New York Stock Market Plunges Across the Board Following Trump's Public Attack: 'Powell is a Loser

Input

Modified

Dow Jones, S&P 500, and Nasdaq All End Lower Trump: "Powell Risks Economic Slowdown by Delaying Rate Cuts" Also Launches Attacks, Calling Him 'Mr. Too Late' and More

The U.S. financial markets are once again in turmoil, rattled by a volatile mix of political pressure and economic uncertainty. President Donald Trump has escalated his attacks on Federal Reserve Chairman Jerome Powell, igniting fears over the independence of the nation’s central bank. As trade negotiations stall globally and investor confidence wavers, Trump’s latest remarks have triggered a dramatic market reaction—one that signals deeper concerns about the future direction of U.S. economic policy.

Market Chaos Deepens Amid Trump's Escalating Attacks

On April 21, the New York Stock Exchange saw a sharp sell-off as Trump's social media outburst intensified pressure on the Federal Reserve to lower interest rates. By 1 p.m. that day, the Dow Jones Industrial Average had plummeted by 1,091 points (2.79%), while the S&P 500 fell by 2.9% and the Nasdaq Composite dropped a staggering 3.17%. Big tech and industrial giants led the losses—Tesla plunged 7%, Nvidia over 5%, and Amazon, AMD, Meta Platforms, and Caterpillar all shed around 3%.

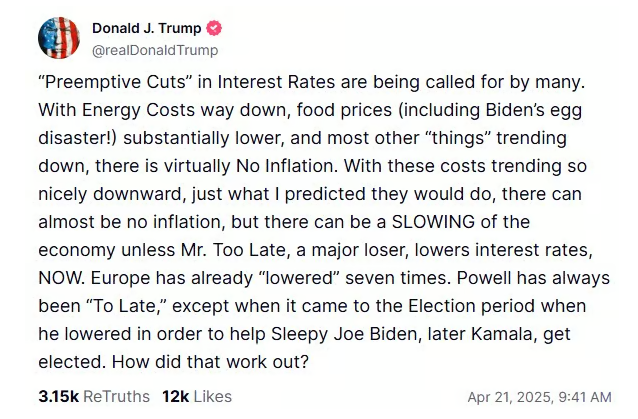

The downturn was largely driven by a post on Trump’s Truth Social account, where he referred to Powell as “Mr. Too Late” and a “major loser,” warning that failure to cut rates could lead to an economic slowdown. Trump argued that while inflation is not currently a concern, delaying a rate cut could trigger a downturn. He emphasized that grocery and energy prices, including what he mockingly called “Biden’s egg prices,” have dropped, and suggested Powell was acting too slowly—unlike European central banks that have already cut rates seven times. Trump even claimed the only time Powell acted swiftly was to support the electoral success of Joe Biden and Kamala Harris.

The markets responded with immediate anxiety. The U.S. dollar slumped to its lowest level in three years, and gold prices soared to an all-time high of over $3,400 per ounce. Financial analyst Adam Crisafulli described the attack as introducing a “new macroeconomic risk,” adding that the Fed may now struggle to lower rates due to lingering inflation concerns tied to tariffs. He further noted that the simultaneous fall in stocks, the dollar, and U.S. Treasury bonds could signal a broader exodus from American financial assets driven by fears of a deepening trade war.

Dismissal Threats and a Clash Over Fed Independence

Trump’s attacks didn’t end with name-calling—he also raised the possibility of firing Powell, marking a continuation of the previous week’s criticism. However, economists across the U.S. believe the chances of such a dismissal are slim. Removing the Fed Chair would not only contradict a 1935 U.S. Supreme Court ruling—originating from President Franklin D. Roosevelt’s failed attempt to oust the FTC chairman—but also strike at the heart of the Fed’s legal and institutional independence.

Powell’s tenure is protected by law, and he has remained firm in asserting that the president lacks the authority to remove him. Trump, for his part, appears to understand the risks: Wall Street has issued stern warnings that interference with the Fed could provoke a historic market crash. Michael Brown, senior strategist at Pepperstone, cautioned that Powell’s dismissal would trigger “the most dramatic sell-off of U.S. assets imaginable,” with serious implications including a weakened dollar and the erosion of U.S. financial leadership.

According to The New York Times, Trump’s advisers have privately warned him that firing Powell could provoke greater market panic. Powell, unfazed, has made it clear he won’t resign under pressure. Speaking recently at the Economic Club of Chicago, he reaffirmed that the Fed’s independence is “widely understood and strongly supported in Washington and Congress.”

Shifting Blame and Steering Monetary Policy

Though the legal and political odds are stacked against Trump, his rhetoric seems to have another goal: to influence monetary policy and redirect blame. During a press conference with Italian Prime Minister Giorgia Meloni, Trump told reporters he had voiced his dissatisfaction with Powell and said that if he wanted him out, “he’s got to go—and quickly.” A day later, he insisted that if Powell “understands what he’s doing,” he would lower interest rates.

Trump’s fury traces back to Powell’s recent speech criticizing tariffs—a cornerstone of Trump’s economic strategy. Powell had warned that tariffs could hinder growth and drive inflation, and his refusal to cut rates sparked Trump’s aggressive response.

Behind the political spectacle lies a strategic motive. Trump appears determined to frame any looming recession not as a consequence of his own trade policies, but as a failure of the Fed to act decisively. Francesco Bianchi, a professor of economics at Johns Hopkins University, suggested that Trump’s repeated attacks could condition the public to blame the Fed in the event of an economic downturn. As Bianchi put it, the more Trump insists, the more people will believe “the Fed must cut rates.”