Turning Hedging into Architecture: ASEAN’s Four-B Blueprint for Survival in the Trump 2.0 Era

Input

Modified

This article was independently developed by The Economy editorial team and draws on original analysis published by East Asia Forum. The content has been substantially rewritten, expanded, and reframed for broader context and relevance. All views expressed are solely those of the author and do not represent the official position of East Asia Forum or its contributors.

Sometimes, the most radical thing a small state can do is refuse to choose. That single act of defiance-through-nuance underpins the Association of Southeast Asian Nations’ latest metamorphosis: a sophisticated, data-anchored hedge that no longer tiptoes between Beijing and Washington but instead weaves four mutually reinforcing threads—Blunting, Broadening, Boosting, and Binding—into a policy fabric thick enough to cushion any great-power whiplash. The transformation is not just happening; it's being strategically executed in real-time; fixating on an outdated 2017-era photograph of a former Korean president, as one recent column inadvertently did, only obscures how far the region has moved since the photo was taken.

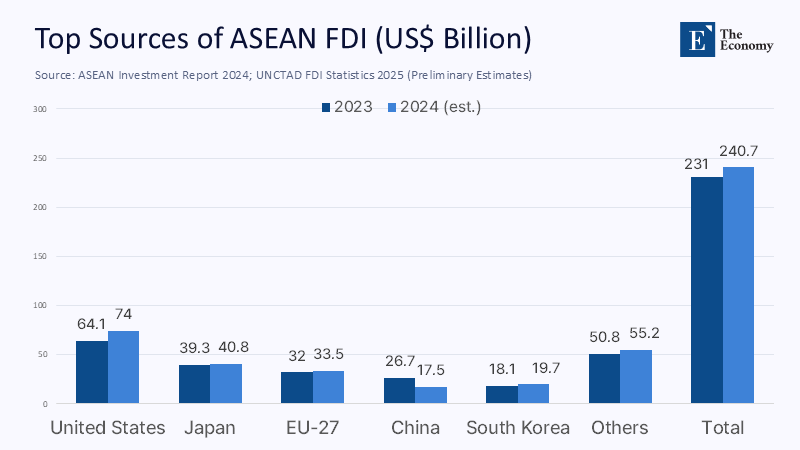

A Portfolio Mind-set in a Binary World

Hedging once implied hesitant non-alignment; today, it resembles portfolio theory writ large. ASEAN now treats geopolitical risk like investors treat market volatility—by diversifying across time horizons, asset classes, and counterparties. The numbers are telling. Foreign direct investment inflows reached a record US$234 billion in 2023 and are on pace for a further rise in 2024 despite a 1.8% slide in global FDI; critically, the United States displaced China as the single-largest source of those inflows, delivering US$74 billion, or 32% of the total, while China fell to fourth place with a 7.5% share. That redistribution was not accidental; it reflects conscious and meticulous policy tweaks—from negative-list investment schedules to expedited golden visas—that widen the funnel for capital not tied to one hegemon. In parallel, intra-ASEAN trade reclaimed the top slot at 21.5% of total merchandise exchange, edging out China’s 19.8% share for the first time since 2019. In other words, the bloc is insulating itself through redundancy, much like a supply-chain manager who refuses to depend on a single factory in a flood-prone valley.

