Input

Changed

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

One of the most inspiring lessons from recent economic disruptions is the resilience and adaptability of industries. U.S. restaurants, once perceived as locked in slow-growth patterns, have defied expectations and shown a remarkable surge in productivity. This shift, driven by changing consumer dining habits and more efficient kitchen practices, challenges the belief that the restaurant sector would be stuck with minimal productivity gains. The industry's ability to adapt and thrive in the face of adversity is a testament to its strength and potential for growth.

Redefining Restaurant Dynamics: The Unexpected Productivity Gain

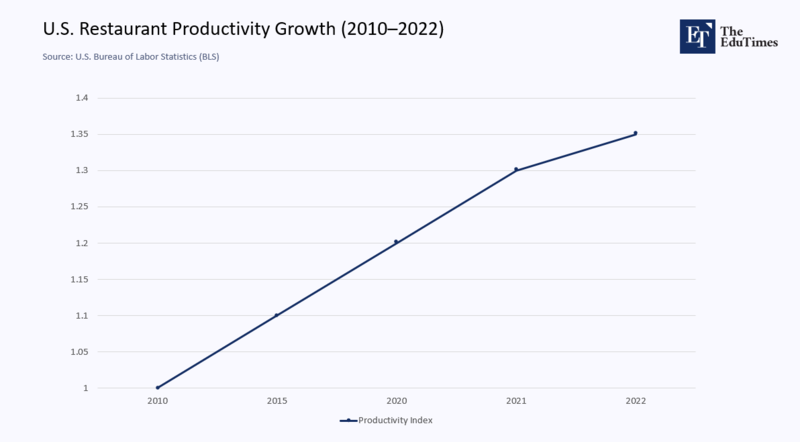

For years, the conventional wisdom held that restaurant productivity was fundamentally limited: Waitstaff could only handle a set number of tables per shift, kitchens were typically squeezed by manual processes, and overall capacity remained capped by seating constraints. However, post-2020 data from the U.S. Bureau of Labor Statistics (BLS) and independent research groups suggest that productivity in the restaurant sector rose by an estimated 3–4% between 2020 and 2022, significantly outpacing the historical annual average of around 1%. This departure from the norm raises a key question: What exactly changed to spark this uptick?

Shorter Dwell Times

A prime factor is how quickly customers move through the dining experience. According to an analysis referenced by the Center for Economic and Policy Research (CEPR), dwell times—how long patrons stay in a restaurant—have declined by about 10–15% in many metropolitan areas. In practical terms, customers now dine and depart faster, often influenced by concerns about indoor crowds or their busy schedules. With shorter visits, operators can cycle through more customers in the same timeframe.

The Delivery and Take-Out Boom

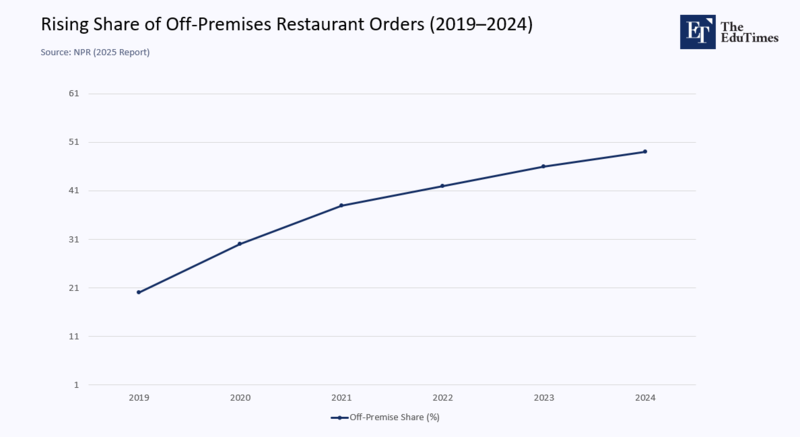

Additionally, the explosive rise of off-premises dining—takeout and delivery—has reshaped restaurant labor requirements. A 2025 NPR report underscores how the ratio of off-premises orders doubled in certain regions during the pandemic’s peak. This reduces the need for extensive waitstaff on the floor and allows the back-of-house (kitchen) to focus more precisely on order output, often with streamlined workflows.

Strengthening the Kitchen Core: Efficiency Tools and Workforce Optimization

Despite the intuitive notion that cooks and prep staff might face unsustainable workloads, many restaurants have successfully harnessed technology and revised their workflow to handle the increased volume.

Process Automation: Automated fryers, portion control devices, and even software-based kitchen display systems have trimmed what once were time-consuming steps. By some estimates, for every 10% increase in off-premises orders, labor productivity can rise by 2% because staff can prepare the same dish repeatedly without pausing for different menu requests and specialized plating.

