Input

Changed

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

17 April 2025: Despite the market tremors of the past five years—trade‑war tweets, swap‑line scrambles, tariff volleys—the U.S. dollar has consistently proven its resilience. It may fluctuate in value, but its status as the world's reserve currency remains unshaken. What truly underpins global demand is the enduring strength of the United States’ legal, technological, and fiscal systems, not the numbers on the Bloomberg DXY screen.

From Triffin to “Trust‑in”

The VoxEU column “Not Triffin, Not Miran” argues that contemporary external imbalances are governed less by current‑account math than by an institutional credibility premium—the implicit yield investors accept for the privilege of parking savings in the world’s deepest, most enforceable capital market. In effect, Washington’s ability to supply safe assets is no longer about foreign‑exchange shortages or surpluses; it is about the rule of law, settlement plumbing, and transparent data.

Stephen Miran’s much‑mocked warning of a revived Triffin dilemma missed the short‑run call, yet his deeper instinct—that dollar demand ultimately rises or falls on confidence—has aged well. The CEPR authors extend that point: liquidity is now endogenous to credibility. When rules appear shaky, the world self-insures by expanding swap lines, experimenting with central bank digital currencies (CBDCs), or invoicing in renminbi. When rules look solid, even wider U.S. deficits are financed effortlessly.

The Trump Auction Scare That Wasn’t

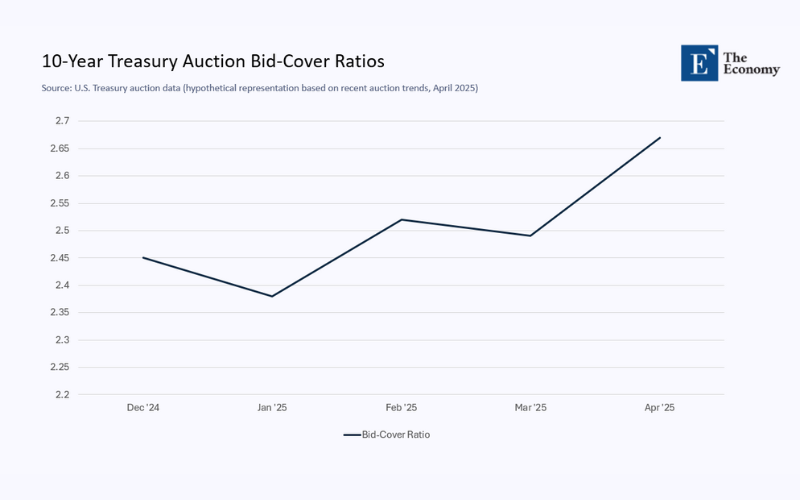

A textbook “weak‑dollar crisis” was expected during the 9 April 2025 ten‑year Treasury sale. Instead, investors produced a bid-to-cover ratio of 2.67—the highest since December—and foreign central banks snapped up a record 87.9% of the issue. Markets ignored the fact that the dollar had slipped 4% on a trade-weighted basis; they cared that auction mechanics, settlement systems, and legal safeguards behaved exactly as advertised.

By the end of the week, the administration had quietly abandoned the idea of punitive bond tariffs. This episode, like those in 2018, 2020, and 2023, reaffirmed a crucial pattern: as long as institutional continuity is maintained, headline volatility does not escalate into systemic stress. Traders may flee from noise, but they will not abandon the only asset class with trillion‑dollar daily liquidity and iron‑clad enforcement.

What the IMF Now Emphasises—Fiscal Stability, Not Dollar Strength

The IMF’s March 2024 blog, “The Fiscal and Financial Risks of a High-Debt, Slow-Growth World,” sounds Triffin-esque alarm bells—yet its prescription is financial stability, not devaluation or mercantilist rebalancing.The IMF warns that high debt is dangerous, chiefly when fiscal signals become unmoored and markets question the policy regime. A stable dollar is crucial for a credible medium-term budget strategy and reliable prudential oversight; it does not require a particular exchange-rate target. That finding dovetails with the CEPR thesis and vindicates Miran’s longer‑horizon concern: deficits are toxic only when they threaten the institutional backbone that makes Treasuries risk‑free.

