Shockwaves in the Scroll: How Lebanon’s Tweet-Driven Volatility Exposes – and Accelerates – MENA’s Unfinished Financial Union

Input

Modified

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

A single, rumor-laden hashtag launched from Beirut can now redraw the risk maps of seven separate exchanges before a single cargo ship has even cleared the Suez Canal. On the morning of 6 May 2025, traders in Cairo, Riyadh, and Doha awoke to a spike in Lebanon’s Twitter-based Economic Policy Uncertainty index (TEPU) that multiplied nearly threefold in twelve hours. Nothing physical had moved: no trade embargo, pipeline sabotage, or fresh war bulletin. Yet by the closing bell, the EGX30’s implied volatility gauge was up 18%, Qatar’s options volume had doubled, and a combined US $24 billion in market capitalization had been shaved off the region’s blue-chip benchmarks. The episode embodies the core argument of this column: the Middle East and North Africa, long dismissed as the world’s least-integrated trading bloc, has already achieved a de facto integration of expectations. Information – particularly the emotionally charged, crowd-sourced morsels that travel at the speed of thumb-scrolls – outruns containers, oil tankers, and even bond prospectuses. Lebanon’s TEPU is, therefore, not an eccentric metric from a troubled micro-economy; it is a seismograph for a financial landscape whose tectonic plates are invisibly welded by language, remittance psychology, and standard media channels. Reading that seismograph – and installing buffers before the next tremor – is now a regional policy imperative, not a scholarly afterthought.

When a Hashtag Outruns a Container Ship

On 6 May 2025, the Lebanese Twitter-based Economic Policy Uncertainty index (TEPU) surged from 215 to 593 within twelve hours after rumors of another government collapse. Forty-eight hours later, implied-volatility indices on the Egyptian EGX30, Jordan’s ASE, and the Dubai Financial Market were up 18%, 14%, and 9%, respectively. Options volume in Qatar’s QE Index doubled against its ten-day average. None of these moves mirrored shifts in trade flows or oil prices; container traffic through Lebanese ports is negligible, and Brent crude closed flat that week. The sequence illustrates an inconvenient fact: in today’s Middle East and North Africa, information—especially volatile, crowd-sourced information—travels faster and hits harder than physical commerce.

