Samsung Eyes Growth as Smartphone Sales and Chip Price Surge Offset Industry Uncertainty

Input

Modified

Smartphones Step Up as Chip Sales Stall Tariff Fears Spark Chip Stockpiling Frenzy Strategic Balance: Samsung’s Dual Engines of Growth

Smartphones Step Up as Chip Sales Stall

Samsung, one of the world’s largest technology companies, recently announced that its first-quarter profits exceeded market expectations, even as the company faced challenges in its key memory chip business. While the semiconductor sector, which has traditionally been a major contributor to Samsung's revenue, showed signs of sluggishness, the company’s smartphone sales stepped in to fill the gap, delivering a much-needed boost to profitability. Looking ahead to the second quarter, Samsung is optimistic about further growth, particularly as the demand for memory chips is expected to rise amid growing concerns over looming tariffs on these critical components.

Despite a soft performance from its semiconductor division, Samsung managed to report better-than-expected profits, much of which was fueled by strong sales in its mobile business. In fact, the South Korean tech giant saw a notable surge in demand for its smartphones, driven by a combination of factors, including the release of new models and seasonal buying trends. While the semiconductor industry has been facing difficulties—partly due to fluctuating demand and supply chain issues—the mobile division’s performance helped offset some of these challenges, underscoring Samsung’s ability to pivot and maintain profitability even when one of its core businesses is under pressure.

In the first quarter of 2025, the company’s profit performance was aided by strategic product launches and an effective marketing strategy that resonated with both consumers and businesses. These sales figures have provided a much-needed cushion to Samsung’s bottom line, compensating for a dip in its memory chip business, which has been grappling with oversupply and reduced demand. Nevertheless, analysts have pointed out that the profitability from phone sales may not be enough to sustain the company’s growth momentum in the long run if the semiconductor business doesn’t recover.

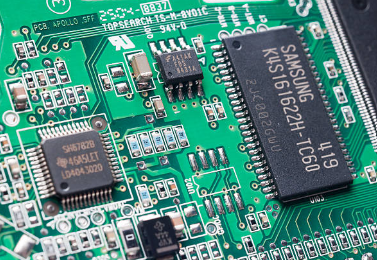

Samsung’s outlook for the second quarter is notably more optimistic, especially for its semiconductor business. One key factor contributing to this positive forecast is the expected rise in memory chip prices, which have been bolstered by stockpiling activities as customers anticipate the impact of tariffs. In early April, Samsung announced that it would be increasing the price of its key memory chips by up to 5%. This price hike is a direct response to growing concerns over potential tariffs on chips, which have sparked a buying frenzy among companies hoping to stockpile essential components before the tariffs are imposed.

The decision to raise prices is also indicative of broader market trends that are putting upward pressure on semiconductor costs. As tariffs loom, many companies are rushing to secure chips at current prices, fearing that future supply shortages or tariff-related price increases could drive up costs in the months to come. Samsung’s price increase is a clear sign that the semiconductor market is responding to these dynamics. It’s not just a reactive move in anticipation of tariffs—it’s also a strategic decision that capitalizes on the supply-demand imbalance in the industry.

Tariff Fears Spark Chip Stockpiling Frenzy

The surge in demand for memory chips ahead of the expected price hikes is a direct result of concerns over tariffs, particularly on the critical components used in a variety of consumer electronics. This behavior mirrors previous instances when companies preemptively bought up inventory to shield themselves from future price increases caused by trade restrictions or export curbs. The rising price of chips reflects not only supply chain pressures but also the broader uncertainty in global trade relations. As customers rush to purchase memory chips in advance, it creates a temporary surge in demand that benefits manufacturers like Samsung.

This stockpiling trend has proven advantageous for semiconductor companies, as it pushes up prices and helps cushion the impact of ongoing market volatility. Given that the demand for memory chips is expected to continue to rise through the second quarter, Samsung’s decision to raise prices is likely to bolster its revenue and improve the outlook for its semiconductor division. With this strategy in place, Samsung is positioning itself to benefit from the heightened demand, even if the longer-term effects of the tariffs remain uncertain.

The upward trend in memory chip prices isn’t just a Samsung-specific phenomenon; it’s indicative of broader shifts in the semiconductor industry. Memory chip prices have been on the rise over the past few weeks, driven by concerns about potential supply shortages and higher costs. These price increases have been further exacerbated by trade restrictions, such as Japan’s export curbs, which have limited the availability of key materials needed to manufacture high-performance chips.

For the semiconductor industry as a whole, this price jump is a positive development. It signals that demand for chips remains strong, despite the volatility in global markets. For companies like Samsung, the ability to raise prices during a time of heightened demand is a strong indicator of market power and strategic agility. These price hikes suggest that the memory chip business may be poised for a recovery in the coming months, as customers scramble to secure components before tariffs take effect.

In many ways, the price surge can be seen as a sign of confidence for the semiconductor sector, as it indicates that companies are successfully navigating the challenges of global supply chain disruptions and trade-related uncertainties. If the price increases continue and demand remains steady, Samsung and other semiconductor businesses could see their profitability rise in tandem with the price adjustments.

Strategic Balance: Samsung’s Dual Engines of Growth

Samsung’s ability to weather the storm of fluctuating semiconductor prices and sluggish demand for memory chips is a testament to its strategic positioning within the tech industry. As one of the leading producers of both memory chips and smartphones, Samsung is uniquely positioned to capitalize on trends in both sectors, especially when one business division faces challenges.

The company’s diversified portfolio has allowed it to adjust to changes in market conditions quickly. When the memory chip business was struggling, Samsung relied on the strength of its mobile phone sales to sustain profitability. Now that memory chip prices are expected to rise, Samsung stands to benefit once again. This kind of agility is crucial in an industry where rapid technological advancements, global trade tensions, and supply chain disruptions are all common factors.

Looking forward, Samsung’s ability to maintain a balance between its mobile and semiconductor businesses will be key to its continued success. If the company can successfully navigate the volatility in the memory chip market while maintaining strong sales in its smartphone division, it could emerge as a stronger player in the global tech industry. However, the company will need to remain vigilant about the ongoing challenges posed by tariffs and other external factors that could disrupt the supply chain or dampen demand.

Samsung’s strong first-quarter performance is a reminder of the company’s resilience in the face of market uncertainty. Even with challenges in its semiconductor business, Samsung has been able to rely on the strength of its smartphone sales to sustain profitability. Looking ahead, the company’s strategic decision to raise memory chip prices in response to rising demand and the threat of tariffs is a smart move that positions it well for the second quarter of 2025.

The looming tariffs on chips may continue to disrupt the global semiconductor market, but Samsung’s ability to adapt and capitalize on market trends, including the stockpiling of chips, will likely help it navigate these challenges. As the company moves into the second quarter, the rise in chip prices and the ongoing demand for smartphones could provide the stability needed to drive growth. In an increasingly volatile market, Samsung’s strategic decisions and diversified business model will be key to maintaining its competitive edge.