Input

Changed

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

When economies stall, faith in the state falters. When stagnation becomes global, the damage to political trust is not just national—it’s systemic and demands immediate attention.

Growth as the Bedrock of Political Trust

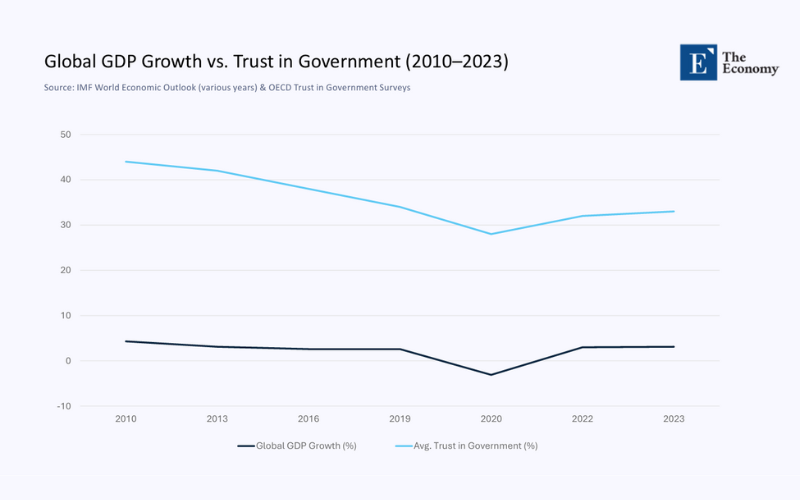

Across the world, confidence in governments is falling, and the culprit is not just corruption, polarization, or disinformation. It’s economic underperformance. New research from CEPR reveals that when economic growth slows, public trust in government erodes in lockstep. Crucially, when this slowdown is global, as it is today, the effects multiply: governments everywhere find it harder to maintain credibility, coordinate policy, or meet the promises citizens expect of them.

This is not a coincidence. It is a structural breakdown. Trust in the state is tethered to its perceived ability to deliver prosperity. When growth stops delivering, belief in government falters—first domestically, then across borders, highlighting the intricate relationship between trust and economic development.

The Data: Growth and Trust Move Together

According to a sweeping cross-national analysis from CEPR covering over 2.8 million individuals in 161 countries, lifetime economic experiences are deeply correlated with trust in government. Those growing up in faster-growing economies are more likely to express confidence in their institutions. The link is statistically robust even after controlling for age, income, and political context.

As of 2023, only 39% of adults in the OECD said they trusted their national government. In the United States, Pew surveys show trust languishing near 22%, a historic low that mirrors its broader long-run GDP stagnation.

Trust, in short, is a performance-based currency, and growth is the state’s yield. Just as a currency's value is tied to the economy's performance, trust in the government is tied to its ability to deliver prosperity. When that yield diminishes, the credibility premium vanishes.

A Global Slowdown, A Systemic Crisis

While slow growth is damaging, today’s challenge is deeper: the slowdown is synchronized globally. The IMF forecasts global GDP growth to hover around 3.2% in 2024, down from over 4% in the early 2000s. The UN has issued even grimmer warnings: just 2.3% growth in 2025 if trade tensions worsen.

This creates a legitimacy vacuum. Citizens in one country can no longer point to another as a working model. When all governments underperform simultaneously, the global public becomes broadly skeptical—not just of their leaders, but of the idea that governance can deliver results.

Integrated Economies, Shared Distrust

In regions with high economic interdependence, such as the European Union, this crisis compounds. One government’s policy failure often spills over into others. Austerity in Germany, fiscal risk in Italy, or political gridlock in France don’t stay local; they influence expectations across the eurozone.

Trust, much like contagion, becomes composite in these environments. A failing policy in one country can drag down sentiment across the entire bloc, reducing the space for collective action just when it’s most needed.

