’s continued presence in Eastern Europe and deterring future Russian aggression.

Additionally, Ukraine itself could be forced into a position where its sovereignty is compromised. European nations have been among Ukraine’s most steadfast supporters, supplying weapons, financial aid, and humanitarian assistance. A settlement that is imposed without their input could undermine Kyiv’s ability to recover and defend itself in the future.

While NATO allies insist that Europe must be part of any peace process, questions remain about whether European nations have the leverage to influence the outcome. The United States has long held the most sway in security negotiations, and some analysts argue that European countries may struggle to assert themselves if Washington moves forward with a unilateral approach.

At the same time, European leaders are making efforts to push back against any deal that does not include their participation. They argue that Europe’s strategic future is too closely tied to the outcome of the war in Ukraine to be treated as a secondary concern.

The ongoing debate over peace talks is testing the resilience of NATO and transatlantic cooperation. European officials maintain that a united front is essential for ensuring a lasting peace, rather than a short-term settlement that could embolden Russia to pursue further territorial ambitions.

The future of U.S.-European relations may also be at stake. If Washington moves ahead with direct talks that disregard European concerns, it could create lasting fractures within NATO and force European nations to reconsider their defense strategies independent of U.S. leadership.

Ultimately, the outcome of this diplomatic standoff will shape not only Ukraine’s future but also the broader security order in Europe. Whether European leaders can secure a seat at the negotiating table may determine the long-term balance of power in the region.