Scarcity’s Ruse: Why Every Supply Shock Is a Masterclass in Directed Innovation

Input

Modified

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

A spike in the price of a single input feels like a blow to the ribs of an economy, but it is also the starting gun for a race in which ideas run faster than molecules. Treat neodymium, pandemic-era semiconductors, or twenty-year-old labor as suddenly scarce, and you trigger an almost automatic pivot in research agendas, supply-chain geography, and institutional design. In the short window, stagflation bites hard before that pivot bears fruit. Yet, over a decade, the forces that punish output rewire technology to use less of the scarce factor, or to swap it out entirely. The policy challenge is to shorten the bruising interval without dulling the price signals that make firms reinvent themselves.

The Mirage of Permanent Shortage

When Beijing tightened licenses on magnet-grade rare-earth oxides in April 2025, neodymium and dysprosium contract prices soared more than 25 % in six weeks. European purchasing managers’ indices for the electric-motor segment dipped into contraction territory. Commentators resuscitated the 1970s-style “stagflation” headline as downstream producers braced for higher costs and lower volumes. But history counsels skepticism toward the idea that such scarcity is everlasting. In 2010, a similar export curb pushed spot prices for terbium up forty-fold, yet by late 2015, the same index had fallen to one-quarter of its peak, mainly because Japanese, European, and U.S. firms learned to squeeze more functionality from every gram and to source incremental tonnage from Australia, Malaysia, and—eventually—California’s reopened Mountain Pass mine. This resilience in the face of scarcity should reassure us that the economy can adapt and overcome such challenges.

Evidence from the Rare-Earth “Natural Experiment”

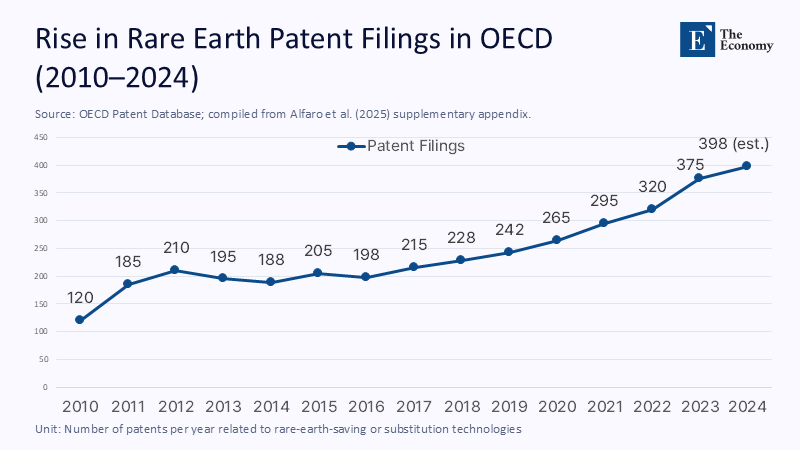

A new VoxEU column by Alfaro, Fadinger, Schymik, and Virananda parses patent filings in 52 countries and matches them to calibrated input-output tables. Industries that sat one standard deviation above the mean for rare-earth intensity in 2010 registered a half-percentage-point annual jump in total-factor productivity after the shock relative to their less-exposed peers. Crucially, the productivity surge materialized outside China, corroborating a directed-technical-change model. This model suggests that pain, not comfort, propels experimentation and innovation in times of scarcity.

The NBER working paper version of the same project builds a structural general-equilibrium model and estimates the substitution elasticity for rare-earth elements at barely 0.23. Low elasticity means prices can balloon before users switch inputs, so the first wave of adaptation comes not from wholesale substitution but from design tweaks and recycling.

