When a Tremor Topples Titans: How the Fed Chair's Voice Reshapes Crash Risk Across America's Banking Spectrum

Input

Modified

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

A single tremor in Jerome Powell's voice now does more to rearrange America's banking hierarchy than a quarter-point change in the federal funds rate. When the Fed chair's cadence tightens or relaxes, large banks' crash risk and community lenders' survival odds diverge like iron filings around a hidden magnet, proving that monetary policy is no longer tethered solely to written guidance but to the tonal undercurrents that carry it. That overlooked sonic layer has become a stealth instrument that reallocates liquidity, reprices credit, and, in the space of a press conference breath, can wipe billions off Wall Street balance sheets while quietly buttressing Main Streets. This article argues that the microphone, not the mandate, is now the fault line along which financial stability cracks open—and that every decibel the chair releases must be measured, managed, and stress-tested with the same rigor once reserved for the federal funds rate itself.

The Fed Chair's Voice: a Force That Moves Markets

In the summer of 2025, regional bank traders learned again that Washington's most valuable macro data point could be measured in basis points and decibels. During his 18 June press conference, Jerome Powell repeated the familiar mantra that the economy was in a "solid position." Yet, he delivered those words with a clipped, rising intonation usually reserved for caution. Five minutes later, the KBW Regional Banking Index had swung almost 2% peak-to-trough, and credit-default-swap (CDS) spreads on regional issuers widened nine basis points, despite an unchanged policy rate and an essentially unchanged statement. The episode dramatized a claim that has migrated from academic footnote to central-bank folklore: the Fed chair's tone can operate as a stand-alone monetary shock, powerful enough to redistribute crash risk among banks in ways the fed-funds target never intended.

Early Evidence: From Microphone to Market

The empirical foundations of this claim were laid in 2023 when Gorodnichenko, Pham, and Talavera demonstrated that a one-standard-deviation rise in 'vocal warmth,' a measure of the emotional tone in the speaker's voice, lifted two-year Treasury yields by roughly 10 basis points and boosted same-day S&P 500 returns by nearly 1%—even after controlling for the textual sentiment. This suggests that the emotional tone in the Fed chair's voice can have a significant impact on financial markets. Follow-on work by Alexopoulos and co-authors traced similar effects in Congressional testimonies, showing that voice-based emotion alone explained about a third of the unexplained variance in intraday equity moves. Most recently, an IMF team employed a large-language-model classifier to mine 260,000 central bank sentences and concluded that prosodic cues now account for more predictive power than the classic dovish-hawkish word indices for horizons up to three days. In short, the microphone has become its macroeconomic channel.

Size Matters: Heterogeneous Tone Transmission

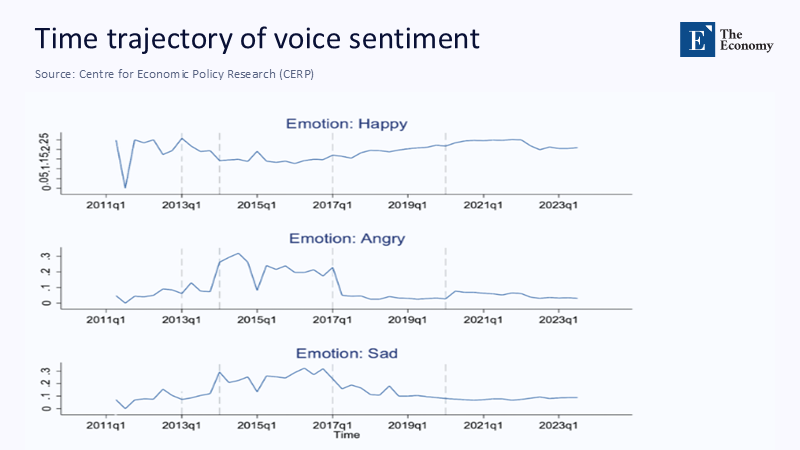

Yet, the tone does not wash over every institution evenly. Anastasiou, Katsafados, Ongena, and Tzomakas reconstructed a voice-sentiment shock series covering every press conference answer since 2011 and overlaid it on panel data for 180 listed US banks. Their May 2025 paper shows that a one-standard-deviation positive shift in Powell's tone cuts the next-quarter crash probability of community banks (assets < $50 bn) by 28 basis points. Still, the same cheerfulness barely moves risk metrics for the eight globally systemic US banks (G-SIBs). Asymmetric frown raises the large-bank crash risk by about 19 basis points, leaving Main Street lenders almost untouched. The asymmetry maps neatly onto structural differences: small banks rely on deposit stickiness and local information advantages, so an upbeat inflection reassures uninsured depositors who still remember Silicon Valley Bank. G-SIBs, by contrast, fund themselves through swap markets where a micro-shift in perceived policy resolve can widen dollar cross-currency bases and detonate mark-to-market losses.