Blunting: Raising the Cost of Coercion Without Waving a Flag

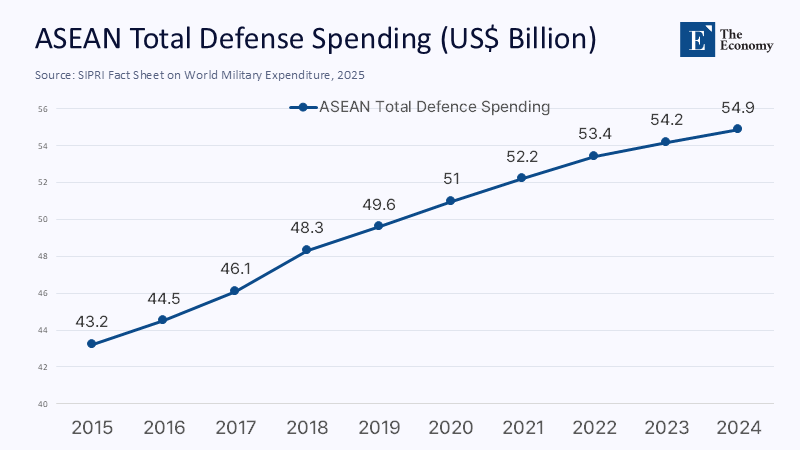

The first “B” is about friction, not firepower. Regional defense spending climbed to an estimated US$55 billion in 2024—up 27% in a decade—and the growth is concentrated in coastal radars, mobile anti-ship batteries, and small-tonnage naval craft rather than carrier groups. This is deterrence by inconvenience: the Philippines now live-streams every resupply run to Second Thomas Shoal via commercial satellites, depriving Beijing of deniable harassment; Indonesia fast-tracks rare-earth mining permits in Kalimantan to ensure that any embargo on Chinese processed minerals can be offset within the region; Vietnam has quietly fielded a third regiment of shore-based K-300P Bastion missiles, each able to hold Chinese coast-guard cutters at risk inside the nine-dash line.

These moves share three attributes—low visibility, modest cost, and high agility—offering Manila, Jakarta, and Hanoi the ability to gum up gray-zone tactics without triggering the mutual-defence clauses Washington may not always honor under a transactional Trump 2.0 administration.

Broadening: Turning Multipolarism Into Bargaining Power

If blunting is tactical, broadening is strategic. By late 2024, ASEAN had concluded 27 new trade or investment agreements in just five years, double the pace of the previous decade. The bloc’s revived free-trade talks with Canada and strengthened semiconductor MoUs with the Netherlands, Japan, and Saudi Arabia illustrate an outward swing that reduces China’s veto power over critical inputs. The economic impact is already visible: China’s share of ASEAN trade slipped to 19.8% in 2023, while U.S. trade edged up to 11.2% and EU trade to 7.9%, a rebalancing that gives Southeast Asian negotiators multiple exit ramps should a single partner politicize commerce. Crucially, the new deals are granular—covering digital logistics corridors, mutual recognition of halal certification, and even carbon-credit fungibility—ensuring that the macro numbers rest on legally binding micro-mechanisms. In effect, ASEAN is converting diplomatic optionality into enforceable contracts, thus converting uncertainty into leverage.

Boosting: Building Endogenous Shock Absorbers

The third plank looks inward. Nearly US$74 billion of the recent FDI wave flowed into renewable energy and advanced manufacturing, including a booming battery corridor in Sulawesi and a chip-design park in Penang. Singapore’s SkillsFuture program now offers mid-career Singaporeans a S$4,000 credit top-up usable for quantum-engineering courses co-taught by the National University of Singapore and IBM, effectively deepening a domestic talent pool that foreign suppliers cannot weaponize. Thailand’s Eastern Economic Corridor 2.0 benchmarks dual-use drone standards against EU regulations. At the same time, the Philippines’ Maharlika Investment Fund earmarks 20% for Indigenous signal-processing start-ups linked to the defense sector. These initiatives matter because they reduce single-supplier dependencies. When China imposed cadmium inspections that stalled Vietnamese durian shipments in early 2025, Hanoi’s economy barely blinked, buoyed by rising fruit exports to India and the Gulf secured through earlier broadening pacts. Boosting, then, is self-insurance—each new skill certificate or supply-chain node functions like an extra shock absorber on a rough geopolitical road.

Binding: The Subtle Art of Norm Entrapment

Binding is the chess player’s move to make every square on the board costly for an adversary to occupy. ASEAN negotiators insist that the long-delayed South China Sea Code of Conduct (COC) include a dispute-settlement mechanism referencing UNCLOS Annex VII—the same legal plank on which Manila won its 2016 arbitral victory. Beijing’s diplomats object, yet their acquiescence to similar enforcement provisions in the upgraded ASEAN–China Free-Trade Area (ACFTA 3.0), whose negotiations reached a “substantial conclusion” in May 2025, weakens their case.

Meanwhile, Jakarta shepherds a Digital Economy Framework Agreement (DEFA) that sets regional baselines for data privacy and cross-border e-payments; China wants in, but entry requires meeting standards that could later be invoked in cyber-incursion disputes. The genius of binding lies in cumulative irreversibility: every time Beijing signs a new clause—even a technical one on e-invoicing—ASEAN lawyers acquire a future lever to contest coercion. Like a spider continuing to spin rather than waiting for a single decisive thread, the region is turning soft law into a hard strategic asset.

