Dollarization by Design: How USD Stablecoins Could Rewire Global Finance—and Who Loses Control

Input

Modified

This article was independently developed by The Economy editorial team and draws on original analysis published by East Asia Forum. The content has been substantially rewritten, expanded, and reframed for broader context and relevance. All views expressed are solely those of the author and do not represent the official position of East Asia Forum or its contributors.

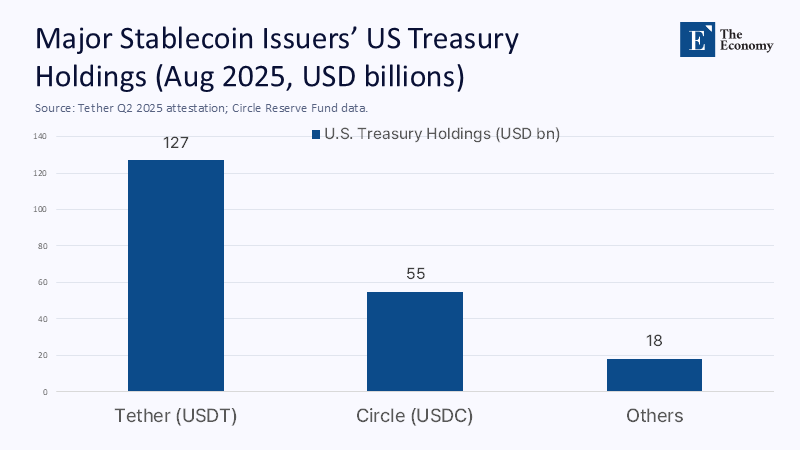

A quiet inversion of monetary power is already visible on the balance sheets. As of early August 2025, Tether—the largest issuer of dollar-pegged stablecoins—reported more than $127 billion of U.S. Treasury exposure, a portfolio comparable to or larger than that of several G20 sovereigns; South Korea's Treasury holdings, for instance, stood near $124 billion in May 2025, according to U.S. Treasury data. Circle's USDC, with roughly $64–65 billion in circulation, parks the vast bulk of its reserves in short-duration Treasuries via a BlackRock-managed cash fund now exceeding $55 billion. Add the rest of the sector, and the result is a new class of nonbank, nonsovereign entities pooling global demand for safe dollar assets at scale. This is not a payment fad. It is a funding machine for the U.S. state that runs on offshore demand for digital dollars—demand that is already strongest where inflation, capital controls, or weak banking push households and firms to dollarize their lives. If Washington formalizes and mainstreams USD stablecoins, the dollar's reach may deepen for decades—precisely because others, not Americans, will do the heavy lifting of buying the bills.

Reframing the Debate: From "Payment Toy" to "Externalized Seigniorage"

The dominant narrative treats stablecoins as slick plumbing for faster, cheaper transfers. That's true, but incomplete. The more critical shift is balance-sheet mechanics: every new dollar-stable token typically corresponds to a dollar of safe assets—overwhelmingly Treasury bills—held by the issuer or its cash fund. In effect, a growing slice of the world's hunger for dollars is being intermediated by private issuers who remit the interest to their income statements. At the same time, the underlying asset demand lowers the U.S. government's short-term financing costs at the margin. Recent BIS work finds that large inflows to dollar-stablecoins statistically nudge 3-month T-bill yields lower within days; the asymmetry is telling too—outflows raise yields more than inflows reduce them, underscoring both the funding channel and its risk in stress. Seen this way, a national policy that standardizes, supervises, and scales USD stablecoins is not about retail checkout lines; it is about harnessing offshore dollarization as an enduring source of demand for U.S. debt.