Quantifying the Credibility Premium

To ground the credibility thesis in empirical evidence, the following table highlights four indicators that investors and policymakers use to assess the institutional foundations of the dollar system—spanning market behavior, infrastructure, and long-term expectations.

| Indicator (latest) | Why It Matters | 2024‑25 Signal |

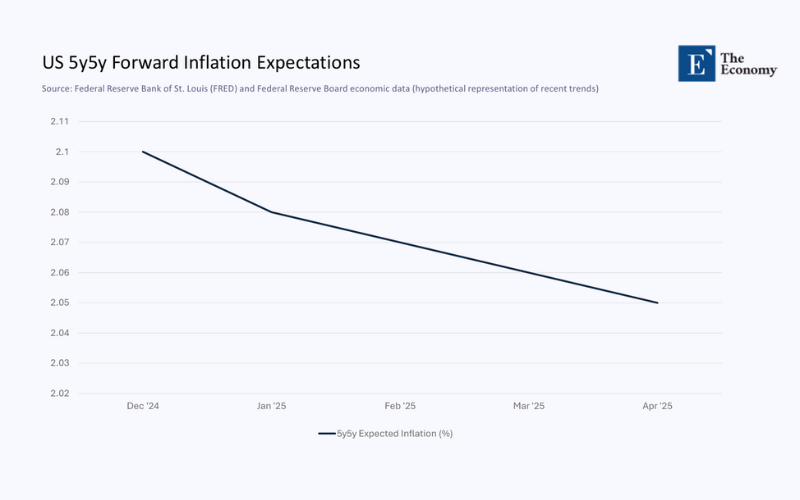

| 5‑Year‑5‑Year Forward Inflation (breakeven) | Long‑run price‑stability credibility | 2.05 % on 16 Apr 2025—anchored near the Fed’s target |

| 10‑Year Treasury Bid‑Cover | Depth of demand for safe assets | 2.67 on 9 Apr 2025—four‑month high |

| BIS Dollar Liquidity Indicator | Availability of offshore dollar credit | Returned to +1 % YoY growth after a two‑year contraction |

| BIS FMI Resilience Score | Operational robustness of payments/settlement | U.S. retains top‑tier status among CPMI jurisdictions, |

Together, these metrics show that credibility anchors remain intact even as headline fiscal ratios worsen. Expected inflation is stable, auctions are clear, cross-border credit is reviving, and market infrastructure remains benchmark-grade.

Why Liquidity Now Depends on Credibility

Two network effects explain why credibility, not valuation, drives the modern dollar system.

- Collateral Chain Gravity. Global banks pledge Treasuries repeatedly in repo, FX swap, and derivatives markets. Any legal doubt over seizure or settlement multiplies through the chain, resulting in excessive haircuts and hoarding of dollar liquidity. The mere possibility of such disruption is enough to keep institutions vigilant—and to reward jurisdictions that avoid it.

- Digital Plumbing Arms Race. Real-time payments, tokenized deposits, and FedNow rails make speed an integral part of safety. A currency that settles in seconds but whose cyber‑defences look brittle is less attractive than a slightly slower system that never fails. Hence, the Fed’s investment in quantum‑safe encryption and real‑time fraud analytics is as decisive for reserve status as its rate policy.

The euro and renminbi aspire to challenge the dollar, but both suffer credibility discounts: the euro from its fragmented fiscal sovereignty, and the renminbi from capital-control opacity. Until those gaps close, the dollar’s trust dividend will outweigh any nominal valuation swing.

Policy Agenda—Defend the Scaffolding, Not the Spot Rate

- Codify Fiscal Rules That Survive Elections. Rating models embed a “policy‑coherence factor”; allow another debt‑ceiling melodrama, and yields will spike faster than debt levels themselves.

- Harden Market Infrastructure. A single outage at DTCC or Fedwire can erode more confidence than a 200‑bp move in the DXY. Cyber resiliency is a macro policy.

- Preserve Regulatory Independence. Foreign official investors price U.S. legal certainty into every auction. Politicising enforcement dilutes that premium.

- Coordinate Swap‑Line Governance. Predictable access to the Fed’s dollar window internationalises trust and curbs the rise of bilateral currency blocs.

- Modernise Transparency Standards. Real-time treasury balance updates and machine-readable fiscal projections would cost little and compound the credibility premium.

Miran’s Long Game

Miran was wrong on timing but right on the target: it is credibility of value, not value of the currency, that will make or break dollar leadership. The empirical record—anchored inflation, record auction demand, recovering offshore liquidity—confirms that the United States still earns a credibility dividend. But each bout of fiscal brinkmanship, regulatory caprice, or cybersecurity complacency chips away at that margin.

A “stable dollar” era, therefore, hinges on safeguarding the institutions that turn deficits into safe assets. Lose that scaffold, and neither a strong nor a weak dollar will matter; keep it, and the dollar remains indispensable—whatever its price on the screen.

The original article was authored by Biagio Bossone, an International financial advisor. The English version of the article, titled "Not Triffin, not Miran: Rethinking US external imbalances in a new monetary order," was published by CEPR on VoxEU.