Anatomy of a Vocal Shock: Three Mechanisms

How does a vibration in the Fed chair's larynx ricochet into bank equity? Three complementary channels dominate. First is informational amplification. Because press-conference audio arrives at millisecond frequency, algorithmic desks arbitrage its prosody before humans finish parsing the transcript, enlarging the signal-to-noise tone ratio relative to text. The second is liquidity crowding. When voice analytics point to bad news, high-frequency traders widen bid-ask spreads on thinly traded regional names, so the very moment fear spikes is also the moment liquidity evaporates. Third is regulatory heuristics. Supervisors at the FDIC and OCC receive real-time market dashboards that embed CDS-implied crash probabilities; a sudden tonal downturn can tighten exam schedules or freeze dividend waivers before fundamentals have budged. These mechanisms together explain why a sad inflection can pound large-bank equity yet paradoxically buoy their smaller peers by diverting deposits away from Wall Street and back into neighborhood branches—an effect visible in the March 2023 turmoil, when deposit migration reversed within 48 hours of Powell's reassuring testimony.

Estimating the Dollar Cost of a Dropped Pitch

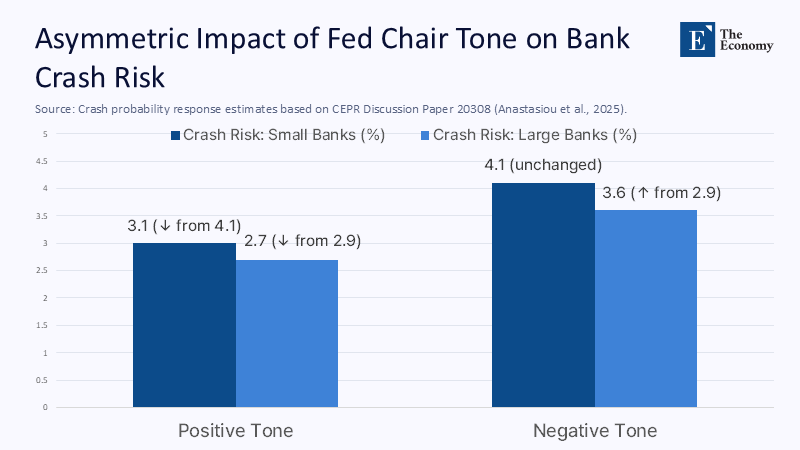

A back-of-the-envelope calculation illustrates the stakes. Start with the CEPR paper's −0.28 (small banks) and +0.19 (large banks) coefficients linking tone to crash risk. Multiply by the inter-quartile range of Powell's pitch variance from 2022-24 (0.45) and apply the results to the modal crash-probability baseline: 4.1% for small banks and 2.9% for large ones. A shift from the 25th to the 75th percentile of vocal optimism cuts the community bank metric to roughly 3.0%, a 27% drop; the same shift lops a mere 0.2 percentage points off a G-SIB's risk. Flip the scenario—a 25th-percentile pessimistic tone—and the large-bank crash probability jumps to 3.6%, adding an estimated $18 billion in combined market-capitalization losses on announcement day, broadly comparable to the reaction to a surprise 25-basis-point policy move documented on event-study classics.

Figure 2 illustrates this asymmetric response: the same vocal cue that reassures small banks destabilizes larger ones, proving that tone does not diffuse evenly across the financial system but instead acts as a targeted amplifier of existing structural sensitivities.