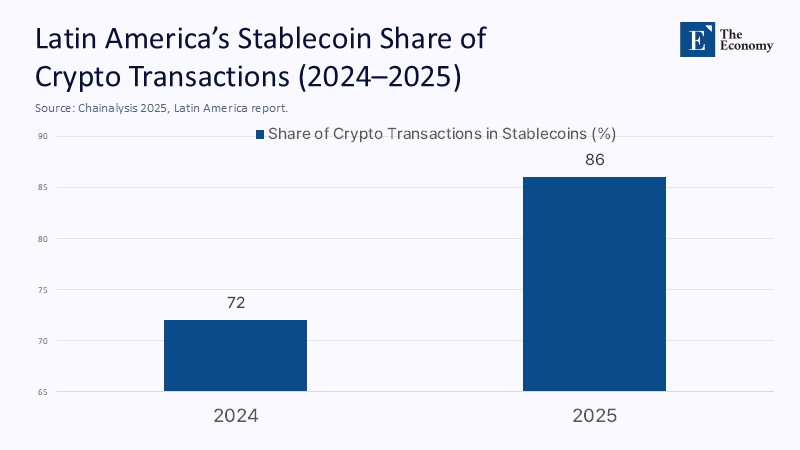

Where the Demand Already Exists: Latin America's On-Chain Dollarization

The deepest pool of organic demand lies in Latin America, where households and firms already dollarize to escape inflation and policy volatility. Exchange and analytics data show stablecoins dominate regional crypto activity: Brazil's central bank officials estimate roughly 90% of the country's crypto flows are stablecoin-related. In contrast, regional platforms report stablecoins accounting for a large share of purchases—often eclipsing Bitcoin. Venezuela's de facto dollarization increasingly occurs in digital form; Chainalysis and media investigations highlight surging stablecoin transactions under $10,000 as families shift daily commerce into tokens that behave like cash dollars without bank accounts. These patterns align with broader remittance dynamics: the World Bank still pegs average global remittance fees above 6%, and Latin America and the Caribbean took in roughly $155 billion in remittances in 2024. Stablecoins thrive where the need for dollars and cheaper cross-border transfers is most acute, which is why formal U.S. endorsement would scale what the region is already doing—and route more of that demand into Treasuries.

From Wallets to Bills: The Balance-Sheet Chain That Funds Washington

Translate a paycheck in Buenos Aires or a wholesale invoice in São Paulo into USDT or USDC, and a chain reaction begins. Issuers (directly or via money-market-like vehicles) hold short-term Treasuries and reverse repos. Tether's latest attestation reports $105.5 billion in direct T-bill exposure and another $21.3 billion indirectly; Circle discloses that around 90% of USDC reserves sit in short-duration U.S. sovereign instruments managed in the Circle Reserve Fund. Aggregated across issuers, private stablecoin treasuries now rival mid-tier sovereign holders of U.S. debt. BIS research suggests these flows can measurably affect bill yields; market commentary increasingly treats stablecoin growth as a structural bid for front-end paper. With marketable Treasuries around $27 trillion in mid-2025 (market value), the stablecoin footprint is still modest in system-wide terms—but its marginal effects and pro-cyclicality are real. The more Washington normalizes and expands the regime, the more durable this "crowdsourced" demand becomes.

The Asian Rebalance: Diversifying Away from Concentrated Official Holdings

For two decades, U.S. debt management has relied heavily on official accumulation by East Asian economies. As of May 2025, Japan held about $1.135 trillion, mainland China roughly $756 billion, Taiwan near $293 billion, and South Korea about $124 billion in Treasuries. This concentration has created a structural sensitivity in U.S. planning: shifts in reserve strategy or geopolitics can ripple through funding costs. A robust, regulated stablecoin complex recasts that exposure. Instead of official institutions warehousing dollars for mercantilist or exchange-rate aims, millions of offshore users, platforms, and corporates collectively generate bill demand through the reserve rule of stablecoins. It is not that official demand disappears; instead, it is complemented—and partially displaced over time—by market-led, payments-driven demand. In a world of rising geopolitical fragmentation, diversifying the buyer base for Treasuries away from a few concentrated sovereigns toward a diffuse matrix of private issuers and their global users is a strategic objective hiding in plain sight.

The Policy Turn in Washington: From Ambivalence to Architecture

The missing piece has been legal clarity. That gap is closing. The payment-stablecoin bills moving through Congress in 2025, including the House-reported STABLE framework and the GENIUS Act, converge on core principles: 1:1 high-quality reserve backing, segregation of assets, bank-like supervision for issuers, and clear anti-money-laundering obligations under the Bank Secrecy Act. The administration's policy posture has also shifted: public communications emphasize innovation with guardrails, and agencies have signaled a pivot from ad-hoc enforcement toward rulemaking. The effect is to re-denominate a previously gray market into regulated demand for T-bills and reverse repos. This isn't a fringe idea; major card networks and large asset managers are already integrating stablecoin rails precisely where the U.S. system aims to be strongest—wholesale settlement and cross-border flows—while keeping the reserves inside the perimeter of U.S. sovereign credit. The legislation and executive signals amount to an industrial policy for dollar liquidity in digital form.

