Input

Changed

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

Steven Miran’s interpretation of “fair trade” is a concerning blend of economic naivety and political bravado. As one of President Trump’s key financial advisors, Miran has endorsed tariffs as both a punitive measure and a negotiation tactic. However, following the backlash from Trump’s initial tariff salvos—what many dubbed the “tariff bomb”—it’s increasingly clear that this strategy is neither economically sound nor diplomatically sustainable.

At its core, Miran’s position diverges from global consensus and economic fundamentals. The claim that imposing tariffs will lead to a more balanced trade environment ignores decades of empirical evidence and betrays a startling misreading of global trade dynamics.

The Myth of Tariffs as Trade Equalizers

With Miran’s backing, the Trump administration launched its tariff-heavy policy to correct trade imbalances and revive domestic manufacturing. The logic? Making imports more expensive would thereby nudging consumers and companies toward domestic alternatives.

But here’s the catch: trade deficits, which are the difference between a country's exports and imports, are not the result of unfair trade practices alone—they’re macroeconomic phenomena tied to savings and investment dynamics. As outlined in the CEPR article, “Looking for a fair international monetary system,” trade deficits often stem from structural imbalances in domestic economies, not necessarily from external manipulation. Miran’s disregard for this macroeconomic reality—his insistence on using tariffs as a cure-all—puts him at odds with nearly every serious economist.

The Short-Term Illusion, the Long-Term Cost

Even if one assumes that tariffs can reduce the trade deficit in the short term (a claim still hotly debated), the long-term costs are undeniable and should be a cause for concern. Tariffs raise input costs for domestic producers, inflate consumer prices, and invite retaliatory measures. American exporters are often the first to suffer when foreign partners strike back, targeting agricultural and industrial exports that support thousands of U.S. jobs.

Let’s quantify that pain. A 2024 analysis by the Peterson Institute for International Economics showed that the steel and aluminum tariffs alone cost American consumers and businesses $900,000 for every job supposedly saved. Meanwhile, U.S. Bureau of Economic Analysis data indicates that price inflation in tariff-hit sectors has outpaced wage growth, eroding purchasing power.

This isn’t policy—it’s protectionist theater with middle-class families as collateral damage.

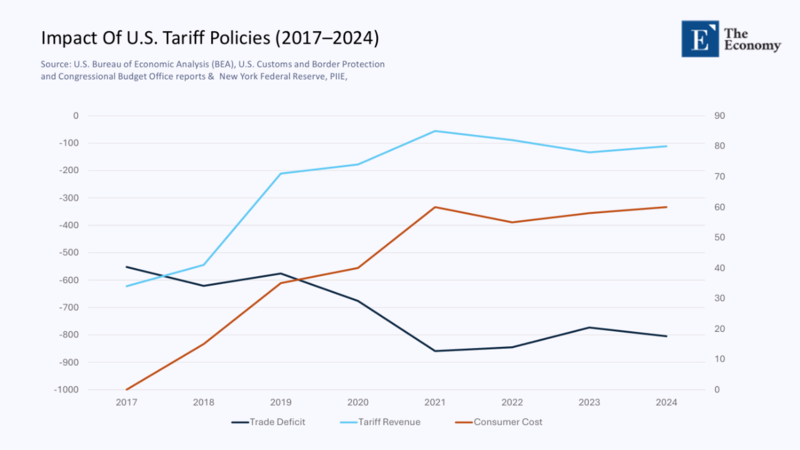

A closer look at the numbers illustrates the policy's ineffectiveness. From 2017 to 2024, the trade deficit widened, contrary to the tariff agenda's goals, while tariff revenues saw only modest increases. Meanwhile, American consumers quietly shouldered rising prices. The chart below visualizes this dynamic, showing how the illusion of "tariff gains" masks a regressive shift of cost onto everyday Americans:

This data underscores the fundamental contradiction of Miran’s policy logic: while trade imbalances persisted, tariffs failed to produce meaningful fiscal or structural gains—and came at direct cost to household budgets.

The Collapse of Negotiating Power

The original tariff imposition was supposed to give the U.S. leverage, forcing trading partners to “play fair.” However, as analysts in the referenced Korean news article rightly point out, that leverage vanished almost instantly when other countries refused to bend and instead hardened their positions. Miran’s tactical miscalculation effectively locked the Trump administration into a corner: too proud to roll back tariffs, yet too exposed to escalate further without triggering broader economic harm.

Moreover, the U.S. alienated allies just as China expanded its influence through alternative trading blocs. By 2025, the U.S. was excluded from critical supply chain arrangements in Asia, while the Regional Comprehensive Economic Partnership (RCEP), a free trade agreement among 15 Asia-Pacific countries, deepened cooperation across the Indo-Pacific, without Washington at the table.

The Sacrifice of American Households

The greatest irony of Miran’s stance on tariffs is that it purports to defend American workers while ultimately making them worse off. Tariffs function as a regressive tax. A 10% tariff on imported goods does not hit corporations equally—it hits low- and middle-income families who rely on imported consumer goods for affordability. A working family buying a washing machine or school supplies pays more because of Miran’s supposed “fair trade” agenda, which should evoke sympathy for their plight.

Economist estimates suggest the average household paid an extra $1,000 per year during the peak of Trump’s tariff policies—real money for people already dealing with housing, healthcare, and wage stagnation.

A Misguided Definition of Fairness

Miran’s conception of “fair” seems rooted not in economic analysis but in a punitive, transactional worldview that views trade as a zero-sum game. But trade fairness isn’t about zero-sum balancing acts—it’s about creating systems that foster competitiveness, innovation, and equitable growth. The CEPR piece argues for global monetary reform and rebalancing of capital flows as deeper routes to fairness. These are the kinds of systemic changes that require multilateral cooperation, not unilateral tariffs and nationalistic grandstanding.

The Tariff Gambit Failed—It’s Time to Admit It

Steven Miran’s insistence on tariffs as the linchpin of fair trade policy was flawed from the start, and the evidence now overwhelmingly shows that the approach has failed. Rather than correcting trade deficits, it introduced new distortions, raised consumer costs, and weakened America’s global economic standing.

Fair trade cannot be built on economic fiction or political slogans. It must rest on smart policy, structural reform, and international cooperation. Miran’s brand of “fairness” has become a liability—not just to the Trump administration’s legacy but also to the country's economic future.

The original article was authored by Agnès Bénassy-Quéré, a Deputy-Governor at Banque De France. The English version of the article, titled "Looking for a “fair” international monetary system," was published by CEPR on VoxEU.