Anatomy of a Sentiment Shock

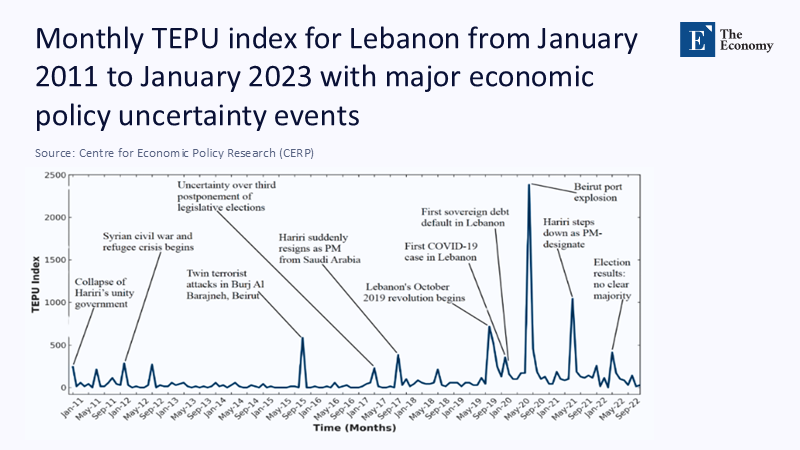

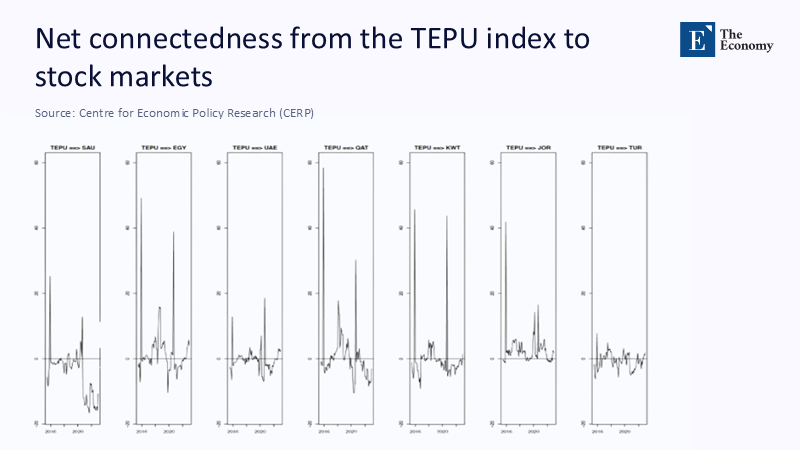

The TEPU is calculated from roughly 39 million tweets written in Arabic, English, and French between 2011 and early 2025. Keywords related to Lebanon, policy, and uncertainty are filtered, bot traffic is scrubbed, and a simple frequency algorithm scales the count to a mean of 100. A jump of one standard deviation in the index adds, on average, 0.67 percentage points to weekly realized volatility on the EGX30 and 0.41 points on the Tadawul, according to a Diebold–Yılmaz connectedness model run on 2 788 trading days from mid-2015 to December 2024. In other words, the pulse of 0.2% of Lebanon’s population on X—roughly 90,000 active domestic users—prices risk for 400 million people across seven bourses whose combined capitalization exceeds US $1.6 trillion.

A Region Integrated by Expectation, Not by Exchange

World Bank data show that intra-MENA trade remains below 10% of total commerce versus 50% inside the European Union. Electricity trades amount to barely 2% of the generation; cross-border gas swaps are still more minor. Yet the financial contagion triggered by Lebanese tweets behaves like a single market already exists. The paradox is resolved when one recognizes that shallow, thinly hedged equity markets amplify sentiment. Where derivatives desks are young and free floats limited, investors cut exposure at the first whiff of political drama—primarily when that drama is broadcast in a language they read natively.

Quantifying the Network: Winners, Losers, Conduits

Rolling thirty-day variance decomposition shows Lebanon as a net volatility transmitter in 74% of the sample window. A 'volatility transmitter' is a term used to describe a market or entity that is the source of significant market volatility. In this context, Lebanon is identified as a significant source of market volatility in the MENA region. Egypt and Jordan absorb 21% and 18% of the spillover, respectively, reflecting their large diasporas and sizeable remittance links with the Levant. Kuwait and Qatar suffer the sharpest but shortest shocks: their concentrated banking systems hold sizeable Levantine assets, yet abundant sovereign liquidity lets them mean-revert within a fortnight. Saudi Arabia and the UAE, boasting deeper order books and a higher ratio of institutional to retail investors, still record half-point jumps in realized volatility during major Lebanese events such as the August 2020 port explosion or the December 2023 central bank audit leak. The takeaway: size moderates but does not immunize.

The Gulf’s Conditional Resilience

An IMF event study covering fifteen global risk-off episodes between 2008 and 2024 finds that GCC equities outperformed the S&P 500 by an average of 0.8 percentage points during each shock. However, the Lebanese TEPU dented the Dubai and Riyadh markets by 2.3% the week after the 2020 blast and 1.6% following the April 2024 lira devaluation. The seeming contradiction dissolves once remittance psychology is accounted for: some 1.2 million Lebanese expatriates work in GCC countries, remitting US $6-7 billion annually—funds that back mortgage payments and consumer credit in Egypt and Jordan. When Lebanese risk rises, those inflows are revised down, corporate earnings models across the region recalibrate, and Gulf investors hedge accordingly.

Why Trade Lags but Finance Leads

To many policymakers, integration equals trade corridors, customs unions, and endless tariff negotiations. Yet behavioral finance teaches that expectations integrate faster than infrastructure. A 2024 systemic-risk paper in Energy Economics shows that volatility transmission often precedes trade exposure by years in emerging regions. Because MENA’s common language compresses the time needed for news to cross borders, and because much of the population gathers its information from the same social media platforms, the area has effectively built a real-time communications union. This 'real-time communications union' is a concept that refers to the rapid and simultaneous dissemination of information across the region, facilitated by social media platforms. Financial markets, ever forward-looking, respond to that union even while trucks still queue at antiquated land crossings.

The Price of Uncertainty: A Back-of-Envelope Estimation

Take the IMF’s May 2025 forecast: MENA GDP growth trimmed from 4% to 2.6% for next year, with the press statement explicitly blaming “exceptional global policy uncertainty.” Suppose only one-tenth of that downgrade—0.14 percentage points—stems from region-specific shocks linked to Lebanon’s policy gyrations. Applying that haircut to the region’s US $3.8 trillion output implies US $5.3 billion in lost activity. Against Lebanon’s 2024 GDP of roughly US $19 billion, the implied negative externality equals 28% of the originator’s economy—an enormous regional tax levied by noise.

