In Response to U.S. Tariff Bombs, ASEAN Prepares Negotiation Cards, EU Expands Trade with China, Latin America, and the Middle East

Input

Modified

Major Southeast Asian Countries Prepare to Negotiate Tariff Cuts on U.S. Imports Security Ally EU Strengthens Independent Course Amid “Europe Bypass” and Tariff Bombs Trump Administration May Pressure Trade Partners to Limit Deals with China

When President Donald Trump granted a 90-day reprieve on newly imposed reciprocal tariffs, countries across Asia and Europe moved swiftly to seize the opportunity. For some, this was a chance to defuse escalating trade tensions. For others, it marked a pivotal moment to reevaluate their economic alignment in a world where the U.S. increasingly uses tariffs as a geopolitical weapon. As Trump’s second-term administration turns up the heat on trade partners, regions are responding in distinctly strategic ways—from bolstering bilateral ties with Washington to forging stronger partnerships with one another. The result is a reconfiguration of global trade diplomacy that’s intensifying by the day.

ASEAN Nations Offer Concessions to Ease Trade Tensions

Southeast Asia’s response has been pragmatic and calculated. Vietnam, often accused of serving as a backdoor for Chinese exports to the U.S., has taken major steps to present itself as a cooperative partner. According to The Wall Street Journal, Hanoi recently signed a $300 million aircraft deal with Boeing and granted Elon Musk’s Starlink permission to offer satellite internet services until 2031. In a further gesture of goodwill, Vietnam approved a Trump-linked resort project when his re-election appeared imminent last year. These moves are widely interpreted as a strategy to reduce Vietnam’s massive $123.5 billion trade surplus with the U.S.—a figure that dwarfs even the U.S. deficit with China. In return, Vietnam has been hit with a 46% reciprocal tariff.

Thailand, subject to a 36% tariff, is sending a delegation to Washington led by Deputy Prime Minister Pichai Chunhavajira. Their negotiation arsenal includes potential tariff cuts on U.S. energy imports and agricultural products—such as LNG, corn, soybeans, pork, and beef—along with defense procurement and cybersecurity tech integration.

Meanwhile, Cambodia, bearing the highest ASEAN tariff at 49%, has vowed to lower tariffs on 19 U.S. product categories in a bid to offset its past role as a transshipment hub for Chinese goods. Malaysia, which faces a 27% tariff, is pivoting toward reinforcing intra-ASEAN trade and advocating for a more integrated regional economy modeled after the EU.

Europe Diversifies Away from the U.S. and Warms to China

While ASEAN is attempting to reconcile with Washington, Europe is choosing a path of resistance and realignment. Trump’s decision to target traditional NATO allies with over 20% in reciprocal tariffs has sparked backlash across the continent. According to The Wall Street Journal, even America’s long-time European partners are questioning the durability of the transatlantic alliance, already weakened by recent diplomatic sidelining during Ukraine peace negotiations.

To reduce reliance on the U.S., the EU is reviving stalled trade talks with third parties. Negotiations with the UAE have resumed for the first time since 2008, and a long-delayed free trade agreement with South America’s Mercosur bloc has finally been finalized after 25 years. The most dramatic shift, however, is in Europe’s approach to China. While the EU previously labeled China its greatest diplomatic challenge, the shared pressure from U.S. trade policies has led to renewed cooperation. Though EU officials insist their China strategy remains unchanged, they are now reportedly reviewing high tariffs placed on Chinese electric vehicles, suggesting a potential thaw in economic relations.

China Courts Southeast Asia While Trump Draws Battle Lines

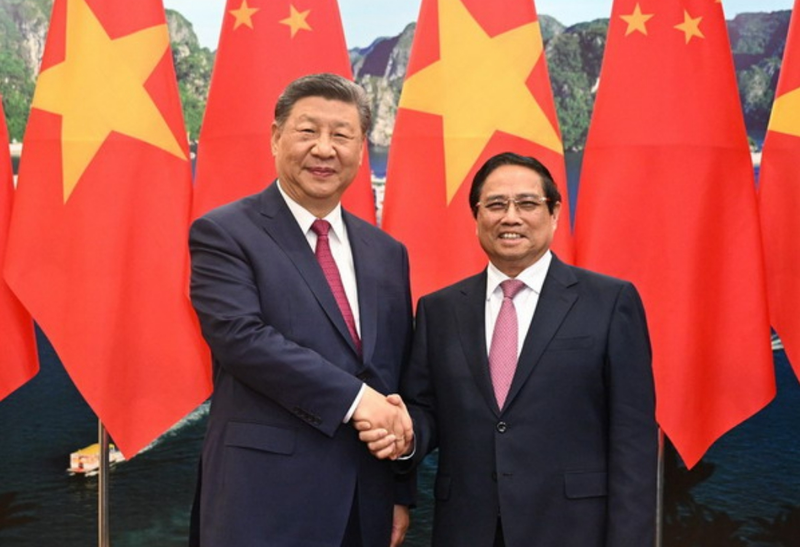

President Xi Jinping wasted no time in capitalizing on the geopolitical tension. From April 14 to 18, he embarked on a regional tour of Vietnam, Malaysia, and Cambodia—nations all hit by U.S. tariffs—offering solidarity and strategic alignment. While the trip had been scheduled in advance, the timing proved critical. In his meetings, Xi urged regional leaders to unite against “protectionism and hegemony,” framing China as a “reliable partner.”

Reuters described the tour as a “charm offensive” aimed at exploiting the vacuum in U.S. leadership. Given ASEAN’s long-standing engagement with Beijing through the Belt and Road Initiative and decades of infrastructure partnerships—including Chinese-funded railroads in Vietnam, dams in Cambodia, and ports in Malaysia—their mutual interests remain deeply embedded.

However, Trump viewed Xi’s diplomatic blitz as a direct affront. He denounced it as a “conspiracy to destroy America” and signaled plans to counter it through tougher trade tactics. According to WSJ, the Trump administration is now leveraging tariff negotiations to compel allies to limit trade with China. The strategy includes offering tariff relief in exchange for commitments to:

- Block Chinese goods shipped through third countries,

- Prevent the relocation of Chinese manufacturing to avoid tariffs,

- Stop the dumping of cheap Chinese products into foreign markets.

Speaking with Fox Noticias on April 15, Trump explicitly warned that major trade partners may be forced to “choose between America and China.” The initiative is reportedly being led by Treasury Secretary Scott Bessent, who laid out the plan during an April 6 meeting at Mar-a-Lago. His approach hinges on extracting concessions from U.S. trade partners to ensure Chinese firms cannot circumvent sanctions and trade restrictions.