Input

Changed

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

A single threatening declaration—China’s vow to unload its portfolio of U.S. Treasuries if tariffs escalate—captures a more profound structural shift: When major exporters earn less from the American market, they lose the capacity and incentive to channel their profits back into U.S. debt. At first glance, tariffs might seem to protect domestic industries by trimming the trade deficit. Yet the broader picture shows that the same nations with the most enormous surpluses—especially China—play an essential role in financing U.S. government spending through Treasury purchases. If that link weakens, Washington may face a more challenging path to fund its budget, posing significant risks to the U.S. Treasury financing, a matter of grave concern.

The Balancing Act of U.S.–China Trade

China’s position as a chief exporter to the United States has long been mutually beneficial for both nations. American consumers gain access to relatively inexpensive goods. At the same time, exporters in China invest a share of their U.S. dollar profits in Treasuries, helping finance the U.S. government at low interest rates. Raising tariffs disrupts this cycle in two key ways:

- Reduced Export Earnings: Additional tariffs diminish profit margins for Chinese and foreign exporters, meaning fewer dollars are available for Treasury investments.

- Potential Retaliatory Measures: Threats to unload existing Treasury portfolios heighten market volatility; however, the deeper reality lies in the ongoing decrease in foreign capital inflows if exporters’ revenues dwindle.

The potential consequences are far-reaching. According to Reuters (“Tariffs caused US Treasury market dislocations, raising longer term concerns”), analysts have repeatedly warned of growing instability if high-volume buyers like China alter their investment strategies.

Supporting Data and Trends

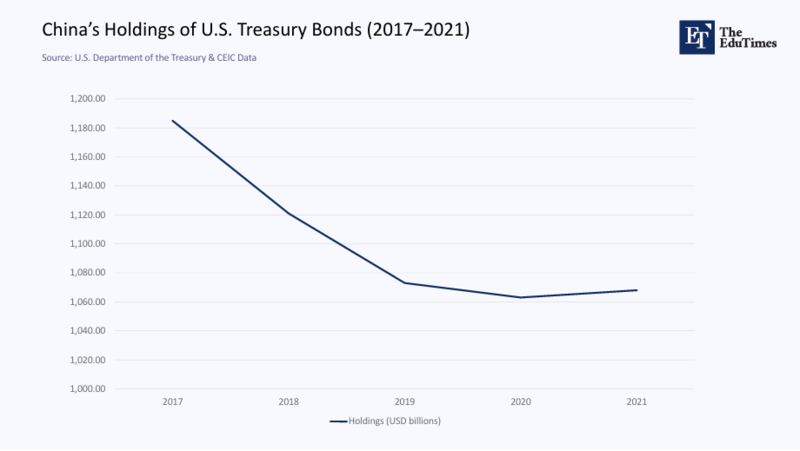

Although dramatic sell-offs make headlines, the subtler long-term shifts in Treasury holdings offer more telling insights. Publicly available data compiled from various financial publications and government releases shows China’s holdings declining over recent years (approximate figures):

- Sustained Erosion: Even a gradual reduction in China’s position underscores an evolving strategy, hinting that tariff disputes only intensify a trend already underway.

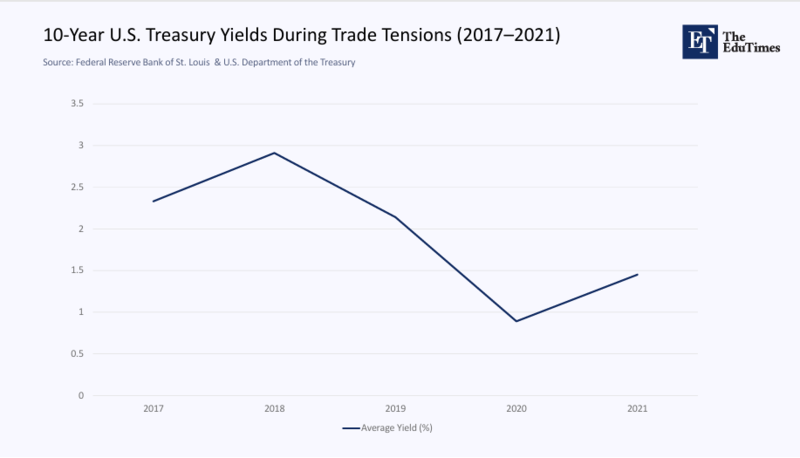

- Yield Pressures: As foreign demand wanes, the U.S. Treasury faces potential upward pressure on yields. Financing costs for U.S. debt could increase if a traditional major buyer scales back its allocations, which demands immediate attention.

To illustrate yield movements during trade tensions, one can visualize how global uncertainties coincide with slight spikes in longer-dated Treasury bonds. While the exact path depends on market sentiment, heightened investor caution about fewer foreign buyers often translates into higher borrowing costs.

Trade Suppression, Consumer Impact, and Policy Implications

Diminished Purchasing Power Abroad

Tariffs increase costs for foreign producers, who may respond by scaling back production for the U.S. market or searching for alternative export destinations. This reduction in export-led earnings lowers the surplus capital once reinvested in Treasury securities.

Domestic Consumer Welfare

Americans enjoy stable or lower prices on a range of imported goods—tariff-induced price hikes risk dampening consumption, which can slow economic growth. The direct revenue from tariffs might reduce the trade deficit on paper, but in practice, it can undercut purchasing power and push inflation higher for certain imports.

Long-Term Financing Questions

A persistent drop in foreign Treasury buying would require the U.S. to rely on domestic investors or other global lenders. A more competitive debt market typically demands higher interest payments, adding to the federal government’s fiscal burdens.

Integrating a Fresh Policy Perspective

Rather than framing tariffs as a simple tool to rectify trade imbalances, policymakers can adopt a more holistic view:

- Selective Tariffs and Exemptions

Calibrating tariffs to address specific grievances, such as intellectual property theft or targeted dumping, can limit collateral damage to broader import flows. This nuanced approach protects domestic industries while preserving essential global investment channels. - Diversifying the Investor Base

If reliance on major exporting nations declines, the U.S. could court a broader range of domestic and international investors by making Treasury securities more attractive through tax incentives or regulatory simplifications. This would potentially diversify the investor base and strengthen the future of U.S. Treasury financing. - Enhanced Multilateral Frameworks

Collaborative trade frameworks can reduce the risk of one-sided retaliation and create predictable environments for exporters. This stability supports foreign holders’ willingness to invest in U.S. debt and safeguards consumer welfare at home.

Sustaining the Flow of Capital

Imposing tariffs on a nation that significantly contributes to one’s debt financing presents a fundamental paradox. While short-term objectives might be met—such as reducing specific parts of the trade deficit—the longer-term question is whether the U.S. can maintain a stable market for its Treasuries if it constrains the very sources of global capital on which it depends.

Analysis from CEPR “International trade suppression and the demand for US Treasuries” and other economic commentaries converges on one warning: continuing trade suppression could make financing the U.S. government increasingly expensive if key investors’ ability to reinvest dollars is curtailed. Ultimately, managing this delicate balance requires a strategic blend of tariff policies and broader financial initiatives—ensuring that America’s immediate economic gains do not come at the cost of its long-term fiscal health.

The original article was authored by Paola Subacchi & Paul van den Noord. The English version of the article, titled "International trade suppression and the demand for US Treasuries" was published by CEPR on VoxEU.