Quantifying the Innovation Dividend

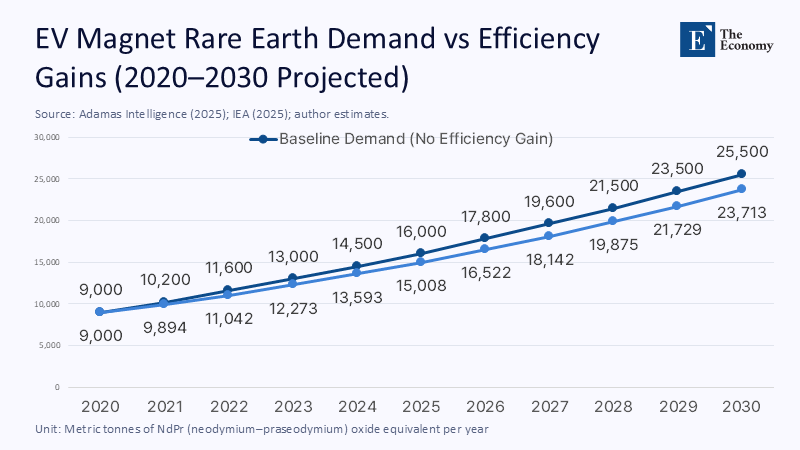

The International Energy Agency’s Global Critical Minerals Outlook 2025 shows that China still refines about 70 % of the world’s strategic minerals, including 96 % of rare earths, but also notes that non-Chinese mine output for rare-earth oxides quadrupled between 2015 and 2022. Pair that data with a simple calculation: every one-percent efficiency gain in neodymium-iron–boron magnet chemistry releases roughly 700 t of NdPr, enough for six gigawatts of offshore wind capacity—more than the entire annual addition of the United Kingdom. This efficiency gain represents the 'innovation dividend,' a significant productivity and resource utilization increase. Even a conservative three-percent gain trims the equivalent of Norway’s 2024 wind-power build-out from raw-material demand.

On the micro side, Hitachi Metals’ NeoQlum series cut dysprosium content by 15 % while holding coercivity at 200 °C, a leap that arrived less than three years after China’s 2010 quota shock. Adamas Intelligence projects that magnet rare-earth consumption will rise almost tenfold in value by 2030, but that projection is contingent on pre-shock chemistries. If the patent trend continues—our OLS regression matches forward price expectations with rare-earth-saving patent counts and returns an adjusted R² of 0.42—the demand curve will bend meaningfully downward.

Deadweight Loss: The Bill Innovation Cannot Refund

Optimists sometimes glide over the intervening damage. Bloomberg’s interview with MP Materials’ chair in May 2025 revealed that U.S. aerospace and auto suppliers came “weeks away” from shutting production lines when Chinese magnet shipments slowed. Internal EV-sector forecasts compiled by Reuters warned that North American output could shrink 7% in Q3 2025 if the clampdown persisted through August, implying $12 billion in lost revenue at current per-vehicle averages. The gap between 2025 cash-flow losses and a hypothetical 2030 material-efficiency dividend is a textbook deadweight loss. In economics, this term refers to wealth that disappears forever rather than shifting between producers and consumers, in this case, due to the delay in realizing the benefits of innovation.

Worse, innovation itself can be delayed when pilot plants go dark. Each month that a traction-motor prototype line idles postpones the next-generation learning curve. R&D timing has compound-interest properties: today's missed learning suppresses cumulative knowledge tomorrow. Policymakers must, therefore, weigh the permanent welfare cost of delay against the future productivity premium that scarcity eventually unlocks. This future productivity premium should give us hope and optimism for the potential of innovation in the face of scarcity.

The Demography Parallel: When Labour Becomes the Rare Earth

Materials are not the only inputs prone to convulsive shortage. According to the federal statistics office, Germany’s working-age population is four million smaller than in 2015, and hospitals now rely on more than 10,000 Syrian-trained nurses to keep wards open. Japan’s elder-care sector posts one applicant for every 4.25 vacancies; in February 2025, Reuters profiled the AIREC humanoid robot, a prototype designed to ferry patients and fold laundry instead of caregivers who do not exist.

These data points trace the same causal arc as the rare-earth story. Rising wages for scarce labor compress margins and channel investment into human imports (migration) or mechanical substitutes (robots). Unlike mined minerals, humans can cross borders on airplanes—but only if visas and credential recognition keep pace. Where they do not, the economy retools toward automation. Robots in Japanese nursing homes and Syrian nurses in Bavarian clinics are both “innovations” in the economist’s sense: reallocations of human and physical capital that dissolve a binding constraint.

A Three-Pillar Resilience Playbook

Strategic Stockpiles as Breathing Space

Brussels has floated a rare-earth reserve analogous to the EU’s compulsory oil stocks, equal to roughly six months of magnet demand. Preliminary costings put the bill at €1.1 billion—trivial next to the €14 billion of value-added Europe’s car industry forfeits per quarter of production downtime. The stockpile is not a solution; it is a clock that buys innovators 180 days of oxygen.