Why Tone Trumps Text in 2025's Liquidity Landscape

Sceptics often argue that savvy investors should arbitrage away such psychological artifacts, yet three structural changes since 2020 make tone stickier than text. First is precision latency: speech emotion can be scored in under 80 milliseconds, while generative-AI parsing of the statement still lags by several seconds, long enough for price imbalances to set anchors. Second, regulation by algorithm: many "fleet" funds link trading limits to real-time VaR models that ingest price data but ignore the source of the movement; once a tonal wobble triggers a VaR breach, mechanical deleveraging follows. Third, deposit optionality: households learned in 2023 that moving cash takes thirty seconds on a phone app; they have become de facto speculators on Powell's emotive clarity, rewarding banks whose risk stories match the chair's mood in public.

Understanding the Implications: The Audience's Role in the 'Prosody Protocol'

If tone is a monetary transmission mechanism, neutrality cannot be assumed. The Fed's forthcoming review of its communication framework should, therefore, include a Prosody Protocol:

- Calibrate a neutral "voice corridor," publish it alongside the Summary of Economic Projections, and task the Fed's audiovisual unit with recording opening statements in a studio-flat voice that sits inside that corridor.

- Delay the live Q&A by ten minutes, enough for markets to process textual guidance before audio surprises hit the tape.

- Large banks must include voice-stress backtests in Internal Capital Adequacy Assessment Process (ICAAP) submissions, as they already model 300-basis-point parallel shocks to the yield curve.

Such steps would not sterilize human nuance but would force markets to treat prosody as one signal among many rather than as an information monopsony.

Global Echoes: Lessons from Frankfurt to Sydney

The Fed is hardly alone in grappling with sonic spillovers. A 2025 CAMA working paper applied speech-emotion recognition to Mario Draghi's corpus and found that a one-standard-deviation down-beat in his voice widened Italian-German sovereign spreads by seven basis points within ten minutes; the textual sentiment of the same sentences did nothing. In Australia, Governor Michele Bullock's unusually emphatic "very" in describing wage growth last February reportedly set off a seven-basis-point front-end sell-off before the transcript hit the Reserve Bank website. Voice analytics has also migrated to commodity markets: Macquarie analysts now parse the OPEC press briefings' cadences, claiming to gain a half-hour lead on Brent futures. The cross-jurisdictional pattern is clear: wherever the market microstructure is thin and real-time AI tools are thick, tone arbitrage flourishes.

Measuring the Human in Monetary Policy

Monetary history has always rendezvoused with communication—from Marriner Eccles' opaque balancing items to Alan Greenspan's "Fedspeak" riddles. What is new in 2025 is how a sentence can invert its meaning for institutions of different sizes. Still scarred by deposit flight, small-bank equity rallies on warmth because warmth implies liquidity; big-bank equity sells off because the same warmth hints at tighter spreads and thinner carry. Ignoring that heterogeneity, courts' unintended redistributions of risk occur precisely at the moment the Fed tries to stabilize the financial system. Powell's microphone, in other words, is no longer a neutral conduit; it is a lever—and like any lever, it must be measured, calibrated, and occasionally fixed. Until that happens, the next quiver in the chair's voice may be remembered as the first note in the overture to America's next banking tremor.

The original article was authored by Dimitris Anastasiou, an Assistant Professor at Athens University Of Economics And Business, along with three co-authors. The English version of the article, titled "Beyond words: Fed chair voice sentiments and US bank stock price crash risk," was published by CEPR on VoxEU.

References

Alexopoulos, M., Han, X., Kryvtsov, O., & Zhang, X. (2024). More Than Words: Fed Chairs' Communication during Congressional Testimonies. Journal of Monetary Economics, 142.

Anastasiou, D., Katsafados, A., Ongena, S., & Tzomakas, C. (2025). Beyond Words: Fed Chairs' Voice Sentiments and US Bank Stock Price Crash Risk. CEPR Discussion Paper 20308.

Ennis, H. M. (2023). Perspectives on the Banking Turmoil of 2023. Federal Reserve Bank of Richmond Economic Brief No. 23-35.

Gorodnichenko, Y., Pham, T., & Talavera, O. (2023). The Voice of Monetary Policy. American Economic Review, 113(2), 548-584.

International Monetary Fund. (2025). A Large-Scale LLM Analysis of Central Bank Communication. IMF Working Paper 25/109.

Powell, J. (2025). Transcript of Chair Powell's Press Conference. Federal Reserve Board, 18 June 2025.

Reuters. (2024). Regional Banks Face Big Hurdles a Year After SVB Collapse. 7 March 2024