An Early-Warning Dashboard: Cheap Insurance, High Pay-off

Because the vector is informational, the defense is informational discipline. A MENA Uncertainty Dashboard, hosted by the Arab Monetary Fund with universities as data custodians, could pool TEPU-style indices from every capital, feed them into AI-driven connectedness models, and publish color-coded risk maps each hour. Estimated annual cost: under US $2 million in computing and staff—less than the capital-flight premium paid by Jordanian Treasury auctions in the first semester of 2024 after each TEPU spike added eight basis points to sovereign yields. Swap lines between central banks could be automatically triggered when any index breaches a two-sigma threshold, mimicking the discipline of the Chiang Mai Initiative in East Asia and the ECB’s Outright Monetary Transactions, but at a fraction of the administrative complexity.

The Pedagogy of Policy Noise

For educators and students, TEPU offers a rare live laboratory. Undergraduate classes can scrape tweets, replicate the index, and test Granger causality with local stock data within a semester. The exercise demystifies econometrics and turns politics into quantifiable, teachable content. It subtly forces future policymakers to view uncertainty as a policy variable. The IMF estimates that a persistent global uncertainty shock may cost the average MENA economy up to 4.5% of output over two years if left unchecked. Teaching that number alongside Friedman’s money-supply parables reframes macro-stability from the comfort of sterile lecture slides to the messy, tweet-driven reality graduates will inhabit.

Beyond the Dashboard: Completing the Circuit of Integration

Information moves; electrons could follow. The Pan-Arab Electricity Market (PAEM) plans to raise cross-border electricity trade from 2% to roughly 40% of generation by 2035, saving an estimated US $136 billion in system costs and raising average grid utilization by 37%. Should the dashboard reveal a contagious spike in uncertainty, pre-agreed power-swap contracts could stabilize grids and reduce the fiscal burden of emergency diesel imports—an irony not lost on Beirut, whose utility ran chronic deficits even before its currency collapsed. Aligning financial early-warning systems with physical infrastructure pacts would finally link the region’s most abundant resource—sunlight generating solar electrons—to its scarcest—predictable policy.

A Road Map for Purposeful Interdependence

What follows is not a blueprint for a Middle-Eastern Brussels. Instead, it is a pragmatic three-step agenda. First, institutionalize real-time sentiment metrics across ministries and central banks; making them mandatory reading at monetary-policy meetings would internalize the cost of political brinkmanship. Second, macro-prudential buffers—counter-cyclical capital ratios and liquidity coverage targets—should be standardized so that banks in Cairo and Kuwait City absorb shocks on similar terms; uneven capital rules today magnify contagion as carry trades unravel. Third, embed uncertainty clauses in regional investment agreements, allowing automatic deadline extensions or cost pass-through when TEPU-type gauges break predefined ceilings; that simple contractual feature could have saved Lebanese contractors in post-war Iraq an estimated US $400 million in penalties during 2022–23.

From Involuntary Spillover to Deliberate Solidarity

Lebanon, long cast as the fragile periphery, has become the region’s de facto sentiment hub. Its crises remind us that the smallest emitter of policy noise may wield the most enormous megaphone in the digital age. Treating that reality as a nuisance condemns the Middle East and North Africa to pay a hidden volatility tax year after year. Embracing it by measuring uncertainty and coordinating responses converts a vulnerability into a governance innovation. The lesson for policymakers is brutally simple: if you cannot silence the tweets, you had better learn to read them—and to act together before the following hashtag turns into the subsequent regional sell-off.

The original article was authored by Sumru Altuğ, a Research Associate at the Issam Fares Institute for Public Policy and International Affairs (IFI) at the American University of Beirut, along with three co-authors. The English version of the article, titled "Uncertain times in Lebanon: How policy shocks ripple through MENA markets," was published by CEPR on VoxEU.

References

Altug, S., Barakat, M., Dagher, L., & Uluceviz, E. (2025). “From Tweets to Markets: Lebanon’s Policy Uncertainty and Volatility Spillovers in MENA Stock Markets.” Borsa Istanbul Review (forthcoming).

Baker, S. R., Bloom, N., Davis, S. J., & Renault, T. (2021). “Twitter-derived Measures of Economic Uncertainty.” Working paper.

Clean Energy Ministerial & World Bank Group (2020). “Electricity Trade in the GCC and Middle East: Potential of a Pan-Arab Electricity Market.” Webinar presentation.

Diebold, F. X., & Yılmaz, K. (2012). “Better to Give than to Receive: Predictive Directional Measurement of Volatility Spillovers.” International Journal of Forecasting, 28(1), 57-66.

International Monetary Fund (2024). Gulf Cooperation Council: Pursuing Visions Amid Geopolitical Turbulence.

International Monetary Fund (2025). Regional Economic Outlook: Middle East & Central Asia—Charting a Path Through the Haze. May.

World Bank (2025). Middle East and North Africa Economic Update—Shifting Gears: The Private Sector as an Engine of Growth. April.