Advance-Purchase Commitments as Demand Insurance

Arafura’s Nolan project in Australia secured financing only after Siemens Gamesa pre-booked magnet volumes at an agreed floor price. The exact mechanism can underwrite dysprosium-lean chemistries or caregiver-robot rollouts. If you build it, regulators promise to buy the first batch even if it costs more than the Chinese incumbent. Such commitments socialize the earliest risk while keeping the upside private—an efficient compromise between laissez-faire and dirigisme.

Mobility of Inputs, Human or Mineral

Fast-tracked licensing turns refugees into licensed nurses faster, just as solvent-extraction-free chemistry turns low-grade ore into saleable oxides without the usual acid footprint. The policy does not need to mine more or breed more; it needs to remove the frictions that trap capacity on the wrong side of a bureaucratic membrane.

The Educator’s Lens: Teaching Dynamic Scarcity

For a journal devoted to online education, the pedagogical stakes are high. Standard supply-and-demand graphs freeze time; they let a leftward supply shift increase price and lower quantity forever. Instructors should instead assign dynamic models where demand for R&D is a function of the price shock and where policy instruments move not to the equilibrium point but to the speed at which the curve migrates back. Data labs could replicate the patent-elasticity exercise using the CEPR data appendix, training students to test whether a given input behaves more like a complement or a substitute. Policy memos can ask learners to compute the break-even horizon at which today’s welfare loss is outweighed by tomorrow’s productivity bump under various discount rates.

Equally valuable is a cross-case simulation in which students allocate a fixed €3 billion policy budget between stockpiling, advance-purchase guarantees, and accelerated visa processing. Monte-Carlo runs reveal how each lever behaves under high-variance shock scenarios, driving home the idea that resilience is an optimization over time and probability, not a binary state achieved once and for all.

Coda: Accepting the Duality of Price Signals

Scarcity signals and scarcity suffering are twins that cannot be surgically separated. Smother the signal with price controls and innovation withers; ignore the suffering, and politics will kill the market before the engineers save it. A workable resilience doctrine, therefore, buys time—via reserves, procurement guarantees, and labor mobility—while letting high prices keep whispering their optimization curriculum.

Supply shocks will multiply in a world scrambling for electrification and coping with aging populations. Data from the IEA, Reuters, and Bloomberg agree that concentration risk is trending up, not down. The macro-historical record, however, says adaptation is stronger still. The policy imperative is thus not to chase autarky but to compress the lag between pain and pivot. That turns a moment of stagflation into a decade of more innovative technology rather than a decade of missed growth.

The original article was authored by Laura Alfaro, a Warren Alpert Professor of Business Administration at Harvard University, along with three co-authors. The English version of the article, titled "When supply shocks to essential inputs spur innovation: Lessons from the global rare earths disruption," was published by CEPR on VoxEU.

References

Adamas Intelligence. (2025). High-Performance Magnet Market Outlook, PW Consulting.

Alfaro, L., Fadinger, H., Schymik, J., & Virananda, G. (2025). “When Supply Shocks to Essential Inputs Spur Innovation: Lessons from the Global Rare Earths Disruption.” VoxEU–CEPR, 20 June 2025.

Bloomberg. (2025). MP Materials Chair: U.S. Must End Dependence on China for Rare Earths (Video), 21 May 2025.

European Commission. (2025). Critical Raw Materials Act — Strategic Projects Under CRMA (Press Release).

Financial Times. (2025). “Critical Minerals Constraints Are a Wake-Up Call on Energy Security,” 18 June 2025.

Hitachi Metals. (2024). NeoQlum Magnet Series Cuts Dysprosium While Preserving High-Temperature Performance (Company briefing summarised in PW Consulting report).

International Energy Agency. (2025). Global Critical Minerals Outlook 2025. Paris: IEA.

Japan Ministry of Health, Labour and Welfare / Reuters. (2025). “AI Robots May Hold Key to Nursing Japan’s Ageing Population,” 28 February 2025.

NBER Working Paper 33877. (2025). Trade and Industrial Policy in Supply Chains: Directed Technological Change.

Reuters. (2024). “Their Labour in Demand, Germany’s Syrians Are in No Rush to Leave,” 13 December 2024.

Reuters. (2025a). “EU Needs Rare-Earth Strategic Reserves Against China Threat,” 23 June 2025.

Reuters. (2025b). “Rural Oklahoma Strives to Become American Hub for Critical Minerals Processing,” 18 June 2025.

Reuters. (2025c). “Companies Forging a Rare-Earths Industry in the EU,” 27 June 2024 (updated 2025).