Bond Yields Rising, Options Shrinking: Japan’s Fragile Balancing Act

Input

Modified

Rising debt and yields are tying the Bank of Japan’s hands. Inflation is climbing, but policy tools are running out. Without serious reform, Japan’s economic stability is at risk.

Japan’s deepening fiscal woes and rising bond yields are limiting the Bank of Japan’s ability to raise interest rates. Inflation is up, but policy options are narrowing. Without reform, economic stability remains at risk.

Japan's Fiscal Alarm Bells Ring Louder as Economic Normalization Hangs in the Balance

TOKYO — The fallout from Japan’s recent Upper House election signals more than a shift in the political wind; it is the latest marker of a government caught in deepening economic quicksand. As the ruling Liberal Democratic Party and Komeito coalition lose their grip on legislative control, markets are beginning to reprice not just political risk, but also the fundamental question of Japan’s fiscal credibility.

For years, Japan’s public debt has been the elephant in the room: vast, looming, yet ignored mainly due to the domestic ownership of government bonds and the Bank of Japan’s long-standing ultra-loose monetary policy. But recent events have begun to pierce that veil of complacency. Prime Minister Shigeru Ishiba’s alarmist warnings about the fiscal position being “worse than Greece” may have once been dismissed as campaign rhetoric, an electoral tactic to counter opposition calls for temporary consumption-tax relief. Still, now they are beginning to sound like a premature confession.

Political Gridlock Deepens Fiscal Worries

As the election dust settles and the coalition faces legislative gridlock, Japan's ability to enact needed fiscal reforms is now in serious doubt. Investors, who were once content with paltry returns on Japanese Government Bonds (JGBs), are now facing a potential storm. The political paralysis raises red flags about any credible path toward fiscal consolidation. Without the ability to rein in spending or increase revenues through unpopular measures, such as tax hikes, the deficit is poised to deepen.

It is in this context that Ishiba's campaign warnings are gaining new significance. While critics derided his comparisons to the Greek debt crisis as exaggerated, the market's muted reaction may not last for long. The deterioration of government balance sheets is becoming harder to ignore. Fitch Ratings recently flagged Japan’s fiscal policy as the primary risk to its sovereign credit rating, underscoring that even a nation with the world's third-largest economy is not immune to the consequences of unchecked debt growth.

Moreover, the government's reluctance to consider corporate tax increases, even as it resists calls for easing the consumption tax, signals a broader unwillingness to redistribute fiscal burdens. What was once labelled prudent policy restraint now appears increasingly like political stasis. The situation is exacerbated by a rapidly aging population and stagnant productivity, leaving few levers to pull without incurring economic or political backlash.

Markets Reprice Risk as Bond Yields Climb

The international financial community is taking notice. While the domestic ownership of JGBs has historically shielded Japan from the volatility seen in countries like Greece or Italy, globalization and interconnected capital markets mean no country is truly insulated. The fear is not that Japan will default, but that the rising cost of servicing its debt could trigger a broader loss of confidence. That concern alone is enough to push bond yields upward—a development that is already underway.

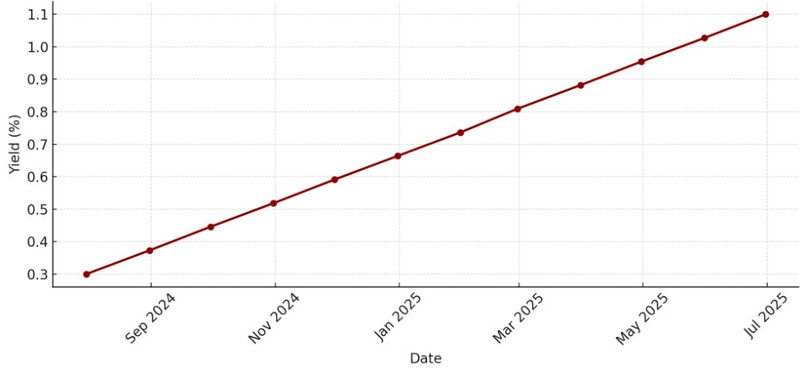

JGB yields have begun to creep higher in recent months, with the 10-year benchmark now hovering well above the 1 percent mark for the first time in years. The move, while moderate by global standards, represents a sea change for a nation that has lived in a world of near-zero rates for decades. As yields rise, so too does the burden on government finances, creating a vicious cycle that could further undermine fiscal stability.

Compounding the issue is the Bank of Japan’s precarious position. For years, the BoJ has served as both buyer and backstop for the government's borrowing spree, keeping interest rates low through aggressive bond purchases and yield curve control. But the monetary authority now finds itself in a tightening vise: it must balance the need to manage inflation and wage growth with the imperative of maintaining financial stability.

Monetary Policy Faces a Tightrope Walk

Japan is finally experiencing inflation consistently above the 2 percent target, with wages rising at their fastest pace in over three decades. Consumer demand is showing signs of recovery, and inflation expectations are rising among households. On paper, this should be the perfect time for the BoJ to normalize policy. But the reality is more complicated.

Any move to raise interest rates could exacerbate the upward pressure on bond yields, increasing the government’s debt servicing costs and potentially triggering financial instability. The BoJ has already signaled its caution, keeping its policy rate at a modest 0.5 percent and slowing the reduction of its bond purchase program. It appears increasingly constrained, not by macroeconomic fundamentals, but by the very fiscal imbalances the Ishiba administration has failed to resolve.

This hesitation in monetary policy reflects a broader anxiety: Japan’s so-called normalization may be built on shaky ground. Despite positive indicators, structural weaknesses remain. Household demand is still fragile, and export-driven growth remains vulnerable to global trade disruptions. The moment the BoJ signals a clear shift away from accommodative policy, it risks pulling the rug from under a nascent recovery.

Investors understand this paradox all too well. The rise in JGB yields is not just a response to inflation; it is also a pricing-in of risk, a recognition that Japan’s fiscal trajectory may be unsustainable without significant reform. The BoJ’s limited room to maneuver is part of that calculus. Markets are asking whether the central bank can truly normalize without triggering a fiscal crisis, and the answer, increasingly, appears to be no.

Thus, Japan finds itself caught between a rock and a hard place. The government’s fiscal hands are tied by political gridlock and demographic decline, while the BoJ is constrained by the very debt dynamics it once helped to enable. Both pillars of economic policy, fiscal and monetary, are now leaning on each other for support, and neither appears strong enough to stand alone.

If Japan is to navigate this treacherous terrain, it will need more than central bank finesse or electoral slogans. Structural reforms, credible fiscal consolidation plans, and a willingness to engage in honest public discourse about the nation’s economic future are essential. Without them, the current path leads not to normalization, but to a new normal of fragile stability and growing risk.

Ultimately, what began as an election centered on taxes and inflation has revealed the deeper fault lines within Japan’s economy. The international financial community is watching closely. If bond yields continue to climb and the BoJ remains cornered, the next crisis in Japan may not come with a crash, but with a long, slow erosion of confidence—and that could be even more difficult to reverse.