A Dual-Rail Fix for China's Dollar Dilemma: Let Hong Kong Issue the Stablecoins While Beijing Runs the CBDC

Input

Modified

This article was independently developed by The Economy editorial team and draws on original analysis published by East Asia Forum. The content has been substantially rewritten, expanded, and reframed for broader context and relevance. All views expressed are solely those of the author and do not represent the official position of East Asia Forum or its contributors.

Let's begin with the market's assessment. Dollar-linked stablecoins now support over two hundred billion dollars in circulating value and facilitated nearly two trillion dollars in transactions in 2024, with the largest issuer commanding a two-thirds share of the global market. Meanwhile, the renminbi's role in cross-border payments is around 3 percent, despite the e-CNY quietly becoming the world's largest pilot for a central-bank digital currency, surpassing seven trillion yuan in cumulative transactions by mid-2024. This year, the United States has taken the lead by establishing a federal framework for stablecoins, setting a pro-market regulatory standard. In contrast, Beijing faces an apparent dilemma: while the state prefers a manageable central bank digital currency (CBDC) for domestic policy and capital account management, Chinese exporters, traders, and households increasingly engage with the world through dollar-denominated stablecoins. The solution is not to force a single system to accommodate all use cases but to distinguish between them. The e-CNY should operate domestically, while Hong Kong, with its USD-pegged currency and new licensing regime, should be utilized to issue HKD-referenced stablecoins that can serve as compliant "synthetic dollars" in offshore markets.

From Either/Or to Both/And: Reframing the Debate

The prevailing frame treats CBDCs and stablecoins as rivals. That misses the institutional logic. A CBDC is a policy instrument before it is a payment tool, designed to transmit stimulus cleanly, to enforce limits, to encode reporting, and to operate within a capital-control architecture. A fiat-referenced stablecoin—particularly one pegged to the U.S. dollar—has become a market gateway: fast settlement, programmable rails, and global liquidity. For China, forcing either instrument into the other's role is counterproductive. The reframing is straightforward: adopt dual-rail architecture. Beijing preserves complete control of domestic money with the e-CNY. Hong Kong, under its Linked Exchange Rate System that keeps the HKD within HK$7.75–7.85 per U.S. dollar, licenses HKD-referenced stablecoins for offshore finance, trade facilitation, and tokenized-asset settlement. This approach harnesses Hong Kong's position as the dominant offshore RMB hub while meeting global users where they already are—on dollar rails—without importing that logic into the mainland's monetary core.