Workforce Reallocation: As servers shift to handling more digital orders—packaging and verifying take-out food rather than juggling multiple tables—kitchen staff can spend fewer minutes per order since aspects of plating and on-site customer engagement are reduced. This partial reallocation of labor effectively increases throughput.

Training and Upskilling: Some restaurants took advantage of slower in-person foot traffic early in the pandemic to train staff more extensively. This “training lull” meant employees were better prepared to handle a rush of new orders once delivery became a mainstay. Anecdotal evidence from industry-focused publications confirms that well-trained employees are more adept at juggling parallel tasks, increasing efficiency.

Visual Insight: Off-Premises Dining and Productivity on the Rise

Recent data-driven insights reveal how structural shifts are redefining the restaurant industry.

Two key trends illustrate how dramatically the restaurant industry has evolved in recent years—each contributing to a surge in operational productivity.

This graph illustrates a significant departure from the usual productivity trends. For the last ten years, restaurant productivity has been largely stagnant, showing only slight improvements each year. However, starting in 2020, the industry saw a remarkable increase in output, with productivity climbing an estimated 3–4% over a two-year period—more than three times the historical average. This increase is indicative of a wider change in operational strategies, the integration of technology, and improvements in labor efficiency.

The rapid growth of off-premises dining has been equally transformative. The chart shows that take-out and delivery orders increased from just 20% of total restaurant volume in 2019 to nearly 50% by 2024. This shift has reduced the reliance on in-person dining and waitstaff, allowing kitchens to streamline operations and improve efficiency. With more standardized meal preparation and less time spent on plating, many restaurants have been able to serve more customers without needing to hire additional staff.

Together, these trends offer compelling evidence that the restaurant industry is undergoing a structural transformation—one driven as much by evolving consumer preferences as internal innovation.

Policy Implications: A Fresh Perspective

While the restaurant industry has shown resilience and creativity, policymakers and industry leaders are now responsible for sustaining this wave of productivity and ensuring it benefits both businesses and workers. The key policy and strategic considerations outlined below are suggestions and a call to action for all stakeholders to play their part in shaping the industry's future.

Encourage Technology Adoption: Government grants or low-interest loans for small and medium-sized restaurants can help them invest in the same kitchen technologies that larger chains use. By lowering the cost barrier, more establishments can capitalize on the economies of scale that come with automated processes.

Invest in Workforce Training: Productivity improvements require a workforce comfortable with new technology and flexible service models. Partnerships between community colleges and restaurant industry coalitions could offer accelerated training programs, from digital ordering system management to multi-station meal preparation.

Support Pro-Labor Measures: As productivity climbs, policymakers should ensure gains are distributed in ways that uplift workers. Higher wages and greater scheduling predictability can help maintain a stable workforce equipped to deliver these efficiency boosts over the long term.

Focus on Regulatory Flexibility: Cities could explore more flexible regulations for outdoor dining or simplified licensing for off-premises operations. Easing specific legal and administrative burdens allows restaurants to react quickly to consumer shifts while maintaining standards that protect health and safety.

Interpreting the Bigger Picture

The lessons gleaned from this productivity spike transcend the restaurant industry. They highlight how shifts in consumer behavior—once dismissed as unlikely to disrupt a stable market—can accelerate structural changes. The pandemic served as a catalyst, not just a temporary interruption: It pushed restaurants to reinvent their operational models, invest in time-saving tools, and offer new services like curbside pickup and optimized digital ordering systems.

Other service-oriented sectors, from retail to education, may experience similar leaps if they strategically embrace a hybrid model that accommodates traditional, in-person interactions and online convenience. The restaurant sector’s recent trajectory thus offers a blueprint for how innovation and an openness to new consumer-driven norms can upend old assumptions about minimal productivity gains.

Redefining Possibility: Lessons from a Sector Reborn

What looked like a complacent industry, bound by the slow churn of table service, has pivoted into a realm of higher turnover and improved cost-effectiveness. Kitchens have managed to ramp up output without proportionally expanding their workforce, primarily because consumer demands and business models have converged in a way that supports productivity breakthroughs. While it remains to be seen if this momentum can be fully sustained as consumer habits evolve, it is already clear that the restaurant sector’s potential for growth and transformation was understated.

In the final analysis, the real surprise isn’t just that restaurant productivity improved—it’s how swiftly it happened once market forces and technology worked in concert. If stakeholders capitalize on these insights, the restaurant industry could continue charting an unprecedented course of adaptability and efficiency, challenging the assumption that the service sector is condemned to low productivity gains. This surge is a potent reminder that even long-established sectors can innovate rapidly with the right impetus and tools.

The original article was authored by Chad Syverson, a Distinguished Service Professor of Economics at the University of Chicago, along with two co-authors. The English version of the article, titled "The curious surge of US restaurant productivity: The role of take-out and delivery" was published by CEPR on VoxEU.