Europe and East Asia: Monetary Sovereignty on Notice

The European Central Bank has been explicit: dollar-stablecoins pose a tangible threat to the euro's monetary autonomy if they scale within the single market. MiCA's stablecoin chapters, practical since mid-2024, empower EU authorities to cap issuance of "significant" e-money tokens and force conservative reserve structures; the ECB has warned that without a strategic response, Europe could see erosion of monetary control. East Asia is also moving. Hong Kong's licensing regime for fiat-referenced stablecoins went live on August 1, 2025, with strict AML/KYC and limited initial licensing, while mainland China experiments with tightly circumscribed pilots amid persistent capital-flight concerns. The through-line is clear: where the U.S. sees an external financing channel and a strategic export of digital dollars, others see a slow perforation of national policy levers as domestic users transact, save, and borrow in a privately issued dollar surrogate.

How Big Could the Flywheel Get—and What Would It Do to Yields?

Forecasts vary, but mainstream estimates now envision a trillion-plus stablecoin market by decade's end if legal clarity persists. Citi's baseline implies stablecoin issuers could hold up to $1.2 trillion in Treasuries by 2030 under a permissive regime. Even if realized only in part, BIS modeling indicates marginal yield effects at the front end—lower bills in steady inflow periods, steeper curves if issuance concentrates at the very short end, and asymmetric spillovers in stress when redemptions force asset sales. The Treasury Borrowing Advisory Committee has already studied reserve compositions and acknowledges that the growth of fiat-backed stablecoins and tokenized cash funds would correlate with increased Treasury demand. Crucially, the presence of a new, interest-sensitive buyer class introduces a different rhythm into bill markets. As global risk sentiment swings, on-chain flows may amplify front-end rate volatility unless liquidity backstops and prudential rules are sized to the new reality.

Illicit Finance, Privacy, and the CBDC Counterargument

Critics are right to worry about crime and capital flight. Yet the best available data suggest illicit volumes are a small fraction of total on-chain activity—on the order of tenths of a percent—though absolute values remain large and evolving. Chainalysis and TRM Labs both report declining shares of illicit transactions in 2024, even as raw numbers stay significant, a nuance that argues for targeted controls rather than prohibitions. Europe's counter-model—a privacy-aware digital euro plus tight caps on foreign-currency stablecoins—prioritizes public-money primacy. But private stablecoins also carry a relative privacy advantage versus retail CBDCs designed for granular traceability, which is partly why users in emerging markets prefer them to bank accounts that require documentation they cannot easily provide. The policy challenge is not whether to surveil, but how to calibrate transparency: robust KYC at issuance and redemption, transaction-level analytics for service providers, and credible freeze/blocklist processes—all of which are standardizing fast.

Practical Implications for Schools, Systems, and States

Education systems are not bystanders. Universities and technical institutes increasingly pay international researchers, contractors, and students across borders; stablecoins can compress settlement times and fees while keeping working capital in government-backed instruments until the moment of disbursement. Public school districts purchasing ed-tech from foreign vendors could negotiate stablecoin settlement rails to avoid multi-week wire delays, provided procurement policies bake in custody, compliance, and immediate conversion to local currency when appropriate. Ministries of education that administer scholarship or stipends to diaspora students should pilot narrow corridors where stablecoin payouts flow through licensed custodians under clear FX and consumer-protection rules. The upside is material at scale: with global remittance fees still above 6% on average—and much higher in some corridors—tight, regulated stablecoin rails can shift real resources from friction to learning. None of this requires ideological buy-in to crypto writ large; it requires governance and audit trails.

Guardrails That Preserve Autonomy Without Sacrificing Efficiency

Policy is not a binary between blank-check dollarization and closed capital accounts. Europe and East Asia can defend monetary autonomy while still harvesting the efficiency gains of tokenized money. First, prioritize tokenized bank deposits and wholesale CBDC for domestic retail and large-value payments, then confine foreign-currency stablecoins to licensed corridors with circuit-breakers that slow redemptions in stress. Second, require that customer-facing stablecoin balances sit at supervised custodians subject to daylight liquidity coverage and transparent redemption SLAs. Third, use MiCA-style "significant token" thresholds aggressively—not to ban, but to force diversified reserves and caps that reduce cliff effects. Fourth, expand central bank swap lines and settlement links so that exporters invoice and settle in domestic currency at parity-like convenience, eroding the user advantage of dollars without coercion. Finally, in emerging markets, combine capital-flow management with open on-ramps to compliant dollar instruments to reduce incentives for informal channels. These are not anti-innovation moves; they are monetary hygiene for a tokenized age.