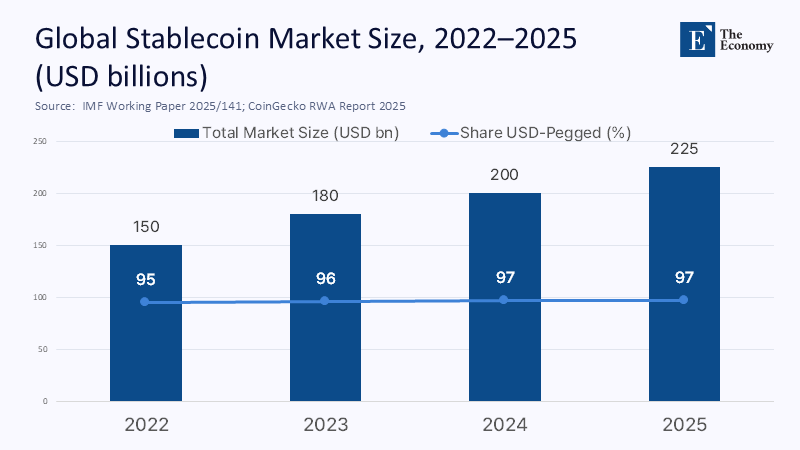

What the Market Is Saying: Dollar Stablecoins Are the New Offshore Dollar

The data point to a durable structural fact. Fiat-backed stablecoins topped $225 billion by April 2025, with growth concentrated in dollar-pegged tokens; one IMF monitor pegs the market leader's share near the mid-60s and shows USDC regaining ground post-regulatory clarity. An IMF working paper estimates international stablecoin flows near $2 trillion in 2024, with Asia-Pacific accounting for $519 billion—evidence that these rails are already embedded in regional commerce, treasury operations, and household dollarization. The BIS warns that if growth continues, large-scale reserve asset selloffs in stress could pose stability risks, underscoring the need for prudential, bank-quality issuance. In short, the market has voted for dollar liquidity on crypto-speed rails; public policy must route that reality safely. A Hong Kong-licensed HKD stablecoin can function as a supervised proxy for the offshore dollar while retaining complete transparency and circuit breakers absent in purely offshore, lightly regulated structures.

Beijing's Control Logic—and the Reach of the e-CNY

The need for a dual-rail architecture becomes apparent when we consider the constraints of international demand and domestic programmability. Inside the mainland, the case for CBDC remains compelling. The e-CNY's cumulative transactions surpassed 7 trillion yuan by June 2024 across seventeen provincial regions and multiple sectors, making it the world's most advanced retail CBDC pilot by scale. Multi-CBDC projects such as mBridge, co-developed by the PBOC's Digital Currency Institute with the HKMA and others, reached the minimum viable product stage in 2024 and are designed precisely to deliver cross-border settlement that preserves jurisdictional control. Meanwhile, the renminbi's global payment share remains modest at 2.88 percent as of June 2025, as a reminder that international demand is constrained more by convertibility and capital-account policy than by technology. A dual rail respects those constraints: e-CNY for domestic programmability and policy transmission; mBridge and permissioned gateways for cross-border CBDC settlement; and HKD-stablecoin rails in Hong Kong, where dollar liquidity is needed without importing crypto's governance gaps onto the mainland.

Hong Kong as Hinge and Firewall

Hong Kong's role as a compliant laboratory for HKD-referenced stablecoins is crucial. The city's Stablecoins Ordinance, which took effect on Aug 1, 2025, brings fiat-referenced stablecoin issuance into a licensing regime administered by the HKMA, with detailed supervisory guidelines on reserves, redemption, disclosure, and governance. This sits atop a 2023 licensing regime for virtual asset trading platforms, creating a contiguous regulatory perimeter across issuance, custody, and secondary trading. The city's e-HKD pilots have already mapped value in programmability, tokenization, and atomic settlement, while the HKD's peg anchors parity to the U.S. dollar. Crucially, Hong Kong processes over 70–80 percent of offshore RMB payments and runs RMB RTGS turnover frequently exceeding RMB 2 trillion a day, positioning it to intermediate between RMB instruments and USD-linked stablecoins. Taken together, Hong Kong can be a compliant laboratory for HKD-referenced stablecoins that integrate with tokenized deposits and CBDC corridors—leveraging the peg as a policy-backed anchor rather than an incidental price point.