Tracking the Payoff: Three Empirical Dashboards

The four Bs are no longer slogans; they are quantifiable variables on what might be called an “ASEAN Hedge Dashboard.” Capital Stickiness—the share of green-field investment—rose from 28% in 2018 to 34% in 2024, locking factories, training centers, and supply contracts onto Southeast Asian soil. Supply-chain redundancy is visible in the semiconductor sector: the region now hosts 16 of the world’s 25 highest-volume back-end plants, lured by Dutch lithography expertise and Japanese quality-control protocols that demand multi-site sourcing. Security Interoperability completes the triangle: ASEAN armed forces have concluded 68 cross-service logistics or radar-data agreements with partners other than China and the United States in just five years, from India’s “Mausam” naval drills to Australia’s under-sea sensor grid. Each metric pushes the region closer to a “safety-net equilibrium” where no single pressure point can paralyze the entire bloc.

Optics versus Substance: Why the Photo Still Matters

Critics might dismiss the fuss over an obsolete photo of a Korean president as trivial. Yet symbolism shapes agenda-setting. Using a 2017 image in a 2025 story on hedging signals unintentional inertia, conjuring a bygone era when the choice appeared binary and great-power dynamics seemed frozen. In reality, ASEAN has moved from tightrope walking to net weaving, from reactive posture to proactive architecture. Updating the imagery is not cosmetic; it is editorial honesty, an acknowledgment that Southeast Asia is mapping its future instead of starring as a prop in someone else’s drama.

A Teaching Moment for Policy Schools

For educators, the Four-B framework offers an overdue antidote to the still-common binary of “balancing versus bandwagoning.” Case simulations can now assign students to design a Blunting package (budgeting for coastal missile batteries under fiscal ceilings), draft a Broadening mini-lateral (India–ASEAN green-hydrogen corridor), or negotiate a Binding clause (digital-trade dispute panel). The pedagogical dividends are substantial: students learn to quantify risk, model second-order effects, and appreciate how norms are forged incrementally, not proclaimed. In doing so, curricula align with Alfred Gerstl’s argument that hedging has matured into a grand strategy in its own right rather than a way station toward alignment.

Quiet Radicalism as Regional Doctrine

ASEAN’s emergent hedge is radical precisely because it claims no headline-grabbing radicalism. By blending Blunting’s friction, broadening’s redundancy, Boosting’s self-reliance, and Binding’s juridical glue, Southeast Asian states are crafting a distributed deterrent that does not rely on the constancy of any external patron—an essential adaptation in an era when U.S. leadership may oscillate between multilateralism and mercantilism every four years. The lesson extends beyond the Indo-Pacific: small and middle powers can still enlarge their freedom of maneuver when systemic shocks proliferate, provided they treat strategy as a portfolio rather than a pledge. Those who doubt the model should stop looking at yesterday’s photos and start reading today’s data—the safety net is already there, and every month, it knots another thread.

The original article was authored by Hunter Marston, who has a PhD in International Relations from the Coral Bell School of Asia Pacific Affairs, The Australian National University. The English version, titled "Southeast Asia deepens hedging amid Trump 2.0 turbulence," was published by East Asia Forum.

References

ASEAN Secretariat. ASEAN Economic Integration Brief, No. 16, December 2024.

ASEAN Secretariat & UNCTAD. ASEAN Investment Report 2024, October 2024.

East Asia Forum. Marston, H. “Southeast Asia deepens hedging amid Trump 2.0 turbulence,” 18 June 2025.

Georgetown Journal of International Affairs. Gerstl, A. “Southeast Asia’s Grand Strategy: Hedging,” 12 August 2024.

International Institute for Strategic Studies. SIPRI Fact Sheet: Trends in World Military Expenditure, 2024, April 2025.

ISEAS-Yusof Ishak Institute. Lin, J. & Pou, S. “The Elusive Code: Why ASEAN Needs a New Playbook for the South China Sea,” ISEAS Perspective 2025/39, April 2025.

Ministry of Education, Singapore. “Enhancing Support for Mid-Career Individuals under the SkillsFuture Level-Up Programme,” Press Release, 6 March 2025.

Reuters. “China and ASEAN complete negotiations on upgraded Free-Trade Area 3.0,” 21 May 2025.

World Economic Forum. Elsig, M. “Implementation Options for ASEAN’s Digital Economy Framework Agreement,” 23 April 2025.