Anticipating the Countercase—and Why It Likely Fails

A common critique is that stablecoins are inherently fragile, have repeatedly de-pegged, and therefore cannot be permitted to intermediate public debt. That objection misreads the heterogeneity of designs and the trajectory of regulation. Algorithmic or under-reserved tokens should indeed be kept away from the safety perimeter; fiat-redeemable, fully reserved instruments under bank-like supervision are different animals. BIS, ECB, and academic analyses set high bars—singleness of money, elasticity, integrity—that private tokens alone will not clear. But the policy response now forming in the U.S., EU, and Hong Kong effectively transforms leading stablecoins into regulated wrappers around sovereign credit, narrowing the failure modes to familiar ones: custody, liquidity management, and governance. None of this eliminates risk. It does channel it into supervised institutions whose assets are themselves claims on the state. This is precisely why the model fortifies dollar dominance: it externalizes seigniorage while internalizing the asset demand.

The New Dollar Diplomacy

The numbers point in one direction. Private issuers already hold sovereign-scale T-bill portfolios; Latin America's on-chain dollarization is entrenched; Europe and East Asia are building defenses; and U.S. legislation is converging on an architecture that will normalize stablecoin demand for public debt. If that architecture hardens, the dollar's "digital shadow banking" will become a core feature of the international system, not a sideshow. For Washington, the prize is a more diversified, durable buyer base for Treasuries—funded by the rest of the world's preference to transact and save in dollars without ever opening a U.S. bank account. For everyone else, the cost is a subtle drift of policy autonomy to offshore platforms whose reserve assets sit in another country's debt. The choice is not whether stablecoins exist, but who governs their reserve pipelines. The responsible path is clear: regulate the rails, mandate conservative reserves, cap systemic concentrations, and build public-money alternatives that are just as easy to use. The longer policymakers wait, the more the new dollar diplomacy will write itself.

The original article was authored by Sayuri Shirai, a Professor at the Faculty of Policy Management, Keio University. The English version, titled "Can stablecoins extend US dollar dominance?" was published by East Asia Forum.

References

Bank for International Settlements (2025). Stablecoin growth – policy challenges and approaches (BIS Bulletin No. 108).

BIS (2025). Stablecoins and safe asset prices (Working Paper No. 1270).

BlackRock (2025). Circle Reserve Fund (USDXX) — Key facts and holdings (as of August 8, 2025).

Chainalysis (2024). 2024 Crypto Crime Report — Introduction.

Chainalysis (2025). 2025 Crypto Crime Mid-Year Update.

Circle (2025). USDC in circulation and reserves — Transparency page (August 7, 2025).

Circle (2025). USDC Reserve Report — February 2025.

Citigroup projection summarized in Investopedia (2025). The GENIUS Act Could Have Interest-Rate Implications. Here's How.

Congress.gov (2025). H.R. 2392 — To provide for the regulation of payment stablecoins (Reported in House, May 6, 2025).

Congress.gov (2025). S. 394 — GENIUS Act of 2025 (Text).

ECB (2025). From hype to hazard: what stablecoins mean for Europe (ECB Blog, July 28, 2025).

ESMA (2024–2025). Markets in Crypto-Assets (MiCA) — overview and timeline.

FXC Intelligence (2025). The state of stablecoins in cross-border payments.

HKMA (2025). Implementation of regulatory regime for stablecoin issuers (Press release, July 29, 2025).

IMF (2025). External Sector Report 2025 — Chapter 2: International Monetary System (stablecoin flow geography).

IMF–FSB (2023). Synthesis paper: Policies for crypto-assets (on seigniorage and monetary sovereignty).

Milken Institute (2025). Global Digital Asset Adoption: Latin America.

Reuters (2025). Hong Kong stablecoin bill's client identity rules spark industry concern (August 7, 2025).

Reuters (2025). Dollar stablecoins threaten Europe's monetary autonomy, ECB blog argues (July 28, 2025).

Tether (2025). Q2 2025 attestation: $127 billion in Treasuries; $4.9 billion quarterly profit.

U.S. Treasury (2025). Debt to the Penny (daily totals, July–Aug 2025).

U.S. Treasury (2025). TIC Table 5: Major Foreign Holders of Treasury Securities (May 2025).

World Bank (2024–2025). Remittance Prices Worldwide (global average cost; latest updates).

World Bank (2024). Remittances to LMICs: 2024 outlook; press release (June 26, 2024).

Supplementary regional sources:

Chainalysis (2024). Latin America Crypto Adoption — The Rise of Stablecoins.

El País (2025). The new gray-area dollar in Venezuela is digital.

Comment