How a Dual System Would Actually Work

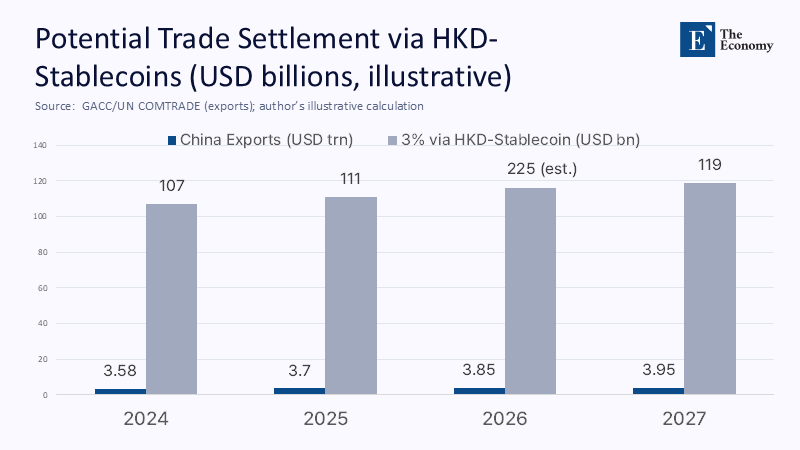

Envision a future with three interoperable tracks. Track one is the e-CNY for domestic retail and wholesale use, including programmable fiscal transfers, B2B invoicing, and regulated consumer payments. Track two is an HKD-referenced stablecoin issued under an HKMA license by designated institutions, fully reserved in cash and short-dated U.S. government securities, redeemable at par in Hong Kong, and distributed to corporates and financial institutions for cross-border settlements, tokenized asset delivery-versus-payment, and treasury operations. Track three is mBridge for central-bank-to-central-bank corridors and bank-mediated FX. The peg keeps HKD stablecoins aligned with the dollar while ring-fencing issuance to Hong Kong's district and AML/CFT perimeter. As a transparent benchmark, suppose just 3 percent of China's 2024 exports (≈$3.58 trillion) migrate to HKD-stablecoin settlement via Hong Kong by 2027. That would route $107 billion annually through supervised rails—meaningful enough to deepen liquidity, yet modest relative to capital-account constraints. This scenario is not just a prediction, but a vision of how a conservative share of goods exports could be applied to a licensed settlement rail that already processes most offshore RMB flows, paving the way for a more efficient and secure cross-border finance system.

Will It Work? The Critiques—and the Rebuttals

Skeptics argue that HKD-stablecoins cannot overcome capital controls or sanctions risk and could undermine RMB internationalization. These concerns are real but manageable. Capital controls remain intact: on- and off-ramps would be licensed in Hong Kong, and usage on the mainland would be restricted, preserving the PBOC's monetary security system. Sanctions risk is mitigated—not eliminated—by strict KYC/AML and transparency embedded in the licensing regime, which is precisely what the BIS has urged to address fire-sale and run risks in stress. As for RMB internationalization, the dual-rail model complements it: Hong Kong processes the bulk of offshore RMB already; routing some trade through HKD-stablecoins does not displace RMB products so much as smooth intermediation between tokenized dollars, CNH instruments, and e-CNY corridors. Finally, peg credibility is the key tail risk. Here, the HKMA's four-decade currency-board record and its standing interventions to keep the 7.75–7.85 band provide operational assurance, even amid periodic market tests.

What Beijing Is Already Signaling—and Why Timing Favors a Pivot

Policy direction is edging toward pragmatism. Reporting indicates Beijing is weighing yuan-backed stablecoins to expand global RMB usage, a notable shift from the 2021 ban on crypto trading and mining. Commentators see Hong Kong as the natural launchpad, precisely because of its new regime and offshore RMB markets. Meanwhile, U.S. federal legislation has clarified the regulatory environment for dollar stablecoins, accelerating institutional adoption and making it harder for rivals to compete on purely private rails. In this landscape, a Hong Kong-licensed HKD stablecoin is not a concession to crypto; it is a policy tool to shape where and how the "digital dollar" interacts with Chinese commerce—without ceding domestic monetary control. The mainland keeps the CBDC; Hong Kong provides a supervised bridge to the instruments global users already hold. That combination reflects the same "one country, two systems" logic that made Hong Kong the RMB's offshore beachhead.

