Counter-Punch or Circular Firing Squad? Re-reading Beijing's Rare-Earth Gambit after the U S Tech-Export Ban

Input

Modified

This article was independently developed by The Economy editorial team and draws on original analysis published by East Asia Forum. The content has been substantially rewritten, expanded, and reframed for broader context and relevance. All views expressed are solely those of the author and do not represent the official position of East Asia Forum or its contributors.

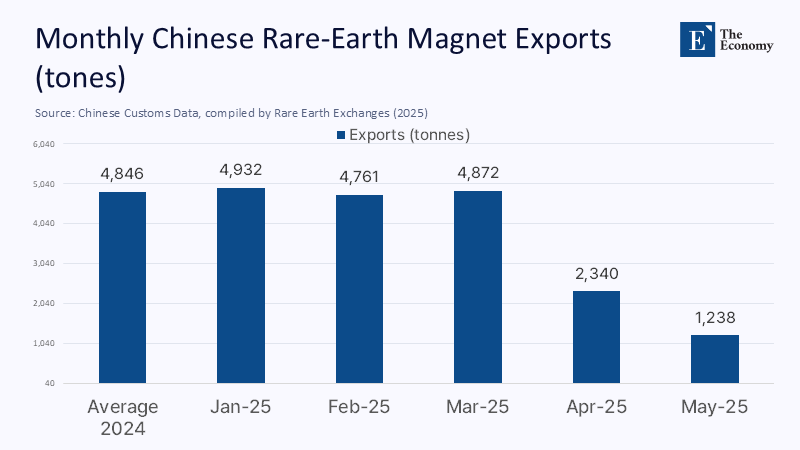

A "strategic" move that erodes its foundations: When Beijing imposed an export-license requirement on samarium, dysprosium, and finished NdFeB magnets on 4 April 2025, its planners hoped to jolt Washington into softening semiconductor restrictions. Yet within eight weeks, China's magnet shipments collapsed by 74% year-on-year, erasing roughly US $70 million in revenue for May alone, while US imports of Chinese magnets tanked 93% over the same span. The policy put the frailty of China's downstream firms on full display far more vividly than it unsettled American negotiators, and the episode illustrated a harsh truth: a commodity monopoly becomes a liability the moment it is brandished as a weapon because the threat itself galvanizes substitution, diversification, and political backlash.

Weaponizing Volume without Securing Value

China's leadership framed the April decree as "controllable security," confident that a country refining 90% of global rare-earth oxides could choreograph a counter-punch to US chip-tool curbs. Yet, leverage in a dispersed supply chain derives less from sheer tonnage than when rivals need to reroute, redesign, or recycle. The 2010 embargo on Japan once convinced Beijing that market panic translated seamlessly into diplomatic leverage. But the intervening decade rewired corporate reflexes: automakers now purchase contingency stock, materials scientists have trimmed dysprosium loading in permanent-magnet motors by double-digit percentages, and processors from Malaysia to Estonia hold dormant capacity they can activate during shocks. By signaling that licenses might be withheld at will, Beijing inadvertently stress-tested those defenses and learned, to its discomfort, that they were already maturing.

License Arithmetic: The Punch that Lands at Home First

Customs data confirm the boomerang. Average monthly magnet exports in 2024 ran 4,846 tonnes. May 2025 saw only 1,238 tonnes clear Chinese ports, a 74.3% plunge; to the United States, the fall was 93%. At a spot price near ¥150 a kilogram (≈ US$ $20), May's shortfall alone cost exporters almost US$70 million. Should that pace persist for a year, gross sales would shrink nearly US $900 million — more than the combined 2024 research budgets of JL Mag, San Huan, and Earth-Panda. Therefore, the State Council's gambit obliged mid-stream producers to bankroll a geopolitical test in which the upside accrues chiefly to ministries. At the same time, the downside bleeds out through private balance sheets.

The Downstream Cash-Flow Tourniquet

On paper, China Northern Rare Earth Group (CNRE) proclaimed a robust RMB 10.04 billion net profit for 2024; in practice, 61% of that EBITDA came from high-value magnet exports. Strip those exports for half a fiscal year, and free cash barely bridges two payroll cycles. Family-owned fabricators working on six-per-cent margins tumble into insolvency in weeks if containers idle at the port. Thus, tightening export lanes triggers a liquidity crisis where employment and R&D are most concentrated. The policy's unintended message to domestic champions is brutal: continue to innovate, but accept that the state may interrupt your revenue stream without notice in pursuit of macro-political leverage.

