Despite Trump’s Pressure, the Fed Holds Interest Rates Steady for the Fourth Consecutive Time: “Economic Uncertainty Persists”

Input

Modified

Fed Maintains Stance of Holding Rates Four Times a Year Powell: “Decisions must consider variables like inflation” Trump: “There are stupid people at the Fed,” intensifies criticism

In the face of mounting political pressure and an increasingly uncertain economic landscape, the U.S. Federal Reserve has chosen caution over capitulation. On June 18, the Fed announced its decision to leave the federal funds rate unchanged for the fourth consecutive time—extending its position first taken in January, then reaffirmed in March and May. This steady hand, held firmly by Fed Chair Jerome Powell, sends a clear message: despite President Donald Trump’s vocal demands for deep interest rate cuts, the central bank remains committed to data-driven decision-making and monetary independence.

The decision arrives at a tense moment. Trump’s aggressive use of tariffs, especially the reciprocal levies imposed since early April, has added turbulence to an already fragile global economy. While the White House continues to dismiss inflation concerns, insisting tariffs will not drive up prices, the Fed sees the risks differently. With inflationary pressures looming and growth slowing, Powell and his team are in no rush to stimulate the economy further—particularly when the effects of trade policy are still unfolding.

A Deliberate Pause in an Uncertain Climate

The Federal Open Market Committee (FOMC) unanimously agreed to maintain the benchmark interest rate at 4.25% to 4.50%. This marks the fourth straight pause following a series of three rate cuts totaling one percentage point in late 2024. But 2025 has ushered in new complexities. Escalating global trade tensions—particularly the Trump administration’s imposition of reciprocal tariffs on major trading partners—along with the ripple effects of Middle Eastern conflicts, have clouded the economic horizon.

Powell made clear that the Fed is holding off on any abrupt shifts in policy until it better understands the evolving conditions. The Fed, he emphasized, is well-positioned to wait and observe rather than react prematurely. According to the Summary of Economic Projections (SEP), officials continue to anticipate two quarter-point cuts before the end of the year, potentially bringing the rate to 3.9%. But not everyone agrees: the Fed’s “dot plot” reveals that seven committee members expect the rate to remain unchanged through December, underscoring the internal divisions and the broader atmosphere of uncertainty.

Longer-term expectations have also been trimmed. For 2026 and 2027, the Fed now projects just one 0.25 percentage point cut per year, down from the two cuts per year previously forecasted. Powell acknowledged the lack of clarity in the current outlook, stating that no one at the Fed feels entirely confident about the path forward. Still, he expressed cautious optimism that some resolution may soon be in sight. He noted that the summer months could offer clearer insight into the trajectory of tariffs and their economic impact. Indeed, Powell said the Fed “will learn a lot over the summer,” conveying hope that the cloud of trade-related uncertainty might lift—potentially opening the door to monetary easing as early as September. Investors have taken note: the CME FedWatch tool showed a 68.4% probability of a rate cut in September, up from 63.2% the day prior.

Economic Forecasts Weaken as Tariff Effects Deepen

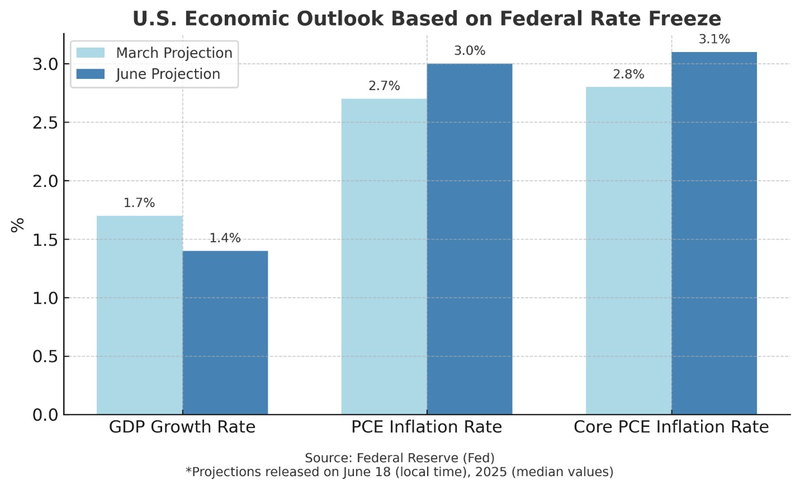

While the Fed’s policy stance remains steady, its outlook on the U.S. economy has notably darkened. In its latest economic projections, the Fed downgraded the country’s GDP growth forecast for the year from 1.7% to 1.4%—a second consecutive downward revision following a 2.1% estimate last December. This revised figure now matches the World Bank’s June 10 outlook, which also cited the Trump administration’s tariff war as a major factor in curbing global economic momentum.

Other indicators tell a similar story. The Fed raised its forecast for year-end personal consumption expenditures (PCE) inflation from 2.7% to 3.0%, and for core PCE inflation—which excludes food and energy—from 2.8% to 3.1%. These revised projections suggest that price pressures, long dismissed by the Trump administration, are beginning to materialize. The year-end unemployment rate was also nudged upward, from 4.4% to 4.5%, suggesting potential weakening in the labor market as businesses face higher input costs and greater operational uncertainty.

Powell underscored the tangible consequences of the administration’s trade policy, warning that this year’s tariff hikes are already pushing prices higher and placing additional strain on economic activity. He pointed specifically to sectors such as personal computing and audiovisual electronics, where tariffs are already translating into noticeable price increases. The Fed, he said, has begun to detect early effects of the tariffs and anticipates that their impact will grow more pronounced in the months ahead. Still, Powell maintained that the Fed would not act impulsively. It will wait for more definitive data before adjusting policy, particularly as inflation data is expected to be volatile through the summer.

Trump’s Fury Boils Over as He Targets Powell and the Fed

The Fed’s resistance to political pressure has done little to calm the mood in the White House. President Trump, long frustrated by Powell’s refusal to cut interest rates aggressively, launched his most personal attack to date following the June 18 announcement. In the days leading up to the decision, Trump renewed his call for a drastic two-percentage-point reduction in rates, arguing that the U.S. was lagging behind global counterparts. “Europe has cut them ten times—we haven’t done it once,” he said, painting the Fed as complacent and out of touch.

When the Fed held its ground, Trump escalated his rhetoric. He denounced Powell as “stupid” and “a political person, not a smart one,” accusing him of inflicting massive financial harm on the country by failing to lower rates. In an extraordinary turn, Trump suggested that he should replace Powell himself, quipping, “I might as well be the Fed Chair. Can I appoint myself? I’d do a much better job.” Though likely said in jest, the statement underscored the president’s deep frustration with the institution’s independence and Powell’s leadership.

Despite his harsh words, Trump clarified that he does not intend to dismiss Powell before his term ends in May of next year. “He’ll be gone in nine months,” the president remarked, effectively ruling out a premature ouster and likely attempting to avoid further rattling financial markets. Earlier in the year, speculation had swirled when Trump openly floated the idea of firing Powell—a threat that raised serious concerns about the politicization of the Federal Reserve.

Yet even as he pulled back on that threat, the damage to the relationship between the executive branch and the central bank was evident. Trump’s outbursts reflect not only political impatience but also a widening rift between economic strategy and monetary stewardship. At a time when inflation is accelerating, growth is slowing, and trade tensions remain unresolved, the Fed is steering through one of its most politically charged climates in decades. Powell may still have nine months left in his term, but the pressure isn’t letting up—and neither is the Fed’s resolve.