Lessons from Trump’s Tariff Wars

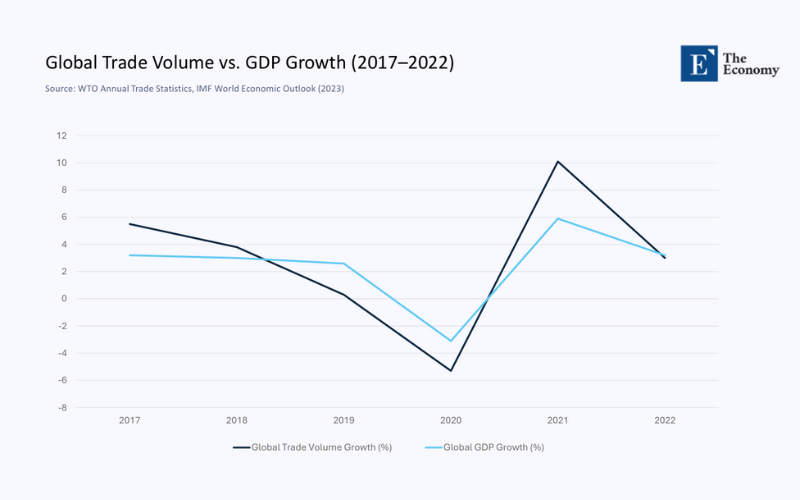

The global trade war initiated during Donald Trump’s first term clearly illustrates how protectionist moves can dampen economic performance and political credibility. In 2019, global trade volume growth fell to near zero, prompting the WTO to cut its forecast to 1.2%, down from 3% in prior years. GDP growth across advanced economies slowed, and global recovery prospects dimmed.

The political fallout was swift. Public confidence in trade policy eroded. Trust in multilateral institutions weakened. The connection was unmistakable:

Tariffs → Trade slowdown → Economic stagnation → Political distrust.

With similar policies again under discussion, the risks of repeating this sequence—on a weaker foundation—are dangerously high.

The Feedback Loop: When Low Growth Feeds Political Paralysis

Perhaps the most concerning dynamic is the feedback loop: weak growth erodes trust, and weakened trust hampers the government’s ability to stimulate growth. This creates a self-reinforcing trap: the policies needed to restore confidence-stimulus, reform, long-term investment-become politically infeasible, especially in democracies with short electoral cycles and volatile public sentiment.

In low-trust environments:

- Economic policies take longer to pass.

- Coordination between governments falters.

- Investors demand higher returns, pushing up public borrowing costs.

This creates a self-reinforcing trap: the policies needed to restore confidence—stimulus, reform, long-term investment—become politically infeasible, especially in democracies with short electoral cycles and volatile public sentiment.

Policy Imperative: Rebuilding Credibility in a Low-Growth World

To break the cycle, governments must treat trust as a strategic asset, not a passive outcome. This means recalibrating the social contract:

- Transparency over Optimism

Stop overpromising—present economic projections with conservative estimates and stress-tested models. Trust grows when expectations are managed, not inflated, underscoring the need for transparency in economic projections. - Resist Economic Nationalism

Trade wars are self-sabotaging. A 1% drop in global trade growth typically reduces global GDP by 0.3 points. Cooperative trade pacts are trust multipliers. - Automatic Stabilizers and Credibility Buffers

Build systems, like real-time unemployment top-up, that activate without legislative approval. Let technocratic institutions regain public confidence by delivering quickly and predictably. - Multilateral “Trust Insurance”

Governments should pool resources into countercyclical funds, especially in the EU or similar blocs. These funds, which are designed to offset economic downturns, show that integration delivers in crises, not just during booms.

Trust Is the Real Deficit

The greatest cost of a global economic slowdown is not just foregone growth—it’s lost faith in governance. When promises become harder to fulfill and no country seems to outperform the others, the entire model of state-led problem-solving becomes suspect.

Restoring growth is critical. However, restoring the belief that the government can deliver growth, primarily through multilateral coordination, is even more urgent. Without that, the next tariff war or financial shock may weaken economies and fracture the public’s confidence in governance.

The original article was authored by Tim Besley, a School Professor of Economics and Political Science, along with two co-authors. The English version of the article, titled "The global growth slowdown is bad news for trust in government," was published by CEPR on VoxEU.