Implementation Priorities for a Dual-Rail Strategy

Execution matters. First, stand up an HKD-referenced stablecoin program under the HKMA with bank-grade disclosure: daily reserve reporting, monthly auditor attestations, strict custody segregation, and mandated instant redemption within Hong Kong's banking hours. Second, integrate issuance with Project Ensemble's tokenized-deposit work so that treasurers can move seamlessly between insured deposits, HKD stablecoins, and e-CNY-denominated obligations. Third, connect the stablecoin's wholesale layer to mBridge nodes for cross-border atomic FX with CNH and e-CNY, using programmable constraints to enforce end-use and geography. Fourth, limit retail exposure initially; target trade finance, coordination escrow, and tokenized-bonds settlement, where professional counterparties and controlled flows reduce conduct risk. Finally, codify red-button circuit breakers—temporary creation halt, enhanced disclosure, and redemption-fee caps—in regulation ex ante. These are not speculative asks; they sit squarely within Hong Kong's new statute, its VATP regime, and the BIS/IMF risk playbooks for scaling private money safely under public oversight.

Use the System You Have to Build the One You Want

The market has already opted for speed and dollar liquidity for numerous cross-border operations. The government has already prioritized control and programmability for local currency. For China, it would be a mistake to ignore either of these realities. A dual-rail system that keeps the e-CNY within its borders while allowing Hong Kong to issue HKD-referenced stablecoins overseas aligns the incentives of institutions. It enables exporters and investors to operate on systems that resemble dollars while maintaining the integrity of the mainland's capital account and policy tools. It utilizes the peg as a public-good foundation, the mBridge stack as a compliance-friendly route, and capitalizes on Hong Kong's strength in offshore RMB as an enhancer rather than a disadvantage. Will it function flawlessly? No system is perfect. However, it will be compelling enough—incrementally, predictably, and under oversight—to bridge the gap between what international users need and what China must protect. This exemplifies a resilient financial strategy: defined pathways, strict guidelines, and unwavering practicality. Now is the moment to establish it.

The original article was authored by Monique Taylor is University Lecturer in World Politics at the University of Helsinki. The English version, titled "Stablecoins prompt strategic rethink of China’s financial strategy," was published by East Asia Forum.

References

Atlantic Council. "Central Bank Digital Currency Tracker." Updated 2024–2025. (e-CNY volumes).

Bank for International Settlements (BIS). Annual Economic Report 2025, Chapter III: The next-generation monetary and financial system. (Stablecoin risks).

BIS. "Stablecoin growth – policy challenges and approaches." BIS Bulletin No. 108, 2025.

BIS Innovation Hub / HKMA et al. "Project mBridge reaches MVP stage," Jun 5, 2024.

CoinGecko. 2025 RWA Report. April 2025. (Stablecoin market size).

Hong Kong Monetary Authority (HKMA). "Central Bank Digital Currency" (e-HKD Pilot Programme, Project Ensemble). 2023–2025.

HKMA. "Linked Exchange Rate System." Jun 27, 2024. (7.75–7.85 band).

HKMA. "Regulatory Regime for Stablecoin Issuers." Effective Aug 1, 2025.

HKMA. Quarterly Bulletin, Chapter 4: Monetary and financial conditions. March 2025. (RMB RTGS and deposits).

Investopedia. "It's Been the 'Summer of Stablecoins,' Goldman Says." Aug 2025. (U.S. regulatory context and adoption trajectory).

International Monetary Fund (IMF). "Decrypting Crypto: How to Estimate International Stablecoin Flows." Working Paper 2025/141, July 2025.

Lowy Institute. "China and America in a stablecoin race that could reshape global finance." Aug 11, 2025.

People's Bank of China via State Council (official English portal). "Digital yuan transactions hit 7 trillion yuan by end-June 2024." Sept 5, 2024.

Reuters. "China's top regulators ban crypto trading and mining." Sept 24, 2021.

Reuters Breakingviews. "China stablecoin push is better late than never." Aug 22, 2025.

SWIFT RMB Tracker. July 2025. (RMB global payment share 2.88%).

U.S. Census / TradingEconomics / GACC. "China exports 2024" (≈$3.58 trillion). Jan 2025 release; UN COMTRADE aggregation.

Hong Kong SAR Government. "LCQ10: Promoting virtual asset development" (notes new stablecoin ordinance taking effect). Jul 30, 2025.

Comment