Price Slippage and the Ore-Glut Feedback Loop

Compounding the cash-flow squeeze is an early-stage price spiral. With export volumes throttled, ore stockpiles at Bayan Obo and Sichuan refineries accumulate, depressing spot quotes for NdPr and dysprosium. Reuters tracking shows heavy-rare-earth quotations sliding 9% between early April and mid-June, a fall large enough that miners have begun delaying strip-ratio upgrades and pushing out capex on solvent-extraction lines. Paradoxically, the policy touted as a blow against foreign buyers undermines the mine-mouth revenue that funds China's upstream expansion, locking Beijing into protective quotas to stabilize local employment.

Demand Destruction: Global Engineering Converts Threat into Deadline

In a display of strategic foresight, foreign engineering teams treat disruption as a timetable, not a surprise. Within a fortnight of the license announcement, BMW shifted its sixth-generation eDrive — a rare-earth-free induction motor scheduled for 2028 — into accelerated integration for the 2026 Neue Klasse platform. The German marque's public briefing emphasized that electromagnetic excitation, rather than permanent magnets, eliminates dysprosium while trimming overall drivetrain mass by 20 kilograms. Nissan, likewise, confirmed that its forthcoming modular motor slashes heavy-rare-earth use to "1% or less" of magnet weight. Such announcements are not marketing flourishes; they mark project-finance milestones that unleash long-dated purchase orders to alternative materials suppliers. Every week, Beijing delays licenses, and design engineers cut a gram more dysprosium from their bill of materials — leverage erodes part by part.

Cost–Benefit Accounting: Negative Expected Value for Beijing

Assume US export controls on advanced lithography inflict an annual productivity drag of roughly US $6 billion on China's most sophisticated fabs. If rare-earth restrictions can squeeze US $1 billion out of foreign manufacturers in additional costs over a year — an optimistic ceiling according to a Monte-Carlo simulation prepared for the German Association of the Automotive Industry — Beijing would still require Washington to lift at least one-sixth of chip-tool barriers in six months to break even on forfeited magnet revenue. That odds-adjusted breakeven threshold implies a 70% probability of US capitulation, a scenario that even sympathetic analysts in Shenzhen put well below 25%. In other words, the coercive wager is mathematically underwater before the first license is denied.

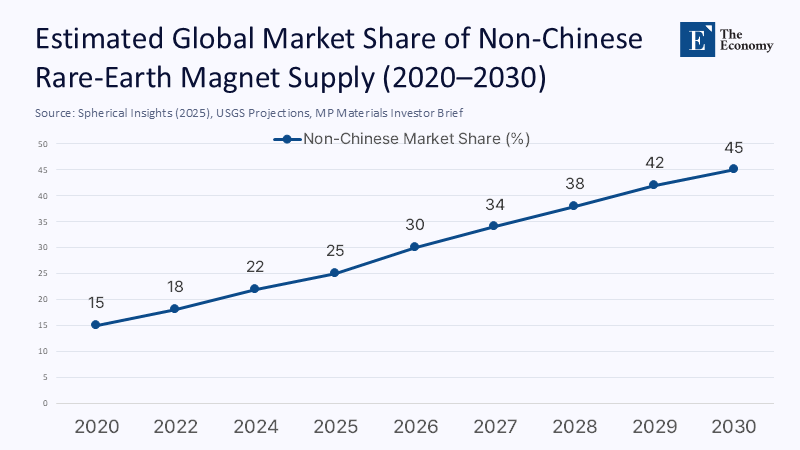

Rival Supply Chains: From PowerPoint to Physical Output

Outside China, the global supply chain is adapting from concept to concrete. Australia's Lynas, already suitable for 6% of global oxide output, will add 5,000 tonnes of magnet-grade NdPr annually from its Texas refinery in early 2026, financed under US Defence Production Act grants. MP Materials has commenced pilot batches of sintered magnets in Fort Worth and targets commercial deliveries before year-end under a US Navy offtake. New ventures in Vietnam, Canada, and India could lift non-Chinese separated-oxide capacity toward 45% of global demand by 2030. Monopoly shares may survive on paper, but once buyers hold a credible alternative—even a pricier one—the marginal leverage of the incumbent supplier collapses faster than its market share.

Europe and India: Strategic Reserves and On-Shore Sintering

Brussels has moved from rhetoric to resource policy. On 23 June 2025, EU Industrial Strategy Commissioner Stéphane Séjourné urged member states to build a joint rare-earth reserve akin to the bloc's crude-oil buffer and pledged tenders for thirteen non-Chinese extraction and processing projects by year-end. Meanwhile, New Delhi is courting private proposals for a 2,000-tonne domestic magnet line, backed by fiscal incentives and guaranteed offtake to insulate its two-wheeler EV market from external shock. Both initiatives underscore the same lesson: each round of Chinese restrictions converts a theoretical diversification agenda into legislated funding.

