Input

Changed

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

In today’s global monetary regime, economic sovereignty is increasingly a myth for most countries—especially those outside the core of international finance. The financial decisions made by the U.S. Federal Reserve are not just domestic policy shifts; they are global economic shockwaves. Even among regional central banks that are ostensibly independent, the gravitational pull of the Fed’s decisions renders local policy reactive, not proactive.

Peripheral Policy Paralysis: Why Local Governments Take a Backseat to the Fed

It has become a defining characteristic of global finance: most regional or national central banks, particularly in peripheral or emerging economies, are more attuned to the U.S. Federal Reserve's pulse than their own fiscal governments. This difference is not ideological—it is a structural necessity. The phenomenon of monetary policy spillovers from financial centers like the U.S. to the periphery has made it clear that international financial hierarchies tightly constrain sovereignty in economic policy.

According to the CEPR’s discussion on Monetary Policy Spillovers and the Role of the Dollar, the U.S. dollar’s dominance in global trade and finance translates into outsized influence. When the Fed tightens rates, capital flies out of emerging markets, local currencies depreciate, and inflation surges. In response, peripheral central banks often raise interest rates preemptively—not because of domestic overheating but to maintain currency stability and capital inflows. This reaction mechanism underscores a fundamental truth: the Fed sets the tempo, and the world follows the beat, a reality that cannot be escaped.

Quantifying Dependence: The Spillover Channel in Action

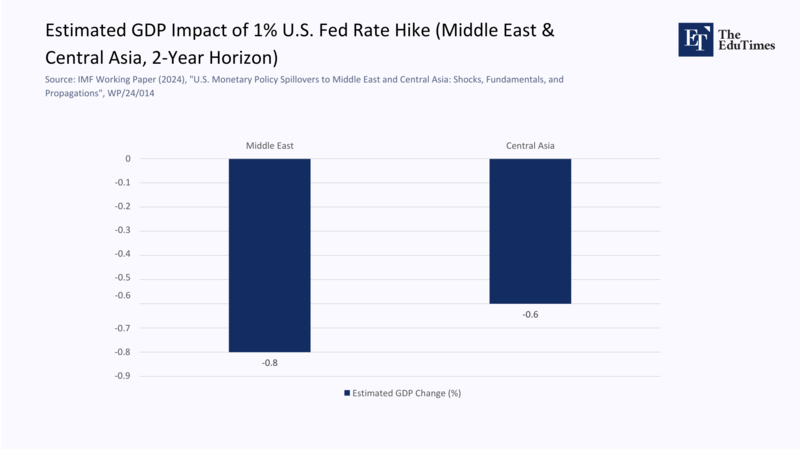

A 2024 IMF Working Paper analyzing U.S. monetary spillovers to the Middle East and Central Asia shows this vividly. It found that a one-percentage-point Fed rate hike can depress output in these regions by up to 0.8% over two years. Moreover, this occurs even when these countries have sound domestic fundamentals. External vulnerability matters more than internal health—particularly through the dollar debt channel and trade linkages.

The IMF paper further notes that exchange rate regimes—especially those pegged to the dollar—make the spillover effects more acute. This underscores the reality that policy independence is often sacrificed at the altar of exchange rate stability. These economies cannot afford to diverge from the Fed, even when domestic conditions call for a different path.

Core vs. Periphery: Asymmetric Sovereignty in Practice

In advanced economies, particularly those in the Eurozone, Canada, or Japan, the U.S. spillover effect is not ignored—it is modeled as a mandatory variable. However, these economies' sophisticated monetary toolkits allow them to partially mitigate the fallout through communication strategies, macroprudential tools, and credibility buffers.

Contrast that with many Middle Eastern and Central Asian countries where monetary policy is mainly defensive. Central banks in these regions are often trapped between supporting fragile growth and fighting imported inflation. Their governments may announce fiscal programs, but monetary tightening driven by Fed spillovers can neutralize these efforts overnight. Even domestic fiscal coordination becomes irrelevant in such cases—the Fed becomes the de facto central bank.

Conclusion: Global Policy Autonomy is a Mirage Without Financial Decentralization

This asymmetry in global monetary governance raises a critical question: What does sovereignty mean when national central banks effectively respond to a foreign institution’s decisions? Unless the international financial system diversifies away from the U.S. dollar and reduces the concentration of capital flows, peripheral economies will continue to operate within a reactive policy space.

The more profound truth is this: until we urgently redefine the rules of global monetary engagement, economic self-determination for most countries will remain more aspirational than actual. The Fed doesn’t just guide U.S. monetary policy—it dictates the contours of global economic behavior.

The original article was authored by Sushant Acharya, an Associate Professor of Economics at the University Of Melbourne, along with four co-authors. The English version of the article, titled "https://cepr.org/voxeu/columns/monetary-policy-spillovers-and-role-dollar," was published by CEPR on VoxEU.