Trust Erosion and the Anti-Coercion Loop

Language shapes outcomes. The EU now characterizes China's license regime as "economic coercion," terminology that automatically activates the bloc's Anti-Coercion Instrument, empowering counter-tariffs and procurement bans. Politico's June coverage quotes German suppliers warning that "supply chains are running empty," a frame that hard-wires the narrative of Beijing's unreliability into public consciousness. Once trust expires, on-time shipments repay an existing deficit; they no longer earn goodwill. The paradox of coercive leverage thus crystallizes: the power to threaten is simultaneously the power to motivate every customer you have to stop needing you.

Collateral Industrial Friction: Global Plants on Pause

License delays reverberate through production lines thousands of kilometers away. By early June, Reuters reported that European auto-components plants in Wolfsburg and Valenciennes had temporarily idled assembly of traction-motor rotors, while Mercedes-Benz and BMW drafted contingency procurement from Vietnamese vendors. The corporate response is two-tiered: short-term shutdowns but medium-term capital-expenditure redirection into rare-earth-light or rare-earth-free designs. These reactions do not dissipate when licenses resume; they embed into next-generation platforms, permanently trimming Chinese content.

Pivot Options: Turning a Blockade into a Buffer

Beijing can still salvage a strategic advantage by converting export control into export insurance. A rules-based buffer system — licenses processed within seven days, quarterly quota releases pegged to OECD demand forecasts, and a transparent price-stability corridor where the state absorbs volatility — would reassure buyers while preserving revenue. Existing traceability databases mean the administrative foundations are already in place; what is missing is the decision to exchange unpredictability for predictability. Such a pivot would reframe China not as a chokepoint risk but as a utility-like provider whose reliability disincentivizes costly diversification elsewhere.

When Strategy Cannibalises Advantage

Rare-earth dominance was never about ore; it rested on global confidence that the ore, the oxides, and the sintered magnets would arrive when ordered. Beijing's April license regime punctured that confidence, and the immediate financial hemorrhage among Chinese magnet fabricators underscores the price of weaponizing supply in an era of transparent inventories and agile engineering. Export controls shrank Chinese revenues faster than they hobbled Western output, ignited diversification programs in Europe, North America, and South Asia, and compelled the market to rehearse a future without Chinese magnets. Unless Beijing pivots swiftly from coercion to credible stewardship, its once-unassailable position will decay — not because rival mines can match Bayan Obo tonnage, but because industrial consumers will design rare earths from their products. Leverage rooted in fear is brittle; leverage grounded in mutual gain endures. For now, the rare-earth play looks less like a counter-punch and more like a circular firing squad, one that risks leaving China the last combatant standing in a market it no longer dominates by default.

The original article was authored by Mengzhen Liu, an Assistant Research Fellow at the Huayang Center for Maritime Cooperation and Ocean Governance based in China. The English version, titled "China’s rare earth strategy reflects caution, not coercion," was published by East Asia Forum.

References

Announcement No. 18 of 2025 of the Ministry of Commerce and the General Administration of Customs of the People's Republic of China: Decision to Implement Export Controls on Certain Medium and Heavy Rare-Earth Items, 4 April 2025.

BMW Group Press Release. "Charge Faster, Drive Further: Revolutionary Electric Drive Concept with 800 V Technology for the Neue Klasse," 20 February 2025.

BMW Group Technical Brief. "The BMW iX xDrive50: Fifth-Generation eDrive and Sustainability," 2021.

Economic Times India. "Magnet Crunch: Indian Firms Pitch Supply-Chain Plans to Curb China's Rare-Earth Dominance," 23 June 2025.

MP Materials. "Commercial NdPr Metal Production Begins at Independence," Company Press Release, 22 January 2025.

Politico Europe. "China's Got the World in a Rare-Earth Choke Hold," 18 June 2025.

Reuters. "China's Rare-Earth Export Curbs Hit the Auto Industry Worldwide," 4 June 2025.

Reuters. "EU Needs Rare-Earths Strategic Reserves Against China Threat, Commissioner Tells Paper," 23 June 2025.

Reuters. "India Plans Rare-Earth Magnet Incentives as Supply Threat Mounts," 5 June 2025.

Wall Street Journal. "Car Makers Mull China Moves to Counter Rare-Earth Curbs," 4 June 2025.

Wall Street Journal. "China Flexes Chokehold on Rare-Earth Magnets as Exports Plunged in May," 20 June 2025.

Wall Street Journal. "Car Companies Risk Factory Shutdowns Over Rare-Earth Magnet Shortage," 10 June 2025.

Wall Street Journal. "China Puts Six-Month Limit on Its Ease of Rare-Earth Export Licenses," 12 June 2025.

Rare Earth Exchanges. "Northern Rare Earths Posts Strong 2024 Profits, Signals Aggressive Expansion," 12 May 2025.